Answered step by step

Verified Expert Solution

Question

1 Approved Answer

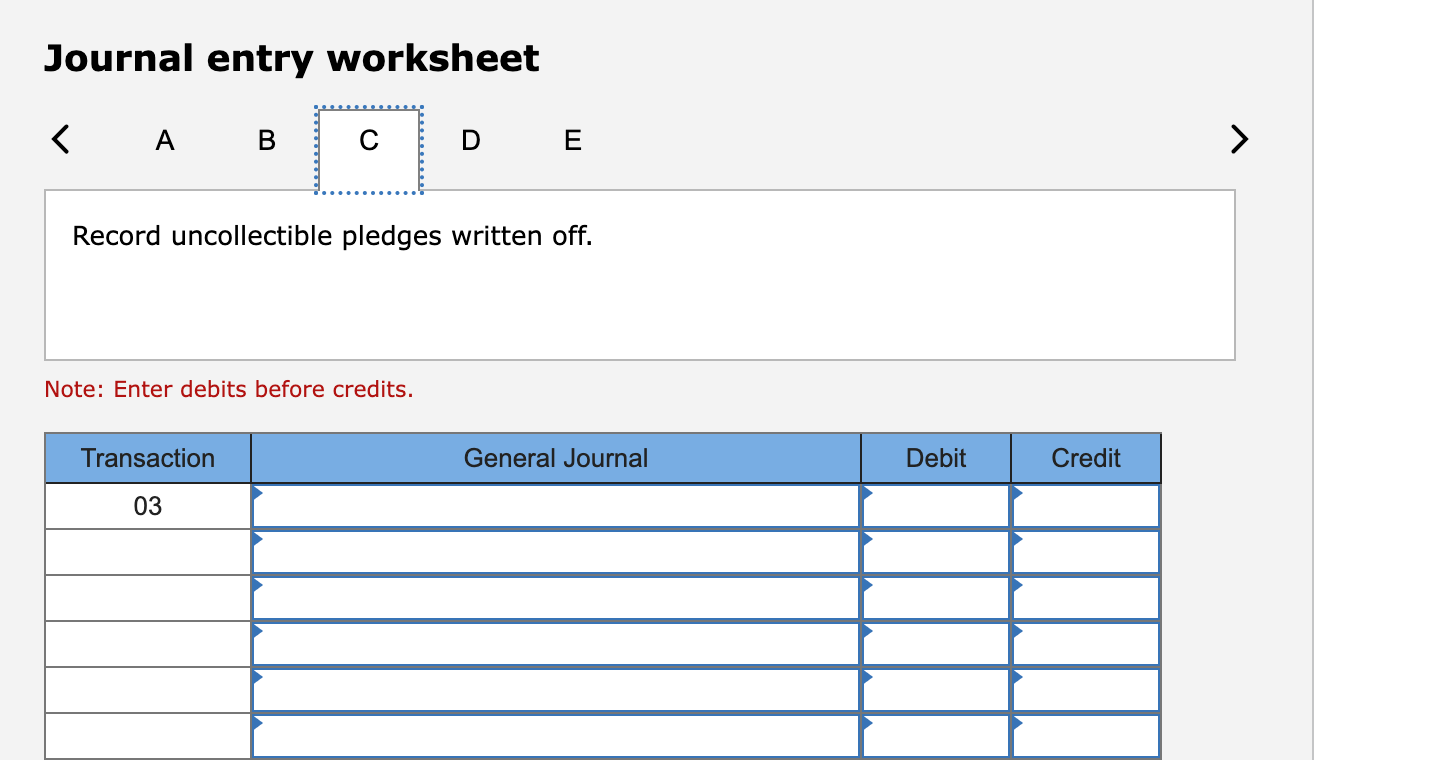

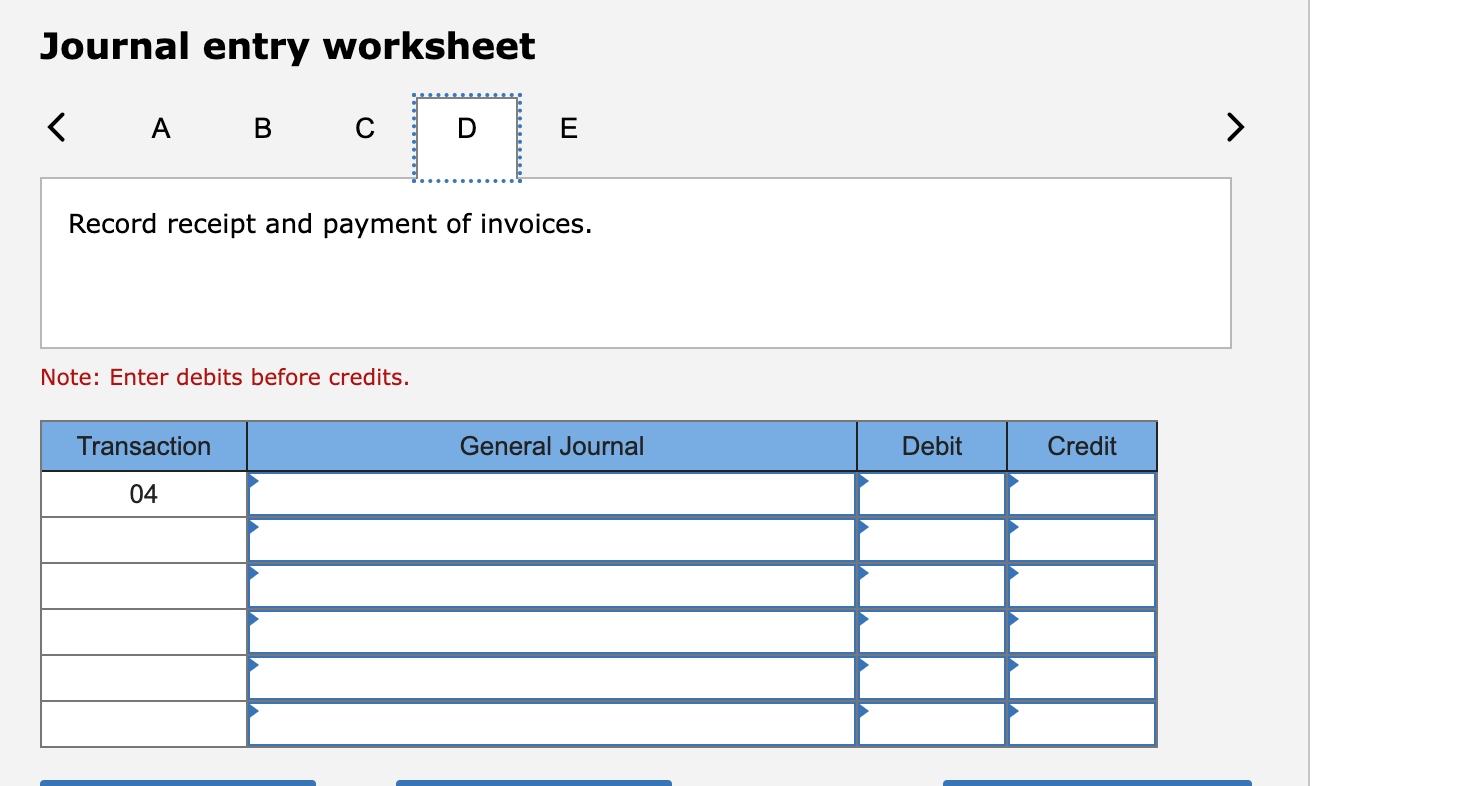

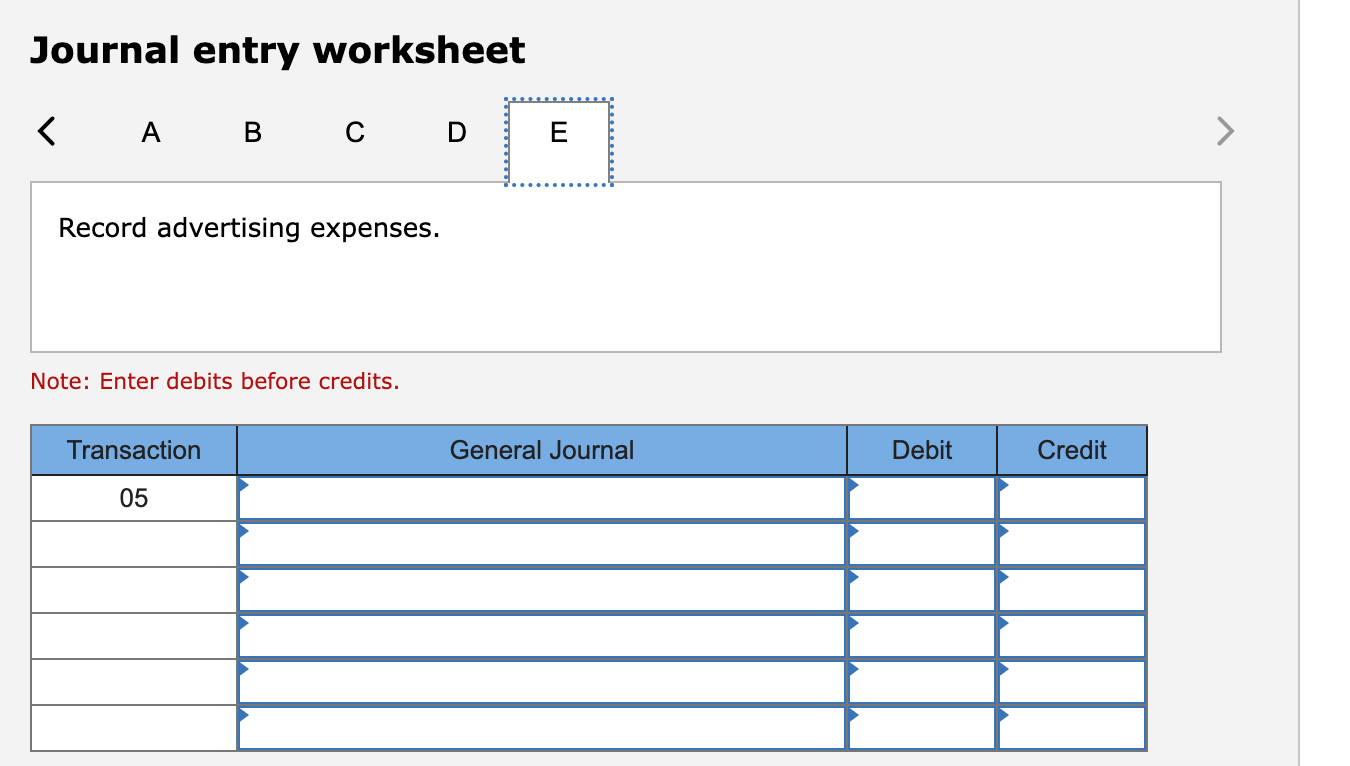

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record receipt and payment of invoices. Note: Enter debits before credits. Journal entry worksheet

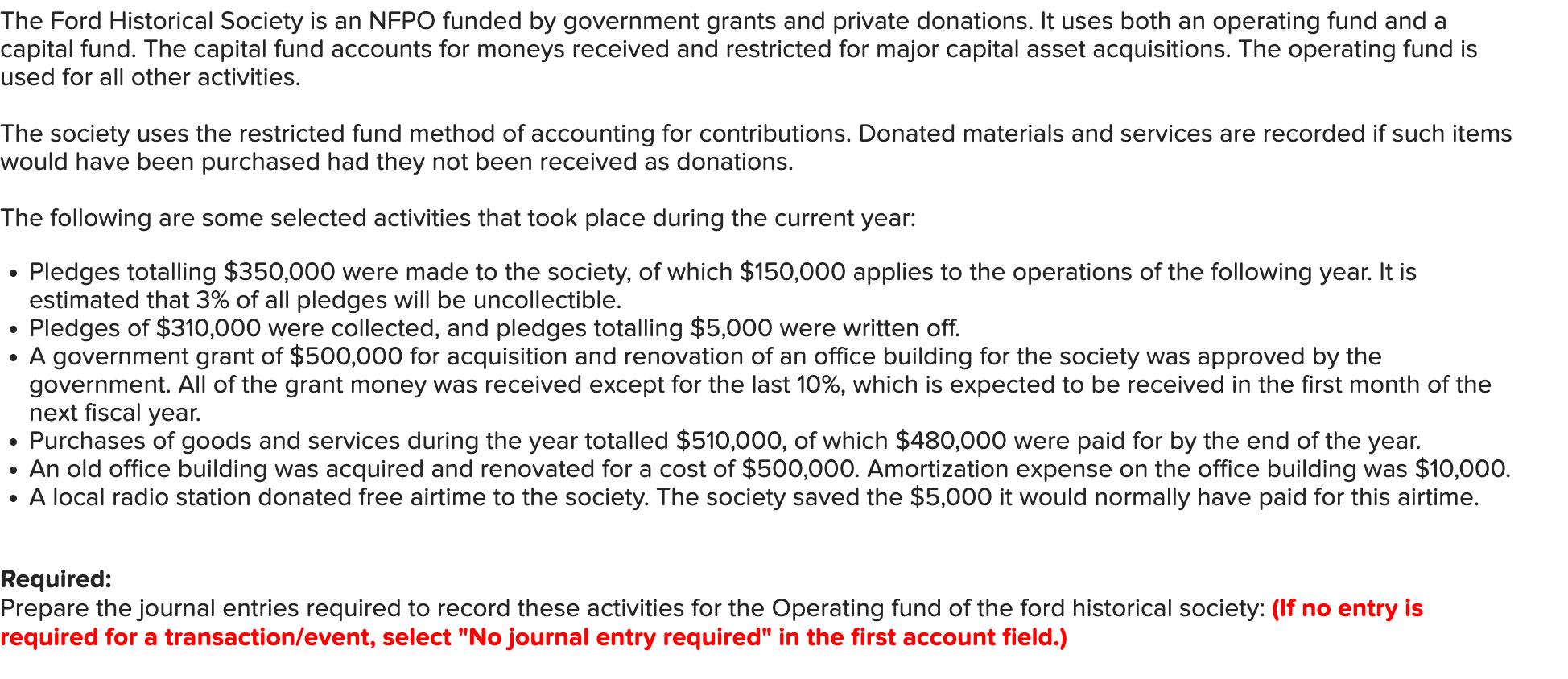

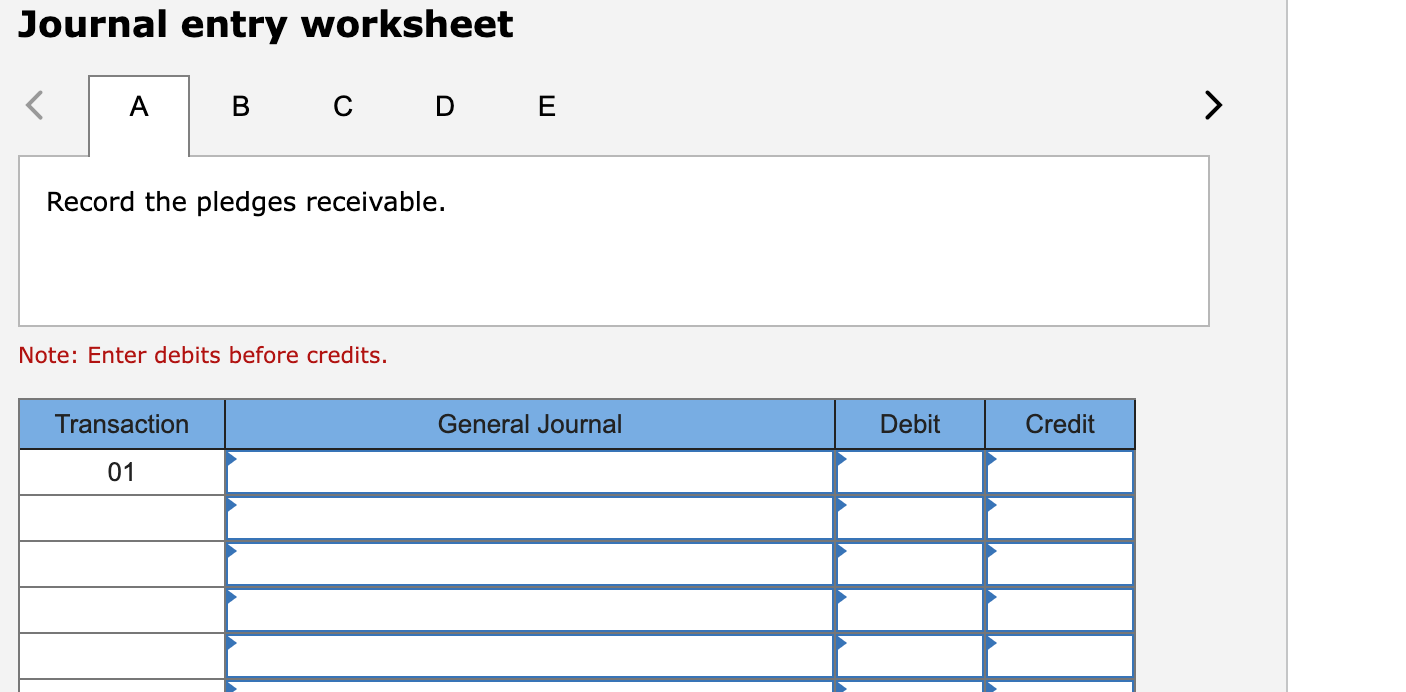

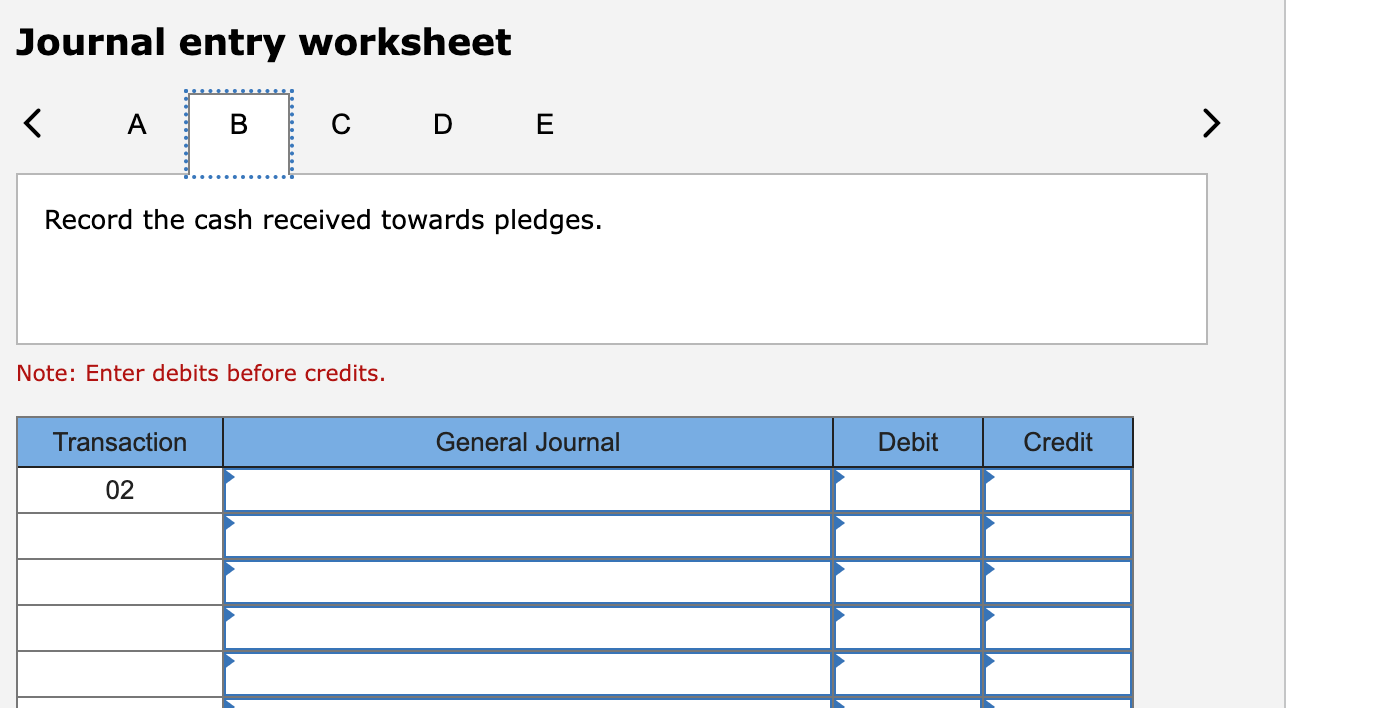

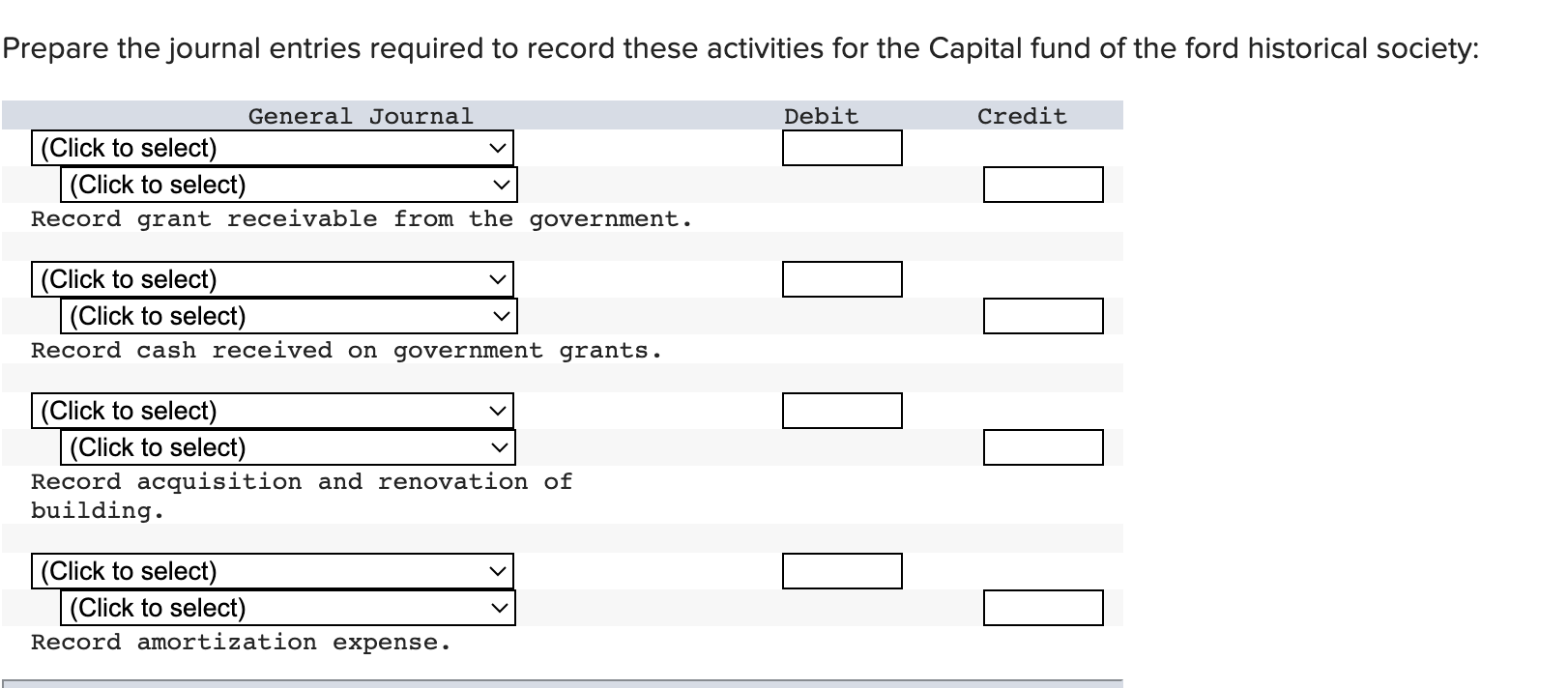

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record receipt and payment of invoices. Note: Enter debits before credits. Journal entry worksheet Record uncollectible pledges written off. Note: Enter debits before credits. repare the journal entries required to record these activities for the Capital fund of the ford historical society: The Ford Historical Society is an NFPO funded by government grants and private donations. It uses both an operating fund and a capital fund. The capital fund accounts for moneys received and restricted for major capital asset acquisitions. The operating fund is used for all other activities. The society uses the restricted fund method of accounting for contributions. Donated materials and services are recorded if such items would have been purchased had they not been received as donations. The following are some selected activities that took place during the current year: - Pledges totalling $350,000 were made to the society, of which $150,000 applies to the operations of the following year. It is estimated that 3% of all pledges will be uncollectible. - Pledges of $310,000 were collected, and pledges totalling $5,000 were written off. - A government grant of $500,000 for acquisition and renovation of an office building for the society was approved by the government. All of the grant money was received except for the last 10%, which is expected to be received in the first month of the next fiscal year. - Purchases of goods and services during the year totalled $510,000, of which $480,000 were paid for by the end of the year. - An old office building was acquired and renovated for a cost of $500,000. Amortization expense on the office building was $10,000. - A local radio station donated free airtime to the society. The society saved the $5,000 it would normally have paid for this airtime. Required: Prepare the journal entries required to record these activities for the Operating fund of the ford historical society: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record advertising expenses. Note: Enter debits before credits. Journal entry worksheet Record the cash received towards pledges. Note: Enter debits before credits

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record receipt and payment of invoices. Note: Enter debits before credits. Journal entry worksheet Record uncollectible pledges written off. Note: Enter debits before credits. repare the journal entries required to record these activities for the Capital fund of the ford historical society: The Ford Historical Society is an NFPO funded by government grants and private donations. It uses both an operating fund and a capital fund. The capital fund accounts for moneys received and restricted for major capital asset acquisitions. The operating fund is used for all other activities. The society uses the restricted fund method of accounting for contributions. Donated materials and services are recorded if such items would have been purchased had they not been received as donations. The following are some selected activities that took place during the current year: - Pledges totalling $350,000 were made to the society, of which $150,000 applies to the operations of the following year. It is estimated that 3% of all pledges will be uncollectible. - Pledges of $310,000 were collected, and pledges totalling $5,000 were written off. - A government grant of $500,000 for acquisition and renovation of an office building for the society was approved by the government. All of the grant money was received except for the last 10%, which is expected to be received in the first month of the next fiscal year. - Purchases of goods and services during the year totalled $510,000, of which $480,000 were paid for by the end of the year. - An old office building was acquired and renovated for a cost of $500,000. Amortization expense on the office building was $10,000. - A local radio station donated free airtime to the society. The society saved the $5,000 it would normally have paid for this airtime. Required: Prepare the journal entries required to record these activities for the Operating fund of the ford historical society: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record advertising expenses. Note: Enter debits before credits. Journal entry worksheet Record the cash received towards pledges. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started