Journalize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journalize the Year 1 transactions and adjusting entries on Page 1.

Journalize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journalize the Year 1 transactions and adjusting entries on Page 1.

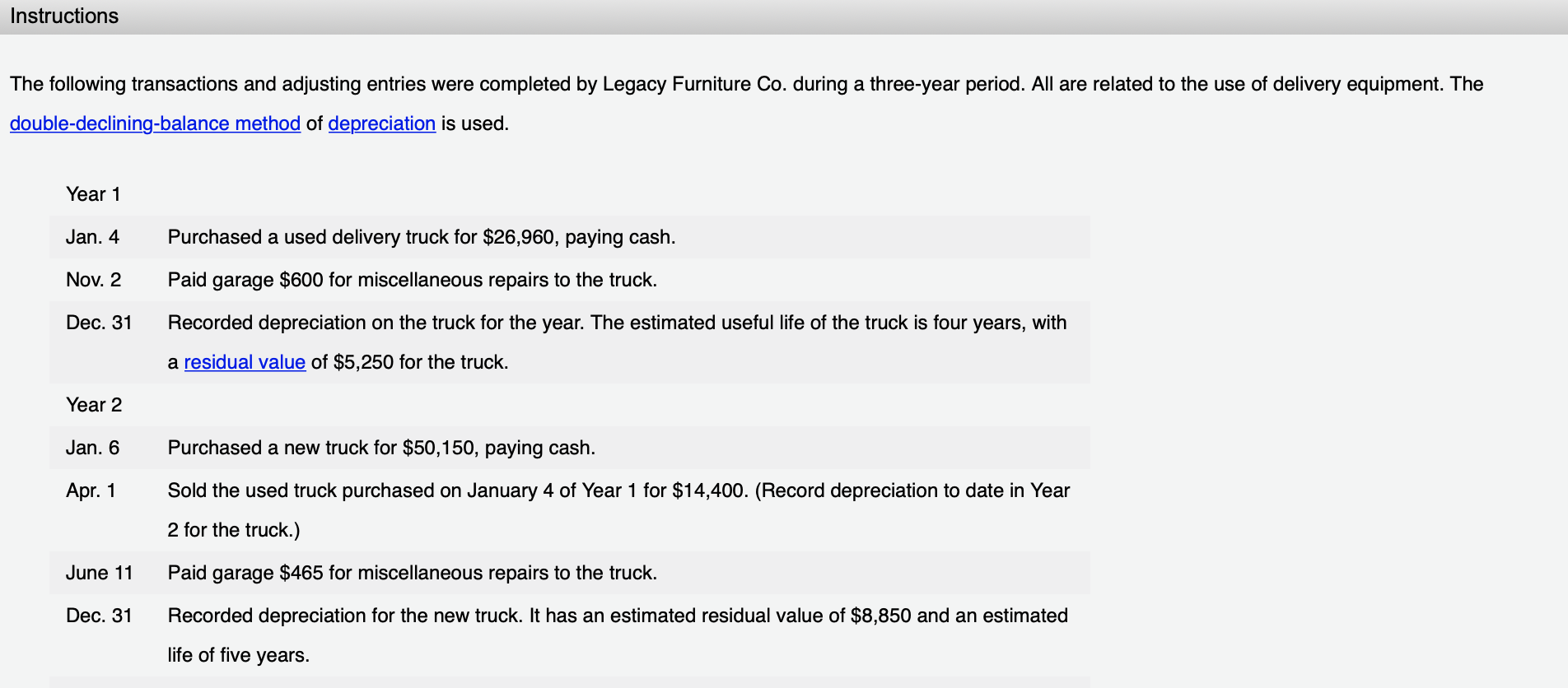

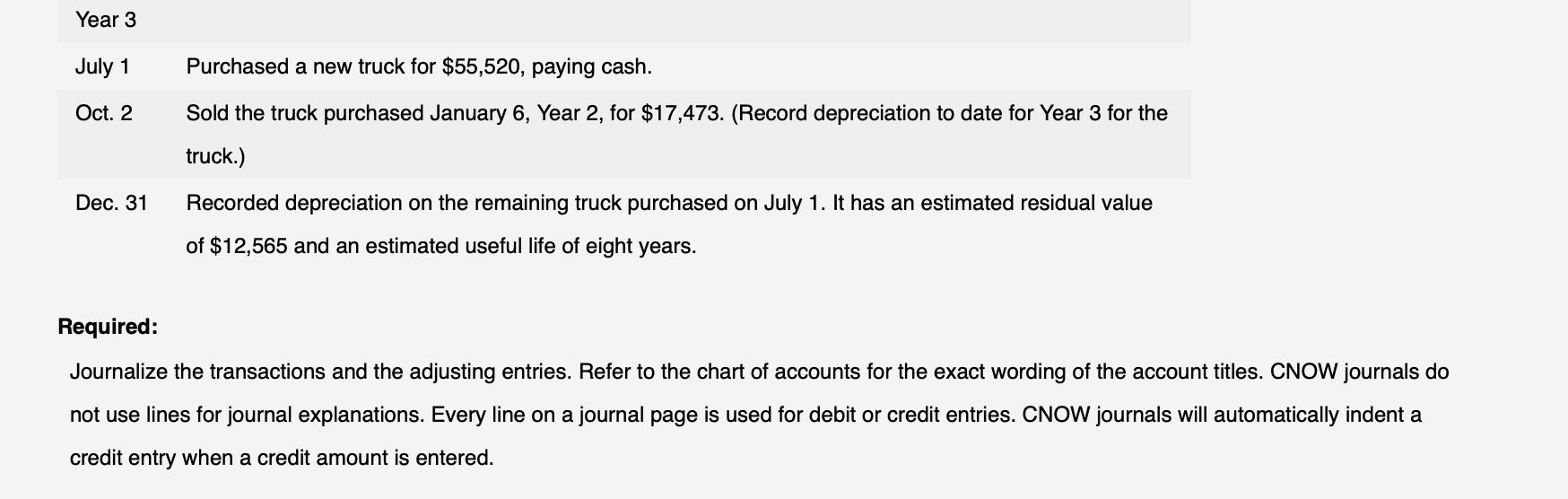

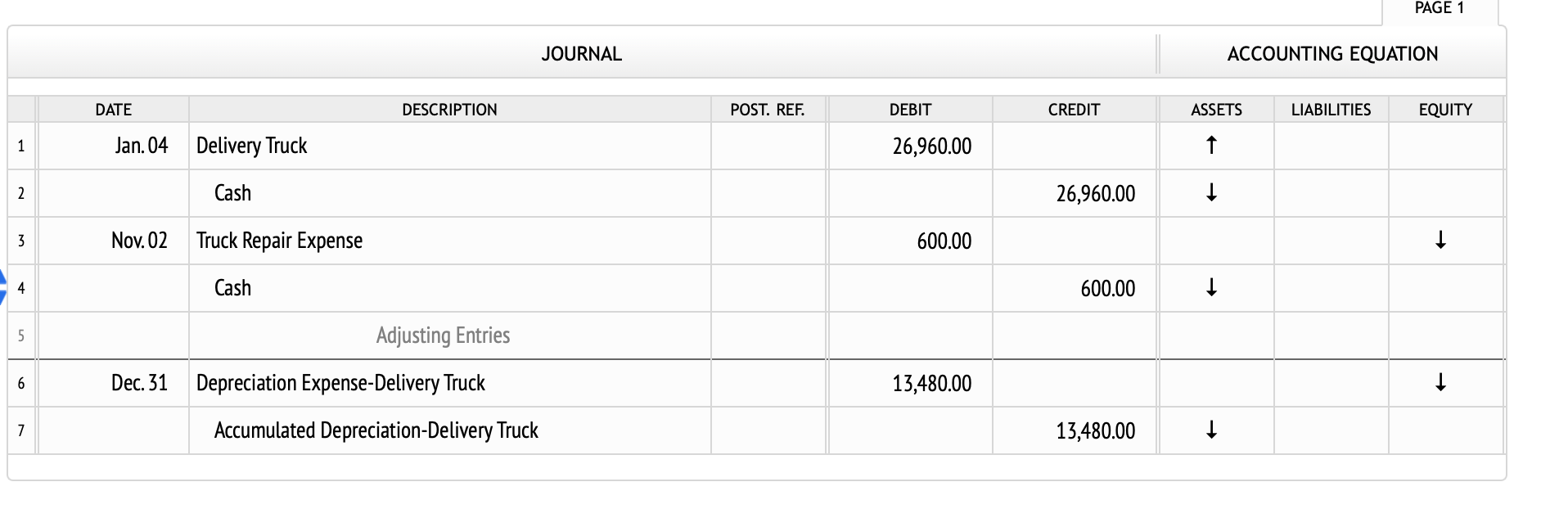

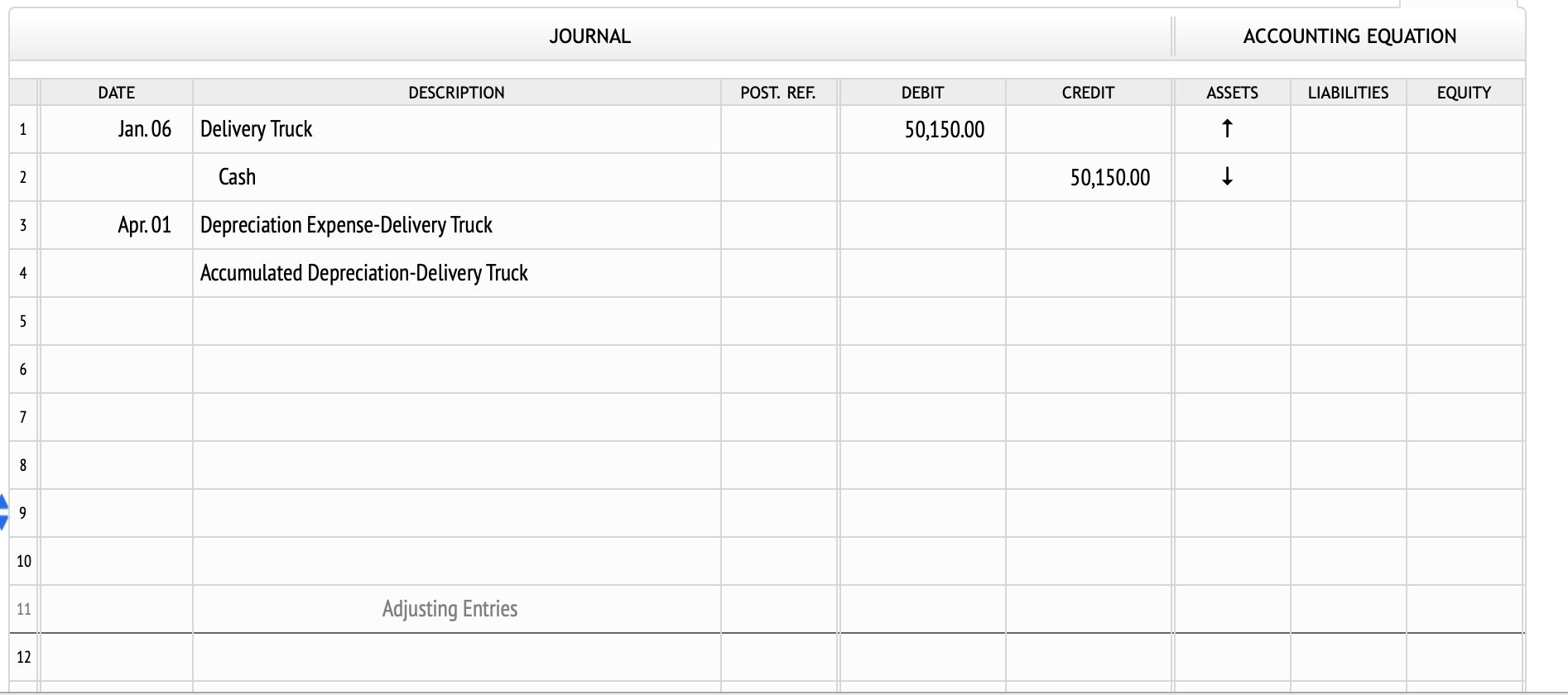

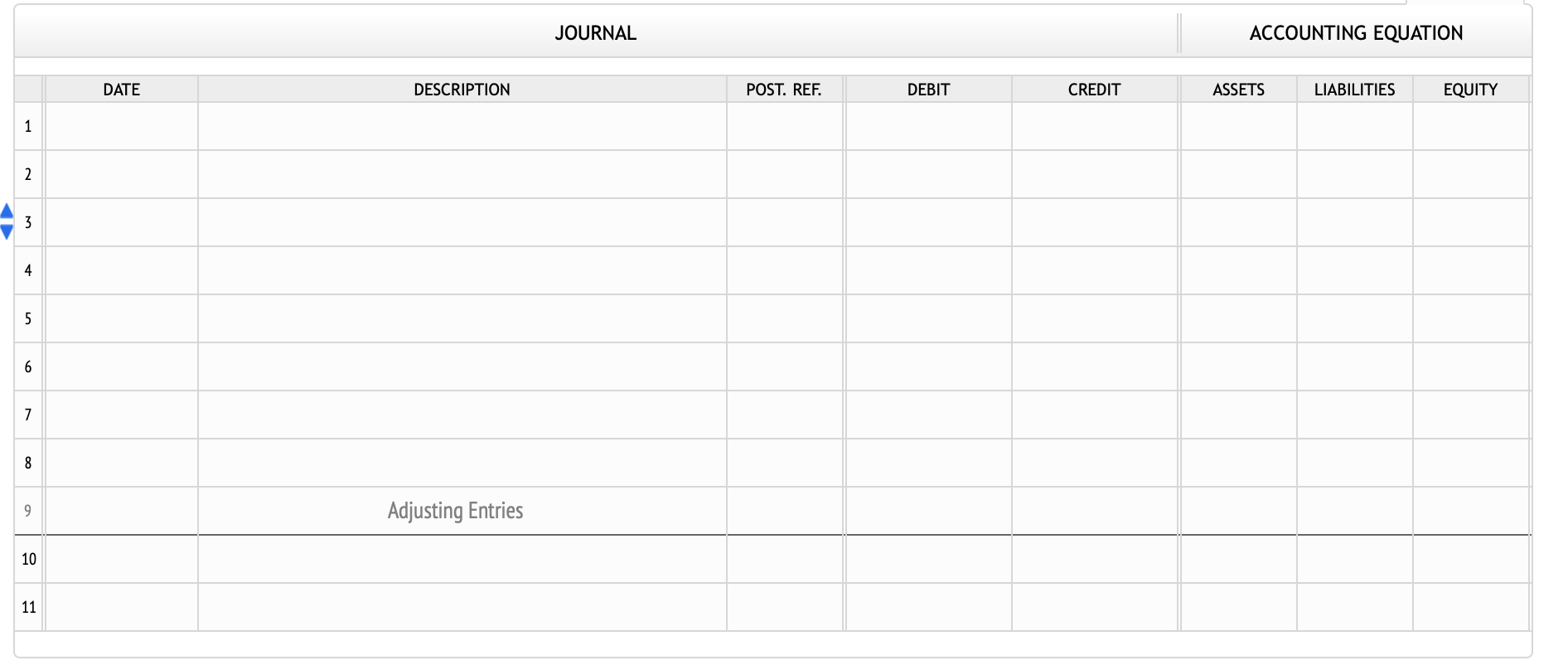

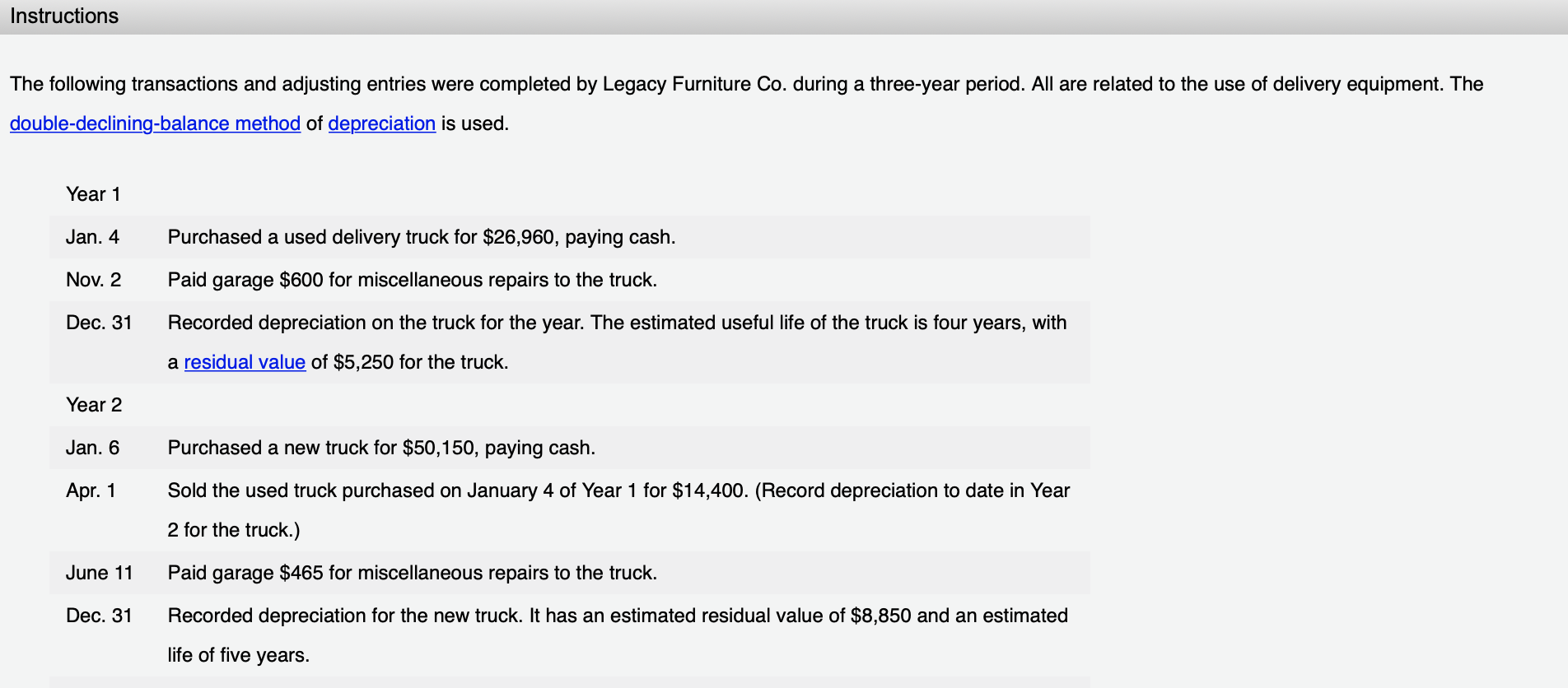

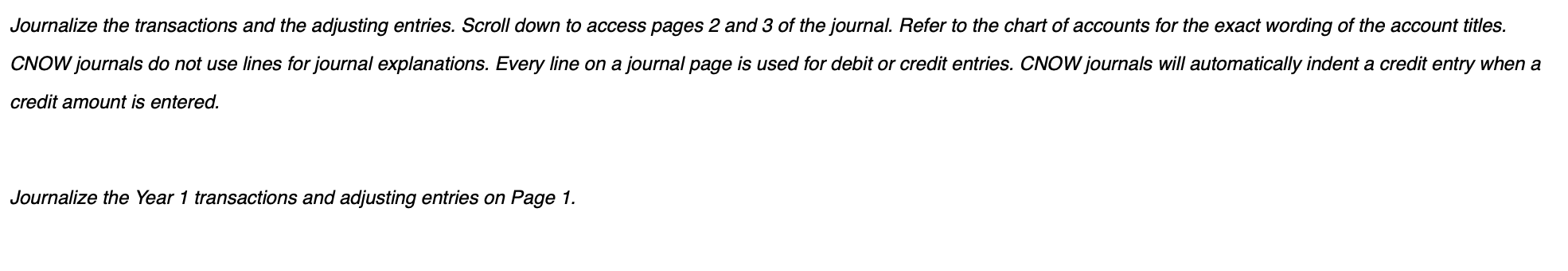

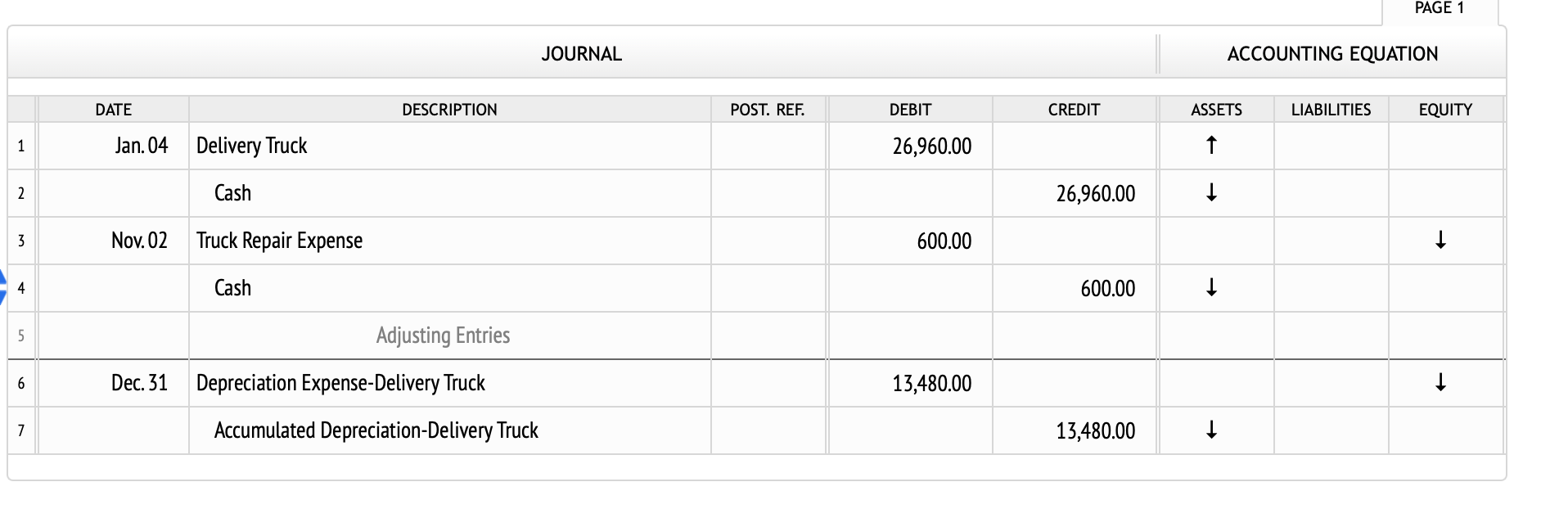

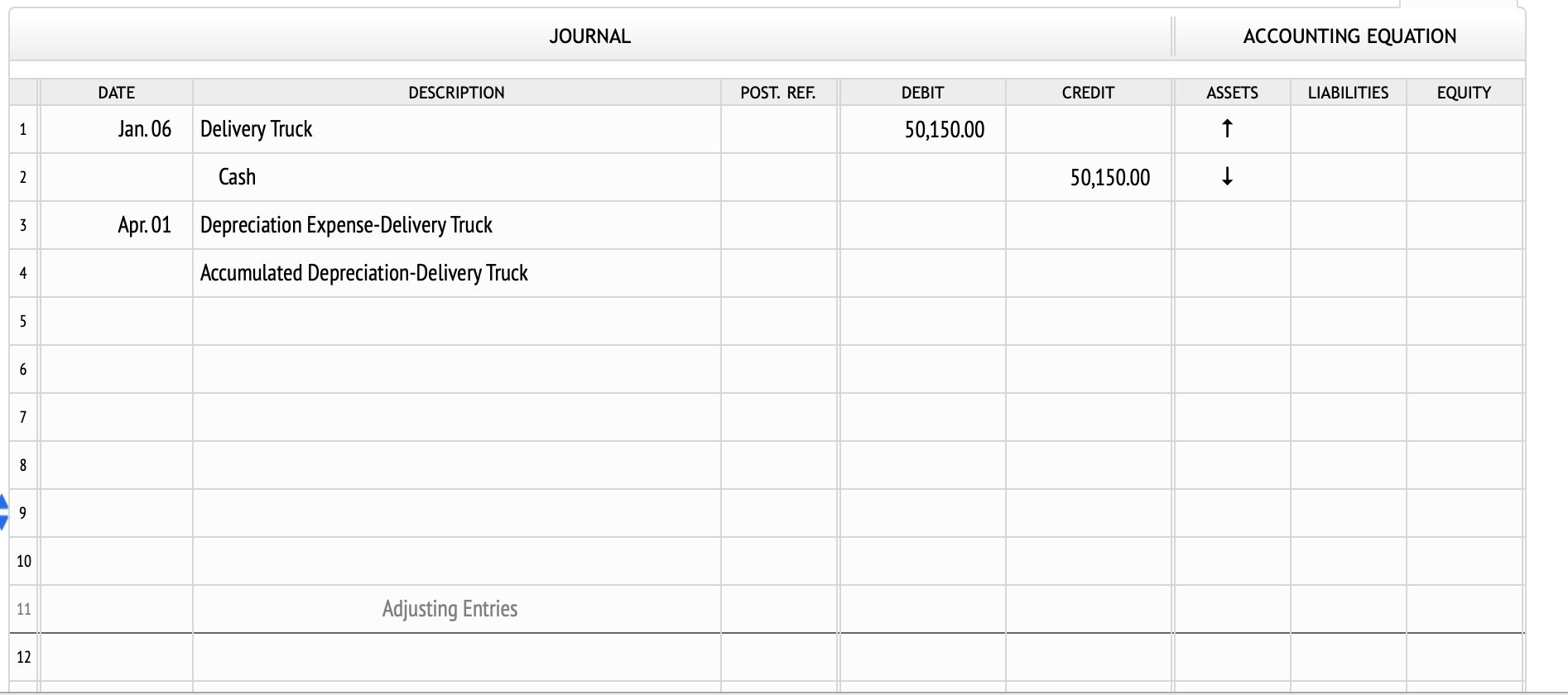

Instructions The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4 Purchased a used delivery truck for $26,960, paying cash. Nov. 2 Paid garage $600 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,250 for the truck. Year 2 Jan. 6 Purchased a new truck for $50,150, paying cash. Apr. 1 Sold the used truck purchased on January 4 of Year 1 for $14,400. (Record depreciation to date in Year 2 for the truck.) June 11 Paid garage $465 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation for the new truck. It has an estimated residual value of $8,850 and an estimated life of five years. Year 3 July 1 Purchased a new truck for $55,520, paying cash. Oct. 2 Sold the truck purchased January 6, Year 2, for $17,473. (Record depreciation to date for Year 3 for the truck.) Dec. 31 Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $12,565 and an estimated useful life of eight years. Required: Journalize the transactions and the adjusting entries. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journalize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a a credit amount is entered. Journalize the Year 1 transactions and adjusting entries on Page 1. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Jan. 04 Delivery Truck 26,960.00 1 2 Cash 26,960.00 1 3 Nov.02 Truck Repair Expense 600.00 1 4 Cash 600.00 5 Adjusting Entries 6 Dec. 31 Depreciation Expense-Delivery Truck 13,480.00 7 Accumulated Depreciation-Delivery Truck 13,480.00 + JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Jan. 06 Delivery Truck 50,150.00 1 2 Cash 50,150.00 1 3 Apr. 01 Depreciation Expense-Delivery Truck 4 Accumulated Depreciation-Delivery Truck 5 6 7 8 9 10 11 Adjusting Entries 12 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 Adjusting Entries 10 11

Journalize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journalize the Year 1 transactions and adjusting entries on Page 1.

Journalize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journalize the Year 1 transactions and adjusting entries on Page 1.