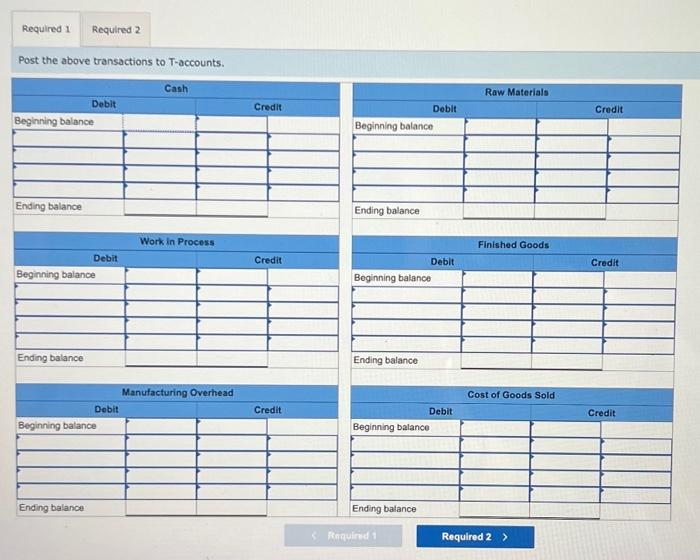

Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $75,400 in raw materials were purchased for cash. b. $72,600 in raw materials were used in production. Of this amount, $65,200 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $150,600 were incurred and paid. Of this amount, $134,300 was for direct labor and the remainder was for indirect labor: d. Additional manufacturing overhead costs of $126,300 were incurred and paid. e. Manufacturing overhead of $127,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. 9. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Post the above transactions to T-accounts. Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $75,400 in raw materials were purchased for cash. b. $72,600 in raw materials were used in production. Of this amount, $65,200 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $150,600 were incurred and paid. Of this amount, $134,300 was for direct labor and the remainder was for indirect labot. d. Additional manufacturing overhead costs of $126,300 were incurred and paid. e. Manufacturing overhead of $127,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. 9. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Complete this question by entering your answers in the tabs below. Determine the adjusted cost of goods sold for the period