Question

Journal entry woksheet: 1. The Edison Company spent $17,000 during the year for experimental purposes in connection with the development of a new product. 2.

Journal entry woksheet:

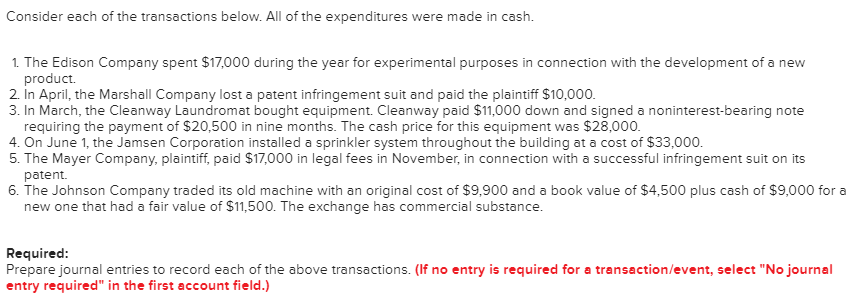

1. The Edison Company spent $17,000 during the year for experimental purposes in connection with the development of a new product.

2. In April, the Marshall Company lost a patent infringement suit and paid the plaintiff $10,000.

3. In March, the Cleanway Laundromat bought equipment. Cleanway paid $11,000 down and signed a noninterest-bearing note requiring the payment of $20,500 in nine months. The cash price for this equipment was $28,000.

4. On June 1, the Jamsen Corporation installed a sprinkler system throughout the building at a cost of $33,000.

5. The Mayer Company, plaintiff, paid $17,000 in legal fees in November, in connection with a successful infringement suit on its patent.

6. The Johnson Company traded its old machine with an original cost of $9,900 and a book value of $4,500 plus cash of $9,000 for a new one that had a fair value of $11,500. The exchange has commercial substance.

Consider each of the transactions below. All of the expenditures were made in cash. 1. The Edison Company spent $17,000 during the year for experimental purposes in connection with the development of a new product. 2. In April, the Marshall Company lost a patent infringement suit and paid the plaintiff $10,000. 3. In March, the Cleanway Laundromat bought equipment. Cleanway paid $11,000 down and signed a noninterest-bearing note requiring the payment of $20,500 in nine months. The cash price for this equipment was $28,000. 4. On June 1, the Jamsen Corporation installed a sprinkler system throughout the building at a cost of $33,000. 5. The Mayer Company, plaintiff, paid $17,000 in legal fees in November, in connection with a successful infringement suit on its patent. 6. The Johnson Company traded its old machine with an original cost of $9,900 and a book value of $4,500 plus cash of $9,000 for a new one that had a fair value of $11,500. The exchange has commercial substance. Required: Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started