Question

Julie just retired and has two options for receiving her retirement benefits. Under the first option, she would immediately receive a lump sum of $120,000.

Julie just retired and has two options for receiving her retirement benefits. Under the first option, she would immediately receive a lump sum of $120,000. Under the second option, she would receive $15,000 each year for 10 years plus a lump-sum payment of $50,000 at the end of the 10-year period.

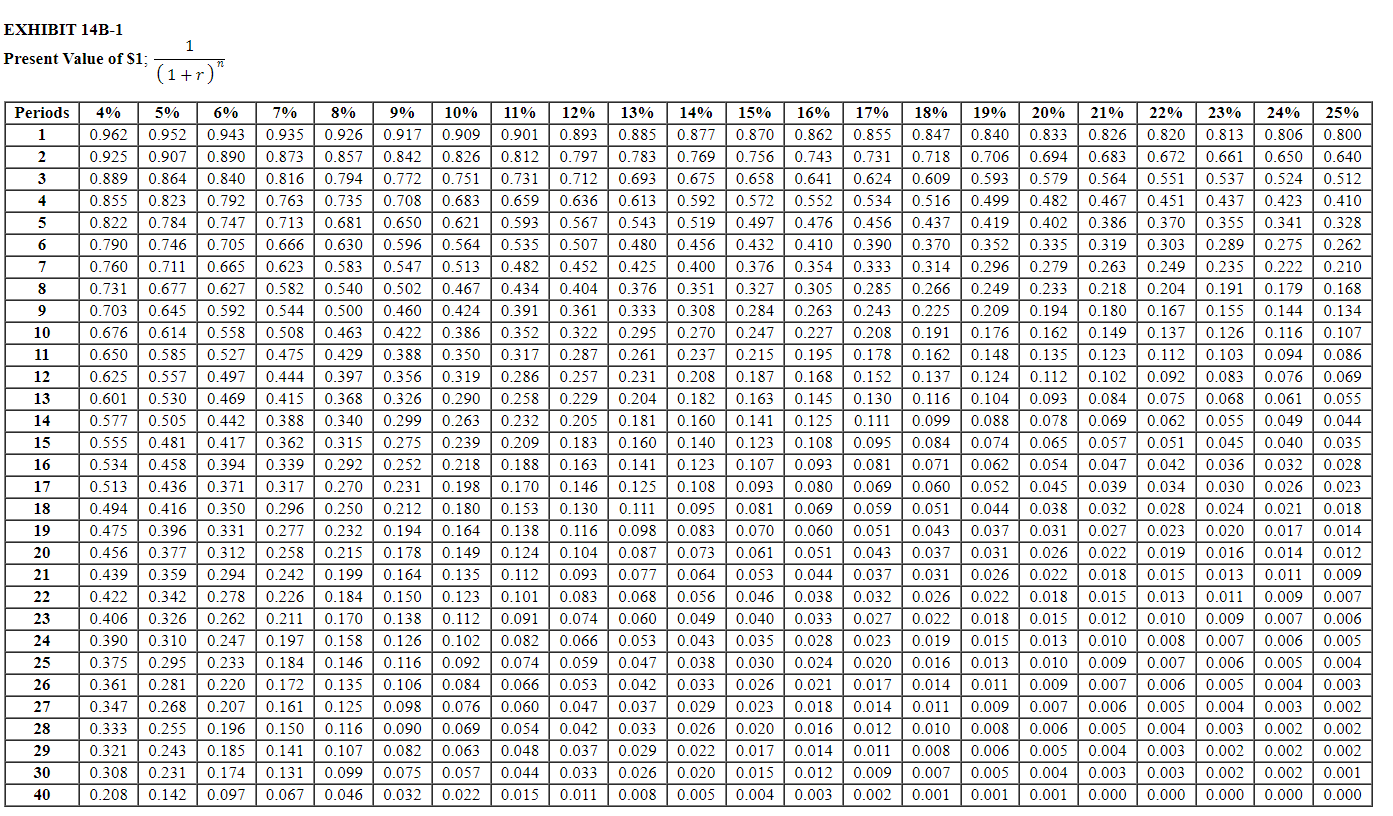

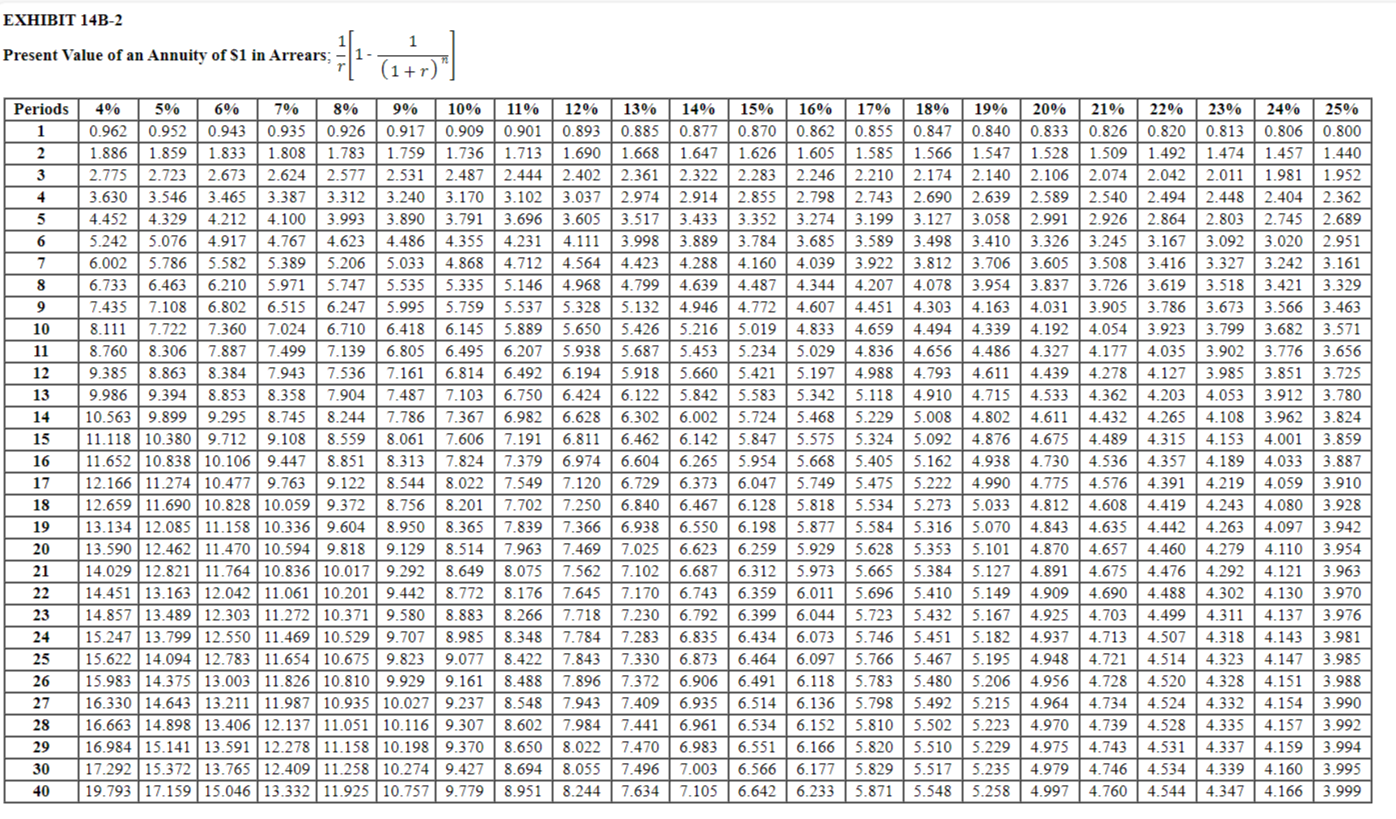

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables.

Required:

1-a. Calculate the present value for the following assuming that the money can be invested at 11%.

1-b. If she can invest money at 11%, which option should she choose?

Tables Below:

EXHIBIT 14B-1 Present Value of $1;(1+r)n1 EXHIBIT 14B-2 Present Value of an Annuity of S1 in Arrears; r1[1(1+r)n1]

EXHIBIT 14B-1 Present Value of $1;(1+r)n1 EXHIBIT 14B-2 Present Value of an Annuity of S1 in Arrears; r1[1(1+r)n1] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started