Answered step by step

Verified Expert Solution

Question

1 Approved Answer

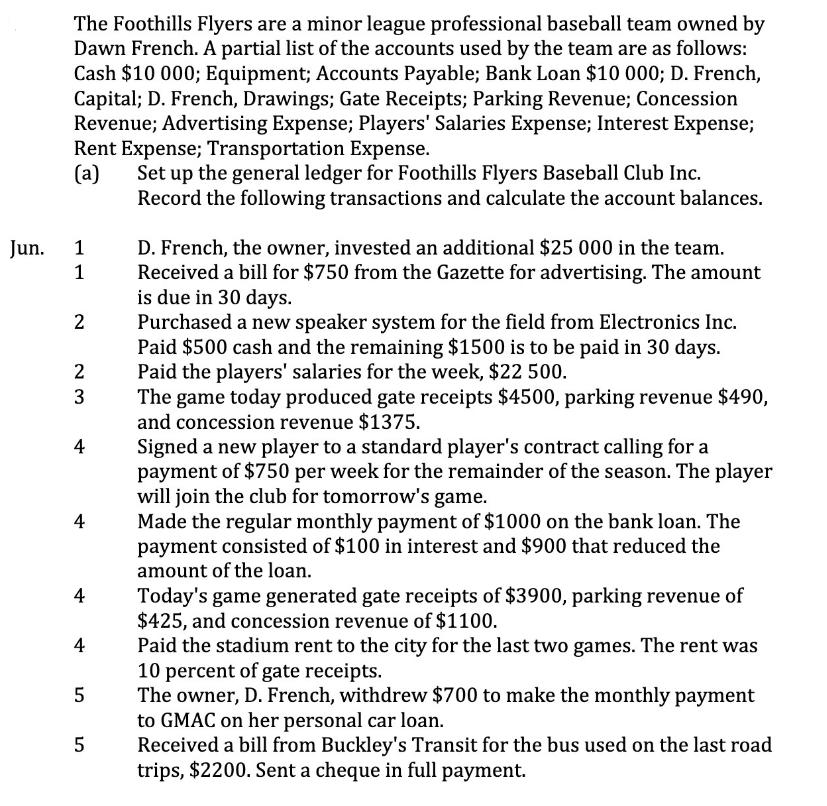

Jun. The Foothills Flyers are a minor league professional baseball team owned by Dawn French. A partial list of the accounts used by the

Jun. The Foothills Flyers are a minor league professional baseball team owned by Dawn French. A partial list of the accounts used by the team are as follows: Cash $10 000; Equipment; Accounts Payable; Bank Loan $10 000; D. French, Capital; D. French, Drawings; Gate Receipts; Parking Revenue; Concession Revenue; Advertising Expense; Players' Salaries Expense; Interest Expense; Rent Expense; Transportation Expense. (a) Set up the general ledger for Foothills Flyers Baseball Club Inc. Record the following transactions and calculate the account balances. 1 1 2 23 4 4 4 4 5 5 D. French, the owner, invested an additional $25 000 in the team. Received a bill for $750 from the Gazette for advertising. The amount is due in 30 days. Purchased a new speaker system for the field from Electronics Inc. Paid $500 cash and the remaining $1500 is to be paid in 30 days. Paid the players' salaries for the week, $22 500. The game today produced gate receipts $4500, parking revenue $490, and concession revenue $1375. Signed a new player to a standard player's contract calling for a payment of $750 per week for the remainder of the season. The player will join the club for tomorrow's game. Made the regular monthly payment of $1000 on the bank loan. The payment consisted of $100 in interest and $900 that reduced the amount of the loan. Today's game generated gate receipts of $3900, parking revenue of $425, and concession revenue of $1100. Paid the stadium rent to the city for the last two games. The rent was 10 percent of gate receipts. The owner, D. French, withdrew $700 to make the monthly payment to GMAC on her personal car loan. Received a bill from Buckley's Transit for the bus used on the last road trips, $2200. Sent a cheque in full payment. Jun. The Foothills Flyers are a minor league professional baseball team owned by Dawn French. A partial list of the accounts used by the team are as follows: Cash $10 000; Equipment; Accounts Payable; Bank Loan $10 000; D. French, Capital; D. French, Drawings; Gate Receipts; Parking Revenue; Concession Revenue; Advertising Expense; Players' Salaries Expense; Interest Expense; Rent Expense; Transportation Expense. (a) Set up the general ledger for Foothills Flyers Baseball Club Inc. Record the following transactions and calculate the account balances. 1 1 2 23 4 4 4 4 5 5 D. French, the owner, invested an additional $25 000 in the team. Received a bill for $750 from the Gazette for advertising. The amount is due in 30 days. Purchased a new speaker system for the field from Electronics Inc. Paid $500 cash and the remaining $1500 is to be paid in 30 days. Paid the players' salaries for the week, $22 500. The game today produced gate receipts $4500, parking revenue $490, and concession revenue $1375. Signed a new player to a standard player's contract calling for a payment of $750 per week for the remainder of the season. The player will join the club for tomorrow's game. Made the regular monthly payment of $1000 on the bank loan. The payment consisted of $100 in interest and $900 that reduced the amount of the loan. Today's game generated gate receipts of $3900, parking revenue of $425, and concession revenue of $1100. Paid the stadium rent to the city for the last two games. The rent was 10 percent of gate receipts. The owner, D. French, withdrew $700 to make the monthly payment to GMAC on her personal car loan. Received a bill from Buckley's Transit for the bus used on the last road trips, $2200. Sent a cheque in full payment.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

June 1 Owners Investment Debit Cash 25000 Owner is putting more money into the business Credit D French Capital 25000 Owners equity increases June 1 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started