Question: [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances:

![[The following information applies to the questions displayed below.] The general ledger](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/10/670fa54c342c9_1729078596152.jpg)

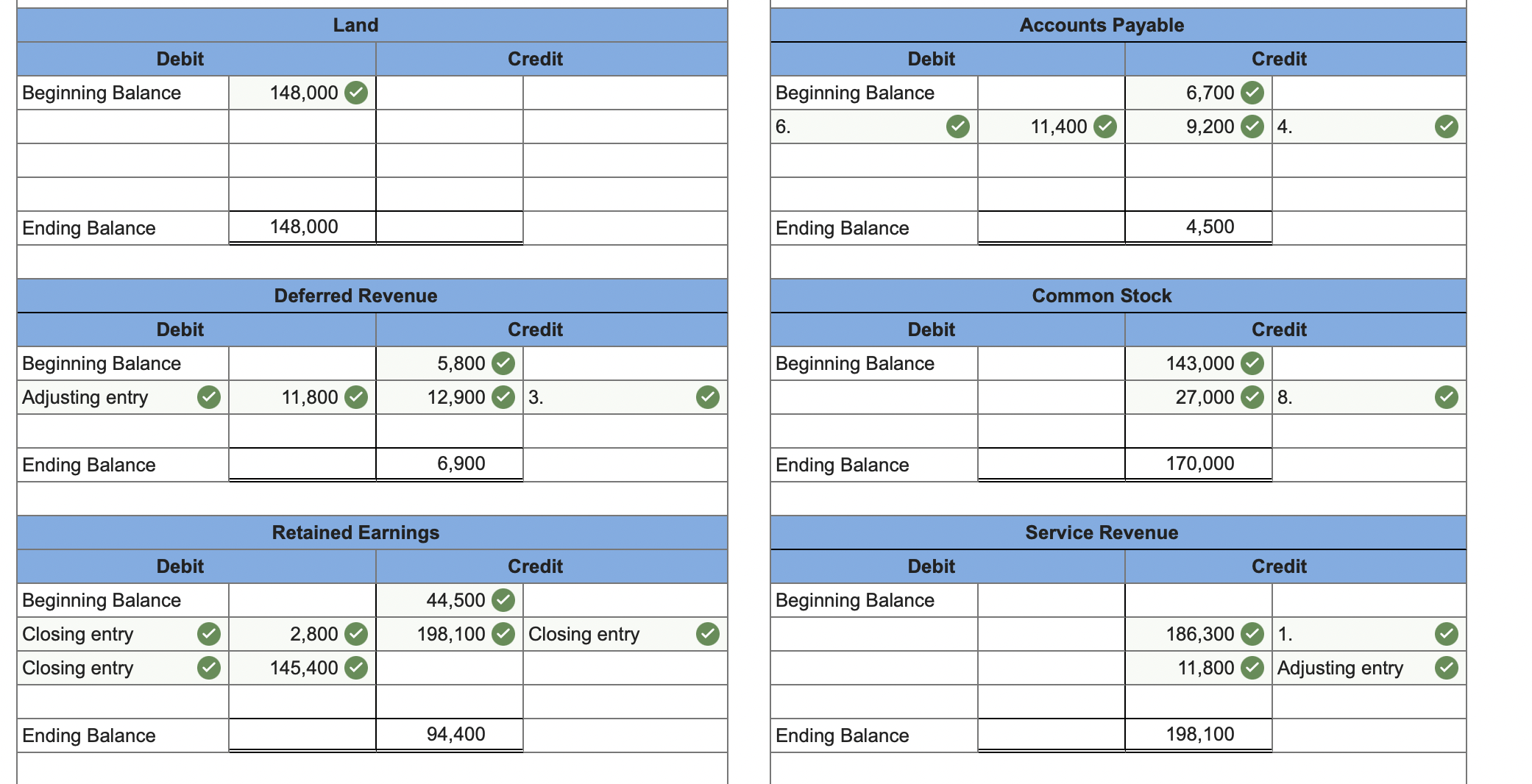

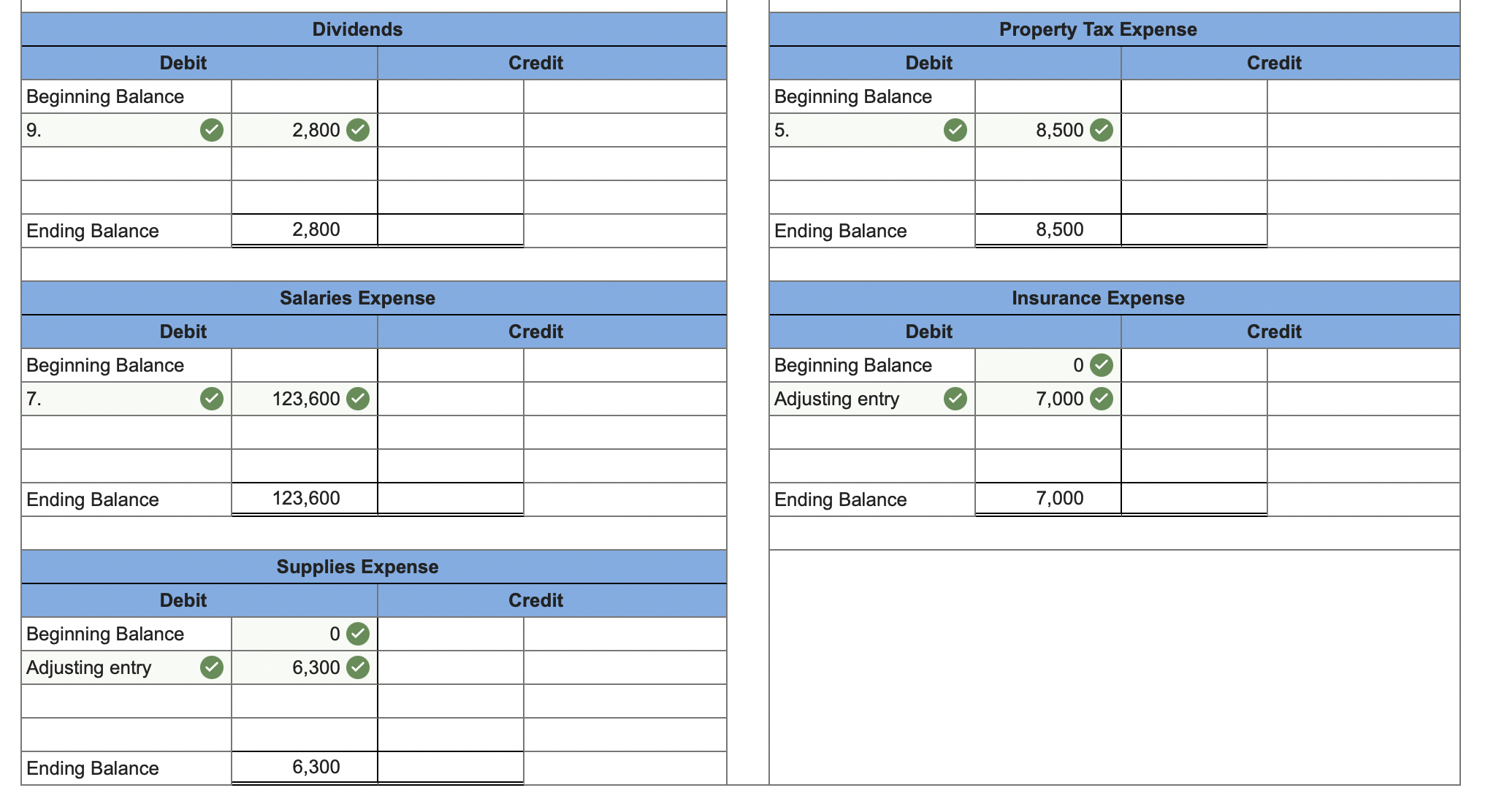

[The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals Debits $24,600 Credits 15,400 12,000 148,000 $6,700 5,800 143,000 44,500 $200,000 $200,000 The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $134,100, and on account, $52,200. Collect on accounts receivable, $51,500. Receive cash in advance from customers, $12,900. Purchase supplies on account, $9,200. Pay property taxes, $8,500. Pay on accounts payable, $11,400. Pay salaries, $123,600. Issue shares of common stock in exchange for $27,000 cash. Pay $2,800 cash dividends to stockholders. 1. 3. 6. & 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. Answer is not complete. Cash Accounts Receivable Debit Credit Debit Credit Beginning Balance 24,600 Beginning Balance 15,400 1. 134,100 8,500 5. 1. 52,200 51,500 2. 2. 51,500 11,400 6. 3. 12,900 123,600 7. 8. 27,000 2,800 9. Ending Balance 103,800 Beginning Balance Prepaid Insurance Ending Balance 16,100 Debit Credit 12,000 7,000 Adjusting entry 4. Ending Balance 5,000 Supplies Debit Credit Beginning Balance 9,200 6,300 Adjusting entry Ending Balance 2,900 Debit Beginning Balance 148,000 Ending Balance 148,000 Land Deferred Revenue Debit Beginning Balance Adjusting entry Ending Balance Debit Beginning Balance Closing entry Closing entry Ending Balance Credit Credit 5,800 11,800 12,900 3. 6,900 Debit Beginning Balance 6. Ending Balance Accounts Payable Credit 6,700 11,400 9,200 4. Common Stock Debit Beginning Balance Ending Balance 4,500 Credit 143,000 27,000 8. 170,000 Retained Earnings Service Revenue Credit Debit Credit 44,500 Beginning Balance 2,800 145,400 198,100 Closing entry 186,300 11,800 1. Adjusting entry 94,400 Ending Balance 198,100 Debit Beginning Balance 9. Dividends 2,800 Ending Balance 2,800 Credit Debit Beginning Balance 5. Property Tax Expense 8,500 Ending Balance 8,500 Credit Salaries Expense Insurance Expense Debit Credit Debit Credit 123,600 Beginning Balance Adjusting entry 0 7,000 Beginning Balance 7. Ending Balance 123,600 Supplies Expense Debit Credit Beginning Balance Adjusting entry 0 6,300 Ending Balance 6,300 Ending Balance 7,000

Step by Step Solution

There are 3 Steps involved in it

Heres how we can complete the transactions adjustments and Taccounts for Zips Storage Below is a breakdown in tabular form for each part based on the ... View full answer

Get step-by-step solutions from verified subject matter experts