Answered step by step

Verified Expert Solution

Question

1 Approved Answer

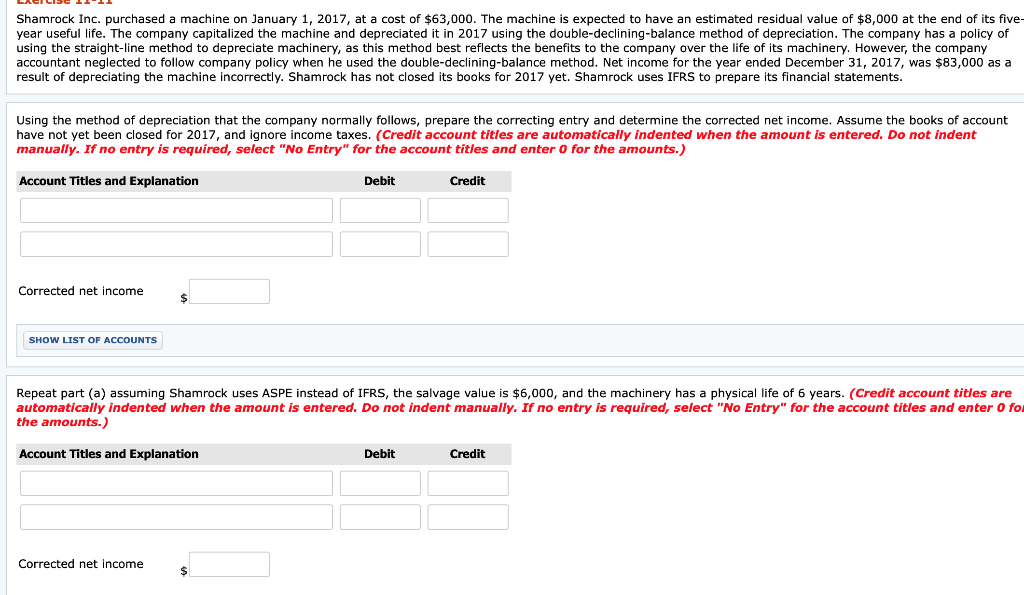

Journal entries should be from the list of accounts above Shamrock Inc. purchased a machine on January 1, 2017, at a cost of $63,000. The

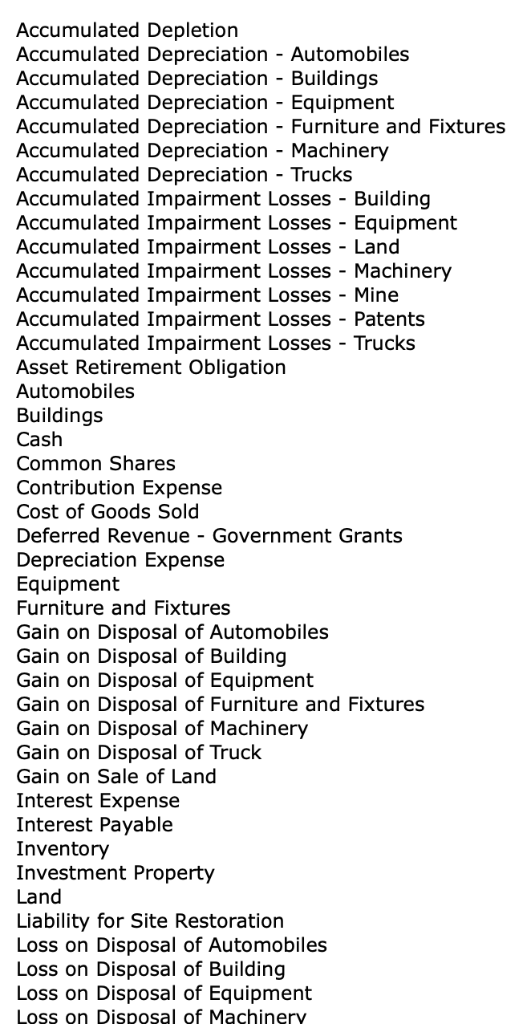

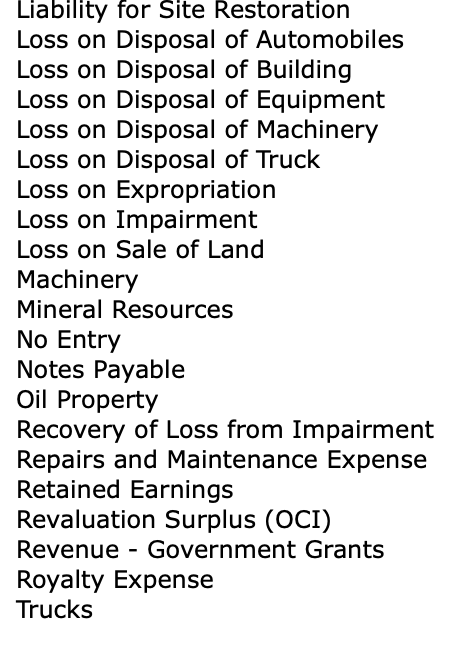

Journal entries should be from the list of accounts above

Shamrock Inc. purchased a machine on January 1, 2017, at a cost of $63,000. The machine is expected to have an estimated residual value of $8,000 at the end of its five- year useful life. The company capitalized the machine and depreciated it in 2017 using the double-declining-balance method of depreciation. The company has a policy of using the straight-line method to depreciate machinery, as this method best reflects the benefits to the company over the life of its machinery. However, the company accountant neglected to follow company policy when he used the double-declining-balance method. Net income for the year ended December 31, 2017, was $83,000 as a result of depreciating the machine incorrectly. Shamrock has not closed its books for 2017 yet. Shamrock uses IFRS to prepare its financial statements Using the method of depreciation that the company normally follows, prepare the correcting entry and determine the corrected net income. Assume the books of account have not yet been closed for 2017, and ignore income taxes. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the aounts.) Account Titles and Explanation Debit Credit Corrected net income SHOW LIST OF ACCOUNTS Repeat part (a) assuming Shamrock uses ASPE instead of IFRS, the salvage value is $6,000, and the machinery has a physical life of 6 years. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter fo the amounts.) Account Titles and Explanation Debit Credit Corrected net income Liability for Site Restoration Loss on Disposal of Automobiles Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Truck Loss on Expropriation Loss on Impairment Loss on Sale of Land Machinery Mineral Resources No Entry Notes Payable Oil Property Recovery of Loss from Impairment Repairs and Maintenance Expense Retained Earning:s Revaluation Surplus (OCI) Revenue - Government Grants Royalty Expense TrucksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started