Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just answers please Sunrise Pools and Spas manufactures fibreglass forms for in-ground pools and swim spas for all season use. Data regarding inventory. production and

just answers please

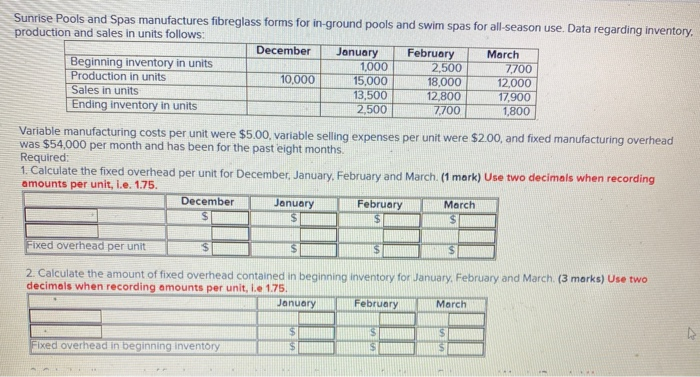

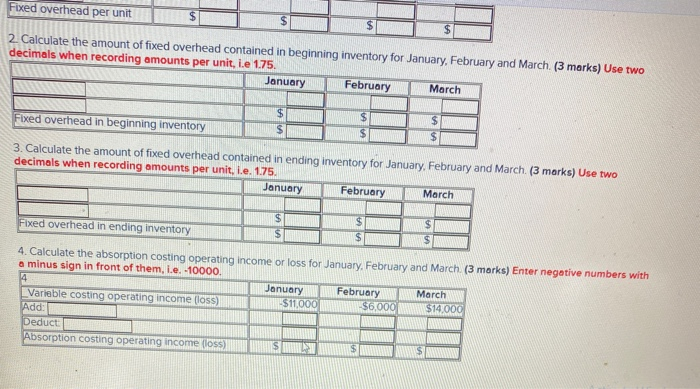

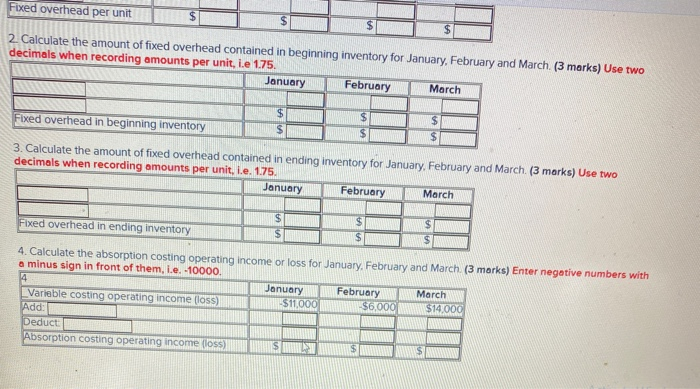

Sunrise Pools and Spas manufactures fibreglass forms for in-ground pools and swim spas for all season use. Data regarding inventory. production and sales in units follows: December January February March Beginning inventory in units 1,000 2,500 7.700 Production in units 10,000 15,000 18.000 12.000 Sales in units 13,500 12,800 17,900 Ending inventory in units 2,500 7,700 1,800 Variable manufacturing costs per unit were $5.00, variable selling expenses per unit were $2.00, and fixed manufacturing overhead was $54,000 per month and has been for the past eight months Required: 1. Calculate the fixed overhead per unit for December January, February and March (1 mark) Use two decimals when recording amounts per unit, i.e. 1.75. December January February March Fixed overhead per unit 2. Calculate the amount of fixed overhead contained in beginning inventory for January, February and March (3 marks) Use two decimals when recording amounts per unit, le 1.75. January March February Fixed overhead in beginning inventory Fixed overhead per unit 2 Calculate the amount of fixed overhead contained in beginning inventory for January, February and March (3 marks) Use two decimals when recording amounts per unit, i.e 1.75. January February March Fixed overhead in beginning inventory 3. Calculate the amount of fixed overhead contained in ending inventory for January, February and March (3 marks) Use two decimals when recording amounts per unit, i.e. 1.75 January February March Fixed overhead in ending inventory inventory S 4. Calculate the absorption costing operating income or loss for January February and March (3 marks) Enter negative numbers with a minus sign in front of them, i.e. -10000. January February Morch Variable costing operating income (IOS) $11,000 $61000 $147000 Add: Deduct Absorption costing operating income (los)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started