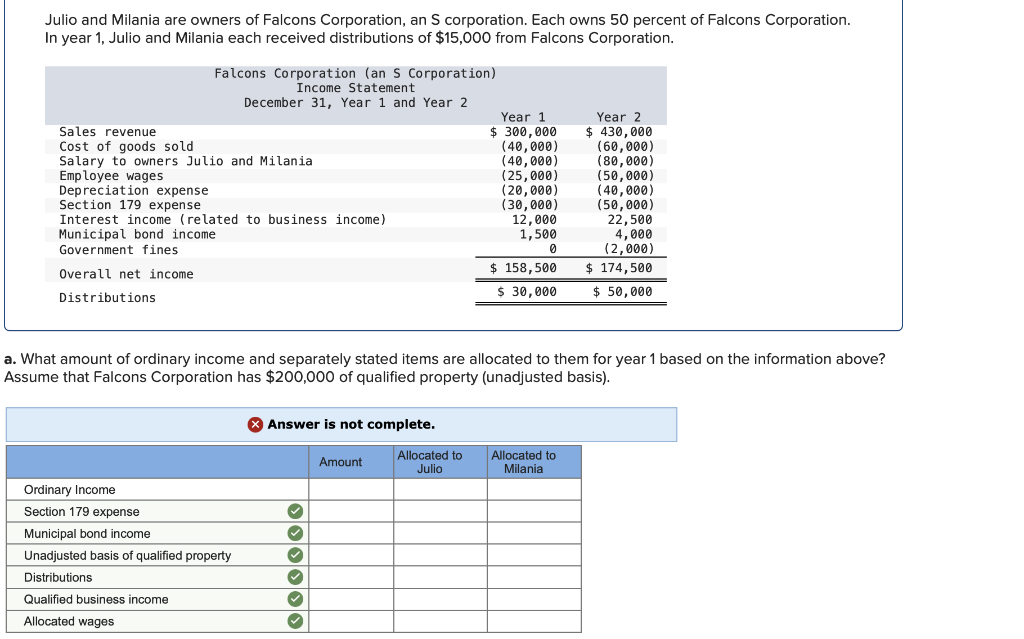

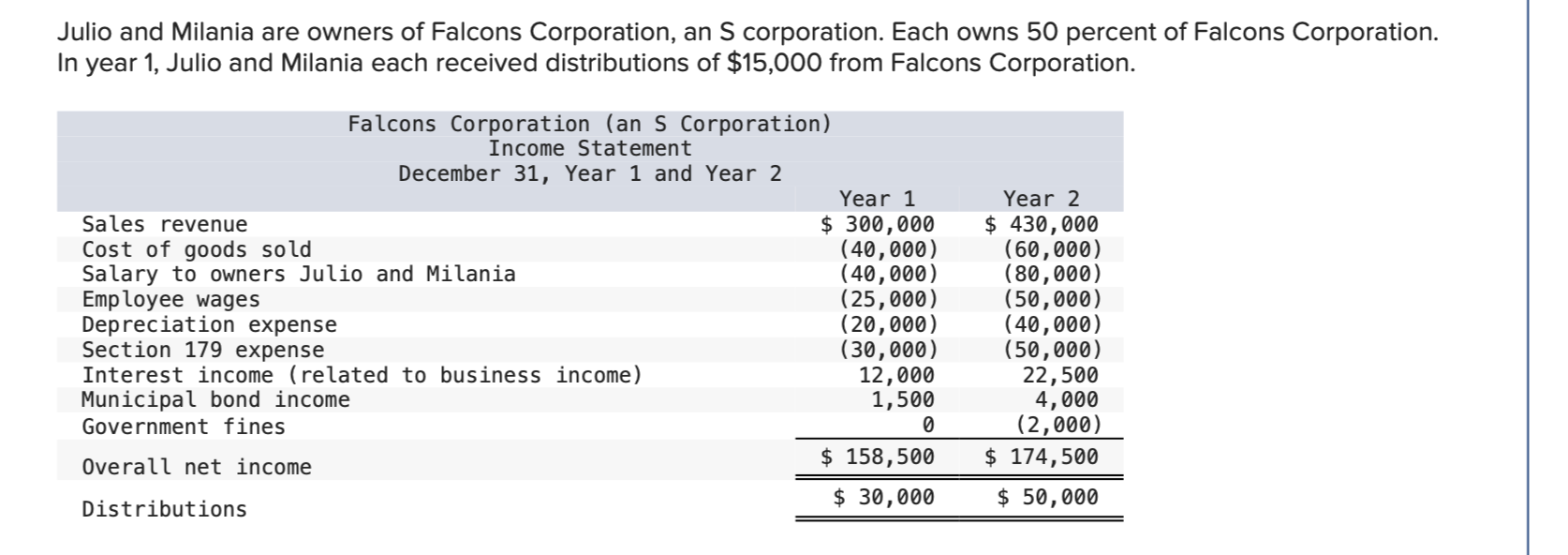

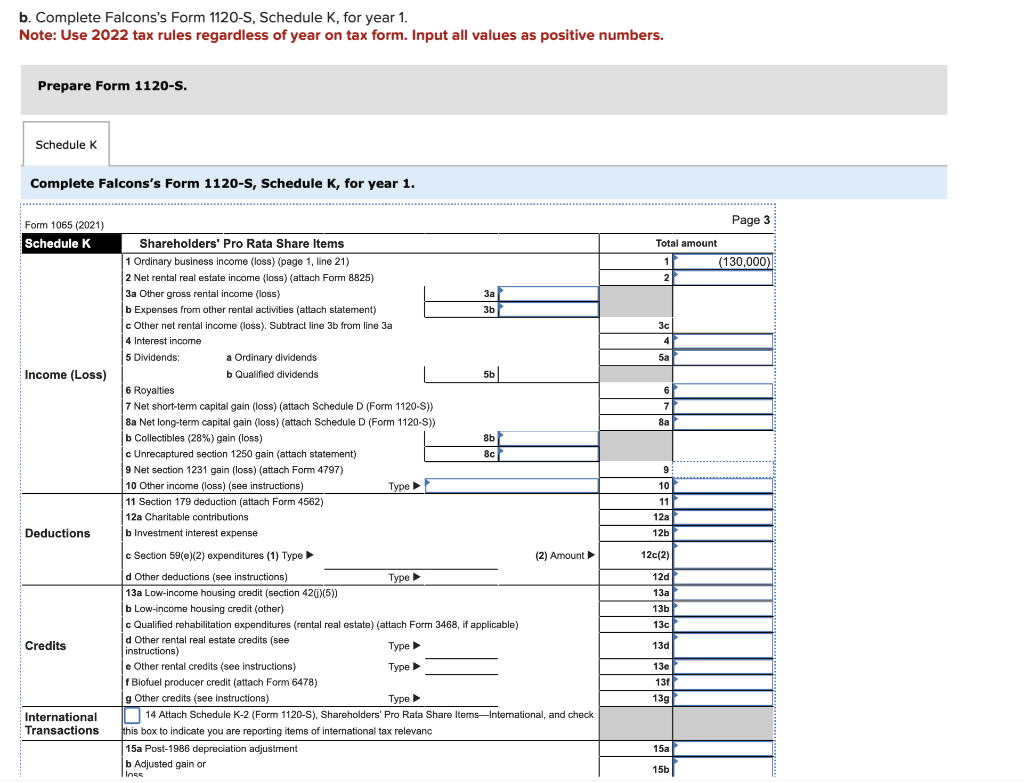

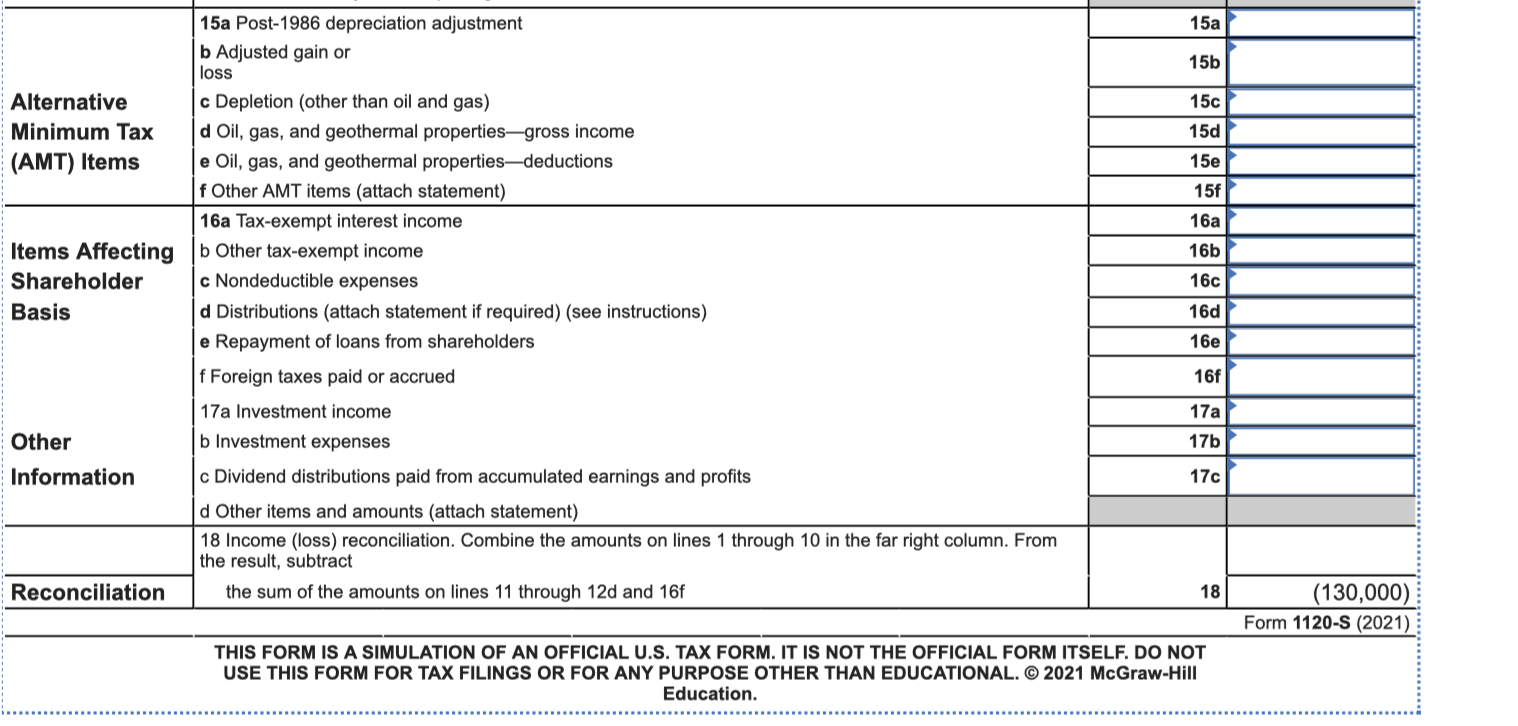

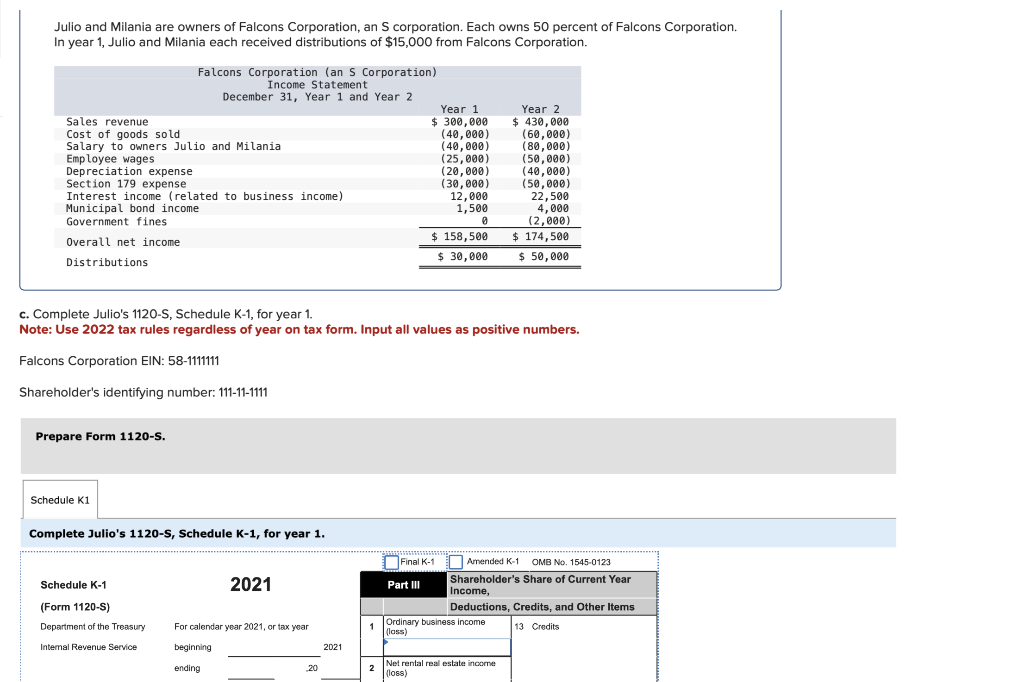

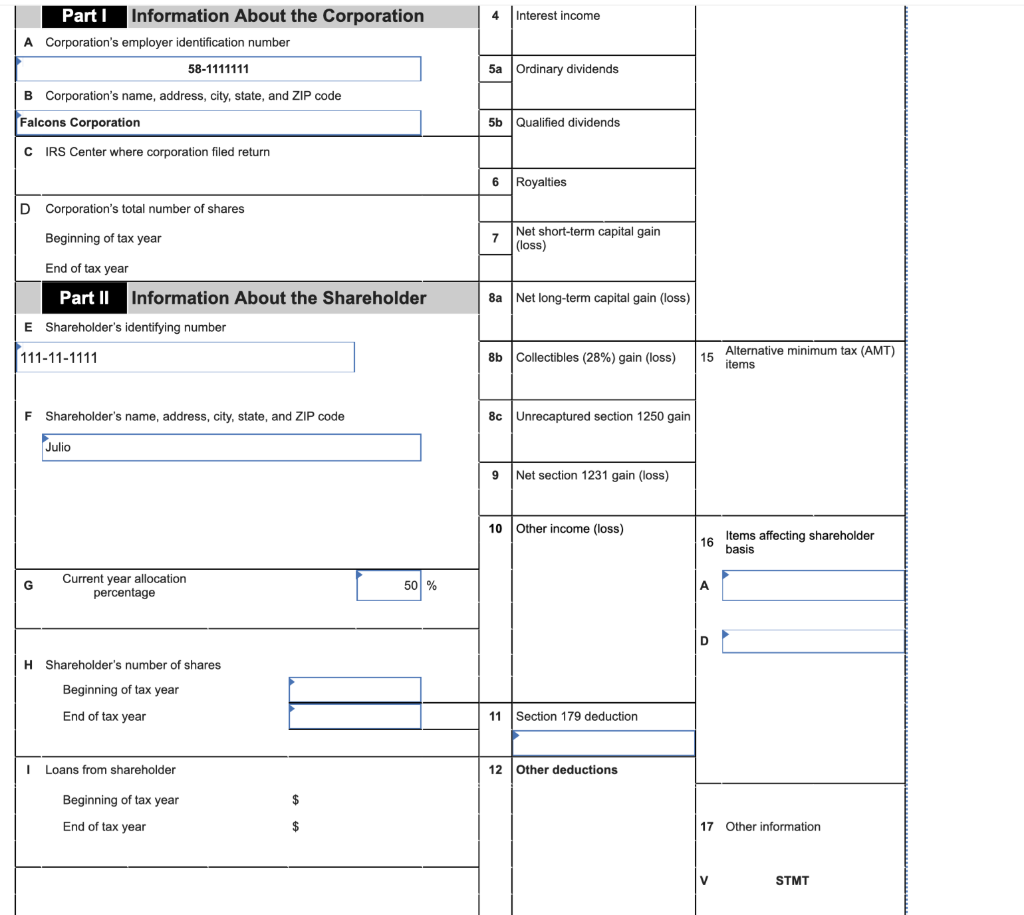

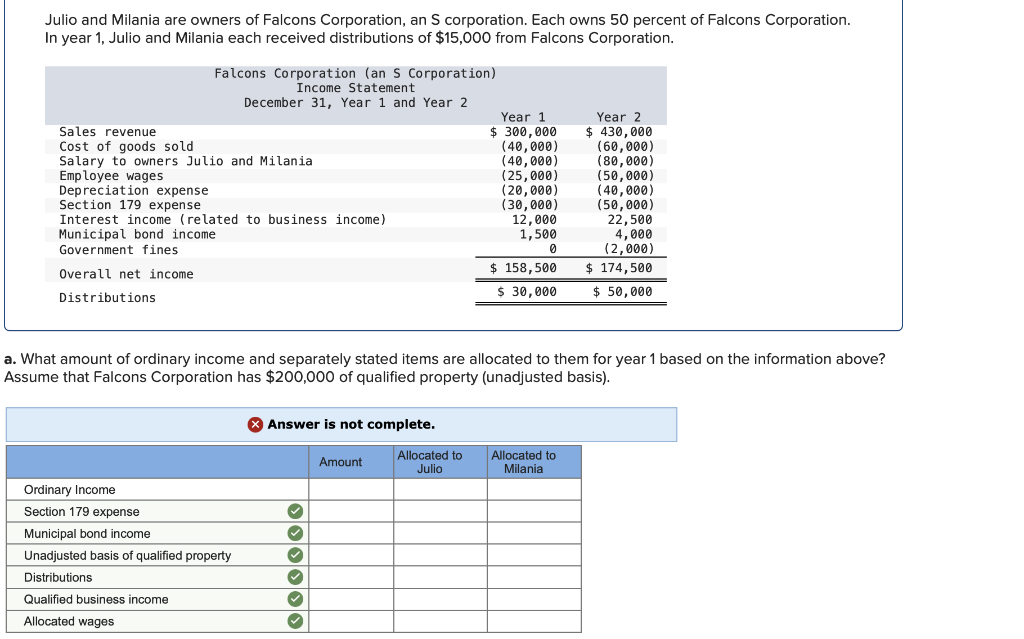

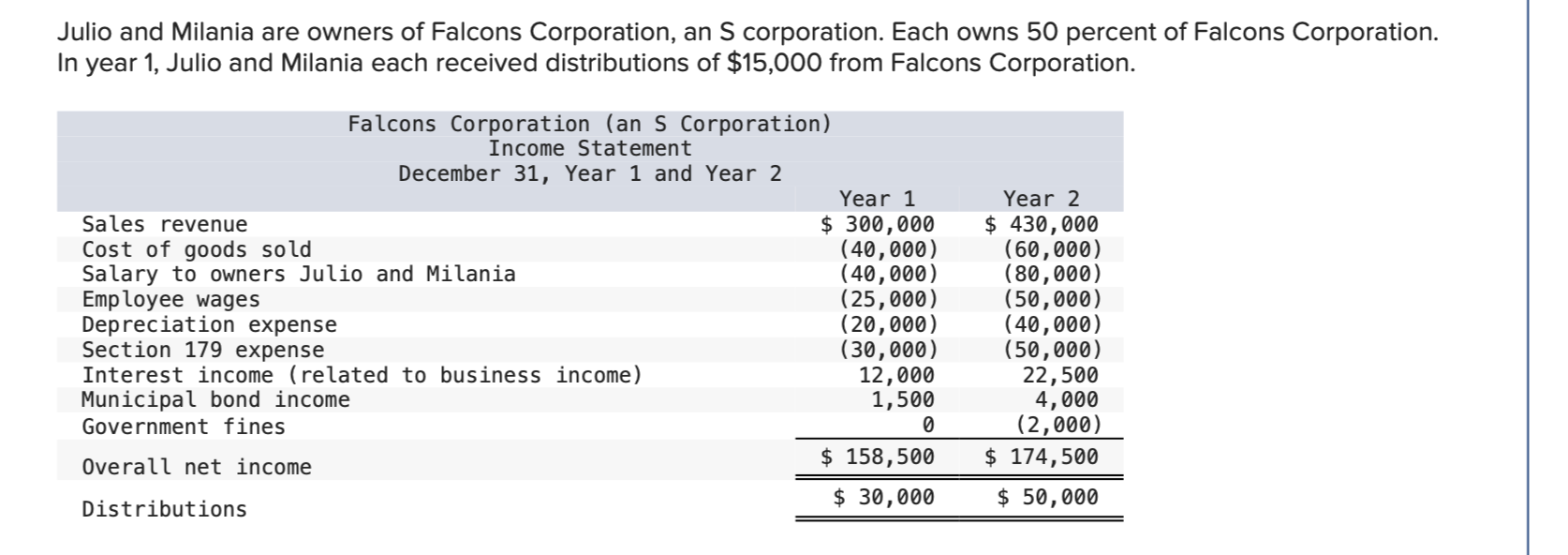

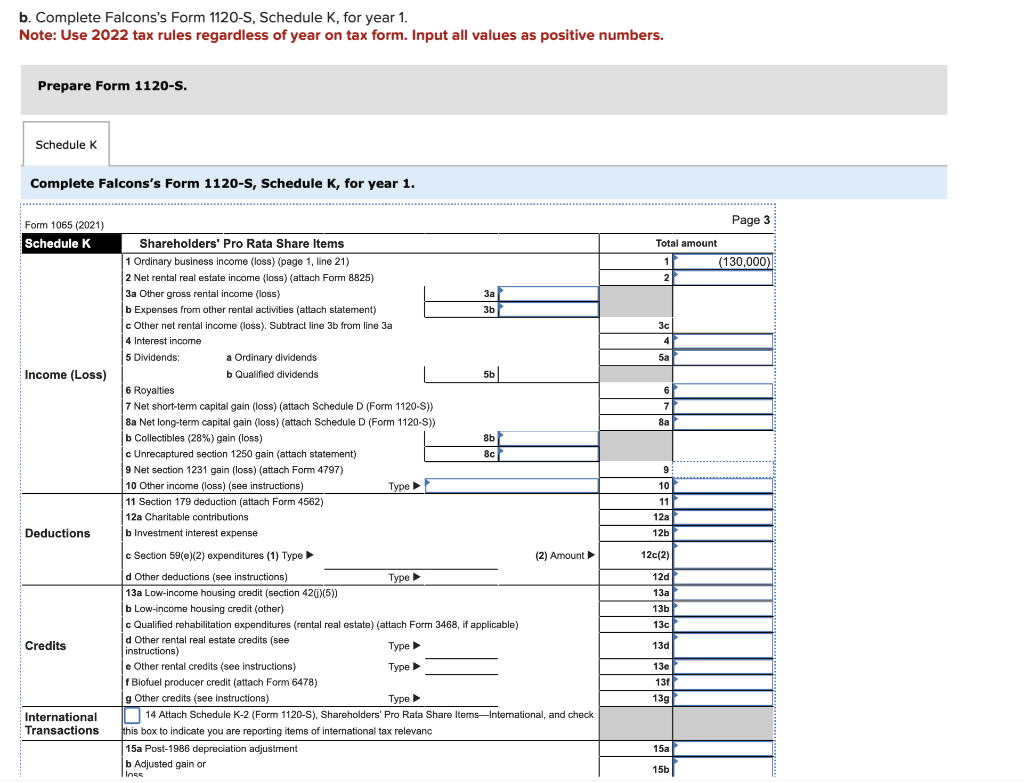

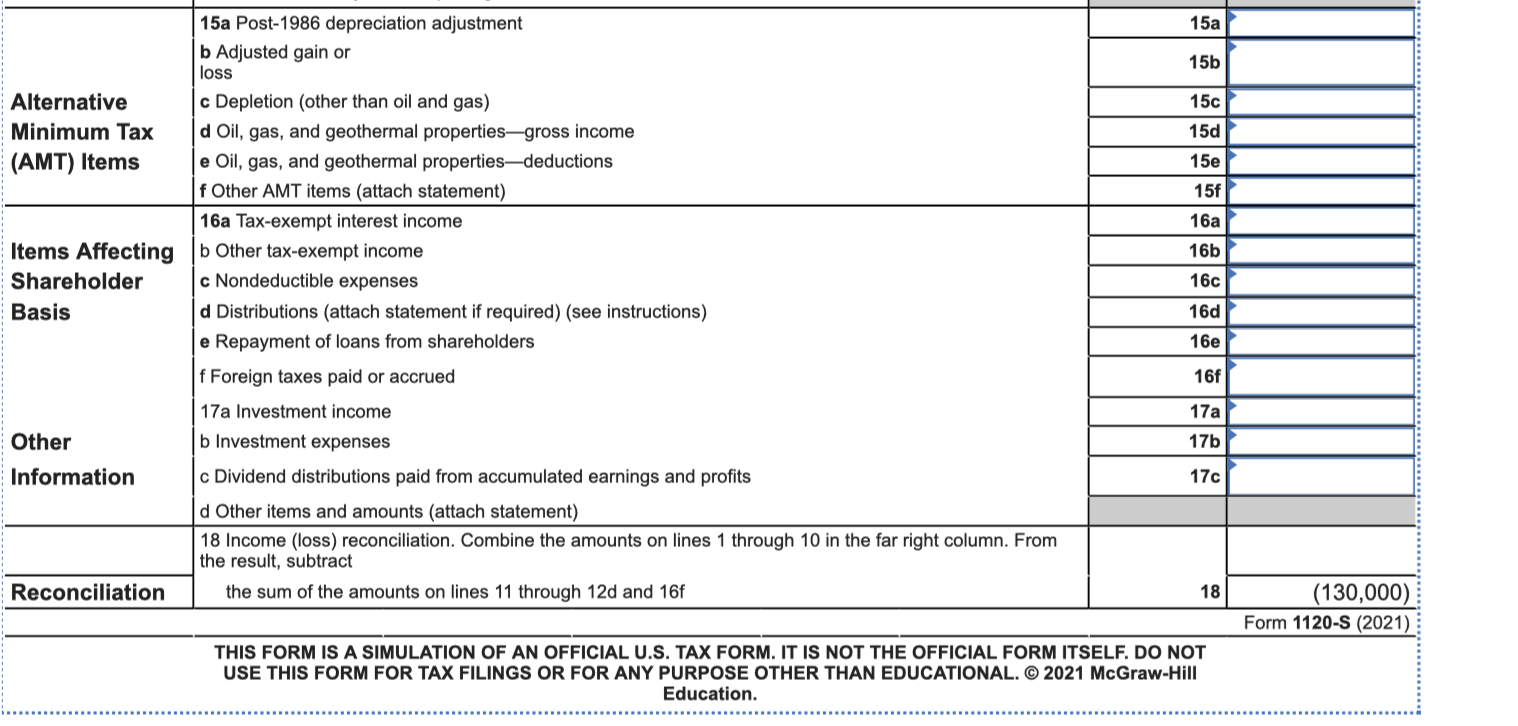

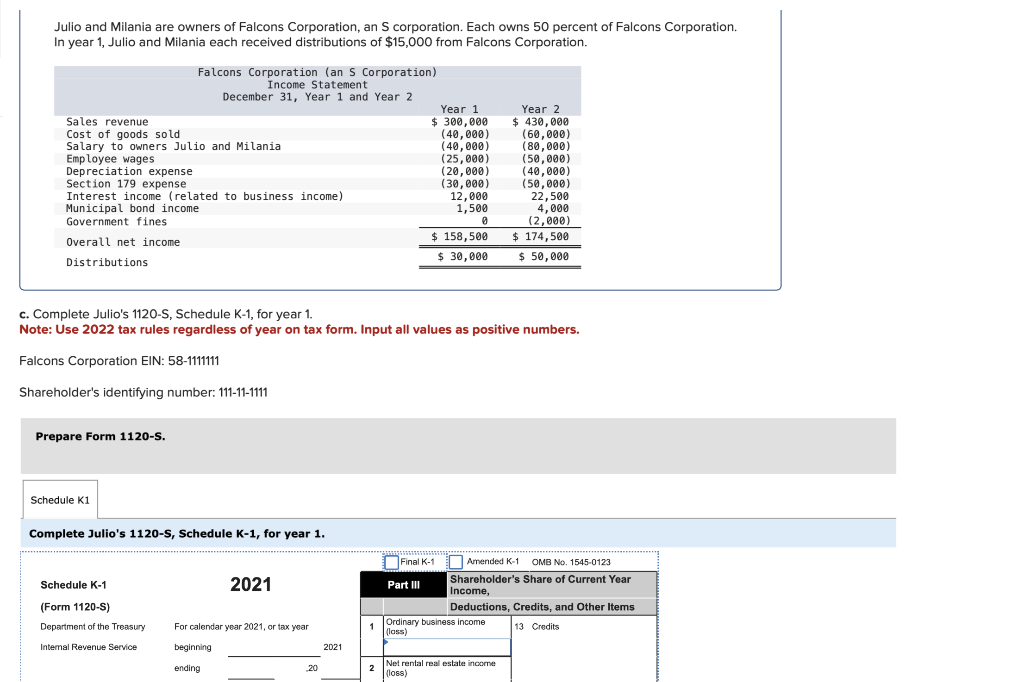

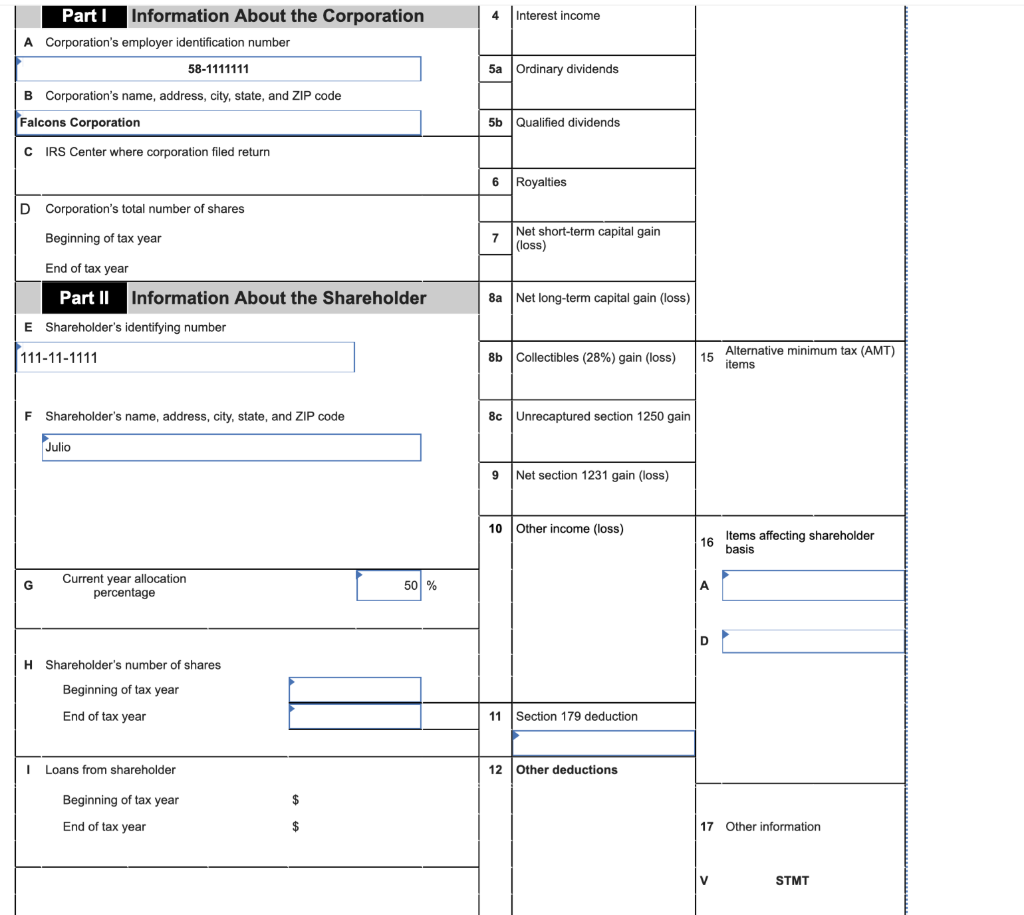

Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $15,000 from Falcons Corporation. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis). Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $15,000 from Falcons Corporation. b. Complete Falcons's Form 1120-S, Schedule K, for year 1. Note: Use 2022 tax rules regardless of year on tax form. Input all values as positive numbers. Prepare Form 1120-S. Complete Falcons's Form 1120-S, Schedule K, for year 1. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2021 McGraw-Hill Education. Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1 , Julio and Milania each received distributions of $15,000 from Falcons Corporation. c. Complete Julio's 1120-S, Schedule K-1, for year 1 . Note: Use 2022 tax rules regardless of year on tax form. Input all values as positive numbers. Falcons Corporation EIN: 58-1111111 Shareholder's identifying number: 111-11-1111 Prepare Form 1120-S. Complete Julio's 1120-S, Schedule K-1, for year 1. Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $15,000 from Falcons Corporation. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis). Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $15,000 from Falcons Corporation. b. Complete Falcons's Form 1120-S, Schedule K, for year 1. Note: Use 2022 tax rules regardless of year on tax form. Input all values as positive numbers. Prepare Form 1120-S. Complete Falcons's Form 1120-S, Schedule K, for year 1. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2021 McGraw-Hill Education. Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1 , Julio and Milania each received distributions of $15,000 from Falcons Corporation. c. Complete Julio's 1120-S, Schedule K-1, for year 1 . Note: Use 2022 tax rules regardless of year on tax form. Input all values as positive numbers. Falcons Corporation EIN: 58-1111111 Shareholder's identifying number: 111-11-1111 Prepare Form 1120-S. Complete Julio's 1120-S, Schedule K-1, for year 1