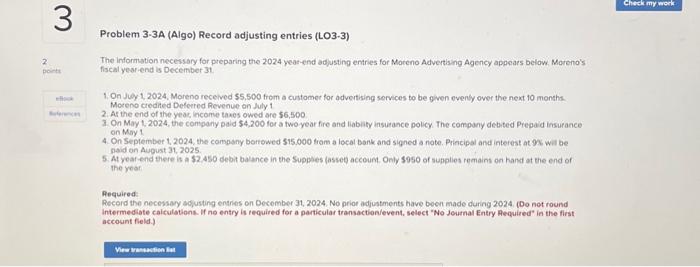

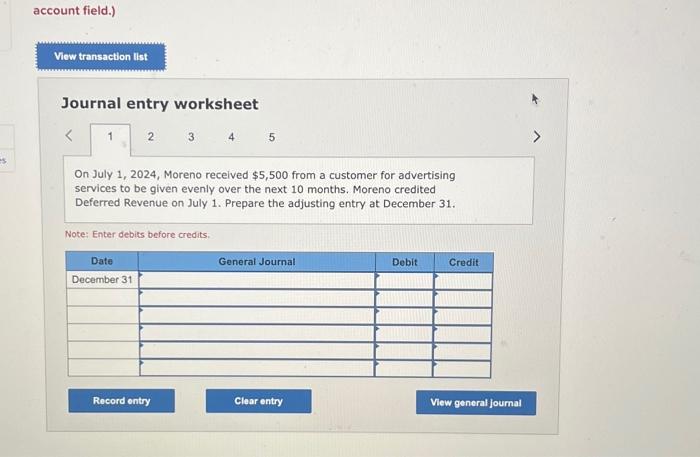

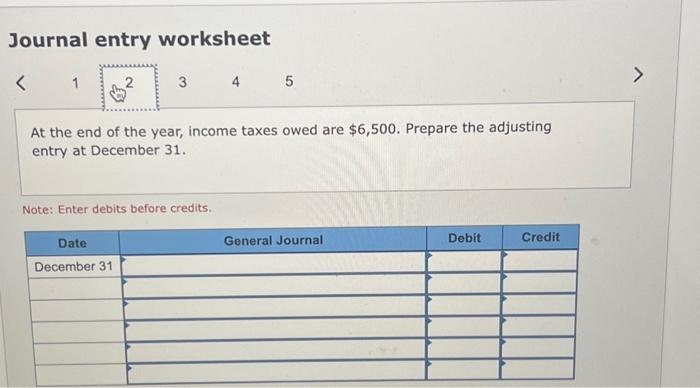

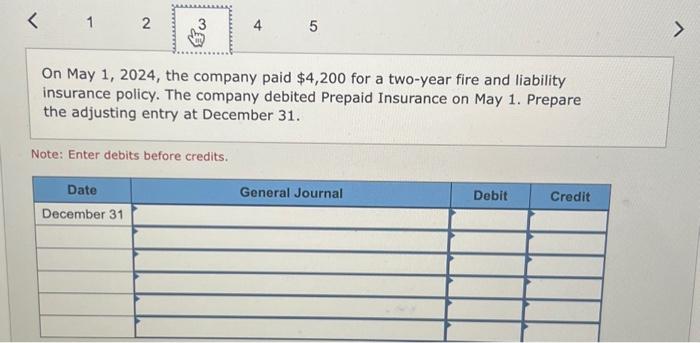

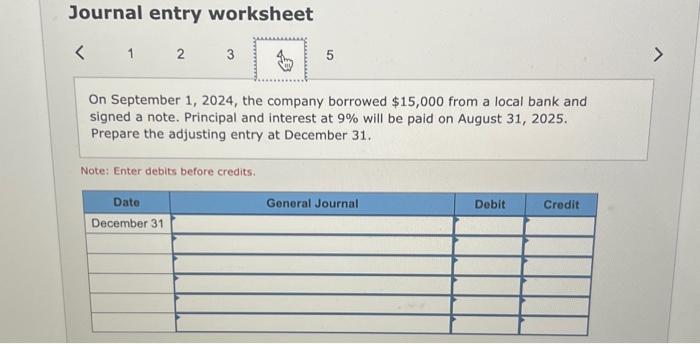

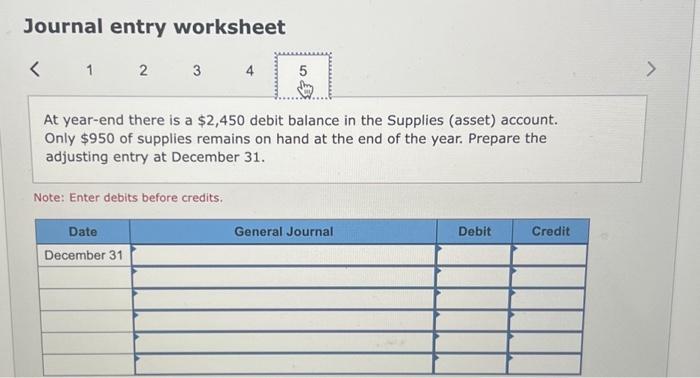

Journal entry worksheet On September 1, 2024, the company borrowed $15,000 from a local bank and signed a note. Principal and interest at 9% will be paid on August 31, 2025. Prepare the adjusting entry at December 31. Note: Enter debits before credits. account field.) Journal entry worksheet 5 On July 1,2024 , Moreno recelved $5,500 from a customer for advertising services to be given evenly over the next 10 months. Moreno credited Deferred Revenue on July 1. Prepare the adjusting entry at December 31. Note: Enter debits before credits. Journal entry worksheet 5 At the end of the year, income taxes owed are $6,500. Prepare the adjusting entry at December 31. Note: Enter debits before credits. On May 1,2024 , the company paid $4,200 for a two-year fire and liability insurance policy. The company debited Prepaid Insurance on May 1. Prepare the adjusting entry at December 31 . Note: Enter debits before credits. Problem 3-3A (Algo) Record adjusting entries (LO3-3) The information necessary for preparing the 2024 year-end adjusting entries for Moreno Advertising Agency appears below. Mareno's fiscal year-end is December 31 1. On Juy 1, 2024, Moreno recelved \$5,500 from a customer for advertising services to be given ovenly over the next 10 months Moceno crodited Deferred Revenue on July 1 2. At the end of the yeas, income taxes owed are 56,500 1. On May 1,2024 , the company paid $4,200 for a two year fire and liability insurance policy. The company debited Prepaid insurance on May 1 4. On September 1,2024 , the company borrowed 515,000 trom a lacal bank and signed a note. Principal and interest at 9N wa be paid on August 31,2025 . 5. At year-end there is a $2.450 debit balance in the Suppses (asseg) account. Onty $950 of supplies remains on hand at the end of the year Aequired: Record the necessary sofusting entries on December 31, 2024. No priof adjustments have been made during 2024. (Do not round intermediate calculstions. If no entry is required for a particular transaction/event, select "No Joumal Entry Aequired" in the first account fields) Journal entry worksheet At year-end there is a $2,450 debit balance in the Supplies (asset) account. Only $950 of supplies remains on hand at the end of the year. Prepare the adjusting entry at December 31 . Note: Enter debits before credits