Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just at the turn of the New Year of 2017, you have just been appointed as a Portfolio Manager and Strategic Pricing Specialist of large

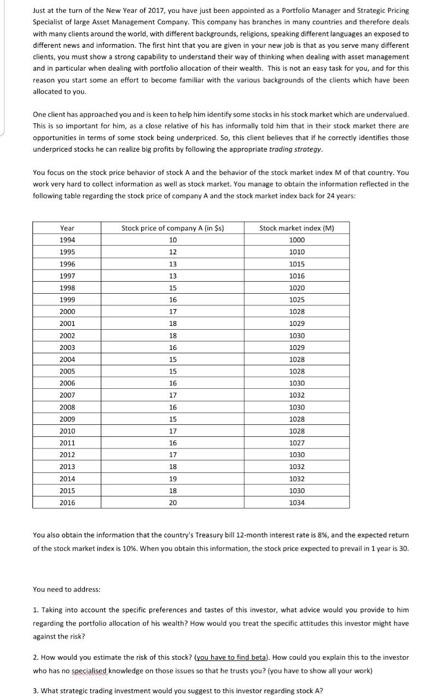

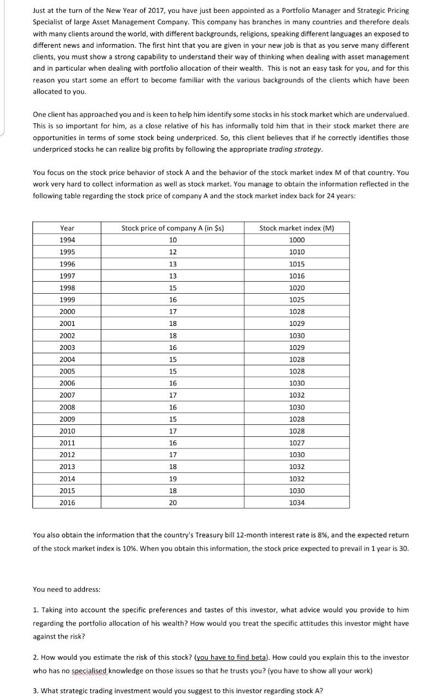

Just at the turn of the New Year of 2017, you have just been appointed as a Portfolio Manager and Strategic Pricing Specialist of large Asset Management Company. This company has branches in many countries and therefore deals with many clients around the world with different backgrounds, religions, speaking different languages an exposed to different news and Information. The first hint that you are given in your new job is that as you serve many different clients, you must show a strong capability to understand their way of thinking when dealing with asset management and in particular when dealing with portfolio allocation of their wealth. This is not an easy task for you, and for this reason you start some an effort to become familiar with the various backgrounds of the clients which have been allocated to you One client has approached you and is keen to help him identify some stocks in his stock market which are undervalued This is so important for him, as a close relative of his has informally told him that in their stock market there are opportunities in terms of some stock being underpriced. So, this client believes that the correctly identifies those underpriced stocks he can realite big profits by following the appropriate trading strotegy You focus on the stock price behavior of stock and the behavior of the stock market index Mof that country. You work very hard to collect information as well as stock market. You manage to obtain the information reflected in the following table regarding the stock price of company and the stock market index back for 24 years Stock price of company Afin $ 10 12 13 15 16 17 Year 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 18 18 16 15 15 16 17 16 15 12 16 Stock market index (M) 1000 2010 1015 2016 2020 1025 1028 1029 1030 1029 1028 1028 1030 1032 1030 1028 1028 1027 1030 1032 1032 1030 1034 17 18 19 18 20 You also obtain the information that the country's Treasury bill 12- month interest rate is 8%, and the expected return of the stock market index is 10%. When you obtain this information, the stock price expected to prevaitin 1 year is 30 You need to address: 1. Taking into account the specific preferences and tastes of this investor, what advice would you provide to him regarding the portfolio allocation of his wealth? How would you treat the specific attitudes this investor might have against the risk? 2. How would you estimate the risk of this stock? (you have to find betal. How could you explain this to the investor who has no specialised knowledge on those issues so that he trusts you? you have to show all your work) 3. What strategic trading investment would you suggest to this investor regarding stock A

Just at the turn of the New Year of 2017, you have just been appointed as a Portfolio Manager and Strategic Pricing Specialist of large Asset Management Company. This company has branches in many countries and therefore deals with many clients around the world with different backgrounds, religions, speaking different languages an exposed to different news and Information. The first hint that you are given in your new job is that as you serve many different clients, you must show a strong capability to understand their way of thinking when dealing with asset management and in particular when dealing with portfolio allocation of their wealth. This is not an easy task for you, and for this reason you start some an effort to become familiar with the various backgrounds of the clients which have been allocated to you One client has approached you and is keen to help him identify some stocks in his stock market which are undervalued This is so important for him, as a close relative of his has informally told him that in their stock market there are opportunities in terms of some stock being underpriced. So, this client believes that the correctly identifies those underpriced stocks he can realite big profits by following the appropriate trading strotegy You focus on the stock price behavior of stock and the behavior of the stock market index Mof that country. You work very hard to collect information as well as stock market. You manage to obtain the information reflected in the following table regarding the stock price of company and the stock market index back for 24 years Stock price of company Afin $ 10 12 13 15 16 17 Year 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 18 18 16 15 15 16 17 16 15 12 16 Stock market index (M) 1000 2010 1015 2016 2020 1025 1028 1029 1030 1029 1028 1028 1030 1032 1030 1028 1028 1027 1030 1032 1032 1030 1034 17 18 19 18 20 You also obtain the information that the country's Treasury bill 12- month interest rate is 8%, and the expected return of the stock market index is 10%. When you obtain this information, the stock price expected to prevaitin 1 year is 30 You need to address: 1. Taking into account the specific preferences and tastes of this investor, what advice would you provide to him regarding the portfolio allocation of his wealth? How would you treat the specific attitudes this investor might have against the risk? 2. How would you estimate the risk of this stock? (you have to find betal. How could you explain this to the investor who has no specialised knowledge on those issues so that he trusts you? you have to show all your work) 3. What strategic trading investment would you suggest to this investor regarding stock A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started