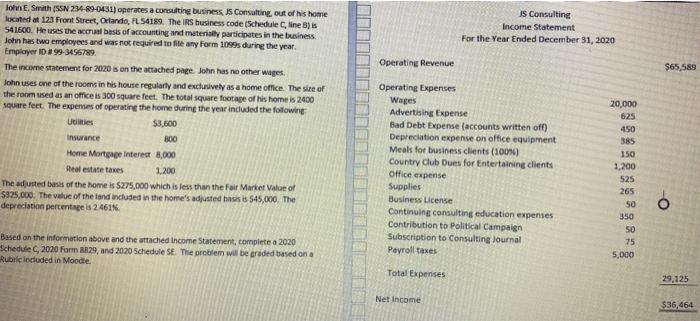

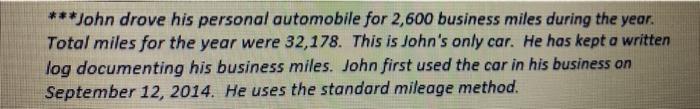

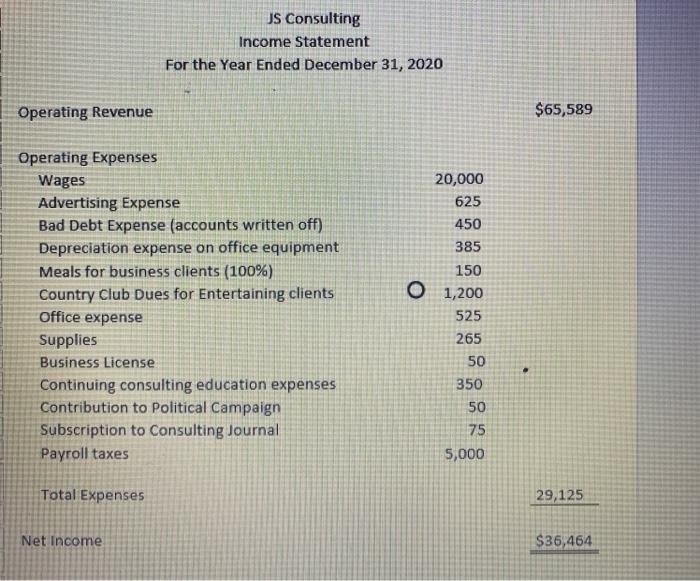

JS Consulting Income Statement For the Year Ended December 31, 2020 Operating Revenue $65,589 John E. Smith (SSN 234-89-0431) operates a consulting business Is Consulting out of his home located at 123 Front Street, Orlando, FL 54189. The IRS business code Schedule C, line 3) is 541600. He uses the aconal basis of accounting and materially participates in the business. John has two employees and was not required to file any Form 1099s during the year. Employer ID# 99-3456789 The income statement for 2020 is on the attached page. John has no other wages John uses one of the rooms in his house regularly and exclusively as a home office. The size of the room used as an office is 300 square feet. The total square footage of his home is 2400 square feet. The expenses of operating the home during the year included the following Utilities $3,600 Insurance 800 Home Mortgage Interest 8,000 Real estate taxes 1.200 The adjusted basis of the home is $275,000 which is less than the Fair Market Value of $325,000. The value of the tand included in the home's adjusted bass 545,000. The depreciation percentage is 2461% Operating Expenses Wages Advertising Expense Bad Debt Expense (accounts written off) Depreciation expense on office equipment Meals for business clients (100%) Country Club Dues for Entertaining clients Office expense Supplies Business License Continuing consulting education expenses Contribution to Political Campaign Subscription to Consulting Journal Payroll taxes 20,000 625 450 385 150 1,200 525 265 O 50 350 50 75 5.000 Based on the information above and the attached Income Statement, complete a 2020 Schedule 2020 Form 1829 and 2020 Schedule SE. The problem will be graded based on a Rubric included in Moodle Total Expenses 29,125 Net Income $36,464 ***John drove his personal automobile for 2,600 business miles during the year. Total miles for the year were 32,178. This is John's only car. He has kept a written log documenting his business miles. John first used the car in his business on September 12, 2014. He uses the standard mileage method. JS Consulting Income Statement For the Year Ended December 31, 2020 Operating Revenue $65,589 20,000 625 450 385 150 0 1,200 Operating Expenses Wages Advertising Expense Bad Debt Expense (accounts written off) Depreciation expense on office equipment Meals for business clients (100%) Country Club Dues for Entertaining clients Office expense Supplies Business License Continuing consulting education expenses Contribution to Political Campaign Subscription to Consulting Journal Payroll taxes 525 265 50 350 50 75 5,000 Total Expenses 29,125 Net Income $36,464 JS Consulting Income Statement For the Year Ended December 31, 2020 Operating Revenue $65,589 John E. Smith (SSN 234-89-0431) operates a consulting business Is Consulting out of his home located at 123 Front Street, Orlando, FL 54189. The IRS business code Schedule C, line 3) is 541600. He uses the aconal basis of accounting and materially participates in the business. John has two employees and was not required to file any Form 1099s during the year. Employer ID# 99-3456789 The income statement for 2020 is on the attached page. John has no other wages John uses one of the rooms in his house regularly and exclusively as a home office. The size of the room used as an office is 300 square feet. The total square footage of his home is 2400 square feet. The expenses of operating the home during the year included the following Utilities $3,600 Insurance 800 Home Mortgage Interest 8,000 Real estate taxes 1.200 The adjusted basis of the home is $275,000 which is less than the Fair Market Value of $325,000. The value of the tand included in the home's adjusted bass 545,000. The depreciation percentage is 2461% Operating Expenses Wages Advertising Expense Bad Debt Expense (accounts written off) Depreciation expense on office equipment Meals for business clients (100%) Country Club Dues for Entertaining clients Office expense Supplies Business License Continuing consulting education expenses Contribution to Political Campaign Subscription to Consulting Journal Payroll taxes 20,000 625 450 385 150 1,200 525 265 O 50 350 50 75 5.000 Based on the information above and the attached Income Statement, complete a 2020 Schedule 2020 Form 1829 and 2020 Schedule SE. The problem will be graded based on a Rubric included in Moodle Total Expenses 29,125 Net Income $36,464 ***John drove his personal automobile for 2,600 business miles during the year. Total miles for the year were 32,178. This is John's only car. He has kept a written log documenting his business miles. John first used the car in his business on September 12, 2014. He uses the standard mileage method. JS Consulting Income Statement For the Year Ended December 31, 2020 Operating Revenue $65,589 20,000 625 450 385 150 0 1,200 Operating Expenses Wages Advertising Expense Bad Debt Expense (accounts written off) Depreciation expense on office equipment Meals for business clients (100%) Country Club Dues for Entertaining clients Office expense Supplies Business License Continuing consulting education expenses Contribution to Political Campaign Subscription to Consulting Journal Payroll taxes 525 265 50 350 50 75 5,000 Total Expenses 29,125 Net Income $36,464