Answered step by step

Verified Expert Solution

Question

1 Approved Answer

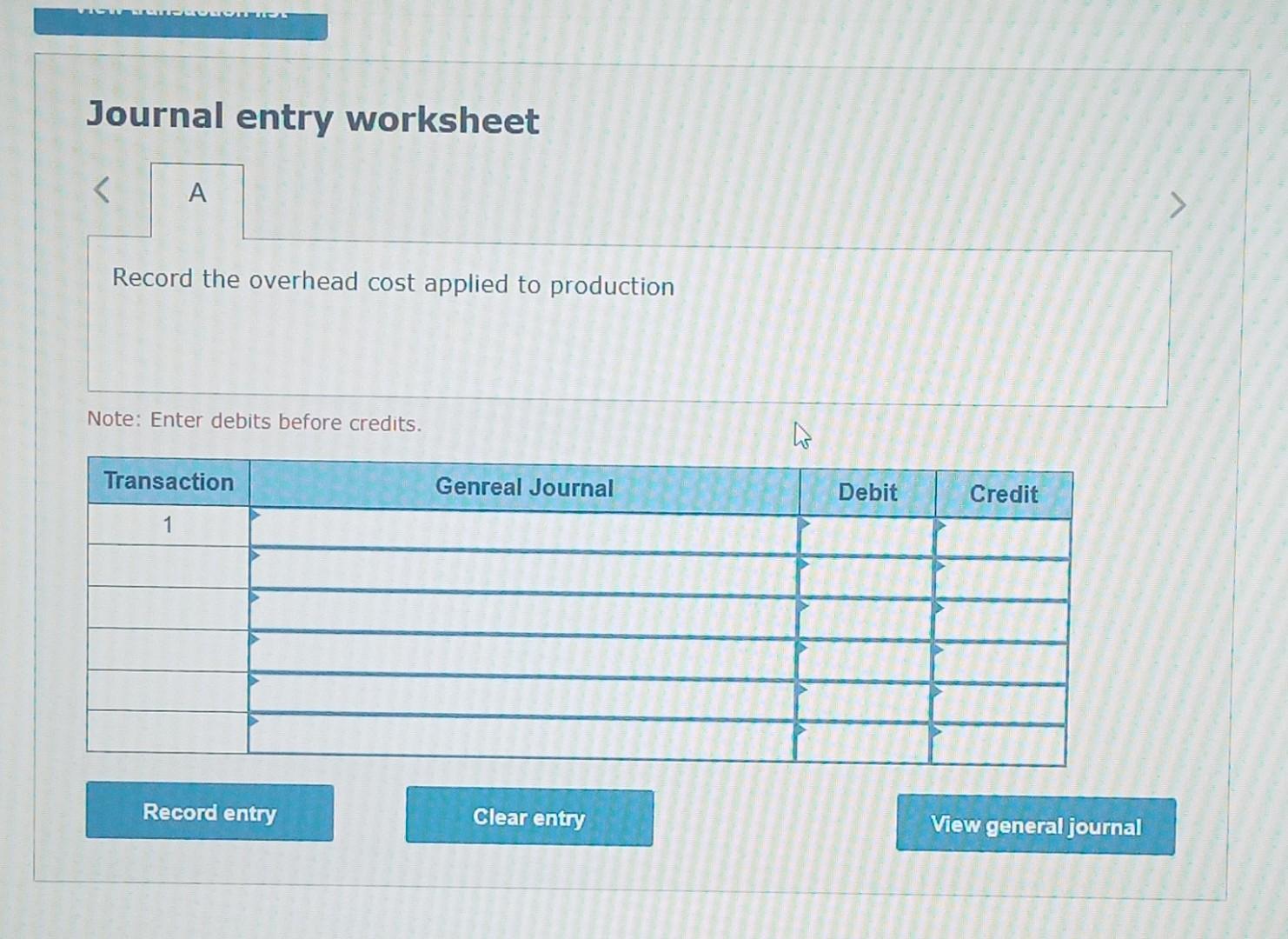

Journal entry worksheet Record the overhead cost applied to production Note: Enter debits before credits. Required information [The following information applies to the questions displayed

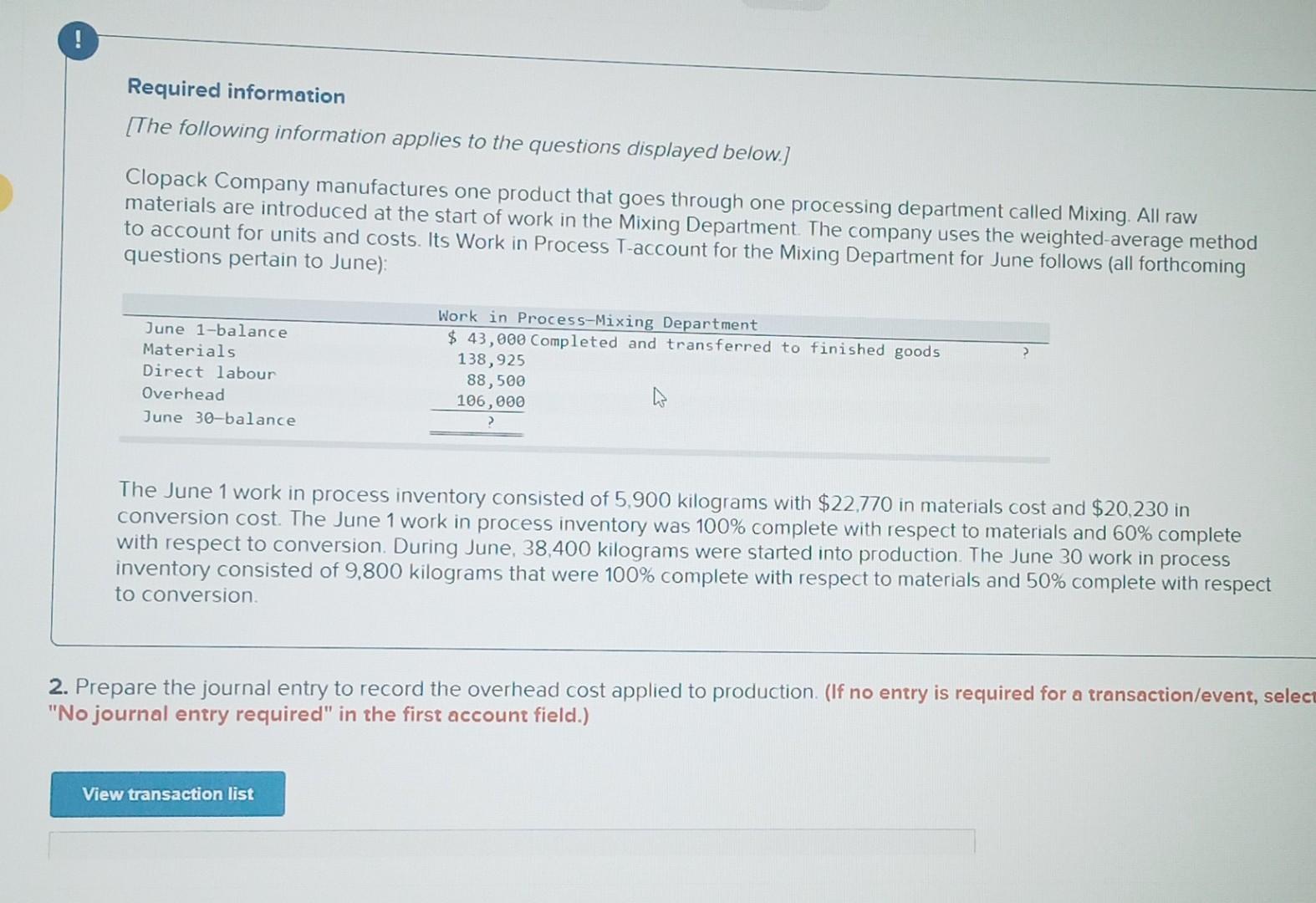

Journal entry worksheet Record the overhead cost applied to production Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method to account for units and costs. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): The June 1 work in process inventory consisted of 5,900 kilograms with $22,770 in materials cost and $20,230 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,400 kilograms were started into production. The June 30 work in process inventory consisted of 9,800 kilograms that were 100% complete with respect to materials and 50% complete with respect to conversion. Prepare the journal entry to record the overhead cost applied to production. (If no entry is required for a transaction/event, sele No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started