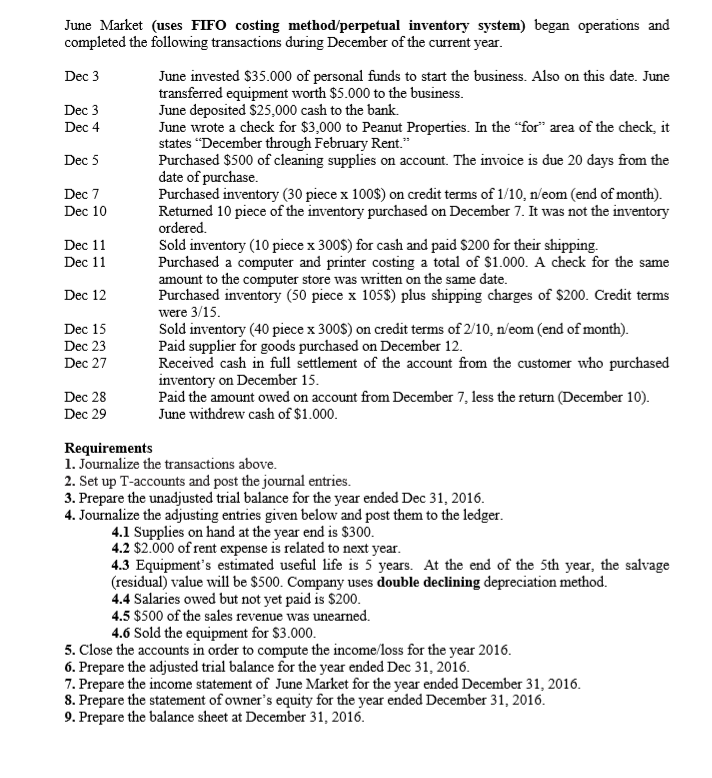

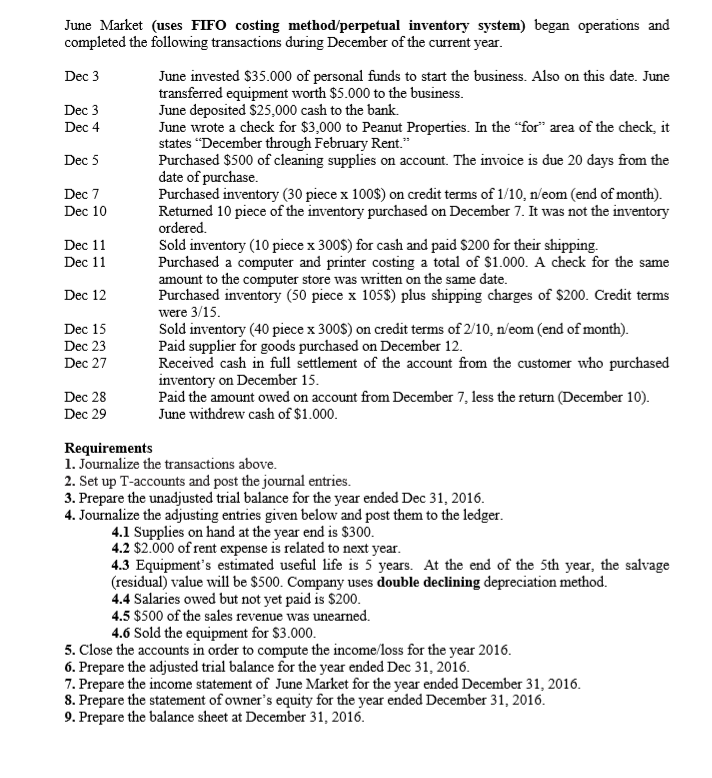

June Market (uses FIFO costing method/perpetual inventory system) began operations and completed the following transactions during December of the current year. Dec 3 June invested $35.000 of personal funds to start the business. Also on this date. June transferred equipment worth $5.000 to the business. Dec 3 June deposited $25,000 cash to the bank. Dec 4 June wrote a check for $3,000 to Peanut Properties. In the for area of the check, it states December through February Rent." Dec 5 Purchased $500 of cleaning supplies on account. The invoice is due 20 days from the date of purchase. Dec 7 Purchased inventory (30 piece x 1008) on credit terms of 1/10, n/eom (end of month). Dec 10 Returned 10 piece of the inventory purchased on December 7. It was not the inventory ordered Dec 11 Sold inventory (10 piece x 300$) for cash and paid $200 for their shipping. Dec 11 Purchased a computer and printer costing a total of $1.000. A check for the same amount to the computer store was written on the same date. Dec 12 Purchased inventory (50 piece x 1055) plus shipping charges of $200. Credit terms were 3/15. Dec 15 Sold inventory (40 piece x 300$) on credit terms of 2/10, n/eom (end of month). Dec 23 Paid supplier for goods purchased on December 12. Dec 27 Received cash in full settlement of the account from the customer who purchased inventory on December 15. Dec 28 Paid the amount owed on account from December 7, less the return (December 10). Dec 29 June withdrew cash of $1.000. Requirements 1. Journalize the transactions above. 2. Set up T-accounts and post the journal entries. 3. Prepare the unadjusted trial balance for the year ended Dec 31, 2016. 4. Journalize the adjusting entries given below and post them to the ledger. 4.1 Supplies on hand at the year end is $300. 4.2 $2.000 of rent expense is related to next year. 4.3 Equipment's estimated useful life is 5 years. At the end of the 5th year, the salvage (residual) value will be $500. Company uses double declining depreciation method. 4.4 Salaries owed but not yet paid is $200. 4.5 $500 of the sales revenue was unearned. 4.6 Sold the equipment for $3.000. 5. Close the accounts in order to compute the income/loss for the year 2016. 6. Prepare the adjusted trial balance for the year ended Dec 31, 2016. 7. Prepare the income statement of June Market for the year ended December 31, 2016. 8. Prepare the statement of owner's equity for the year ended December 31, 2016. 9. Prepare the balance sheet at December 31, 2016