Answered step by step

Verified Expert Solution

Question

1 Approved Answer

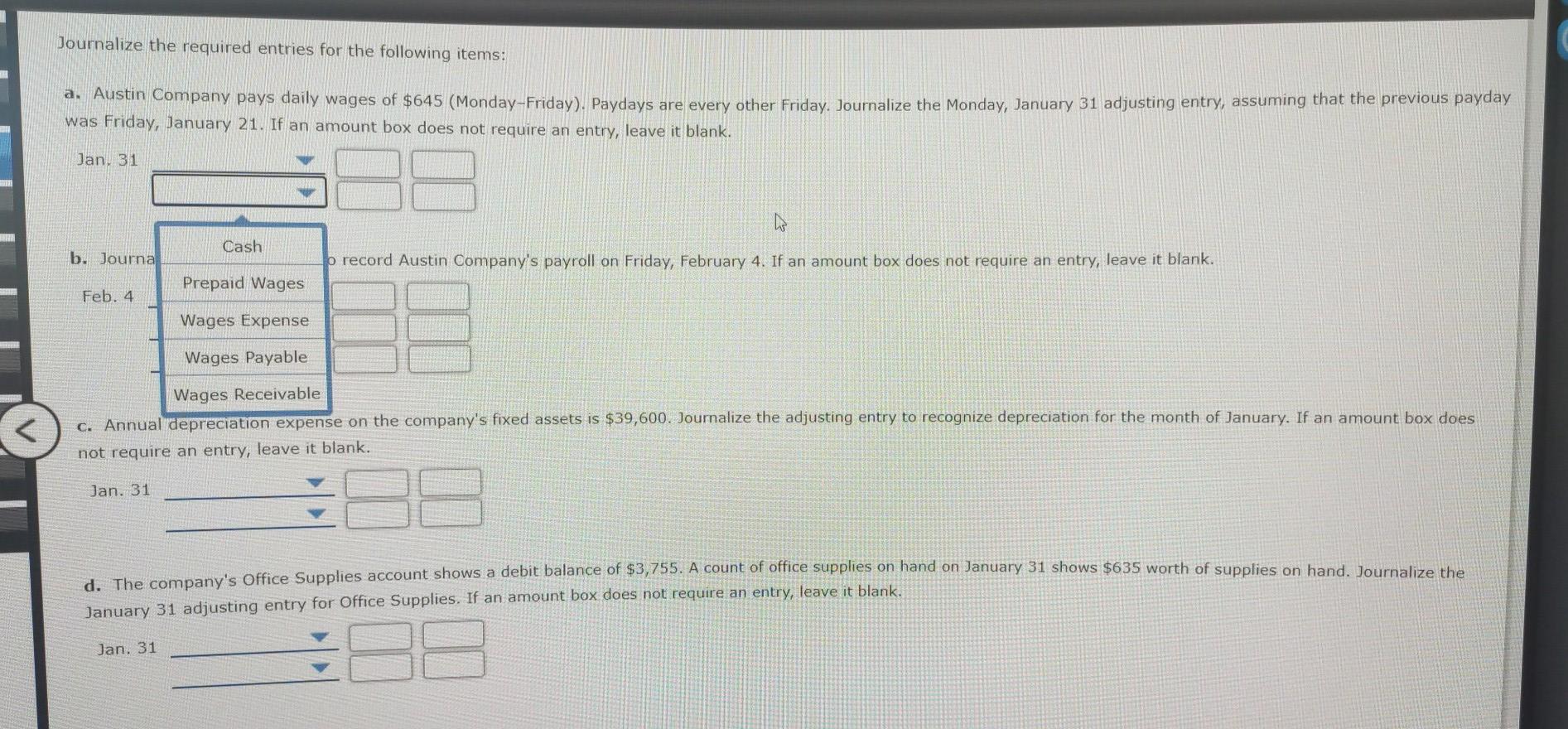

Journalize the required entries for the following items: a. Austin Company pays daily wages of $645 (Monday-Friday). Paydays are every other Friday. Journalize the Monday,

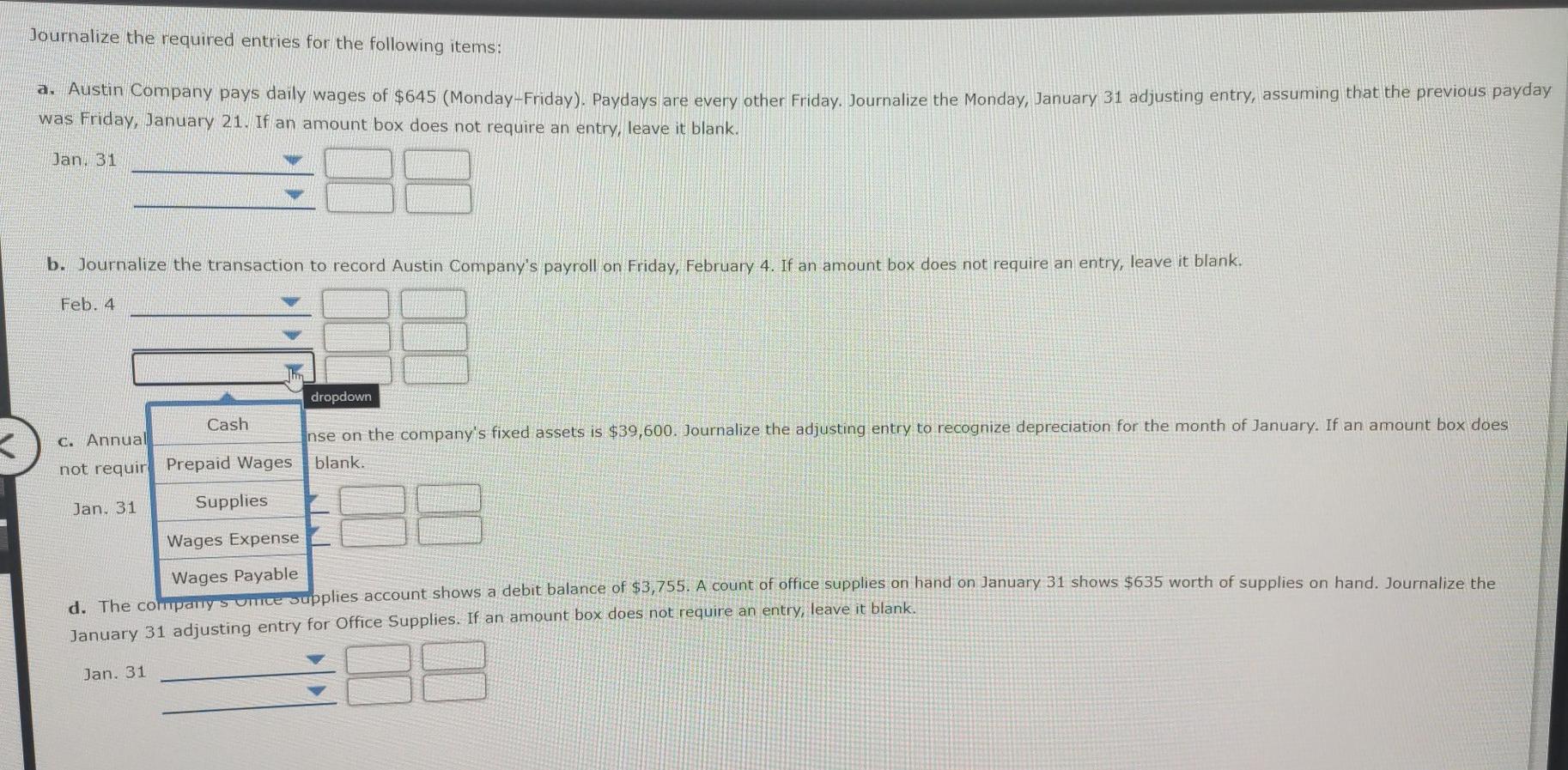

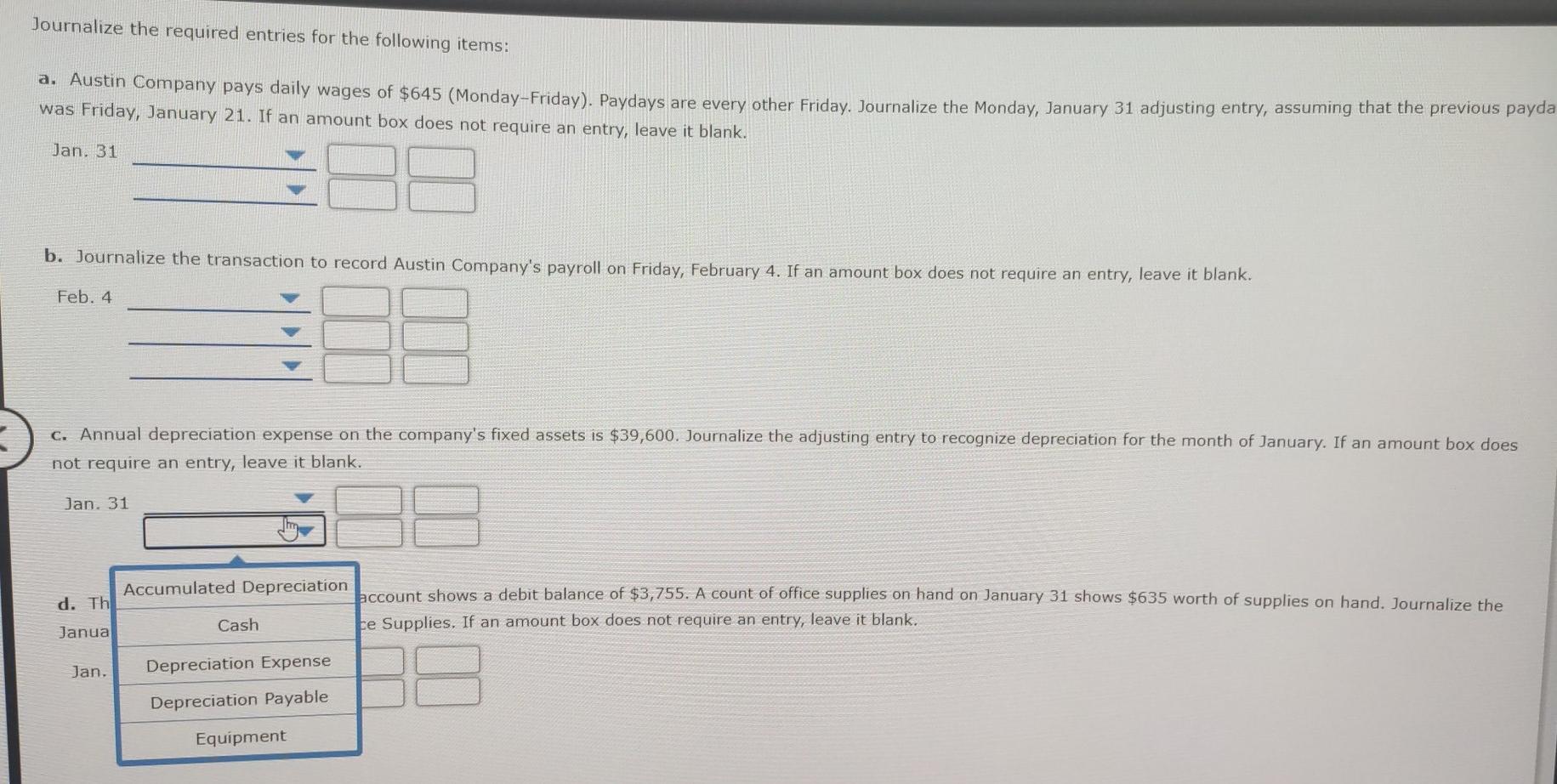

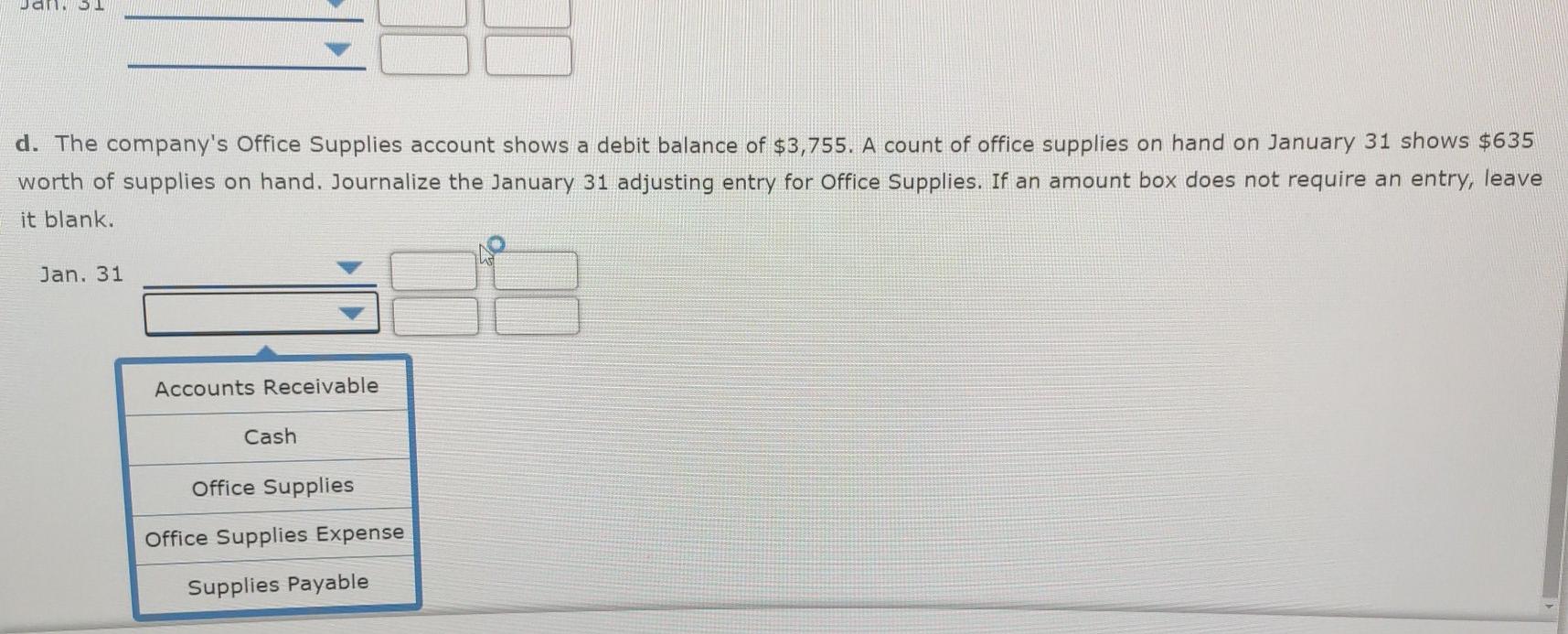

Journalize the required entries for the following items: a. Austin Company pays daily wages of $645 (Monday-Friday). Paydays are every other Friday. Journalize the Monday, January 31 adjusting entry, assuming that the previous payday was Friday, January 21. If an amount box does not require an entry, leave it blank. Jan. 31 Cash b. Journa b record Austin Company's payroll on Friday, February 4. If an amount box does not require an entry, leave it blank. Prepaid Wages Feb. 4 Wages Expense Wages Payable Wages Receivable c. Annual depreciation expense on the company's fixed assets is $39,600. Journalize the adjusting entry to recognize depreciation for the month of January. If an amount box does not require an entry, leave it blank. Jan. 31 d. The company's Office Supplies account shows a debit balance of $3,755. A count of office supplies on hand on January 31 shows $635 worth of supplies on hand. Journalize the January 31 adjusting entry for Office Supplies. If an amount box does not require an entry, leave it blank. Jan. 31 Journalize the required entries for the following items: a. Austin Company pays daily wages of $645 (Monday-Friday). Paydays are every other Friday. Journalize the Monday, January 31 adjusting entry, assuming that the previous payday was Friday, January 21. If an amount box does not require an entry, leave it blank. Jan. 31 b. Journalize the transaction to record Austin Company's payroll on Friday, February 4. If an amount box does not require an entry, leave it blank. Feb. 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started