just 5 & 6

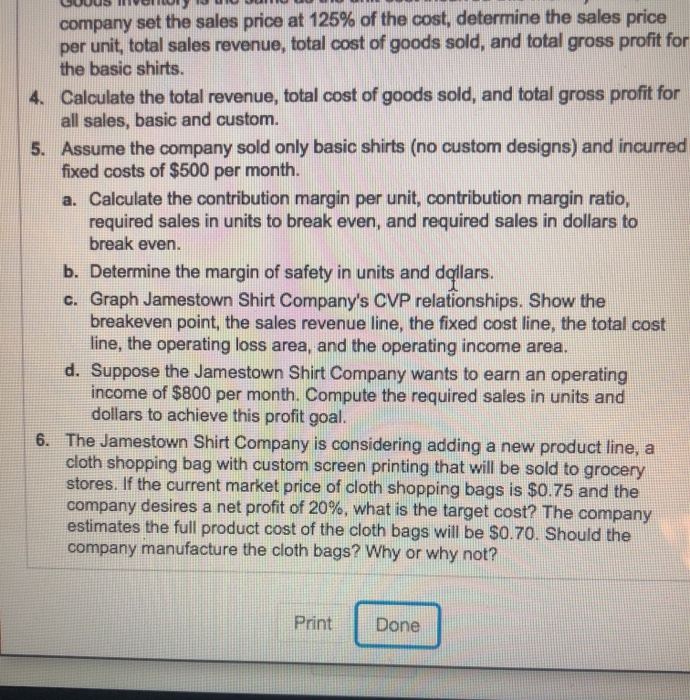

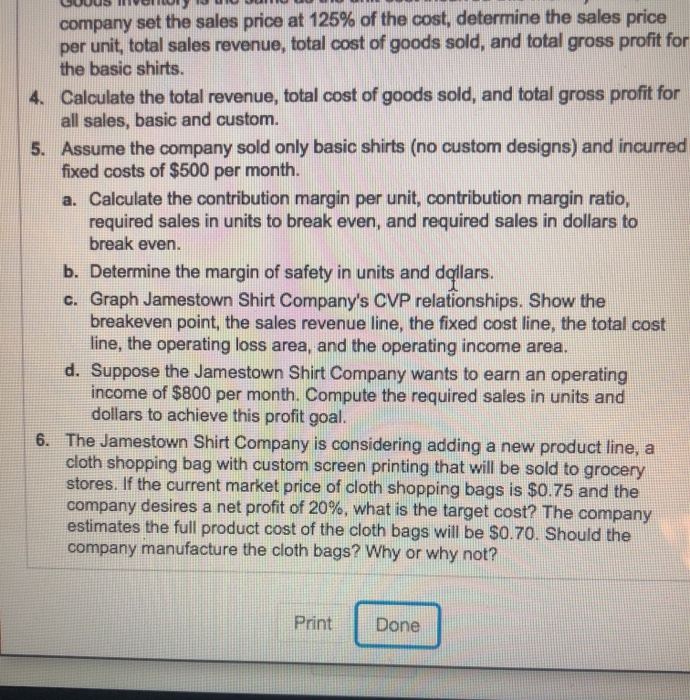

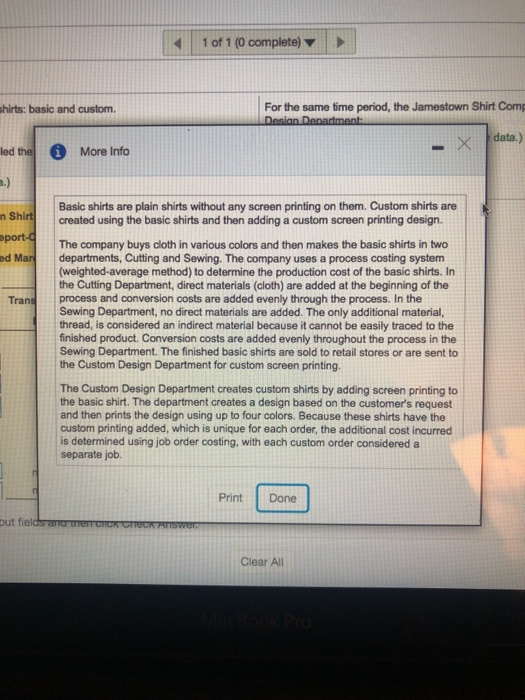

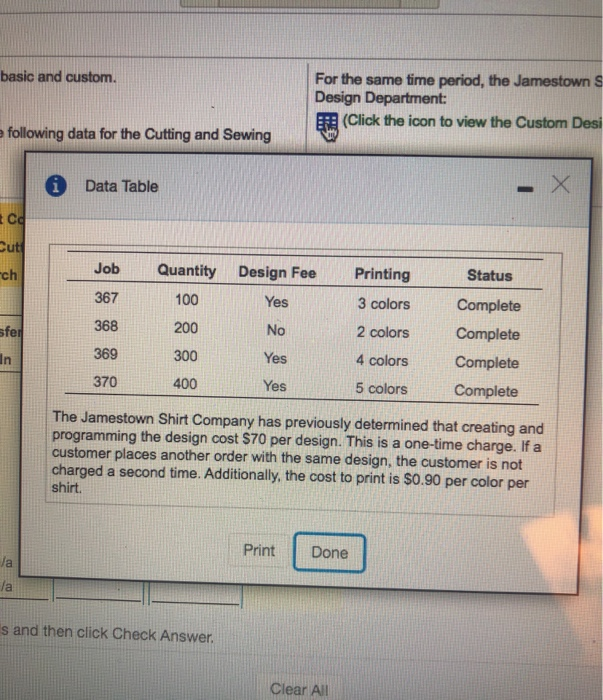

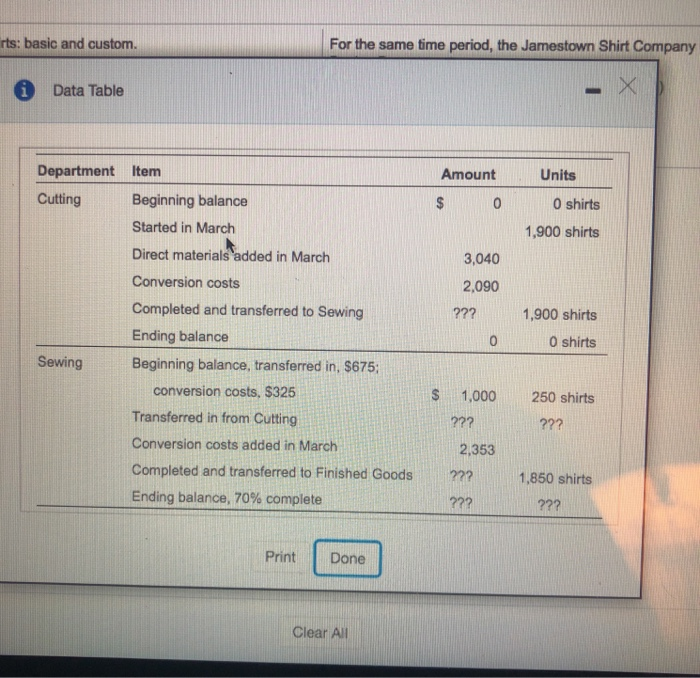

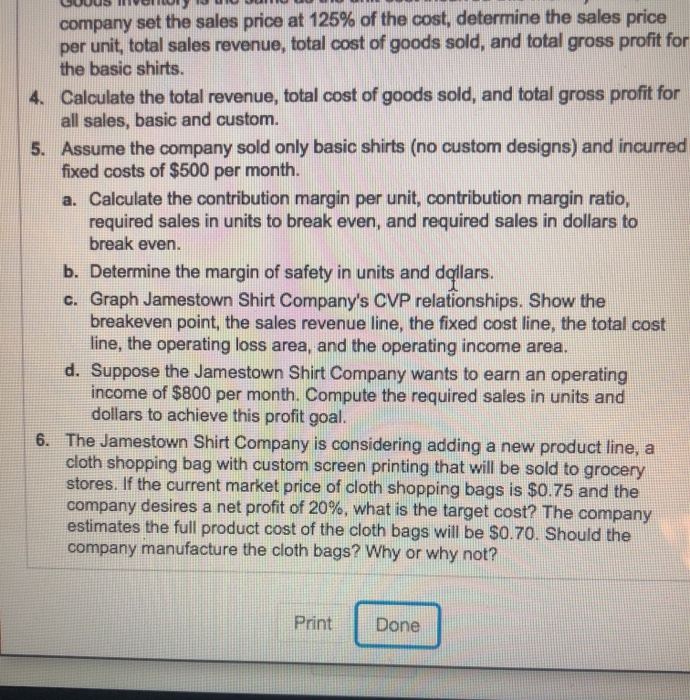

UU UUU UUU ILI UUUS VOULUI company set the sales price at 125% of the cost, determine the sales price per unit, total sales revenue, total cost of goods sold, and total gross profit for the basic shirts. Calculate the total revenue, total cost of goods sold, and total gross profit for all sales, basic and custom. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $500 per month. a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even. b. Determine the margin of safety in units and dqllars. c. Graph Jamestown Shirt Company's CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, and the operating income area. d. Suppose the Jamestown Shirt Company wants to earn an operating income of $800 per month. Compute the required sales in units and dollars to achieve this profit goal. 6. The Jamestown Shirt Company is considering adding a new product line, a cloth shopping bag with custom screen printing that will be sold to grocery stores. If the current market price of cloth shopping bags is $0.75 and the company desires a net profit of 20%, what is the target cost? The company estimates the full product cost of the cloth bags will be $0.70. Should the company manufacture the cloth bags? Why or why not? Print Done rts: basic and custom For the same time period, the Jamestown Shirt Company Data Table Amount SO Units O shirts 1,900 shirts 3,040 2,090 ??? Department Item Cutting Beginning balance Started in March Direct materials added in March Conversion costs Completed and transferred to Sewing Ending balance Beginning balance, transferred in. $675; conversion costs, $325 Transferred in from Cutting Conversion costs added in March Completed and transferred to Finished Goods Ending balance, 70% complete 1,900 shirts O shirts 0 Sewing $ 250 shirts ??? 1,000 ??? 2,353 27? 1,850 shirts ??? Print Done Clear All UU UUU UUU ILI UUUS VOULUI company set the sales price at 125% of the cost, determine the sales price per unit, total sales revenue, total cost of goods sold, and total gross profit for the basic shirts. Calculate the total revenue, total cost of goods sold, and total gross profit for all sales, basic and custom. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $500 per month. a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even. b. Determine the margin of safety in units and dqllars. c. Graph Jamestown Shirt Company's CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, and the operating income area. d. Suppose the Jamestown Shirt Company wants to earn an operating income of $800 per month. Compute the required sales in units and dollars to achieve this profit goal. 6. The Jamestown Shirt Company is considering adding a new product line, a cloth shopping bag with custom screen printing that will be sold to grocery stores. If the current market price of cloth shopping bags is $0.75 and the company desires a net profit of 20%, what is the target cost? The company estimates the full product cost of the cloth bags will be $0.70. Should the company manufacture the cloth bags? Why or why not? Print Done rts: basic and custom For the same time period, the Jamestown Shirt Company Data Table Amount SO Units O shirts 1,900 shirts 3,040 2,090 ??? Department Item Cutting Beginning balance Started in March Direct materials added in March Conversion costs Completed and transferred to Sewing Ending balance Beginning balance, transferred in. $675; conversion costs, $325 Transferred in from Cutting Conversion costs added in March Completed and transferred to Finished Goods Ending balance, 70% complete 1,900 shirts O shirts 0 Sewing $ 250 shirts ??? 1,000 ??? 2,353 27? 1,850 shirts ??? Print Done Clear All