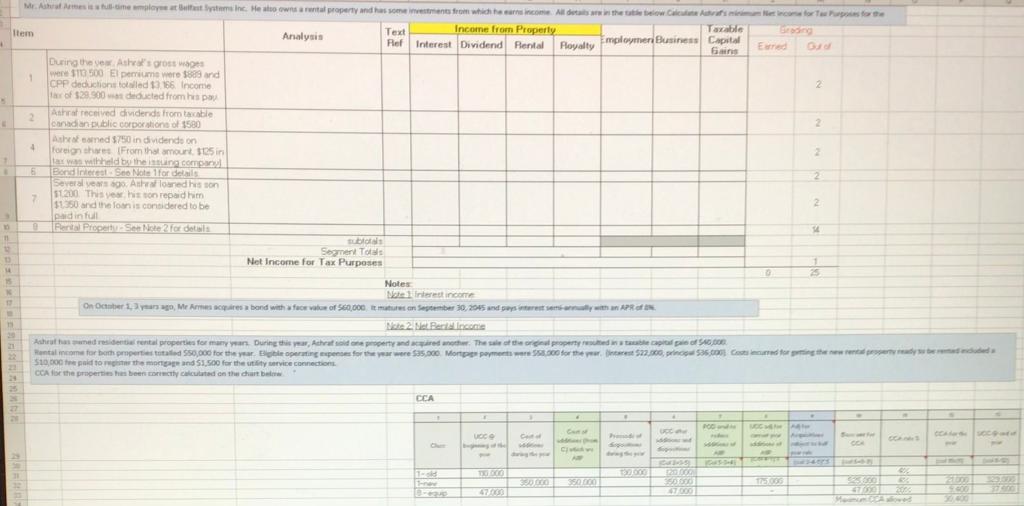

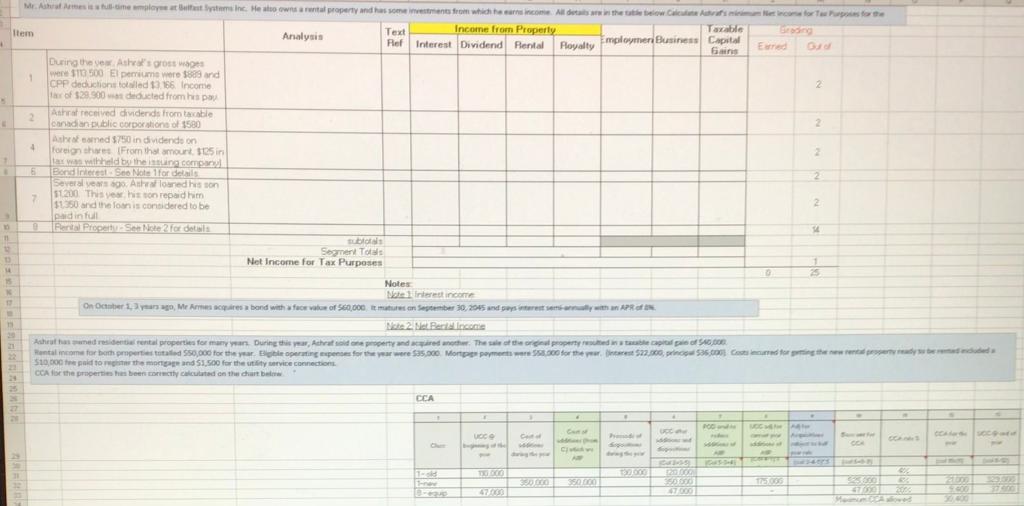

Michellime molestie. He shows tal property and has some investments from which he sain. All the bow voor Income from Property Item Text Tazable Analysis Ref Interest Dividend Rental Ployalty Employmen Business Capital Gain Ered During the Atlas grossos 1 1 were 1500 El perrums were 1883 and CPP deduction totalled 1 166 Income 2 of $23.500 deducted from his pa 2 Ashraf received dividends from table 2 canadan public corporations of $580 Ahmed 5750 in dividends on 4 + foreign the From that amount $25 in tar was held by the como Bondiinterest Soo Not for details 2 Several years. Anh loaned his son 11200. This is on repard him 2 $1350 and the loan is considered to be painful A RODS Noter det tablois Segment To Net Income for Tax Purposes 1 25 5 Notes 11 Once years, Mr Arme scores bond with a fuor valor of Sco,000 con September 10, 2015 and interesesh ARO Note 2 Net Portal Achets med resident rental properties for many year. During this year, Achratsid property and redunetter. The sale of the original property in the capital of 000 antal me for both pmperties totaled 550,000 for the year geoperating expenses for the year were 35,000 Montpps payments for the per $22.30, princ 536. Cated to the event ready wedded 100 to them and 53,500 for the utility service connections CCA for the properties has been concly calculated on the chart CEA VEC CE 350750 Michellime molestie. He shows tal property and has some investments from which he sain. All the bow voor Income from Property Item Text Tazable Analysis Ref Interest Dividend Rental Ployalty Employmen Business Capital Gain Ered During the Atlas grossos 1 1 were 1500 El perrums were 1883 and CPP deduction totalled 1 166 Income 2 of $23.500 deducted from his pa 2 Ashraf received dividends from table 2 canadan public corporations of $580 Ahmed 5750 in dividends on 4 + foreign the From that amount $25 in tar was held by the como Bondiinterest Soo Not for details 2 Several years. Anh loaned his son 11200. This is on repard him 2 $1350 and the loan is considered to be painful A RODS Noter det tablois Segment To Net Income for Tax Purposes 1 25 5 Notes 11 Once years, Mr Arme scores bond with a fuor valor of Sco,000 con September 10, 2015 and interesesh ARO Note 2 Net Portal Achets med resident rental properties for many year. During this year, Achratsid property and redunetter. The sale of the original property in the capital of 000 antal me for both pmperties totaled 550,000 for the year geoperating expenses for the year were 35,000 Montpps payments for the per $22.30, princ 536. Cated to the event ready wedded 100 to them and 53,500 for the utility service connections CCA for the properties has been concly calculated on the chart CEA VEC CE 350750