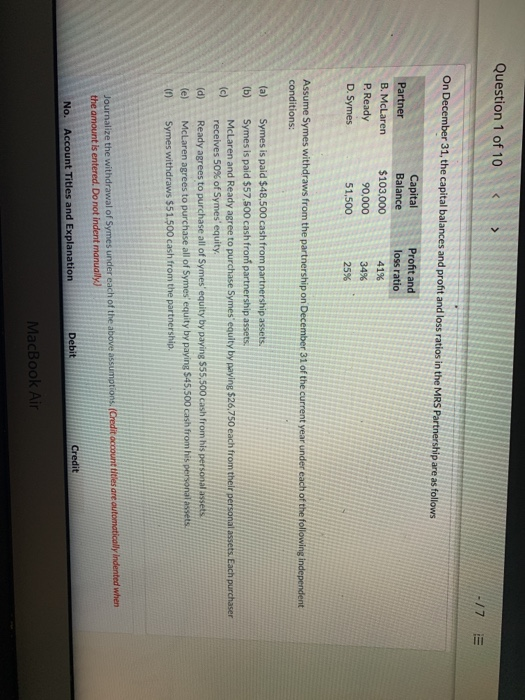

Juices vianagement. Questions Answer these questions about the case: 1. What are the causes of Julie's stress? 2. What are the potential outcomes if this workload continues for Julie? 3. What could Rebecca (or the company) do to reduce the stress that Julie is experiencing? 4. What do you think it is like for the employees on Julie's team? Question 1 of 10 -17 On December 31, the capital balances and profit and loss ratios in the MRS Partnership are as follows Capital Balance $103.000 90,000 51,500 Profit and loss ratio 41% Partner B. McLaren P. Ready D. Symes 34% 25% Assume Symes withdraws from the partnership on December 31 of the current year under each of the following independent conditions: (a) (b) Each purchaser (c) Symes is paid $48,500 cash from partnership assets. Symes is paid $57.500 cash fron partnership assets. McLare ind Ready agree to purchase Symes uity by paying $26,750 each from their personal receives 50% of Symes' equity. Ready agrees to purchase all of Symes' equity by paying $55,500 cash from his personal assets McLaren agrees to purchase all of Symes' equity by paying $45,500 cash from his personal assets Symes withdraws $51.500 cash from the partnership (d) le) () Journalize the withdrawal of Symes under each of the above assumptions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Credit Debit No. Account Titles and Explanation MacBook Air Juices vianagement. Questions Answer these questions about the case: 1. What are the causes of Julie's stress? 2. What are the potential outcomes if this workload continues for Julie? 3. What could Rebecca (or the company) do to reduce the stress that Julie is experiencing? 4. What do you think it is like for the employees on Julie's team? Question 1 of 10 -17 On December 31, the capital balances and profit and loss ratios in the MRS Partnership are as follows Capital Balance $103.000 90,000 51,500 Profit and loss ratio 41% Partner B. McLaren P. Ready D. Symes 34% 25% Assume Symes withdraws from the partnership on December 31 of the current year under each of the following independent conditions: (a) (b) Each purchaser (c) Symes is paid $48,500 cash from partnership assets. Symes is paid $57.500 cash fron partnership assets. McLare ind Ready agree to purchase Symes uity by paying $26,750 each from their personal receives 50% of Symes' equity. Ready agrees to purchase all of Symes' equity by paying $55,500 cash from his personal assets McLaren agrees to purchase all of Symes' equity by paying $45,500 cash from his personal assets Symes withdraws $51.500 cash from the partnership (d) le) () Journalize the withdrawal of Symes under each of the above assumptions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Credit Debit No. Account Titles and Explanation MacBook Air