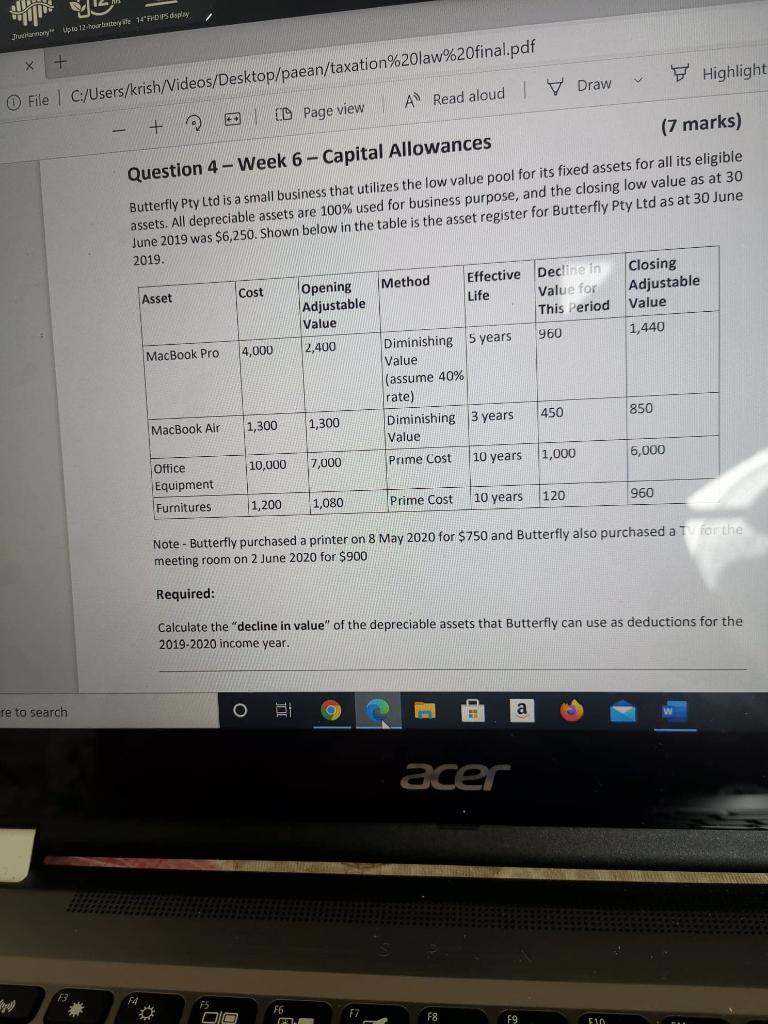

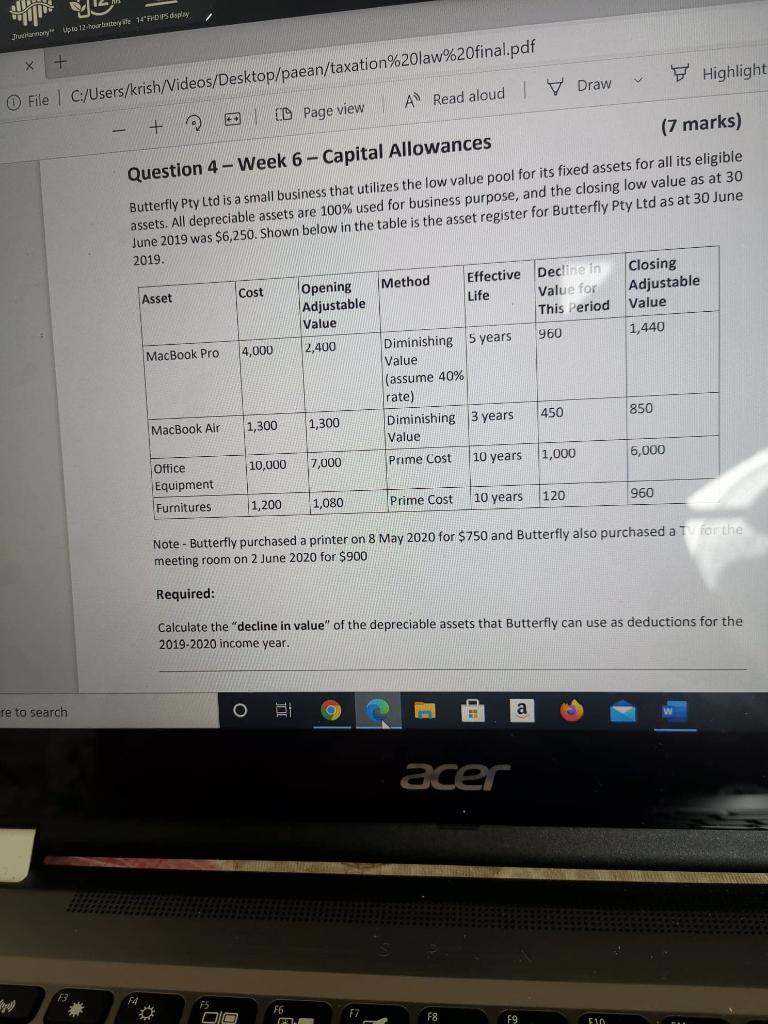

Jurmony up to 12-hour battery ate Cody + Highlight y Draw File C:/Users/krish/Videos/Desktop/paean/taxation%20law%20final.pdf A Read aloud + E D Page view Question 4-Week 6 - Capital Allowances (7 marks) Butterfly Pty Ltd is a small business that utilizes the low value pool for its fixed assets for all its eligible assets. All depreciable assets are 100% used for business purpose, and the closing low value as at 30 June 2019 was $6,250. Shown below in the table is the asset register for Butterfly Pty Ltd as at 30 June 2019. Closing Adjustable Value Opening Cost Asset Adjustable Value 1,440 2,400 4,000 MacBook Pro Method Effective Decline in Life Value for This Period Diminishing 5 years 960 Value (assume 40% rate) Diminishing 3 years 450 Value 850 MacBook Air 1,300 1,300 6,000 1,000 7,000 10 years Prime Cost 10,000 Office Equipment Furnitures 1,200 960 Prime Cost 1,080 10 years 120 Note - Butterfly purchased a printer on 8 May 2020 for $750 and Butterfly also purchased a Tromthe meeting room on 2 June 2020 for $900 Required: Calculate the "decline in value of the depreciable assets that Butterfly can use as deductions for the 2019-2020 income year. re to search O a acer F6 OO F9 510 Jurmony up to 12-hour battery ate Cody + Highlight y Draw File C:/Users/krish/Videos/Desktop/paean/taxation%20law%20final.pdf A Read aloud + E D Page view Question 4-Week 6 - Capital Allowances (7 marks) Butterfly Pty Ltd is a small business that utilizes the low value pool for its fixed assets for all its eligible assets. All depreciable assets are 100% used for business purpose, and the closing low value as at 30 June 2019 was $6,250. Shown below in the table is the asset register for Butterfly Pty Ltd as at 30 June 2019. Closing Adjustable Value Opening Cost Asset Adjustable Value 1,440 2,400 4,000 MacBook Pro Method Effective Decline in Life Value for This Period Diminishing 5 years 960 Value (assume 40% rate) Diminishing 3 years 450 Value 850 MacBook Air 1,300 1,300 6,000 1,000 7,000 10 years Prime Cost 10,000 Office Equipment Furnitures 1,200 960 Prime Cost 1,080 10 years 120 Note - Butterfly purchased a printer on 8 May 2020 for $750 and Butterfly also purchased a Tromthe meeting room on 2 June 2020 for $900 Required: Calculate the "decline in value of the depreciable assets that Butterfly can use as deductions for the 2019-2020 income year. re to search O a acer F6 OO F9 510