Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julia, a close friend, is considering buying her first home. Based on her research, she desires to live in her new home for at least

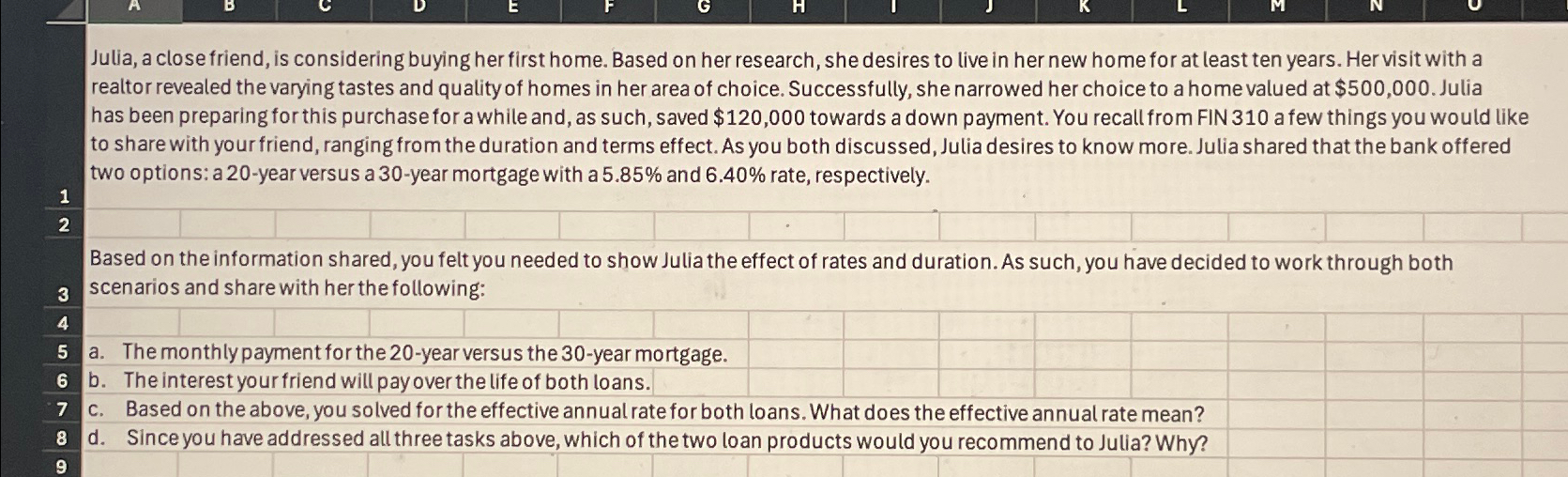

Julia, a close friend, is considering buying her first home. Based on her research, she desires to live in her new home for at least ten years. Her visit with a realtor revealed the varying tastes and quality of homes in her area of choice. Successfully, she narrowed her choice to a home valued at $ Julia has been preparing for this purchase for a while and, as such, saved $ towards a down payment. You recall from FIN a few things you would like to share with your friend, ranging from the duration and terms effect. As you both discussed, Julia desires to know more. Julia shared that the bank offered two options: a year versus a year mortgage with a and rate, respectively.

Based on the information shared, you felt you needed to show Julia the effect of rates and duration. As such, you have decided to work through both

scenarios and share with her the following:

a The monthly payment for the year versus the year mortgage.

b The interest your friend will pay over the life of both loans.

c Based on the above, you solved for the effective annual rate for both loans. What does the effective annual rate mean?

d Since you have addressed all three tasks above, which of the two loan products would you recommend to Julia? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started