Answered step by step

Verified Expert Solution

Question

1 Approved Answer

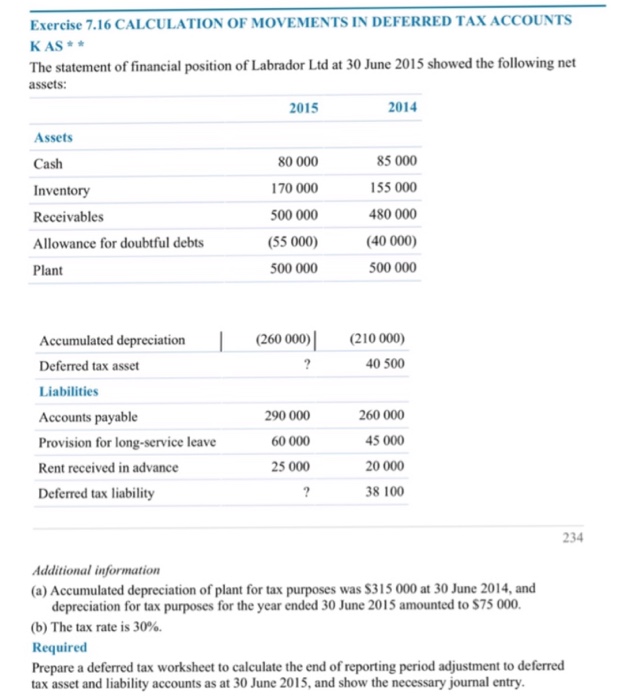

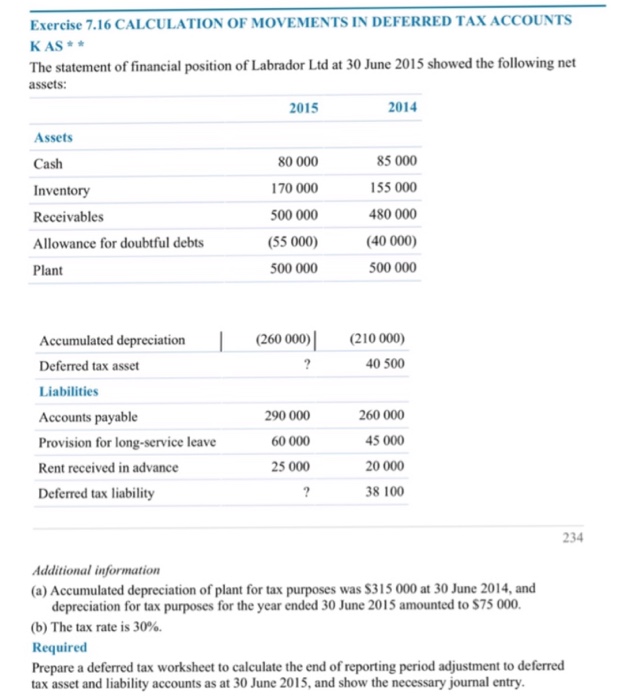

Just for the plant section please. Please write down explaination(eg.why is this amount) and formulas Exercise 7.16 CALCULATION OF MOVEMENTS IN DEFERRED TAXACCOUNTS KAS The

Just for the plant section please.

Exercise 7.16 CALCULATION OF MOVEMENTS IN DEFERRED TAXACCOUNTS KAS The statement of financial position of Labrador Ltd at 30 June 2015 showed the following net assets: 2014 2015 Assets 85 000 80 000 Cash 170 000 155 000 Inventory 500 000 480 000 Receivables (55 000) (40 000) Allowance for doubtful debts 500 000 500 000 Plant Accumulated depreciation l 260 000 210 000) 40500 Deferred tax asset Liabilities 290 000 260 000 Accounts payable 60 000 45000 Provision for long-service leave 25 000 200 000 Rent received in advance 38100 Deferred tax liability Additional information (a) Accumulated depreciation of plant for tax purposes was S315 000 at 30 June 2014, and depreciation for tax purposes for the year ended 30 June 2015 amounted to S75 000. (b) The tax rate is 30%. Required Prepare a deferred tax worksheet to calculate the end ofreporting period adjustment to deferred tax asset and liability accounts as at 30 June 2015, and show the necessary joumal entry Please write down explaination(eg.why is this amount) and formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started