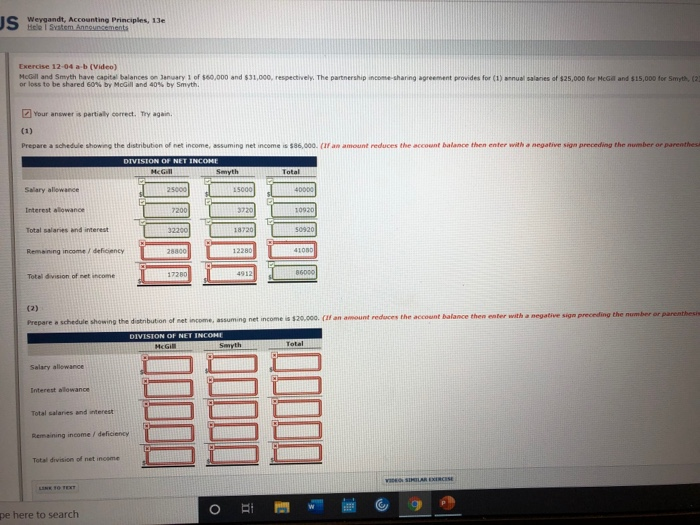

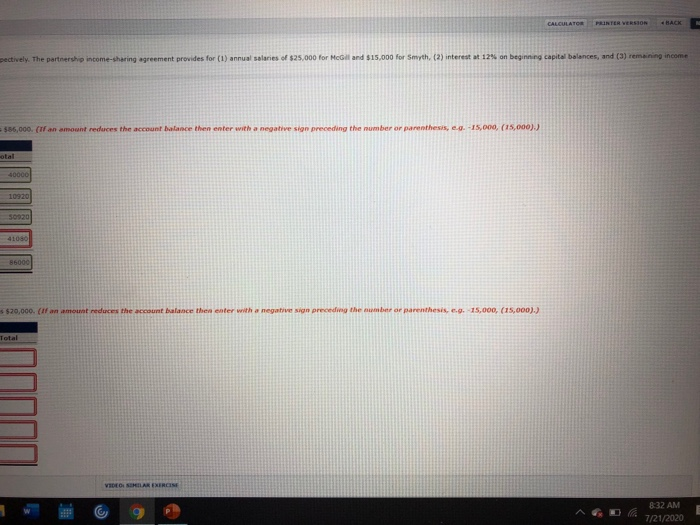

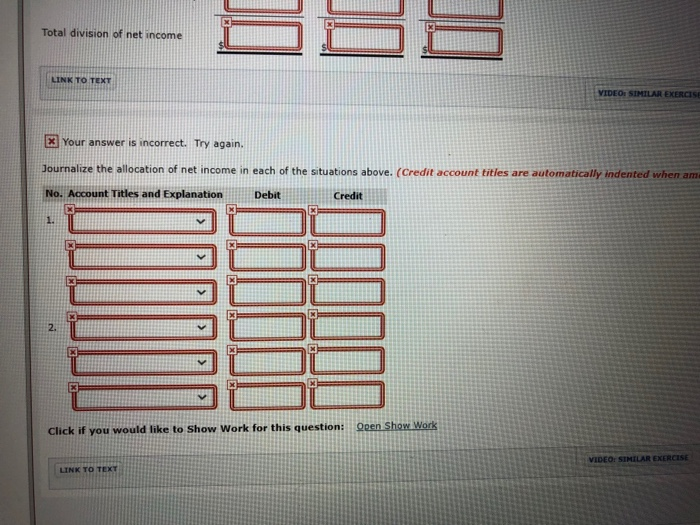

JS Wersandt, Accounting Principles, 13e Exercise 12-04 a-b (Video) McGill and Smyth have capital balances on bary of $60,000 and $31,000, respectively. The partnership income-sharing agreement provides for (1) annual salaries of $25,000 for McGill and $15,000 for Smyth, 621 or loss to be shared 60% by McGilland 40% by Smyth. Your answer is partially correct. Try again (1) Prepare a schedule showing the distribution of net income, assuming net income is $86,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthes DIVISION OF NET INCOME McGill Smyth Total Salary allowance 25000 15000 40000 Interest alowance 7200 3720 10920 Total salaries and interest 32200 18720 50920 Remaining income deney 2800 12280 41050 Total division of net income 17200 4912 86000 (2) Prepare a schedule showing the distribution of net income, assuming net income is $20,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis DIVISION OF NET INCOME MCGI Smyth Total Salary allowance Interest allowance Total salanes and interest Remaining income / deficiency Total division of net income WE SIMILARENCESE ( i O pe here to search CALCULATOR 4 BACK pectively. The partnership income-sharing agreement provides for (1) annual salaries of $25,000 for McGil and $15,000 for Smyth, (2) interest at 12% on beginning capital balances, and (3) remaining income $86,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis, c.9. -15,000, (15,000).) otal 40000 10920 41050 86000 $ $20,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis. c.9. 15,000, (15,000).) Total VIDEO SEDAN ENERGIE 832 AM 7/21/2020 Total division of net income LINK TO TEXT VIDEO: SIMILAR EXERCISE x Your answer is incorrect. Try again. Journalize the allocation of net income in each of the situations above. (Credit account titles are automatically indented when am Debit Credit No. Account Titles and Explanation x 1. x x X X 2 X Click if you would like to Show Work for this question: Open Show Work VIDEO SIMILAR EXERCISE LINK TO TEXT