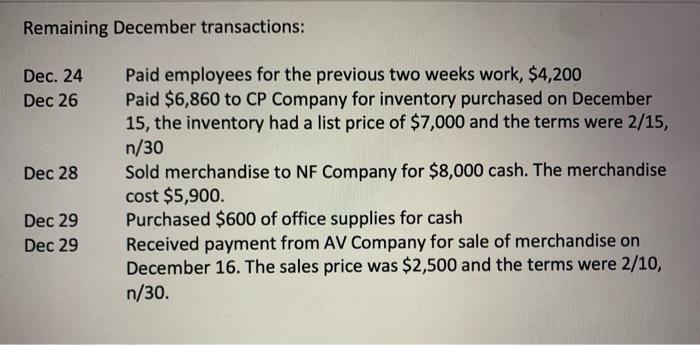

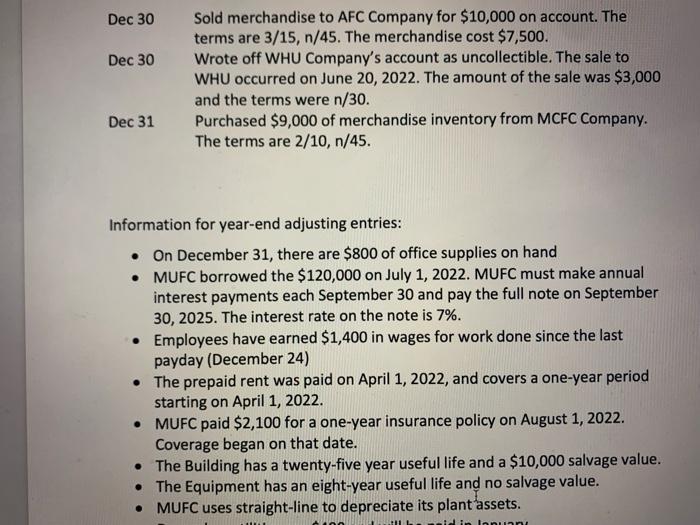

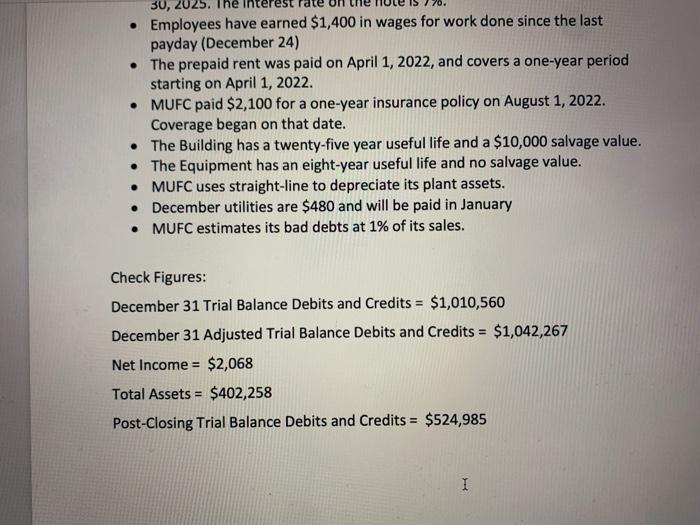

Journalize and post the remaining 2022 transactions Prepare a trial balance at December 31, 2022 Journalize and post the required adjusting entries Prepare an adjusted trial balance at December 31, 2022 Prepare a multi-step income statement for 2022 Prepare a statement of retained earnings for 2022 Prepare a classified balance sheet for December 31, 2022 Journalize and post the necessary closing entries at December 31, 2022 Prepare a post-closing trial balance Remaining December transactions: Dec. 24 Paid employees for the previous two weeks work, $4,200 Dec 26 Paid $6,860 to CP Company for inventory purchased on December 15 , the inventory had a list price of $7,000 and the terms were 2/15, n/30 Dec 28 Sold merchandise to NF Company for $8,000 cash. The merchandise cost $5,900. Dec 29 Purchased $600 of office supplies for cash Dec 29 Received payment from AV Company for sale of merchandise on December 16 . The sales price was $2,500 and the terms were 2/10, n/30. Dec 30 Sold merchandise to AFC Company for $10,000 on account. The terms are 3/15,n/45. The merchandise cost $7,500. Dec 30 Wrote off WHU Company's account as uncollectible. The sale to WHU occurred on June 20,2022 . The amount of the sale was $3,000 and the terms were n/30. Dec 31 Purchased $9,000 of merchandise inventory from MCFC Company. The terms are 2/10,n/45. Information for year-end adjusting entries: - On December 31 , there are $800 of office supplies on hand - MUFC borrowed the $120,000 on July 1, 2022. MUFC must make annual interest payments each September 30 and pay the full note on September 30,2025 . The interest rate on the note is 7%. - Employees have earned $1,400 in wages for work done since the last payday (December 24) - The prepaid rent was paid on April 1, 2022, and covers a one-year period starting on April 1, 2022. - MUFC paid $2,100 for a one-year insurance policy on August 1, 2022. Coverage began on that date. - The Building has a twenty-five year useful life and a $10,000 salvage value. - The Equipment has an eight-year useful life and no salvage value. - MUFC uses straight-line to depreciate its plant assets. - Employees have earned $1,400 in wages for work done since the last payday (December 24) - The prepaid rent was paid on April 1, 2022, and covers a one-year period starting on April 1, 2022. - MUFC paid \$2,100 for a one-year insurance policy on August 1, 2022. Coverage began on that date. - The Building has a twenty-five year useful life and a $10,000 salvage value. - The Equipment has an eight-year useful life and no salvage value. - MUFC uses straight-line to depreciate its plant assets. - December utilities are $480 and will be paid in January - MUFC estimates its bad debts at 1% of its sales. Check Figures: December 31 Trial Balance Debits and Credits =$1,010,560 December 31 Adjusted Trial Balance Debits and Credits =$1,042,267 Net Income =$2,068 Total Assets =$402,258 Post-Closing Trial Balance Debits and Credits =$524,985