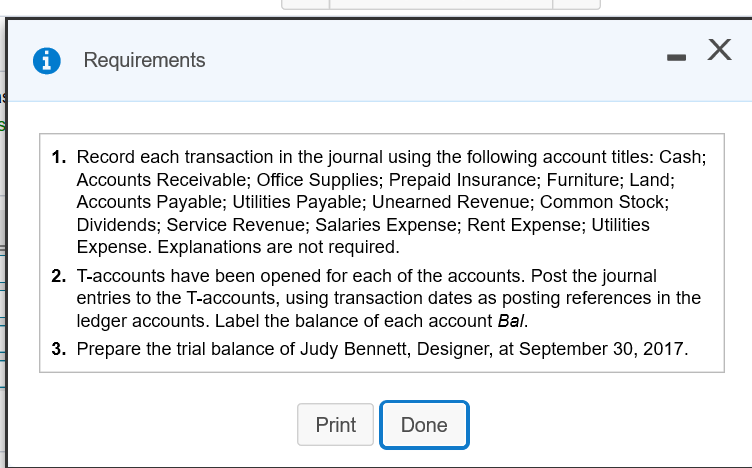

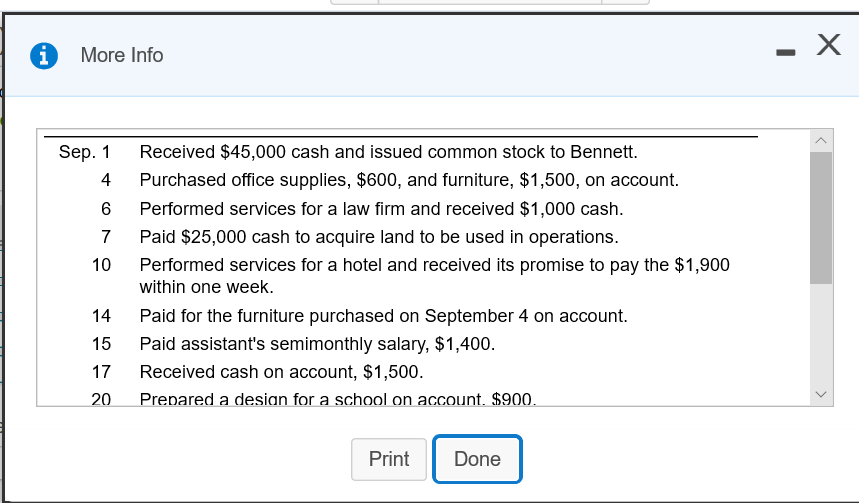

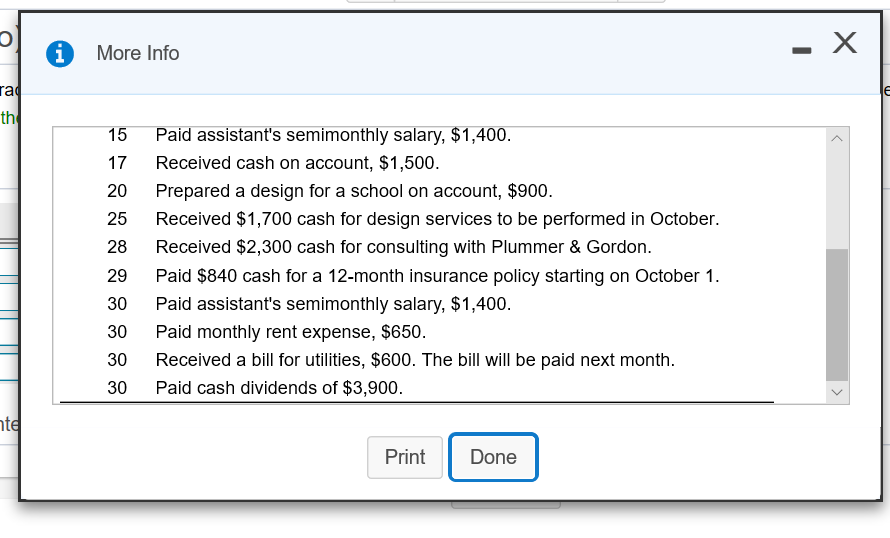

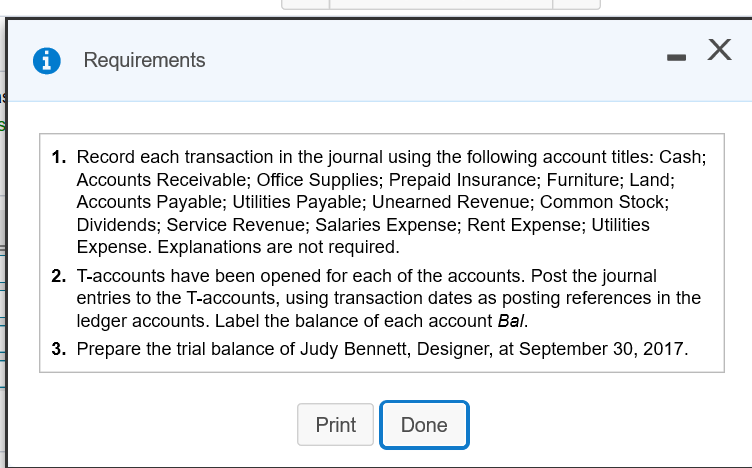

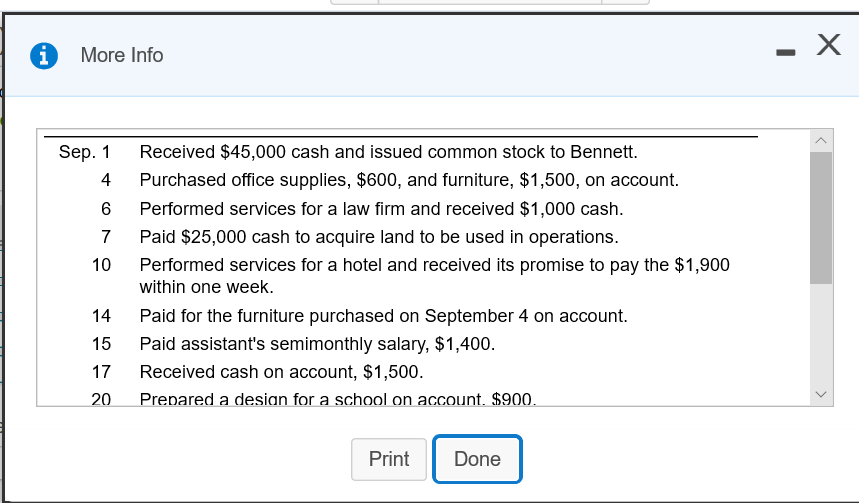

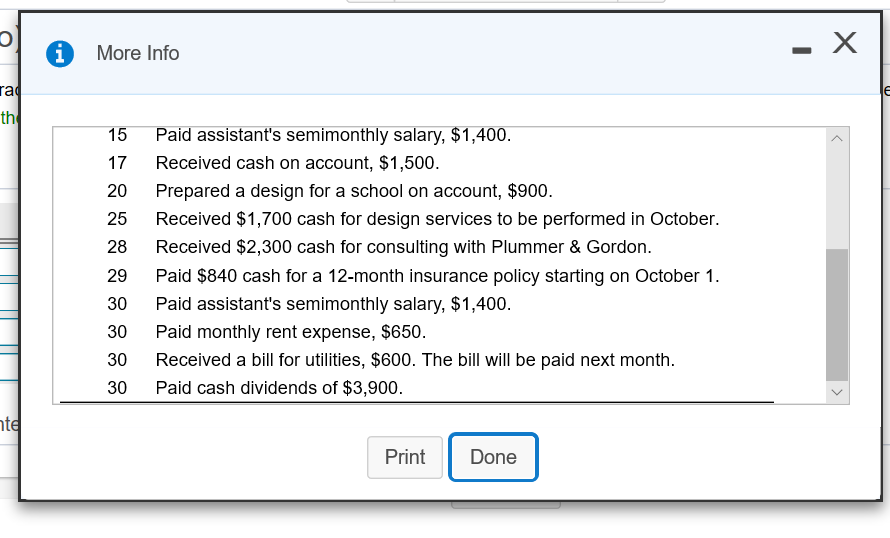

Judy Bennett started her practice as a design consultant on September 1, 2017. During the first month of operations, the business completed the following transactions: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Land; Accounts Payable; Utilities Payable; Unearned Revenue; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Sep. 1: Received $45,000 cash and issued common stock to Bennett. Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer. 0 Requirements - X 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Land; Accounts Payable; Utilities Payable; Unearned Revenue; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense. Explanations are not required. 2. T-accounts have been opened for each of the accounts. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger accounts. Label the balance of each account Bal. 3. Prepare the trial balance of Judy Bennett, Designer, at September 30, 2017. Print Done A More Info Sep. 1 4 6 7 10 Received $45,000 cash and issued common stock to Bennett. Purchased office supplies, $600, and furniture, $1,500, on account. Performed services for a law firm and received $1,000 cash. Paid $25,000 cash to acquire land to be used in operations. Performed services for a hotel and received its promise to pay the $1,900 within one week. Paid for the furniture purchased on September 4 on account. Paid assistant's semimonthly salary, $1,400. Received cash on account, $1,500. Prepared a design for a school on account. $900. 14 15 17 20 Print Done A More Info rad 15 17 20 25 28 29 Paid assistant's semimonthly salary, $1,400. Received cash on account, $1,500. Prepared a design for a school on account, $900. Received $1,700 cash for design services to be performed in October. Received $2,300 cash for consulting with Plummer & Gordon. Paid $840 cash for a 12-month insurance policy starting on October 1. Paid assistant's semimonthly salary, $1,400. Paid monthly rent expense, $650. Received a bill for utilities, $600. The bill will be paid next month. Paid cash dividends of $3,900. 30 30 Print Done