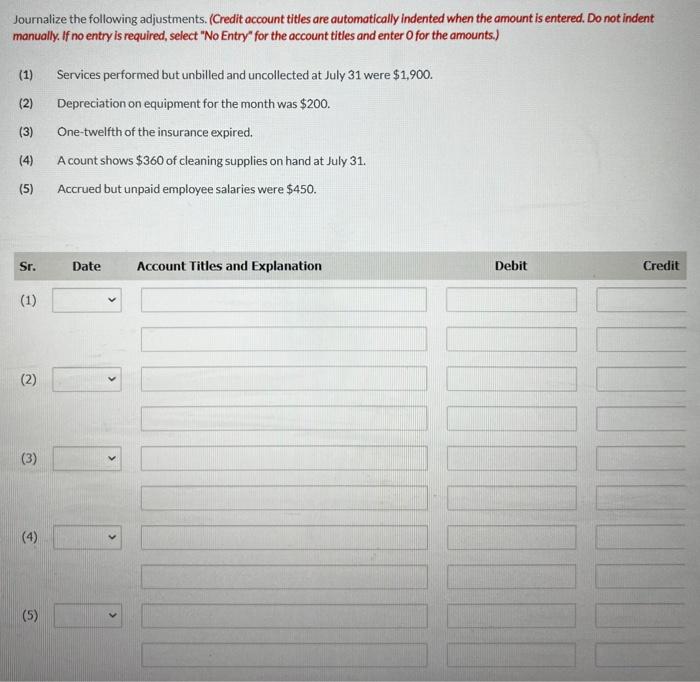

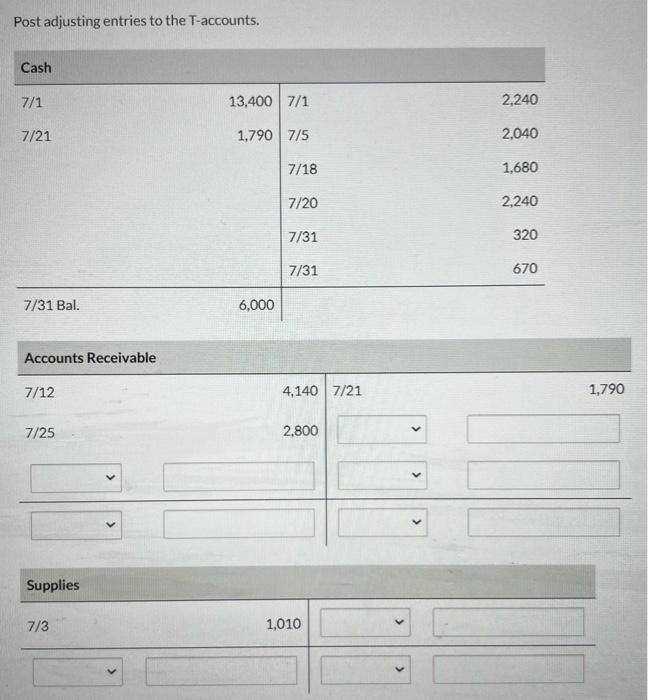

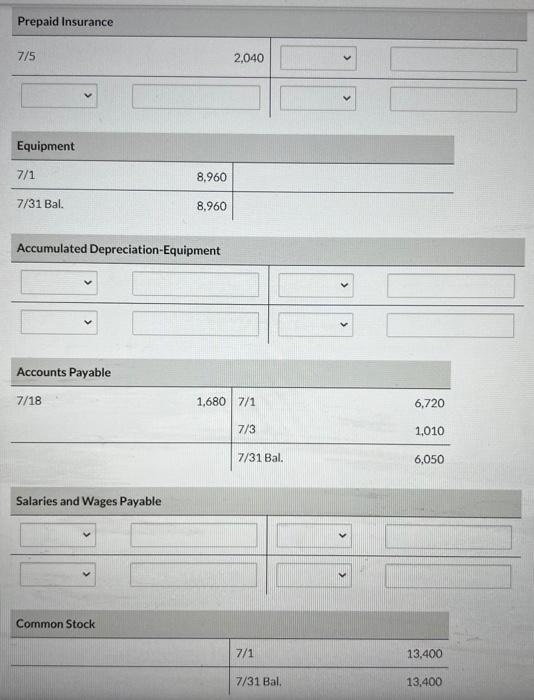

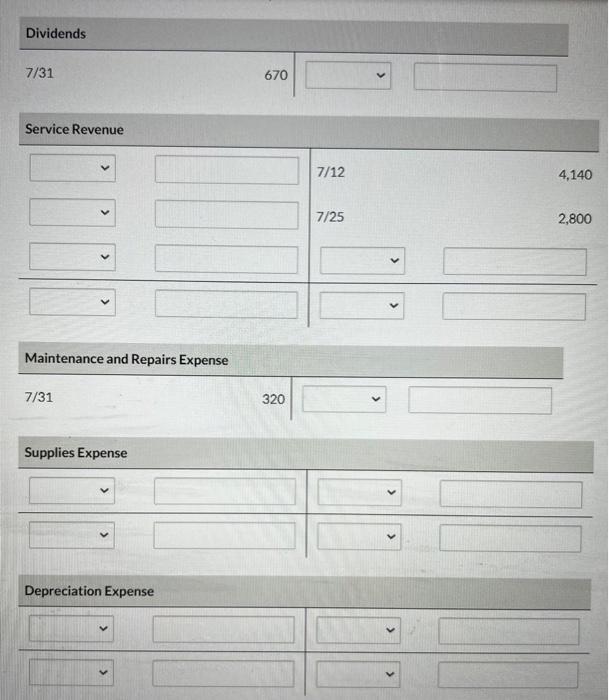

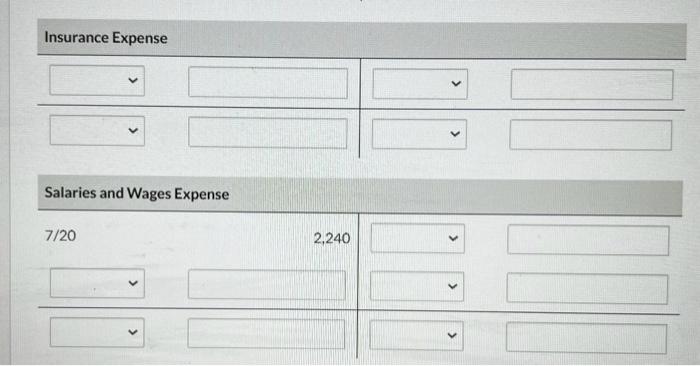

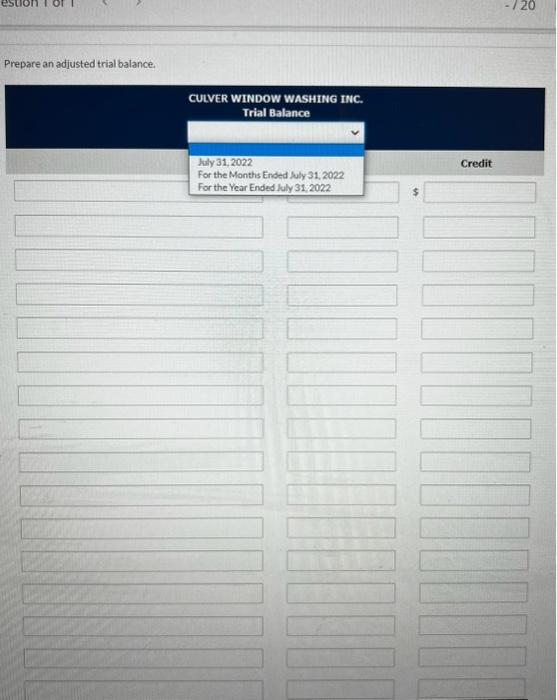

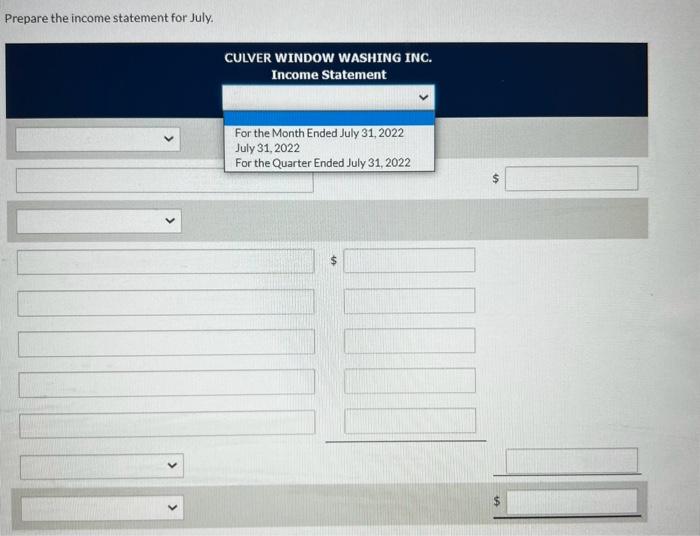

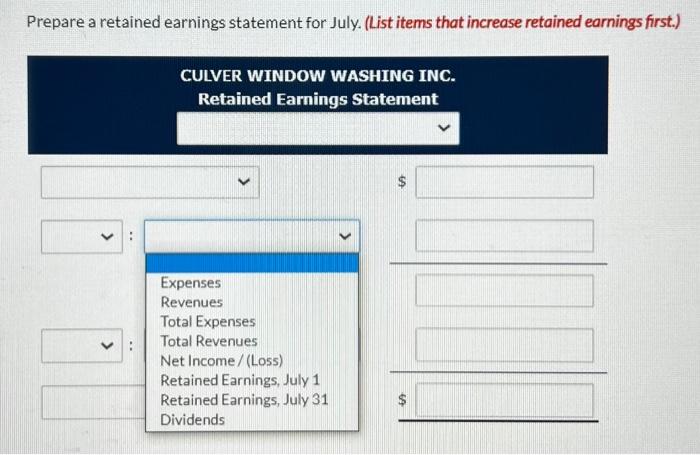

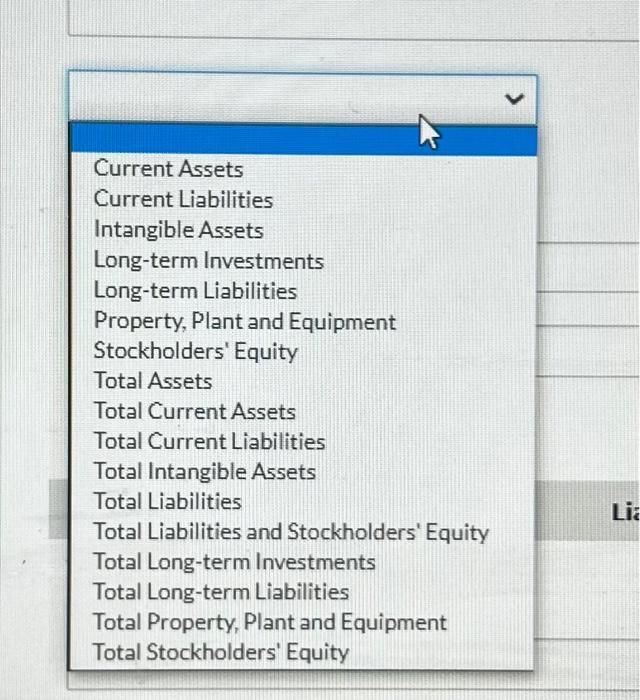

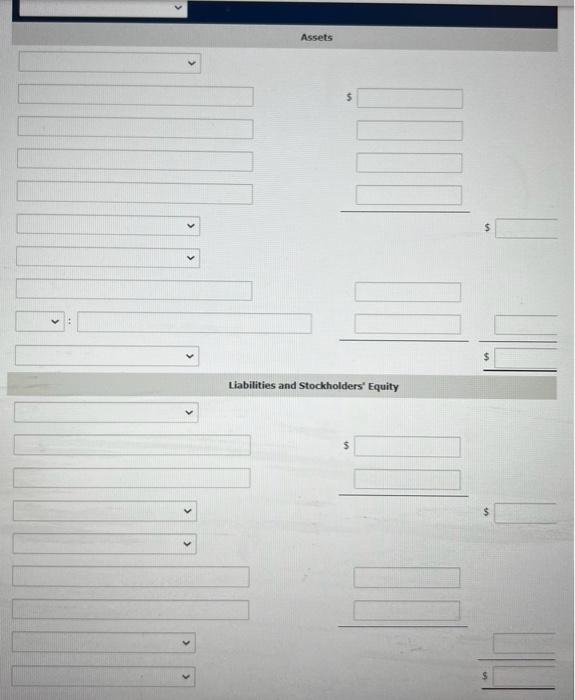

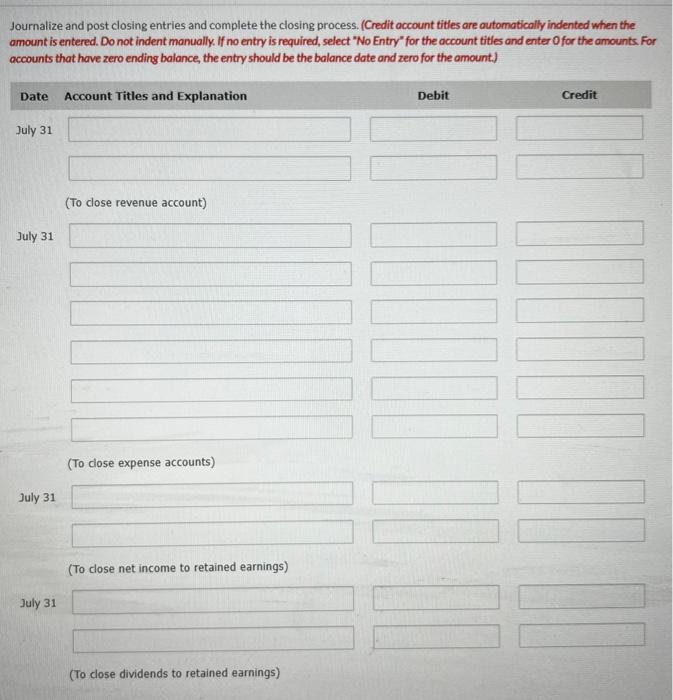

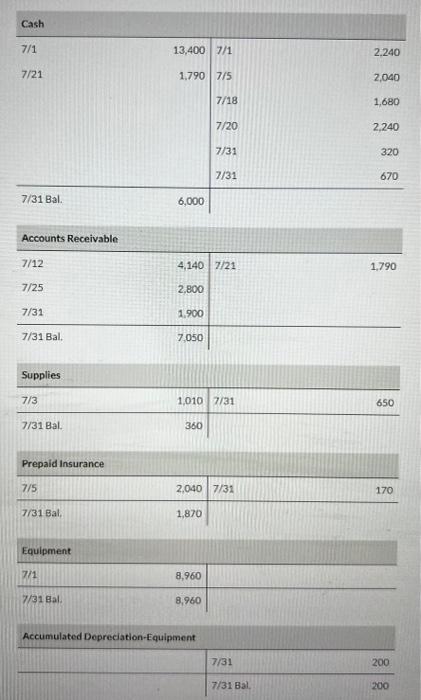

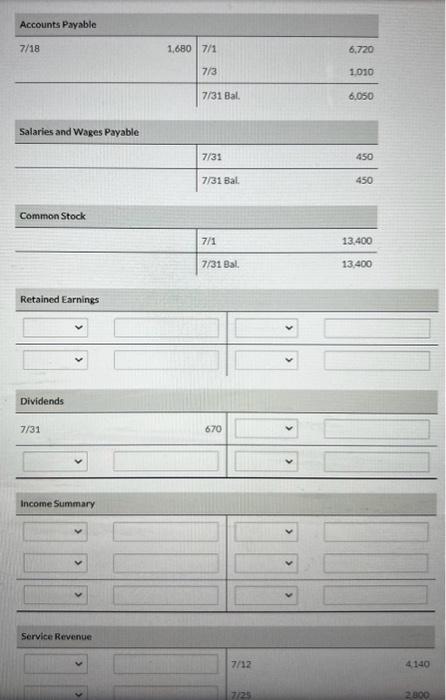

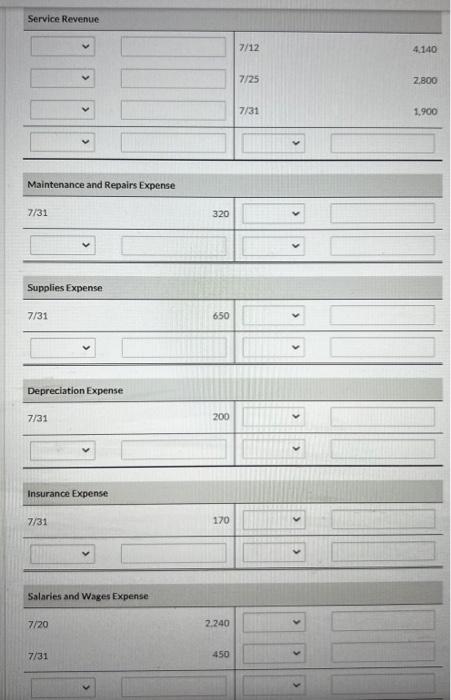

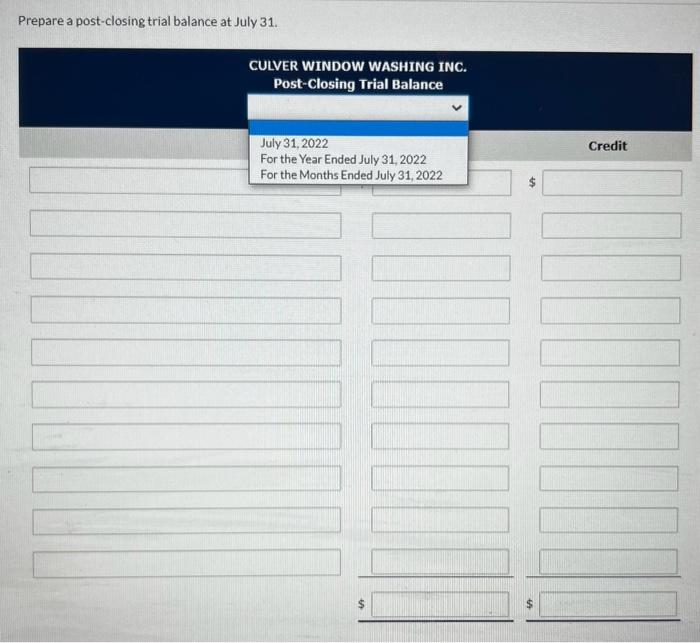

Journalize the following adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entryis required, select "No Entry" for the account titles and enter O for the amounts.) (1) Services performed but unbilled and uncollected at July 31 were $1,900. (2) Depreciation on equipment for the month was $200. (3) One-twelfth of the insurance expired. (4) A count shows $360 of cleaning supplies on hand at July 31 . (5) Accrued but unpaid employee salaries were $450. Post adjusting entries to the T-accounts. Prepaid Insurance \begin{tabular}{ll|l|} \hline Equipment \\ \hline 7/1 & 8,960 & \\ \hline 7/31Bal & 8,960 & \\ \hline \end{tabular} Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Common Stock \begin{tabular}{l|ll} \hline & 7/1 & 13,400 \\ \hline & 7/31Bal. & 13,400 \end{tabular} Dividends 7/31 670 Service Revenue Maintenance and Repairs Expense 7/31 320 Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense Prepare an adjusted trial balance. Prepare the income statement for July. Prepare a retained earnings statement for July. (List items that increase retained earnings first.) Current Assets Current Liabilities Intangible Assets Long-term Investments Long-term Liabilities Property, Plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long-term Investments Total Long-term Liabilities Total Property, Plant and Equipment Total Stockholders' Equity Assets Liabilities and Stockholders" Equity 5 $ Journalize and post closing entries and complete the closing process. (Credit occount titles are outomaticolly indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. For a Accounts Receivable \begin{tabular}{ll|ll} \hline 7/12 & 4,140 & 7/21 & 1,790 \\ 7/25 & 2,800 & & \\ 7/31 & 1,900 & & \\ \hline 7/31 Bal. & 7,050 & & \\ \hline Supplies & & & \\ \hline 7/3 & 1,010 & 7/31 & 650 \\ \hline 7/31 Bal. & 360 & & \\ \hline \end{tabular} Prepaid Insurance Equipment \begin{tabular}{|l|l|l|} \hline 7/1 & 8,960 & \\ \hline 7/318ll. & 8,960 & \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{ll|ll} Accounts Payable \\ \hline 7/18 & 1,680 & 7/1 & \\ \hline & 7/3 & 6,720 \\ & & 7/31Bal. & 1.010 \\ \hline & & 6.050 \end{tabular} \begin{tabular}{l|lc} Common Stock & \multicolumn{2}{l}{} \\ \hline & 7/1 & 13,400 \\ \hline & 7/318Bl. & 13,400 \end{tabular} Retained Earnings Dividends Income Summary Service Revenue 7/12 Service Revenue Maintenance and Repairs Expense \begin{tabular}{ll|l|l} \hline & 320 & & \\ \hline 7/31 & & \\ \hline & & & \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{ll|l|l|} \hline 7/31 & 200 & & \\ \hline & & & \\ \hline \end{tabular} Insurance Expense Salaries and Wages Expense 7/20 7/31 Prepare a post-closing trial balance at July 31