Journalize the transactions in the appropriate journals. use only the accounts listed in the chart of accounts (CofA), you do not need to include explanations.

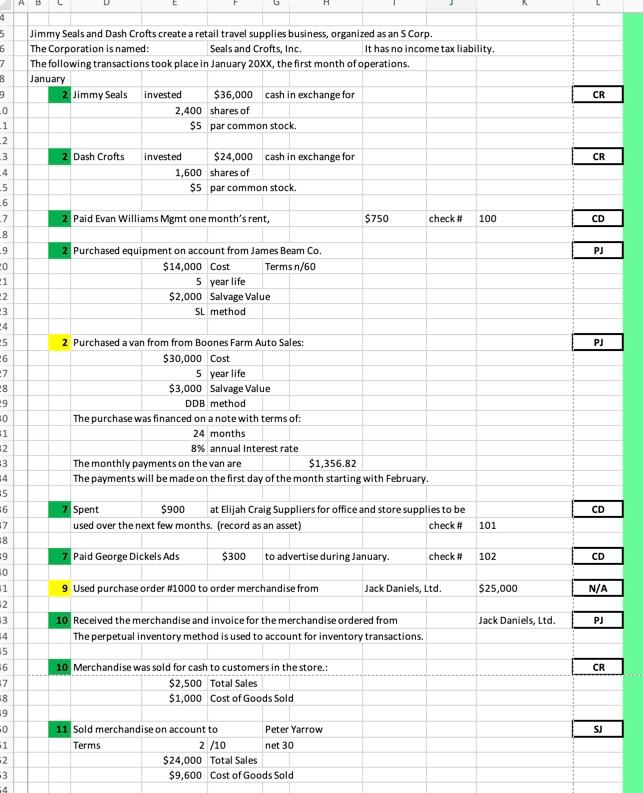

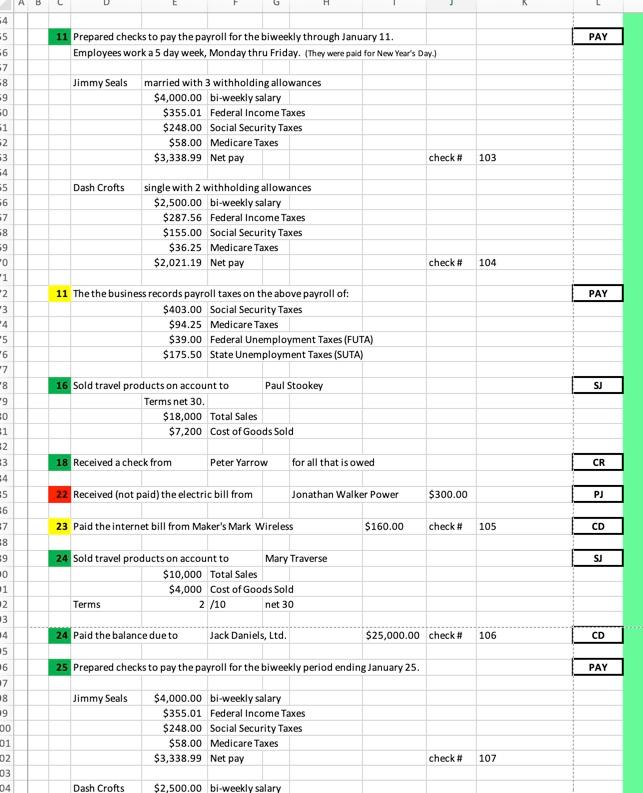

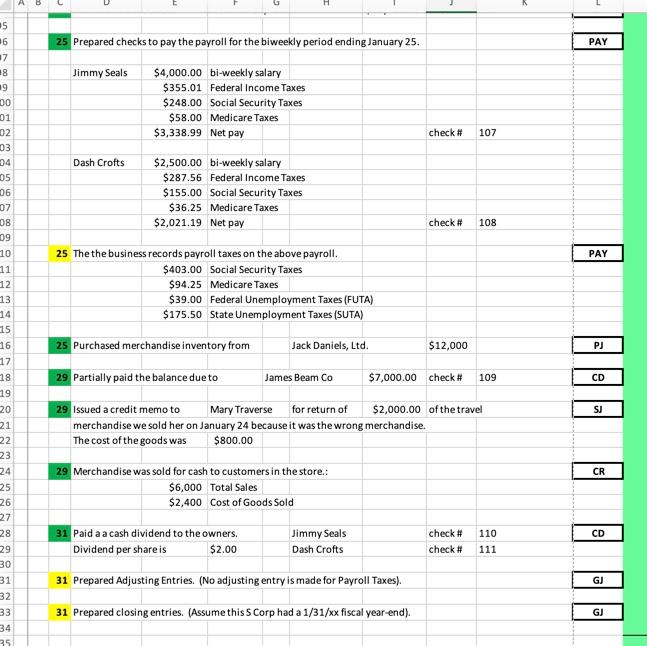

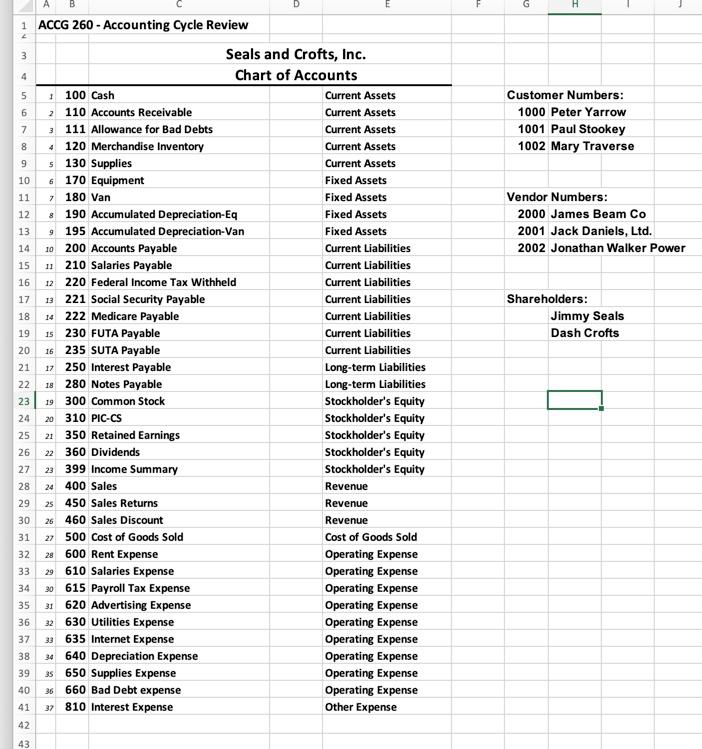

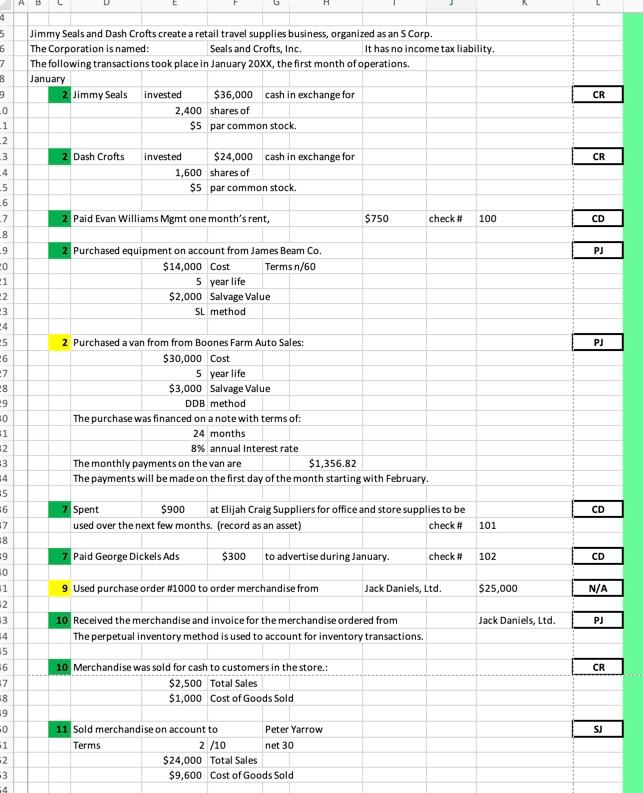

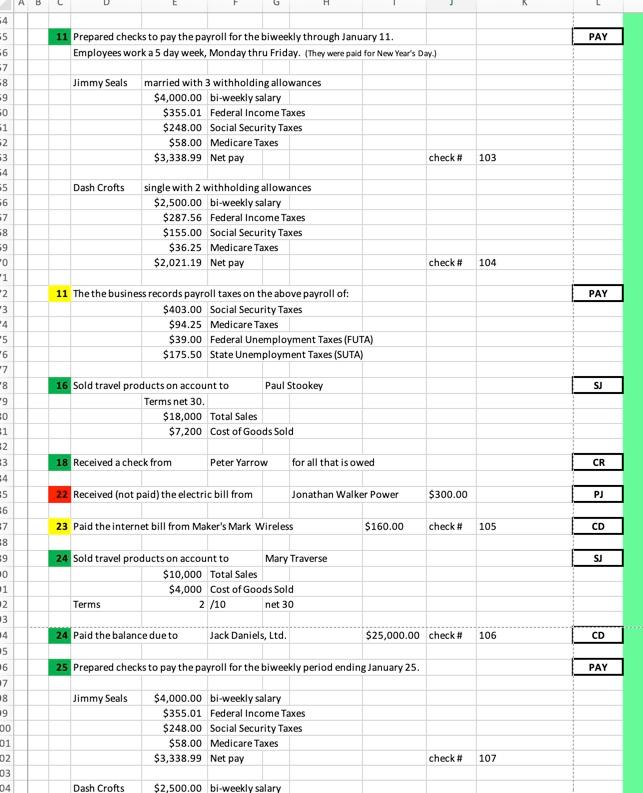

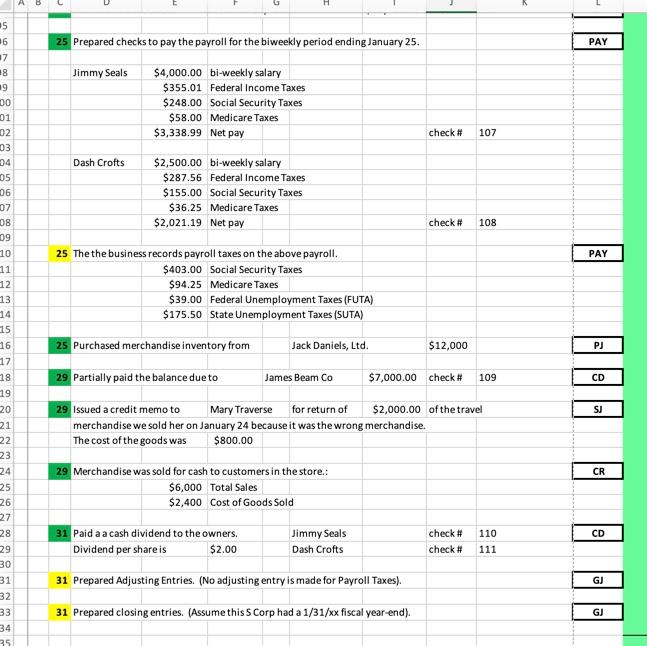

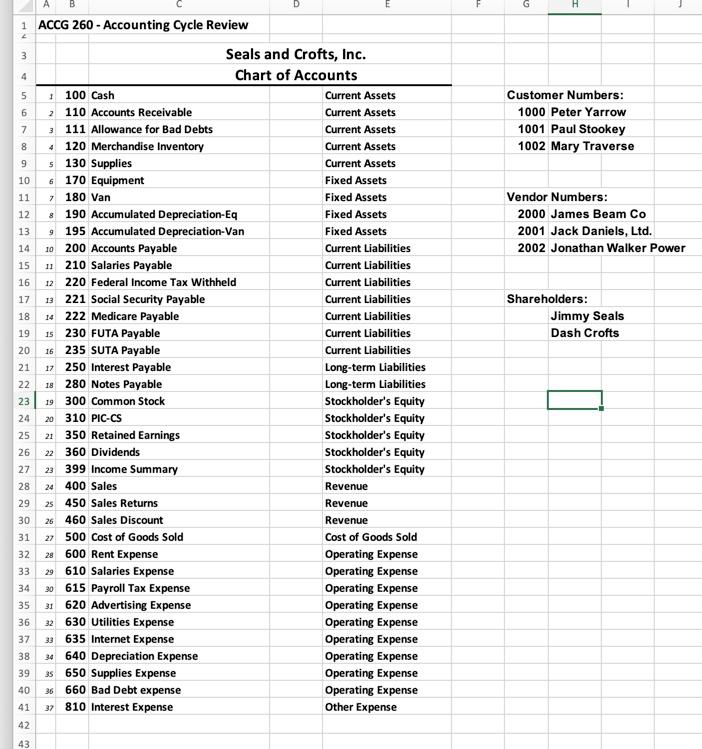

A B 4 5 6 7 8 9 20 1 2 -3 Jimmy Seals and Dash Crofts create a retail travel supplies business, organized as an S Corp. The Corporation is named: Seals and Crofts, Inc. It has no income tax liability, The following transactions took place in January 20XX, the first month of operations. January 2 Jimmy Seals invested $36,000 cash in exchange for 2,400 shares of $5 par common stock. CR 2 Dash Crofts CR invested $24,000 cash in exchange for 1,600 shares of $5 par common stock 2 Paid Evan Williams Mgmt one month's rent, $750 check # 100 CD 5 -6 7 -8 9 CO 1 2 3 PJ 2 Purchased equipment on account from James Beam Co. $14,000 Cost Termsn/60 5 year life $2,000 Salvage Value SL method PJ o un No lo 00N 2 Purchased a van from from Boones Farm Auto Sales: $30,000 Cost 5 year life $3,000 Salvage Value DDB method The purchase was financed on a note with terms of: 24 months 8% annual Interest rate The monthly payments on the van are $1,356.82 The payments will be made on the first day of the month starting with February CD 101 7 Spent $900 at Elijah Craig Suppliers for office and store supplies to be used over the next few months. (record as an asset) check # Paid George Dickels Ads $300 to advertise during January check # 102 CD 7 48 9 40 11 -2 13 9 Used purchase order #1000 to order merchandise from Jack Daniels, Ltd. $25,000 N/A Jack Daniels, Ltd. PJ 10 Received the merchandise and invoice for the merchandise ordered from The perpetual inventory method is used to account for inventory transactions. CR 15 -6 7 18 9 10 Merchandise was sold for cash to customers in the store: $2,500 Total Sales $1,000 Cost of Goods Sold SJ ONM 11 Sold merchandise on account to Peter Yarrow Terms 2/10 net 30 $24,000 Total Sales $9,600 Cost of Goods Sold 14 B PAY -5 -6 -7 11 Prepared checks to pay the payroll for the biweekly through January 11. Employees work a 5 day week, Monday thru Friday. (They were paid for New Year's Day) Jimmy Seals OLD 00 60 51 52 53 married with 3 withholding allowances $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 103 Dash Crofts single with 2 withholding allowances $2,500.00 bi-weekly salary $287.56 Federal Income Taxes $155.00 Social Security Taxes $36.25 Medicare Taxes $2,021.19 Net pay check # 104 PAY 11 The the business records payroll taxes on the above payroll of: $403.00 Social Security Taxes $94.25 Medicare Taxes $39.00 Federal Unemployment Taxes (FUTA) $175.50 State Unemployment Taxes (SUTA) SJ 16 Sold travel products on account to Paul Stookey Terms net 30. $18,000 Total Sales $7,200 Cost of Goods Sold 18 Received a check from Peter Yarrow for all that is owed CR 55 16 7 58 59 "0 1 2 3 14 5 6 7 "8 9 0 1 2 33 54 55 96 37 58 59 0 1 2 3 14 5 16 7 18 19 00 01 02 03 14 22. Received (not paid) the electric bill from Jonathan Walker Power $300.00 PJ 23 Paid the internet bill from Maker's Mark Wireless $160.00 check # 105 CD SJ 24 sold travel products on account to Mary Traverse $10,000 Total Sales $4,000 Cost of Goods Sold Terms 2/10 net 30 24 Paid the balance due to Jack Daniels, Ltd. $25,000.00 check # 106 CD 25 Prepared checks to pay the payroll for the biweekly period ending January 25. PAY Jimmy Seals $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 107 Dash Crofts $2,500.00 bi-weekly salary A B 25 Prepared checks to pay the payroll for the biweekly period ending January 25, PAY Jimmy Seals 5 06 17 8 19 DO 01 02 03 04 05 06 07 08 09 $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 107 Dash Crofts $2,500.00 bi-weekly salary $287.56 Federal Income Taxes $155.00 Social Security Taxes $36.25 Medicare Taxes $2,021.19 Net pay check # 108 PAY 25 The the business records payroll taxes on the above payroll. $403.00 Social Security Taxes $94.25 Medicare Taxes $39.00 Federal Unemployment Taxes (FUTA) $175.50 State Unemployment Taxes (SUTA) 25 Purchased merchandise inventory from Jack Daniels, Ltd. $12,000 PJ 29 Partially paid the balance due to James Beam Co $7,000.00 check # 109 CD SJ 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 29 issued a credit memo to Mary Traverse for return of $2,000.00 of the travel merchandise we sold her on January 24 because it was the wrong merchandise. The cost of the goods was $800.00 CR 29 Merchandise was sold for cash to customers in the store: $6,000 Total Sales $2,400 Cost of Goods Sold CD 31 Paid a a cash dividend to the owners. Dividend per share is $2.00 Jimmy Seals Dash Crofts check # check # 110 111 31 Prepared Adjusting Entries. (No adjusting entry is made for Payroll Taxes). GJ 31 Prepared closing entries. (Assume this S Corp had a 1/31/xx fiscal year-end). G] H Customer Numbers: 1000 Peter Yarrow 1001 Paul Stookey 1002 Mary Traverse Vendor Numbers: 2000 James Beam Co 2001 Jack Daniels, Ltd. 2002 Jonathan Walker Power Shareholders: Jimmy Seals Dash Crofts 1 ACCG 260 - Accounting Cycle Review 3 Seals and Crofts, Inc. Chart of Accounts 5 1100 Cash Current Assets 6 2 110 Accounts Receivable Current Assets 7 3 111 Allowance for Bad Debts Current Assets 8 4 120 Merchandise Inventory Current Assets 9 $ 130 Supplies Current Assets 10 6 170 Equipment Fixed Assets 11 180 Van Fixed Assets 12 8 190 Accumulated Depreciation-Eq Fixed Assets 13 9195 Accumulated Depreciation-Van Fixed Assets 14 10 200 Accounts Payable Current Liabilities 15 11 210 Salaries Payable Current Liabilities 16 12 220 Federal Income Tax Withheld Current Liabilities 17 1221 Social Security Payable Current Liabilities 18 14 222 Medicare Payable Current Liabilities 19 15 230 FUTA Payable Current Liabilities 20 16 235 SUTA Payable Current Liabilities 21 17 250 Interest Payable Long-term Liabilities 22 18 280 Notes Payable Long-term Liabilities 23 19 300 Common Stock Stockholder's Equity 24 20310 PIC-CS Stockholder's Equity 25 350 Retained Earnings Stockholder's Equity 26 22 360 Dividends Stockholder's Equity 27 23 399 Income Summary Stockholder's Equity 28 24 400 Sales Revenue 29 25 450 Sales Returns Revenue 30 26 460 Sales Discount Revenue 31 27 500 Cost of Goods Sold Cost of Goods Sold 32 28 600 Rent Expense Operating Expense 33 29 610 Salaries Expense Operating Expense 34 20 615 Payroll Tax Expense Operating Expense 35 31 620 Advertising Expense Operating Expense 36 630 Utilities Expense Operating Expense 37 33 635 Internet Expense Operating Expense 38 640 Depreciation Expense Operating Expense 39 35 650 Supplies Expense Operating Expense 40 660 Bad Debt expense Operating Expense 41 810 Interest Expense Other Expense 42 21 32 36 37 43 A B 4 5 6 7 8 9 20 1 2 -3 Jimmy Seals and Dash Crofts create a retail travel supplies business, organized as an S Corp. The Corporation is named: Seals and Crofts, Inc. It has no income tax liability, The following transactions took place in January 20XX, the first month of operations. January 2 Jimmy Seals invested $36,000 cash in exchange for 2,400 shares of $5 par common stock. CR 2 Dash Crofts CR invested $24,000 cash in exchange for 1,600 shares of $5 par common stock 2 Paid Evan Williams Mgmt one month's rent, $750 check # 100 CD 5 -6 7 -8 9 CO 1 2 3 PJ 2 Purchased equipment on account from James Beam Co. $14,000 Cost Termsn/60 5 year life $2,000 Salvage Value SL method PJ o un No lo 00N 2 Purchased a van from from Boones Farm Auto Sales: $30,000 Cost 5 year life $3,000 Salvage Value DDB method The purchase was financed on a note with terms of: 24 months 8% annual Interest rate The monthly payments on the van are $1,356.82 The payments will be made on the first day of the month starting with February CD 101 7 Spent $900 at Elijah Craig Suppliers for office and store supplies to be used over the next few months. (record as an asset) check # Paid George Dickels Ads $300 to advertise during January check # 102 CD 7 48 9 40 11 -2 13 9 Used purchase order #1000 to order merchandise from Jack Daniels, Ltd. $25,000 N/A Jack Daniels, Ltd. PJ 10 Received the merchandise and invoice for the merchandise ordered from The perpetual inventory method is used to account for inventory transactions. CR 15 -6 7 18 9 10 Merchandise was sold for cash to customers in the store: $2,500 Total Sales $1,000 Cost of Goods Sold SJ ONM 11 Sold merchandise on account to Peter Yarrow Terms 2/10 net 30 $24,000 Total Sales $9,600 Cost of Goods Sold 14 B PAY -5 -6 -7 11 Prepared checks to pay the payroll for the biweekly through January 11. Employees work a 5 day week, Monday thru Friday. (They were paid for New Year's Day) Jimmy Seals OLD 00 60 51 52 53 married with 3 withholding allowances $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 103 Dash Crofts single with 2 withholding allowances $2,500.00 bi-weekly salary $287.56 Federal Income Taxes $155.00 Social Security Taxes $36.25 Medicare Taxes $2,021.19 Net pay check # 104 PAY 11 The the business records payroll taxes on the above payroll of: $403.00 Social Security Taxes $94.25 Medicare Taxes $39.00 Federal Unemployment Taxes (FUTA) $175.50 State Unemployment Taxes (SUTA) SJ 16 Sold travel products on account to Paul Stookey Terms net 30. $18,000 Total Sales $7,200 Cost of Goods Sold 18 Received a check from Peter Yarrow for all that is owed CR 55 16 7 58 59 "0 1 2 3 14 5 6 7 "8 9 0 1 2 33 54 55 96 37 58 59 0 1 2 3 14 5 16 7 18 19 00 01 02 03 14 22. Received (not paid) the electric bill from Jonathan Walker Power $300.00 PJ 23 Paid the internet bill from Maker's Mark Wireless $160.00 check # 105 CD SJ 24 sold travel products on account to Mary Traverse $10,000 Total Sales $4,000 Cost of Goods Sold Terms 2/10 net 30 24 Paid the balance due to Jack Daniels, Ltd. $25,000.00 check # 106 CD 25 Prepared checks to pay the payroll for the biweekly period ending January 25. PAY Jimmy Seals $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 107 Dash Crofts $2,500.00 bi-weekly salary A B 25 Prepared checks to pay the payroll for the biweekly period ending January 25, PAY Jimmy Seals 5 06 17 8 19 DO 01 02 03 04 05 06 07 08 09 $4,000.00 bi-weekly salary $355.01 Federal Income Taxes $248.00 Social Security Taxes $58.00 Medicare Taxes $3,338.99 Net pay check # 107 Dash Crofts $2,500.00 bi-weekly salary $287.56 Federal Income Taxes $155.00 Social Security Taxes $36.25 Medicare Taxes $2,021.19 Net pay check # 108 PAY 25 The the business records payroll taxes on the above payroll. $403.00 Social Security Taxes $94.25 Medicare Taxes $39.00 Federal Unemployment Taxes (FUTA) $175.50 State Unemployment Taxes (SUTA) 25 Purchased merchandise inventory from Jack Daniels, Ltd. $12,000 PJ 29 Partially paid the balance due to James Beam Co $7,000.00 check # 109 CD SJ 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 29 issued a credit memo to Mary Traverse for return of $2,000.00 of the travel merchandise we sold her on January 24 because it was the wrong merchandise. The cost of the goods was $800.00 CR 29 Merchandise was sold for cash to customers in the store: $6,000 Total Sales $2,400 Cost of Goods Sold CD 31 Paid a a cash dividend to the owners. Dividend per share is $2.00 Jimmy Seals Dash Crofts check # check # 110 111 31 Prepared Adjusting Entries. (No adjusting entry is made for Payroll Taxes). GJ 31 Prepared closing entries. (Assume this S Corp had a 1/31/xx fiscal year-end). G] H Customer Numbers: 1000 Peter Yarrow 1001 Paul Stookey 1002 Mary Traverse Vendor Numbers: 2000 James Beam Co 2001 Jack Daniels, Ltd. 2002 Jonathan Walker Power Shareholders: Jimmy Seals Dash Crofts 1 ACCG 260 - Accounting Cycle Review 3 Seals and Crofts, Inc. Chart of Accounts 5 1100 Cash Current Assets 6 2 110 Accounts Receivable Current Assets 7 3 111 Allowance for Bad Debts Current Assets 8 4 120 Merchandise Inventory Current Assets 9 $ 130 Supplies Current Assets 10 6 170 Equipment Fixed Assets 11 180 Van Fixed Assets 12 8 190 Accumulated Depreciation-Eq Fixed Assets 13 9195 Accumulated Depreciation-Van Fixed Assets 14 10 200 Accounts Payable Current Liabilities 15 11 210 Salaries Payable Current Liabilities 16 12 220 Federal Income Tax Withheld Current Liabilities 17 1221 Social Security Payable Current Liabilities 18 14 222 Medicare Payable Current Liabilities 19 15 230 FUTA Payable Current Liabilities 20 16 235 SUTA Payable Current Liabilities 21 17 250 Interest Payable Long-term Liabilities 22 18 280 Notes Payable Long-term Liabilities 23 19 300 Common Stock Stockholder's Equity 24 20310 PIC-CS Stockholder's Equity 25 350 Retained Earnings Stockholder's Equity 26 22 360 Dividends Stockholder's Equity 27 23 399 Income Summary Stockholder's Equity 28 24 400 Sales Revenue 29 25 450 Sales Returns Revenue 30 26 460 Sales Discount Revenue 31 27 500 Cost of Goods Sold Cost of Goods Sold 32 28 600 Rent Expense Operating Expense 33 29 610 Salaries Expense Operating Expense 34 20 615 Payroll Tax Expense Operating Expense 35 31 620 Advertising Expense Operating Expense 36 630 Utilities Expense Operating Expense 37 33 635 Internet Expense Operating Expense 38 640 Depreciation Expense Operating Expense 39 35 650 Supplies Expense Operating Expense 40 660 Bad Debt expense Operating Expense 41 810 Interest Expense Other Expense 42 21 32 36 37 43