Answered step by step

Verified Expert Solution

Question

1 Approved Answer

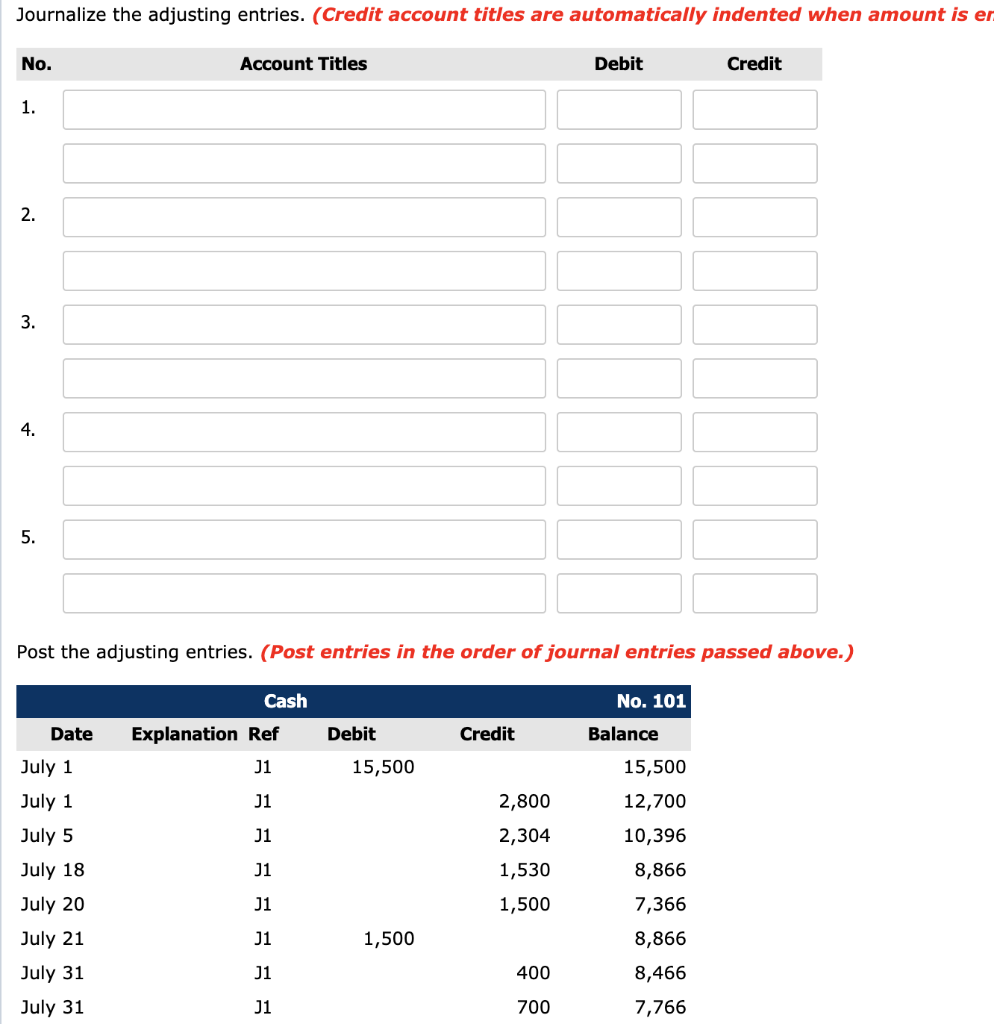

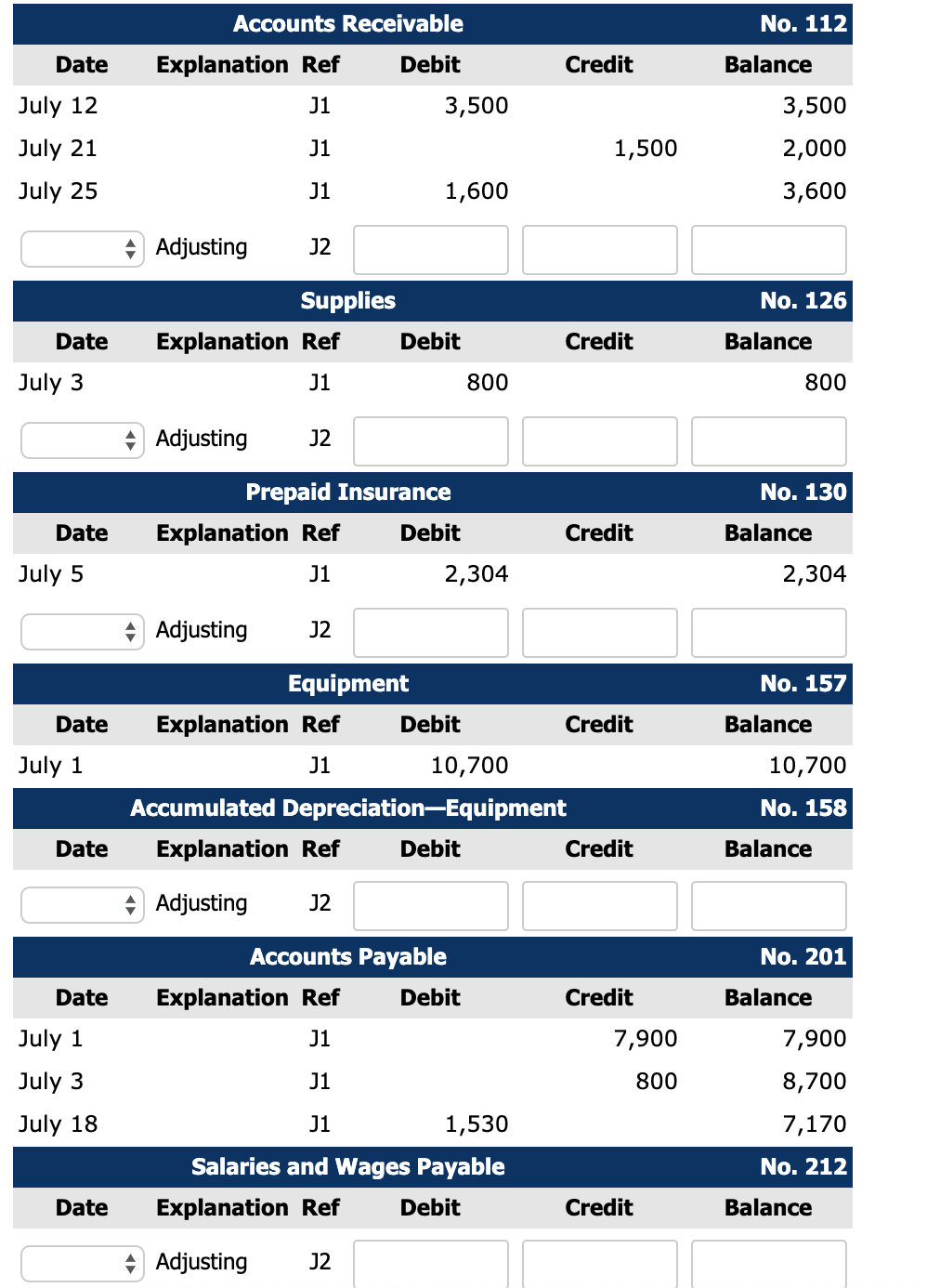

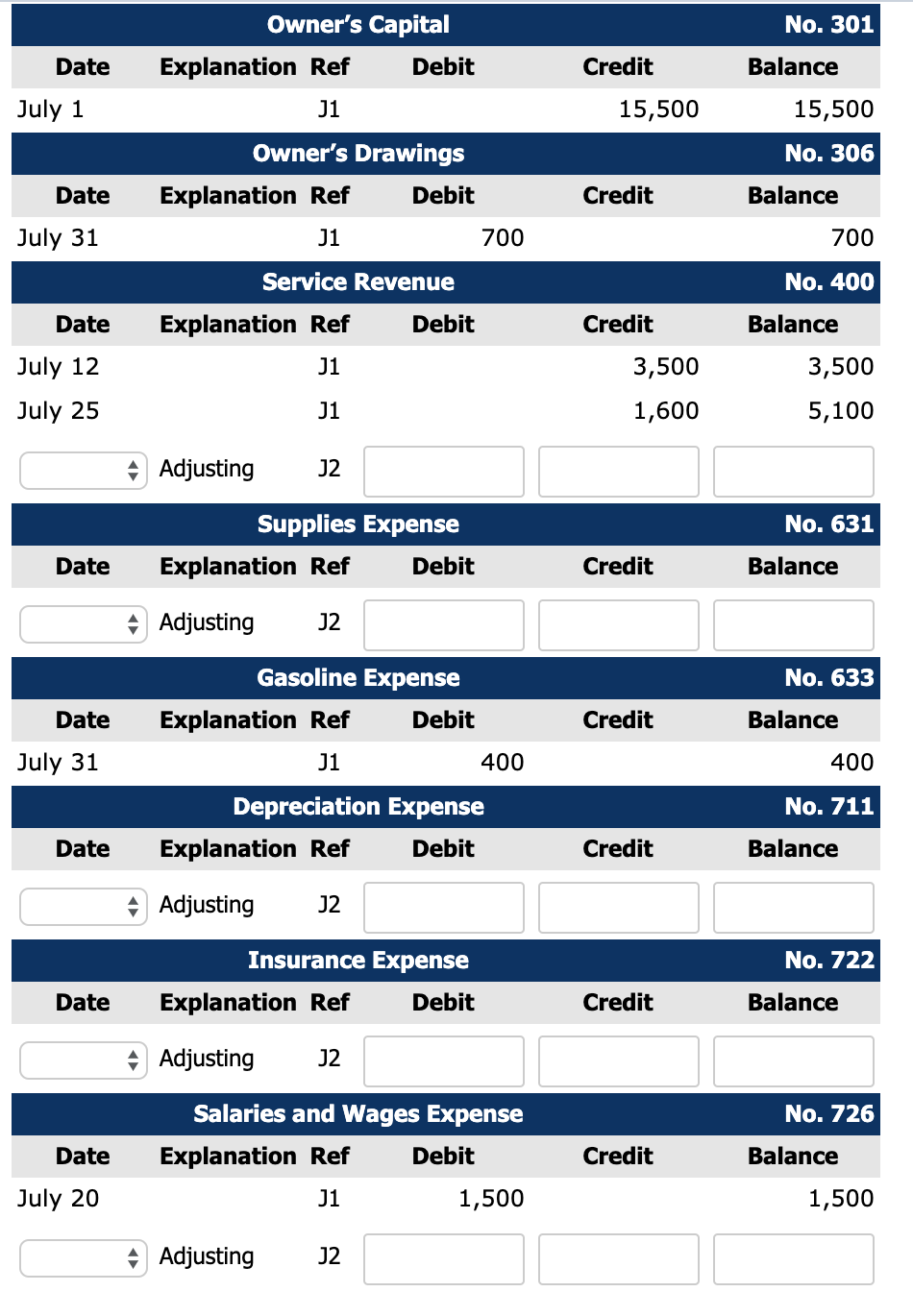

Journalize the adjusting entries and post the adjusting entries: (Information given from previous questions: Ashley Williams opened Ashleys Maids Cleaning Service on July 1, 2017.

Journalize the adjusting entries and post the adjusting entries:

(Information given from previous questions:

Ashley Williams opened Ashleys Maids Cleaning Service on July 1, 2017. During July, the company completed the following transactions.

| July | 1 | Invested $15,500 cash in the business. | |

| 1 | Purchased a used truck for $10,700, paying $2,800 cash and the balance on account. | ||

| 3 | Purchased cleaning supplies for $800 on account. | ||

| 5 | Paid $2,304 on a one-year insurance policy, effective July 1. | ||

| 12 | Billed customers $3,500 for cleaning services. | ||

| 18 | Paid $1,300 of amount owed on truck, and $230 of amount owed on cleaning supplies. | ||

| 20 | Paid $1,500 for employee salaries. | ||

| 21 | Collected $1,500 from customers billed on July 12. | ||

| 25 | Billed customers $1,600 for cleaning services. | ||

| 31 | Paid gasoline for the month on the truck, $400. | ||

| 31 | Withdrew $700 cash for personal use. |

| (1) | Unbilled fees for services performed at July 31 were $1,300. | |||

| (2) | Depreciation on equipment for the month was $200. | |||

| (3) | One-twelfth of the insurance expired. | |||

| (4) | An inventory count shows $300 of cleaning supplies on hand at July 31. | |||

| (5) | Accrued but unpaid employee salaries were $500. |

Here are screenshots of the actual question:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started