just 20, 21, 22 & 24. Not 23 Thankyou!

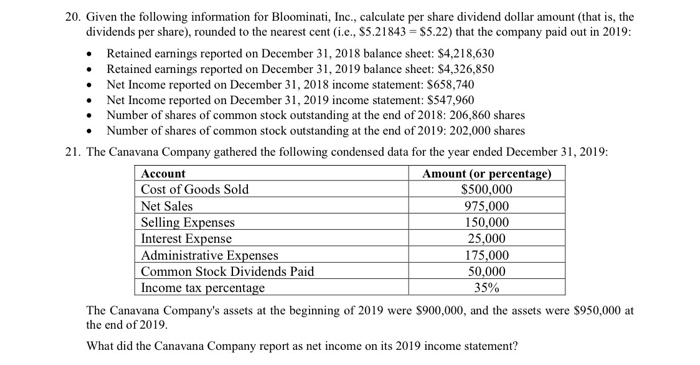

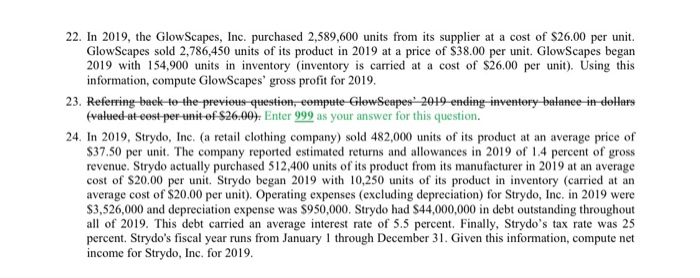

20. Given the following information for Bloominati, Inc., calculate per share dividend dollar amount (that is, the dividends per share), rounded to the nearest cent (i.e., $5.21843 = $5.22) that the company paid out in 2019: Retained earnings reported on December 31, 2018 balance sheet: $4,218,630 Retained earnings reported on December 31, 2019 balance sheet: $4,326,850 Net Income reported on December 31, 2018 income statement: $658,740 Net Income reported on December 31, 2019 income statement: $547,960 Number of shares of common stock outstanding at the end of 2018: 206,860 shares Number of shares of common stock outstanding at the end of 2019: 202,000 shares 21. The Canavana Company gathered the following condensed data for the year ended December 31, 2019: Account Amount (or percentage) Cost of Goods Sold $500,000 Net Sales 975,000 Selling Expenses 150,000 Interest Expense 25,000 Administrative Expenses 175,000 Common Stock Dividends Paid 50,000 Income tax percentage 35% The Canavana Company's assets at the beginning of 2019 were $900,000, and the assets were $950,000 at the end of 2019. What did the Canavana Company report as net income on its 2019 income statement? 22. In 2019, the GlowScapes, Inc. purchased 2,589,600 units from its supplier at a cost of $26.00 per unit. GlowScapes sold 2,786,450 units of its product in 2019 at a price of $38.00 per unit. GlowScapes began 2019 with 154,900 units in inventory (inventory is carried at a cost of $26.00 per unit). Using this information, compute GlowScapes' gross profit for 2019. 23. Referring back to the previous question, compute Glow Seapes 2019 ending inventory balanee-in-dollars valued at eest per unit of $26.00). Enter 999 as your answer for this question. 24. In 2019, Strydo, Inc. (a retail clothing company) sold 482,000 units of its product at an average price of $37.50 per unit. The company reported estimated returns and allowances in 2019 of 1.4 percent of gross revenue. Strydo actually purchased 512,400 units of its product from its manufacturer in 2019 at an average cost of $20.00 per unit. Strydo began 2019 with 10,250 units of its product in inventory (carried at an average cost of $20.00 per unit). Operating expenses (excluding depreciation) for Strydo, Inc. in 2019 were $3,526,000 and depreciation expense was $950,000. Strydo had $44,000,000 in debt outstanding throughout all of 2019. This debt carried an average interest rate of 5.5 percent. Finally, Strydo's tax rate was 25 percent. Strydo's fiscal year runs from January 1 through December 31. Given this information, compute net income for Strydo, Inc. for 2019