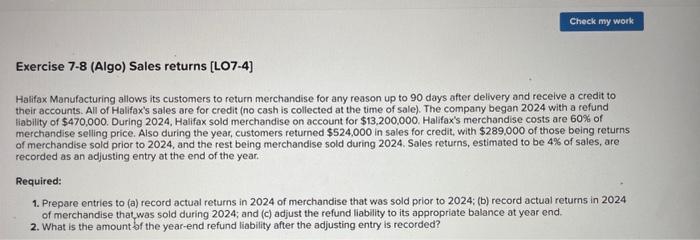

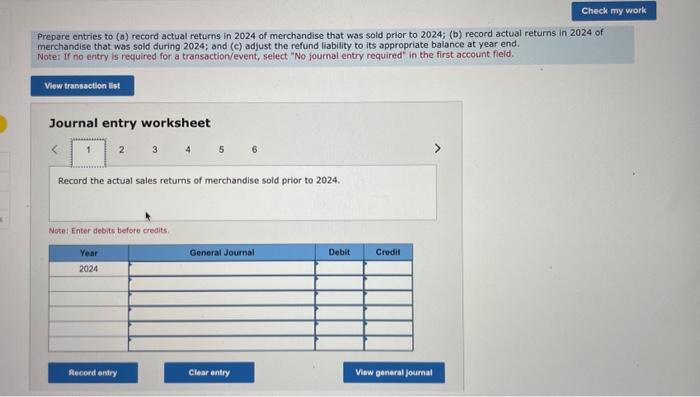

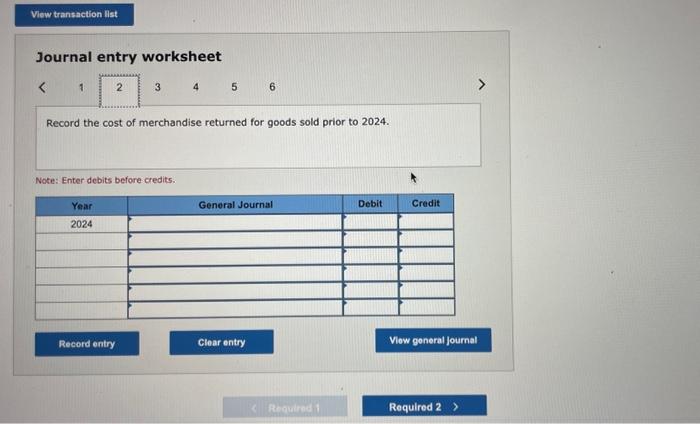

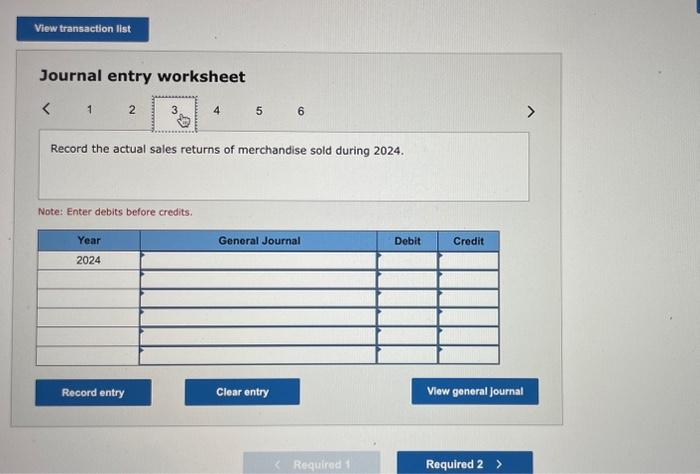

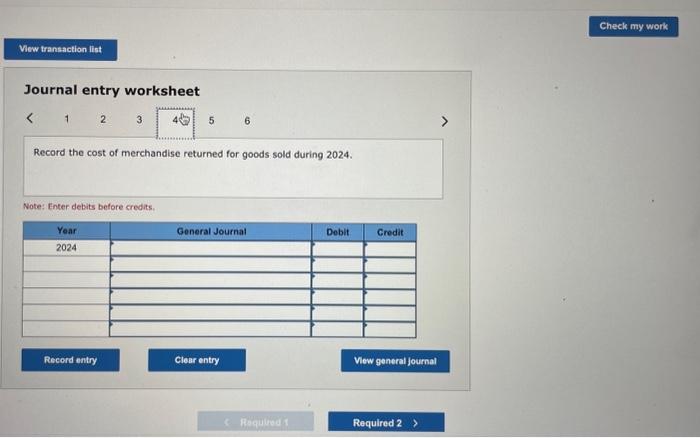

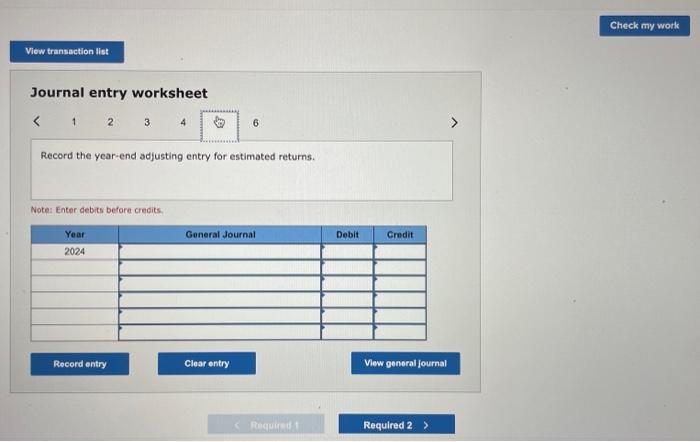

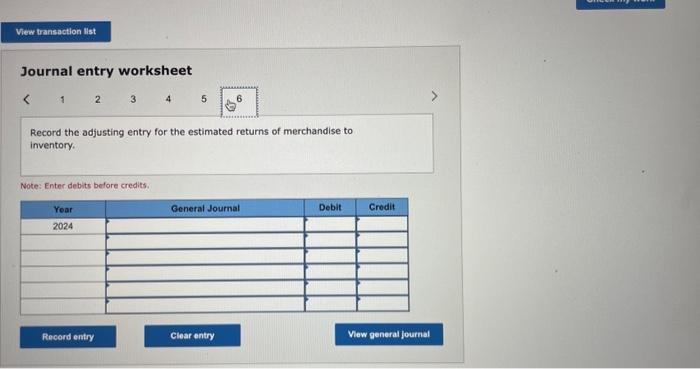

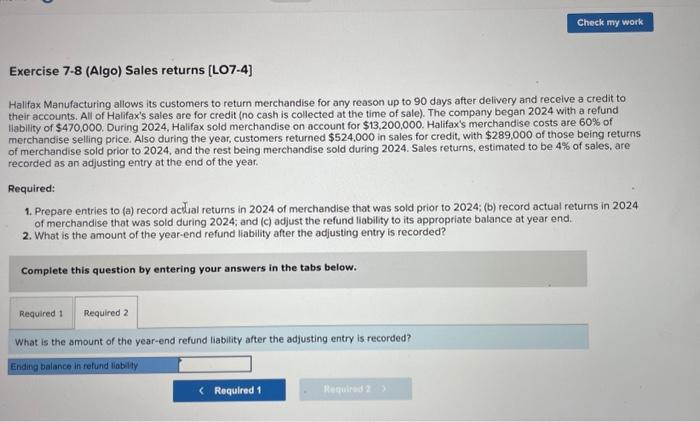

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the actual sales returns of merchandise sold during 2024. Note: Enter debits before credits. Journal entry worksheet 1236 Record the year-end adjusting entry for estimated returns. Note: Enter debits before cregits. Exercise 7-8 (Algo) Sales returns [LO7-4] Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and recelve a credit to their accounts. All of Halifax's sales ore for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $470,000. During 2024, Halifax sold merchandise on account for $13,200,000. Halifax's merchandise costs are 60% of merchandise selling price. Also during the year, customers returned $524,000 in sales for credit, with $289,000 of those being returns of merchandise sold prior to 2024 , and the rest being merchandise sold during 2024 . Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise thatwas sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount bf the year-end refund liability after the adjusting entry is recorded? Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adfust the refund liability to its appropriate balance at year end. Notet if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 56 Record the actual sales returns of merchandise sold prior to 2024. Note: Enter debits before credits. Exercise 7.8 (Algo) Sales returns [LO7-4] Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund tilability of $470,000. During 2024, Halifax sold merchandise on account for $13,200,000. Halifax's merchandise costs are 60% of merchandise selling price. Also during the year, customers returned $524,000 in sales for credit, with $289,000 of those being returns of merchandise sold prior to 2024 , and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024 ; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. What is the amount of the year-end refund liability after the adjusting entry is recorded? Journal entry worksheet 6 Record the cost of merchandise returned for goods sold during 2024. Note: Enter debits before credits. Journal entry worksheet Record the adjusting entry for the estimated returns of merchandise to inventory. Note: Enter debits before credits