Answered step by step

Verified Expert Solution

Question

1 Approved Answer

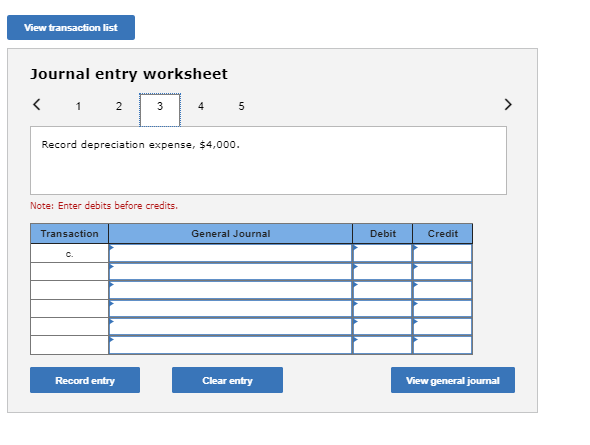

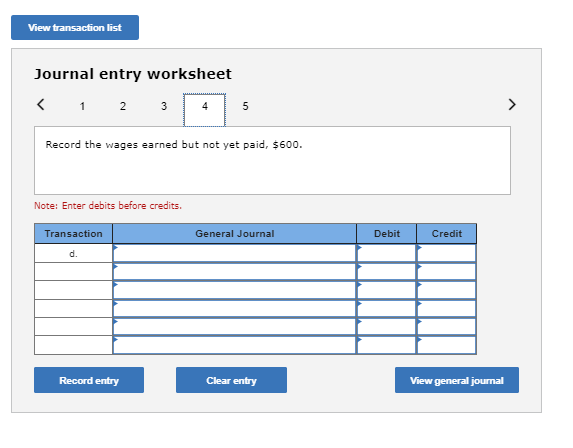

Journal entry worksheet Record the wages earned but not yet paid, $600. Note: Enter debits before credits. Requlred: 1. Record the adjusting entrles. (If no

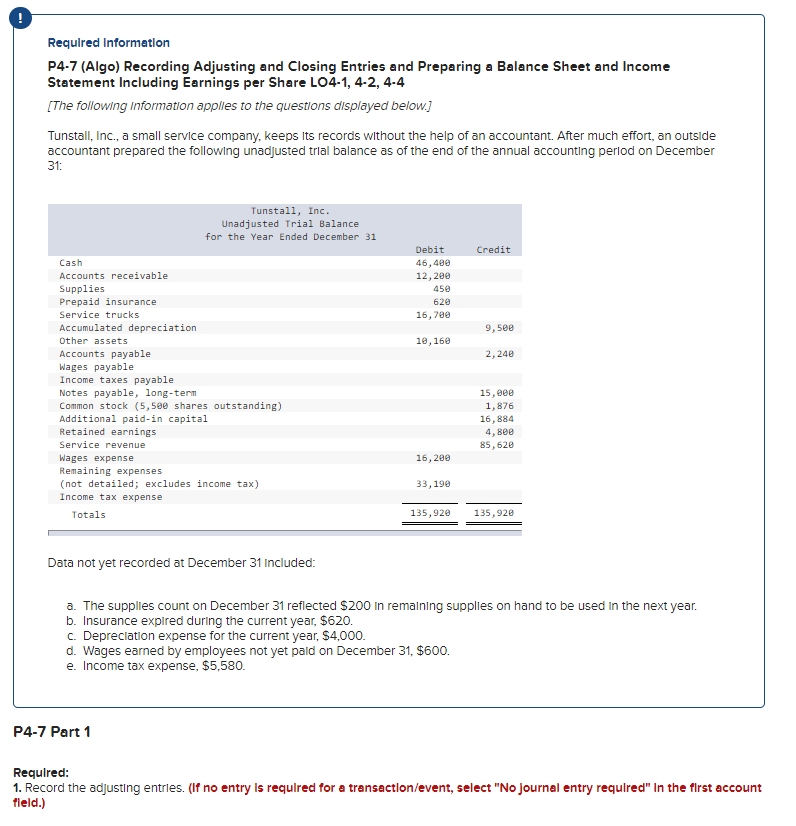

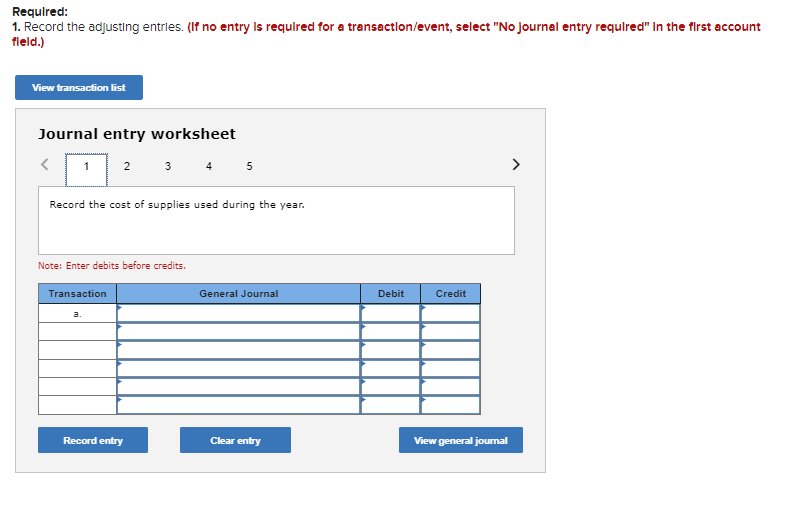

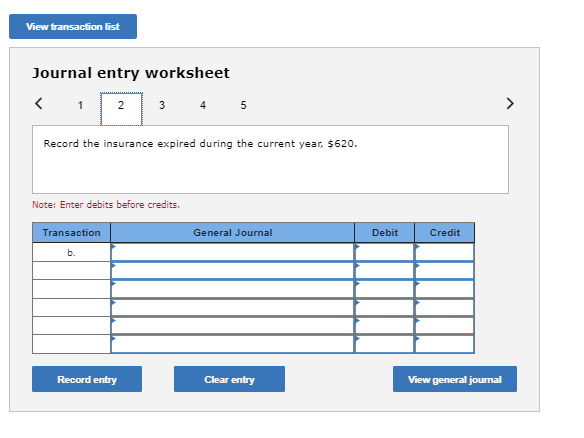

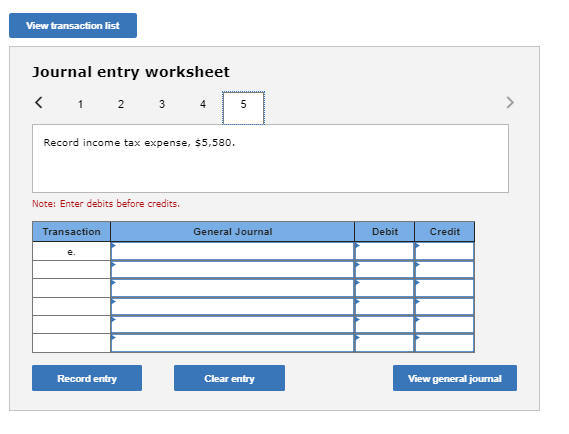

Journal entry worksheet Record the wages earned but not yet paid, $600. Note: Enter debits before credits. Requlred: 1. Record the adjusting entrles. (If no entry Is required for a transaction/event, select "No journal entry requlred" In the flrst account field.) Journal entry worksheet 2345 Record the cost of supplies used during the year. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 123 Note: Enter debits before credits. Journal entry worksheet 5 Record the insurance expired during the current year, $620. Note: Enter debits before credits. Required Information P4-7 (Algo) Recording Adjusting and Closing Entries and Preparing a Balance Sheet and Income Statement Including Earnings per Share LO4-1, 4-2, 4-4 [The following information applles to the questions displayed below.] Tunstall, Inc., a small service company, keeps Its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trlal balance as of the end of the annual accounting perlod on December 31 : Data not yet recorded at December 31 included: a. The supplies count on December 31 reflected $200 In remalning supplles on hand to be used In the next year. b. Insurance expired during the current year, $620. c. Depreclation expense for the current year, $4,000. d. Wages earned by employees not yet pald on December 31,$600. e. Income tax expense, $5,580. P4-7 Part 1 Requlred: 1. Record the adjusting entrles. (If no entry Is required for a transactlon/event, select "No journal entry requlred" In the flrst account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started