Answered step by step

Verified Expert Solution

Question

1 Approved Answer

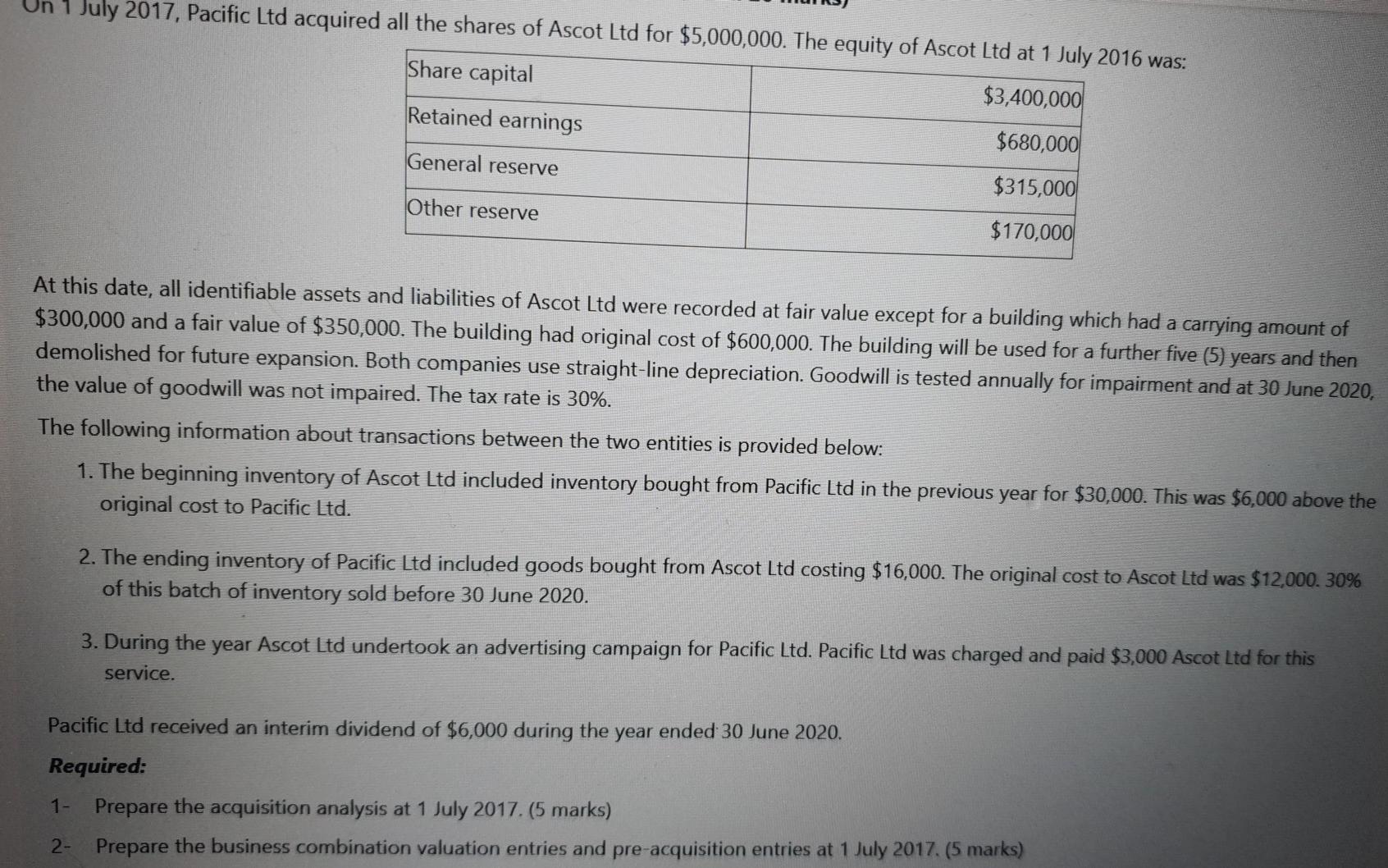

July 2017, Pacific Ltd acquired all the shares of Ascot Ltd for $5,000,000. The equity of Ascot Ltd at 1 July 2016 was: Share capital

July 2017, Pacific Ltd acquired all the shares of Ascot Ltd for $5,000,000. The equity of Ascot Ltd at 1 July 2016 was: Share capital $3,400,000 Retained earnings $680,000 General reserve $315,000 Other reserve $170,000 At this date, all identifiable assets and liabilities of Ascot Ltd were recorded at fair value except for a building which had a carrying amount of $300,000 and a fair value of $350,000. The building had original cost of $600,000. The building will be used for a further five (5) years and then demolished for future expansion. Both companies use straight-line depreciation. Goodwill is tested annually for impairment and at 30 June 2020, the value of goodwill was not impaired. The tax rate is 30%. The following information about transactions between the two entities is provided below: 1. The beginning inventory of Ascot Ltd included inventory bought from Pacific Ltd in the previous year for $30,000. This was $6,000 above the original cost to Pacific Ltd. 2. The ending inventory of Pacific Ltd included goods bought from Ascot Ltd costing $16,000. The original cost to Ascot Ltd was $12,000. 30% of this batch of inventory sold before 30 June 2020. 3. During the year Ascot Ltd undertook an advertising campaign for Pacific Ltd. Pacific Ltd was charged and paid $3,000 Ascot Ltd for this service. Pacific Ltd received an interim dividend of $6,000 during the year ended 30 June 2020. Required: 1- Prepare the acquisition analysis at 1 July 2017. (5 marks) 2- Prepare the business combination valuation entries and pre-acquisition entries at 1 July 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started