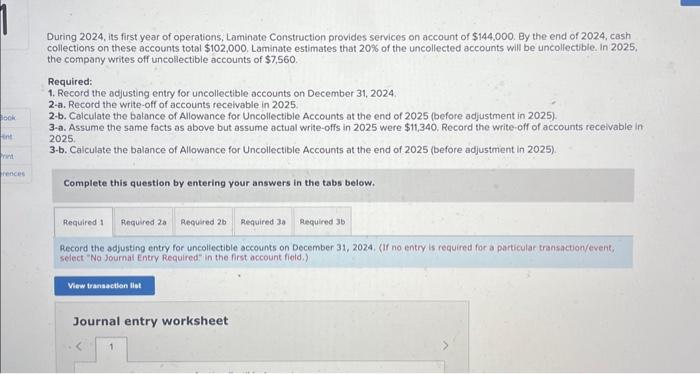

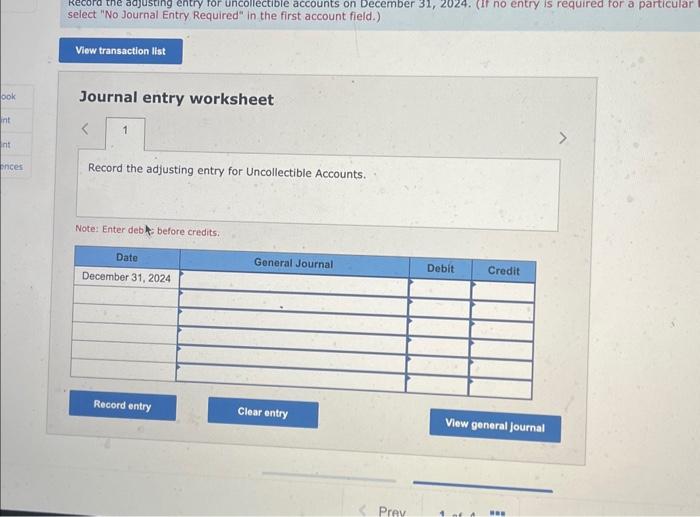

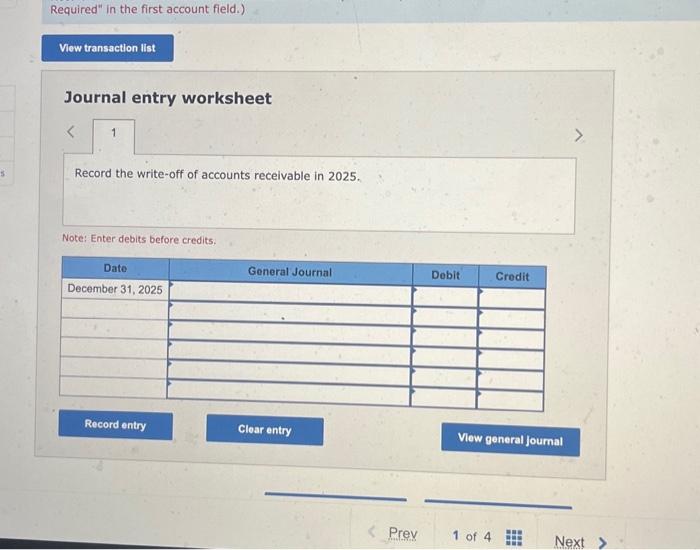

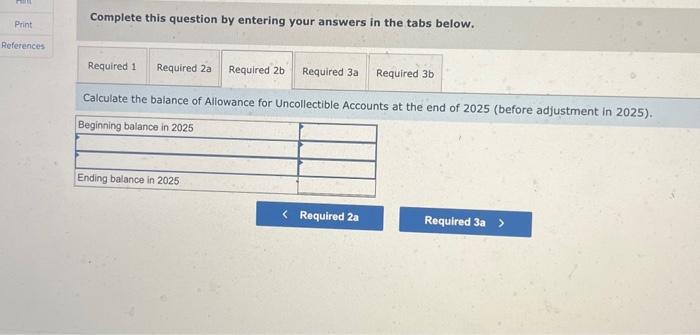

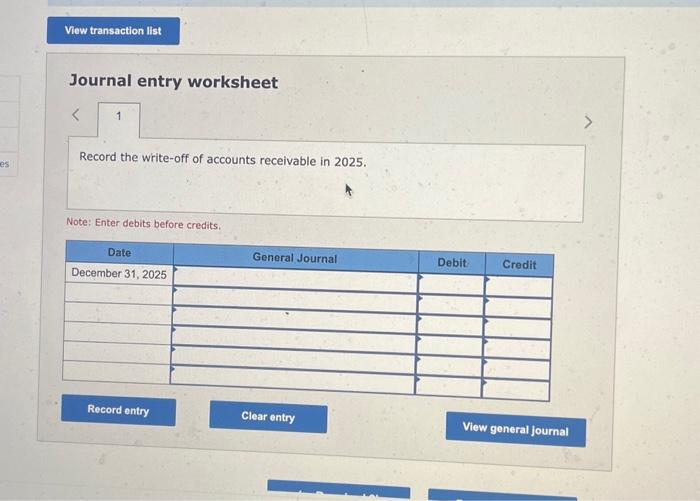

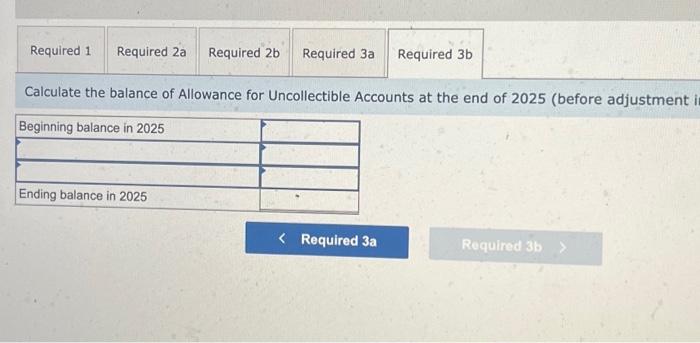

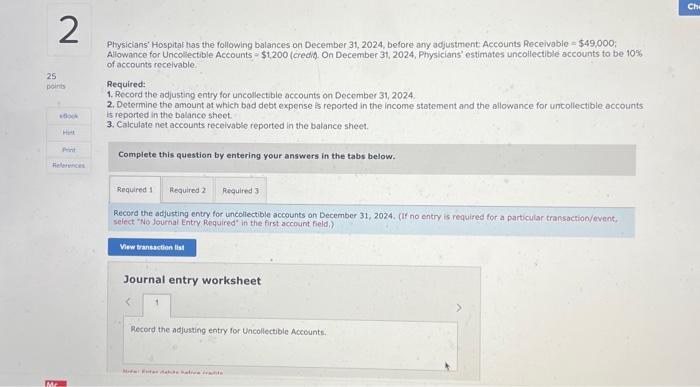

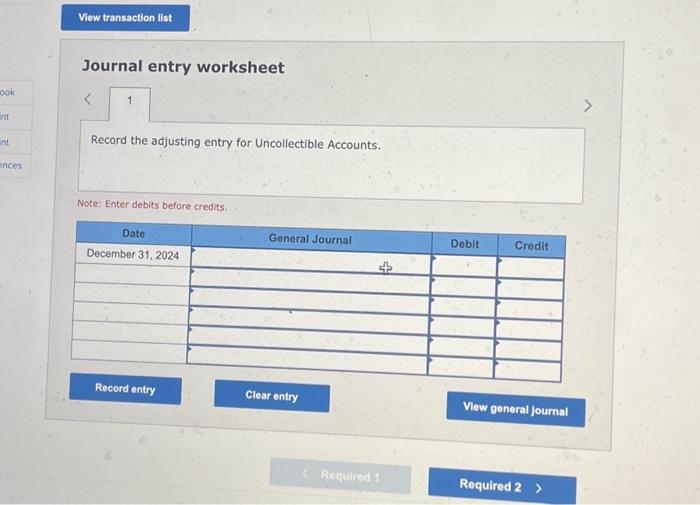

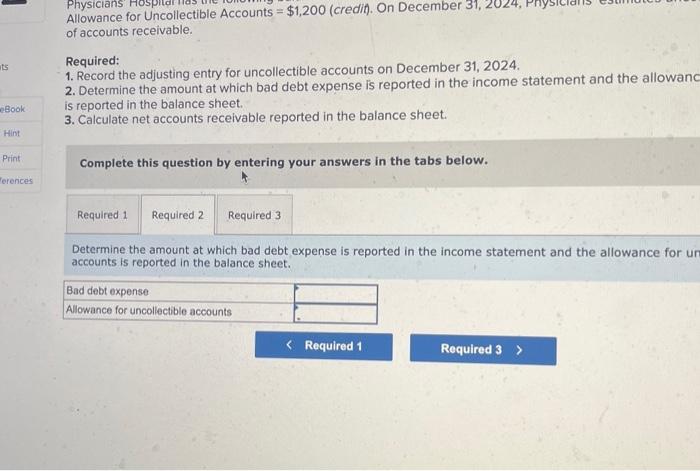

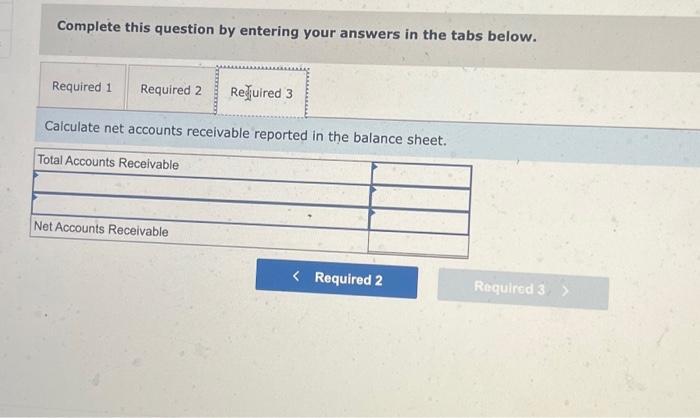

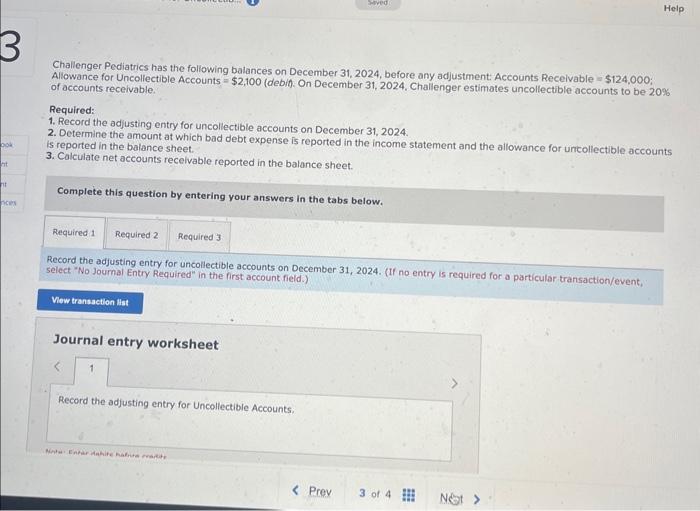

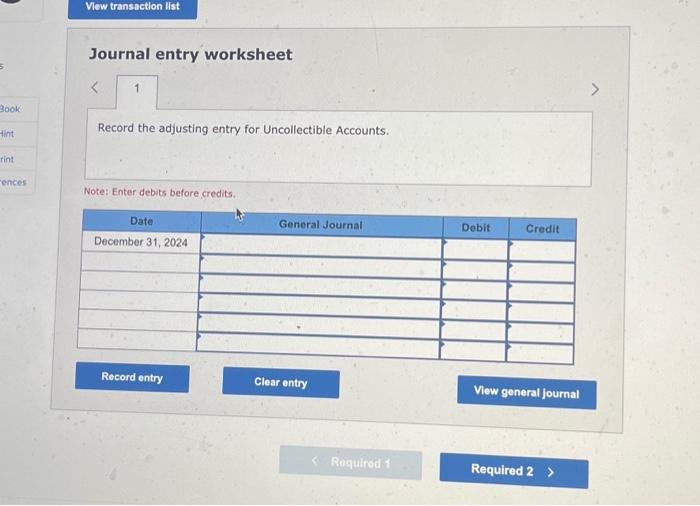

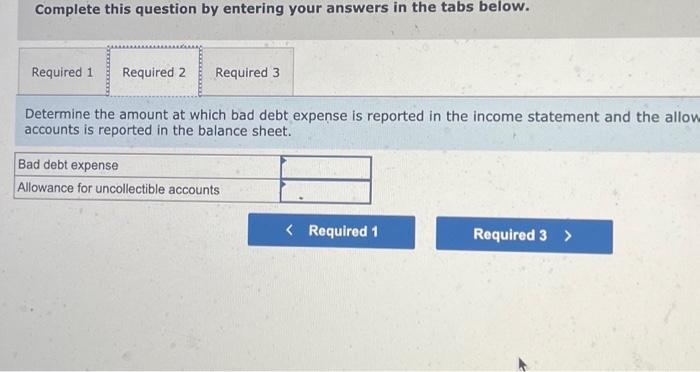

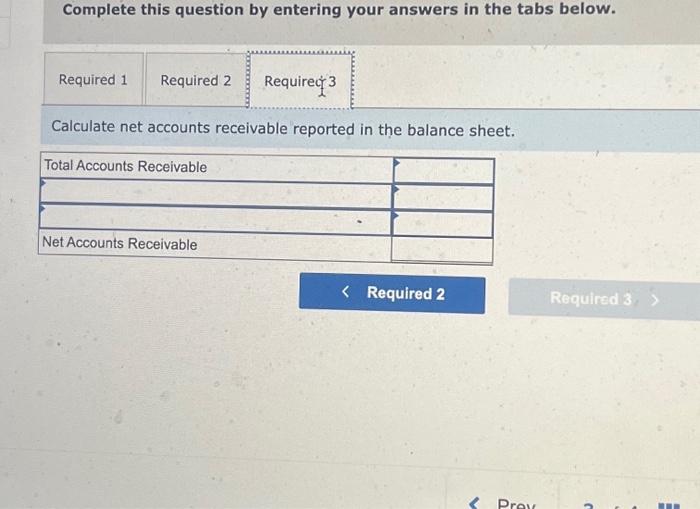

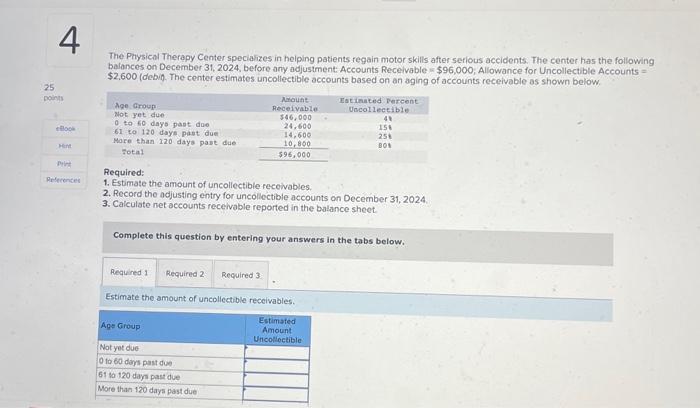

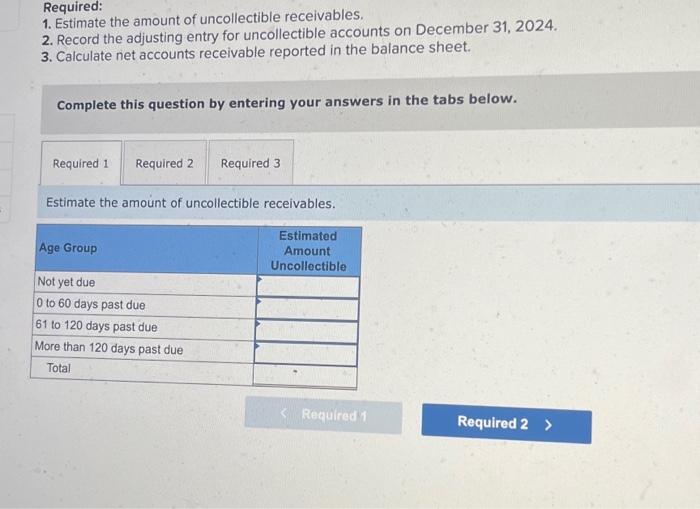

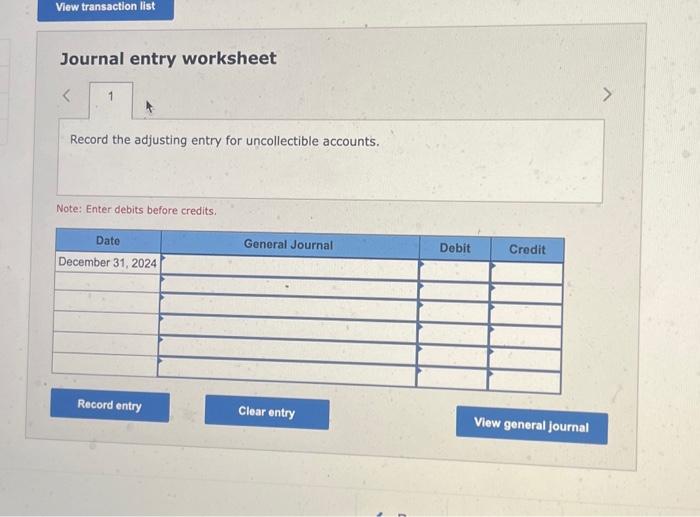

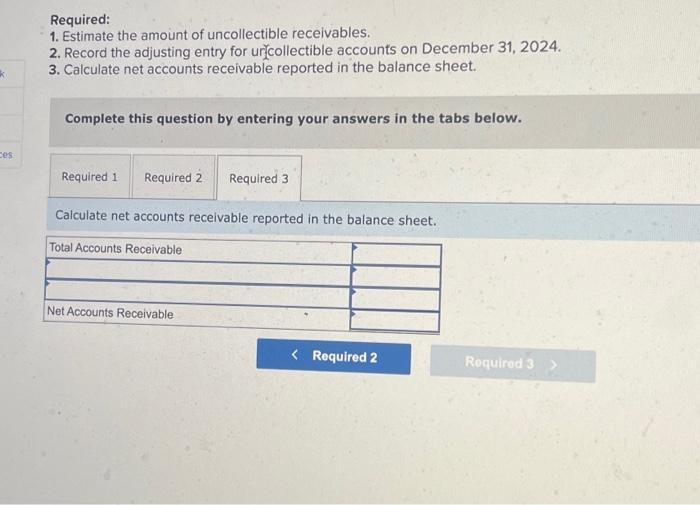

Journal entry worksheet Record the adjusting entry for uncollectible accounts. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Determine the amount at which bad debt expense is reported in the income statement and the allo accounts is reported in the balance sheet. Physicians' Hospital has the following balances on December 31, 2024, before any adjustment Accounts Receivable =$49,000; Allowance for Uncoliectible Accounts = \$1,200 (credit, On December 31, 2024, Physicians' estimates uncollectible accounts to be 10\% of accounts recelvable: Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024. 2. Determine the amount at which bad debt expense Bs reported in the income statement and the allowance for uncollectible accounts is reported in the balatice sheet. 3. Calculate net accounts receivable reported in the batance sheet. Complete this question by entering your answers in the tabs below. Record the adjusting entry for uncoliectible accounts on December 31, 2024. (If no entry is required for a particular transaction/event, select "No Joumal Entry Required" in the first account field, ) The Physical Therapy Center speciaizes in helping patients regain motor skills after serious accidents. The center has the following balances on December 31, 2024, before any adjustment: Accounts Receivable $96,000, Allowance for Uncollectible Accounts = $2.600 (debig. The center estimates uncoliectible accounts based on an aging of accounts receivable as shown below. Required: 1. Estimate the amount of uncollectible recoivables. 2. Record the adjusting entry for uncollectible accounts on December 31,2024. 3. Calculate net accounts receivable reported in the balance sheet. Complete this question by entering your answers in the tabs below. Estimate the amount of uncollectible receivables. Allowance for Uncollectible Accounts =$1,200 (credit). On December of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31,2024. 2. Determine the amount at which bad debt expense is reported in the income statement and the allowan is reported in the balance sheet. 3. Calculate net accounts receivable reported in the balance sheet. Complete this question by entering your answers in the tabs below. Determine the amount at which bad debt expense is reported in the income statement and the allowance for u accounts is reported in the balance sheet. Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet. Required: 1. Estimate the amount of uncollectible receivables. 2. Record the adjusting entry for uricollectible accounts on December 31, 2024. 3. Calculate net accounts receivable reported in the balance sheet. Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet. Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Caiculate net accounts receivable reported in the balance sheet. During 2024, its first year of operations, Laminate Construction provides services on account of $144,000. By the end of 2024 , cash collections on these accounts total $102,000. Laminate estimates that 20% of the uncollected accounts will be uncollectible. In 2025 , the company writes off uncollectible accounts of $7,560. Required: 1. Record the adjusting entry for uncollectible accounts on December 31,2024. 2-a. Record the write-off of accounts recelvable in 2025. 2.b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025). 3-a. Assume the same facts as above but assume actual write-offs in 2025 were $11,340. Record the write-off of accounts recelvable in 2025. 3-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025). Complete this question by entering your answers in the tabs below. Record the adjusting entry for uncollectible accounts on December 31, 2024. (If no entry is required for a particular transaction/event; select "No Joumal Entry Required" in the first account fiold.) Challenger Pediatrics has the following balances on December 31,2024 , before any adjustment: Accounts Receivable =$124,000 : Allowance for Uncollectible Accounts =$2,100 (debit). On December 31,2024 . Challenger estimates uncollectible accounts to be 20% of accounts recelvable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31,2024. 2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet. 3. Calculate net accounts recelvable reported in the balance sheet. Complete this question by entering your answers in the tabs below. Record the adjusting entry for uncollectible accounts on December 31, 2024. (If no entry is required for a particular transaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet Record the write-off of accounts receivable in 2025. Note: Enter debits before credits. Required: 1. Estimate the amount of uncollectible receivables. 2. Record the adjusting entry for uncollectible accounts on December 31, 2024. 3. Calculate net accounts receivable reported in the balance sheet. Complete this question by entering your answers in the tabs below. Estimate the amount of uncollectible receivables. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter deb of before credits. Journal entry worksheet Record the write-off of accounts receivable in 2025. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Calculate the balance of Aliowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025)