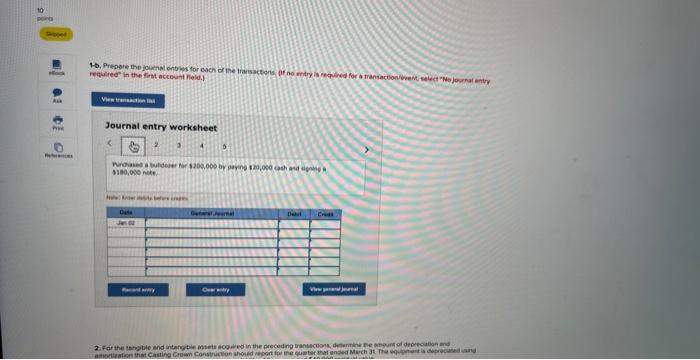

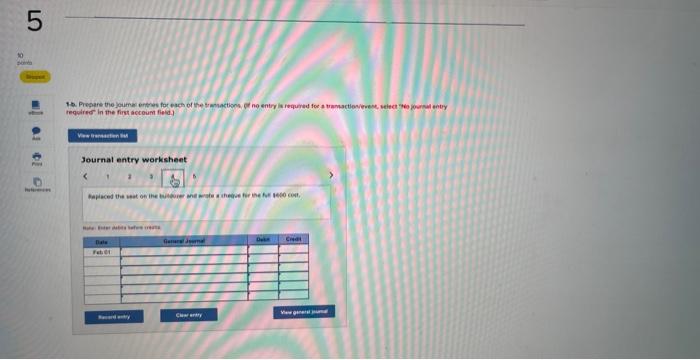

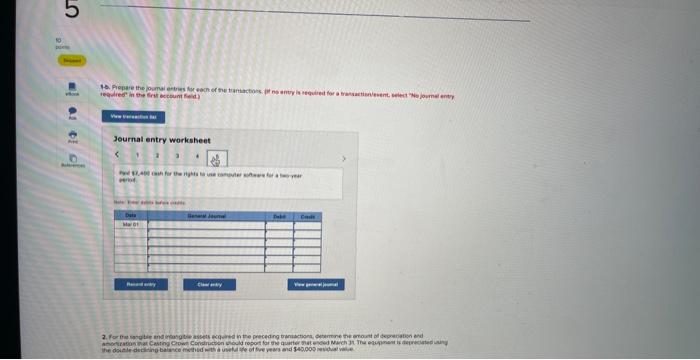

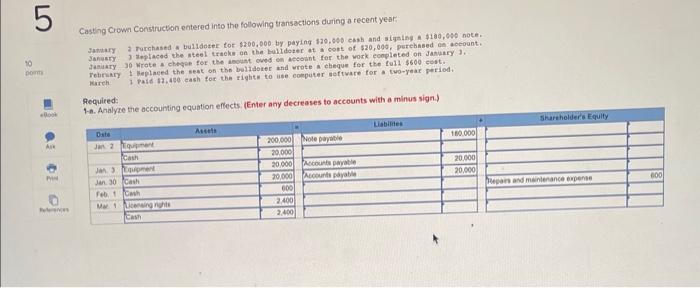

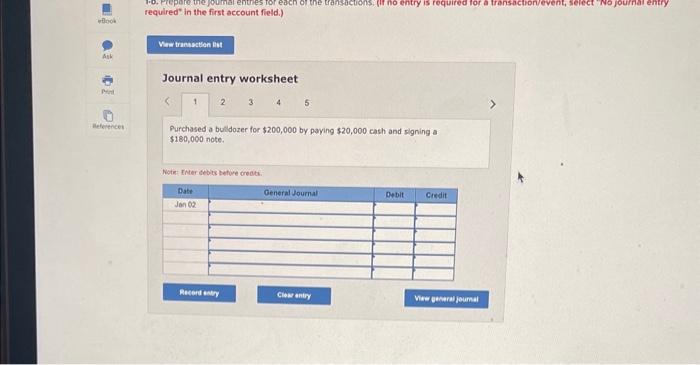

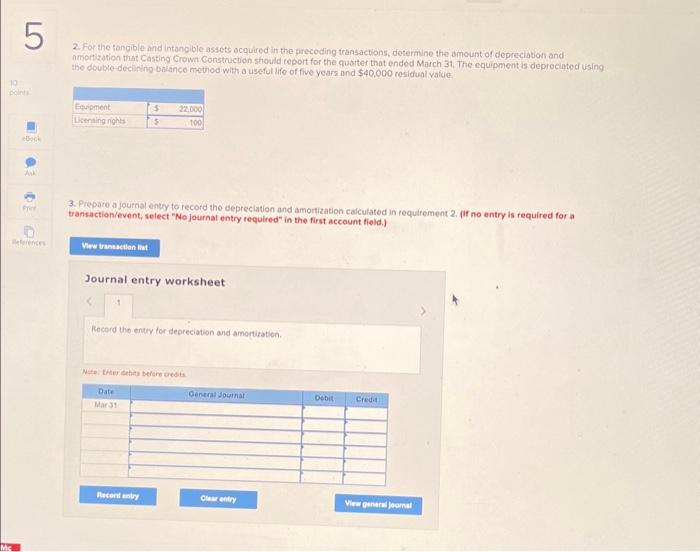

Journal entry worksheet Fecoet the ening for depeostish and wnerlitation. 1-b. Prebare the jound enbles for each of the paisacteds, of no miry is requied for a transaction weent, select "Me journat anty Fequired" in the firmt acicount field.) Journal entry worksheet 3 hrohased a buddoier har {2590006 by geying 420,000 cash and dignepe of 9130,000 nete. thoulredr in the firal acceunt field Journal entry workstheet. accinh rechilred" in the first acceont fietd. Journal entry worlusheet (.) 1.2 Mencers 1 tequired in the first actoum fiesd.) Journal entry worksheet. tegholies" in the firs becount feld 3ournal entry worksheet istind Casting Crows Constructon entered into the following transactions during a recent year Tebriary 1 Beplaced the neat on the balluoier and vrote i cbeque for the foll. $500 cost. Amalum the nccounting equation effects. (Enter any decreases to accounts with a minus sign.) Pequired: required" in the first account field.) Journal entry worksheet 5 Purchased a bulldozer for $200,000 by paying $20,000 cash and signing a $180,000 note. Nots: rhter ccbits bafuce oreath. 2. Foc the tangible and intangible assets ocquired in the preceding transactions, determine the amount of depreclation and amorization that Casting Crown Construction stiould report for the quarter that ended March 31. The equipment is deprociated using the double-decieing balance method with 3 useful life of five years and $40,000 residual value. 3. Prepare a journal entyy to record the depreciation and amontization calculated in requlrement 2, (if no entry is required for a transaction/event, select "No journal entry required" in the first account tield.) Journal entry worksheet Record the entry for depreciation and amortization. Nite theler tethat behere credile Journal entry worksheet Fecoet the ening for depeostish and wnerlitation. 1-b. Prebare the jound enbles for each of the paisacteds, of no miry is requied for a transaction weent, select "Me journat anty Fequired" in the firmt acicount field.) Journal entry worksheet 3 hrohased a buddoier har {2590006 by geying 420,000 cash and dignepe of 9130,000 nete. thoulredr in the firal acceunt field Journal entry workstheet. accinh rechilred" in the first acceont fietd. Journal entry worlusheet (.) 1.2 Mencers 1 tequired in the first actoum fiesd.) Journal entry worksheet. tegholies" in the firs becount feld 3ournal entry worksheet istind Casting Crows Constructon entered into the following transactions during a recent year Tebriary 1 Beplaced the neat on the balluoier and vrote i cbeque for the foll. $500 cost. Amalum the nccounting equation effects. (Enter any decreases to accounts with a minus sign.) Pequired: required" in the first account field.) Journal entry worksheet 5 Purchased a bulldozer for $200,000 by paying $20,000 cash and signing a $180,000 note. Nots: rhter ccbits bafuce oreath. 2. Foc the tangible and intangible assets ocquired in the preceding transactions, determine the amount of depreclation and amorization that Casting Crown Construction stiould report for the quarter that ended March 31. The equipment is deprociated using the double-decieing balance method with 3 useful life of five years and $40,000 residual value. 3. Prepare a journal entyy to record the depreciation and amontization calculated in requlrement 2, (if no entry is required for a transaction/event, select "No journal entry required" in the first account tield.) Journal entry worksheet Record the entry for depreciation and amortization. Nite theler tethat behere credile