Answered step by step

Verified Expert Solution

Question

1 Approved Answer

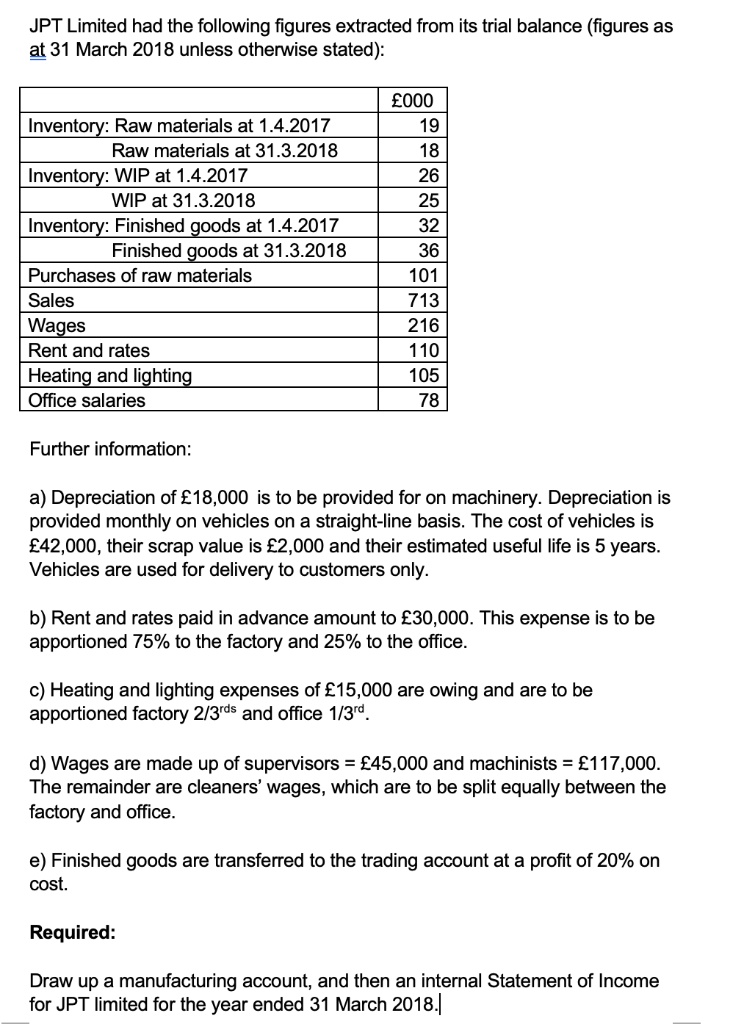

JPT Limited had the following figures extracted from its trial balance (figures as at 31 March 2018 unless otherwise stated): 000 Inventory: Raw materials

JPT Limited had the following figures extracted from its trial balance (figures as at 31 March 2018 unless otherwise stated): 000 Inventory: Raw materials at 1.4.2017 19 Raw materials at 31.3.2018 18 Inventory: WIP at 1.4.2017 26 WIP at 31.3.2018 25 Inventory: Finished goods at 1.4.2017 Finished goods at 31.3.2018 32 36 Purchases of raw materials 101 Sales 713 Wages Rent and rates 216 110 Heating and lighting 105 Office salaries 78 Further information: a) Depreciation of 18,000 is to be provided for on machinery. Depreciation is provided monthly on vehicles on a straight-line basis. The cost of vehicles is 42,000, their scrap value is 2,000 and their estimated useful life is 5 years. Vehicles are used for delivery to customers only. b) Rent and rates paid in advance amount to 30,000. This expense is to be apportioned 75% to the factory and 25% to the office. c) Heating and lighting expenses of 15,000 are owing and are to be apportioned factory 2/3rds and office 1/3rd. d) Wages are made up of supervisors = 45,000 and machinists = 117,000. The remainder are cleaners' wages, which are to be split equally between the factory and office. e) Finished goods are transferred to the trading account at a profit of 20% on cost. Required: Draw up a manufacturing account, and then an internal Statement of Income for JPT limited for the year ended 31 March 2018.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Manufacturing Account 000 000 000 000 To WIP Opening To Raw Materials Consumed 26 By Closing WIP By ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started