Just help with the Journal Entries please!!

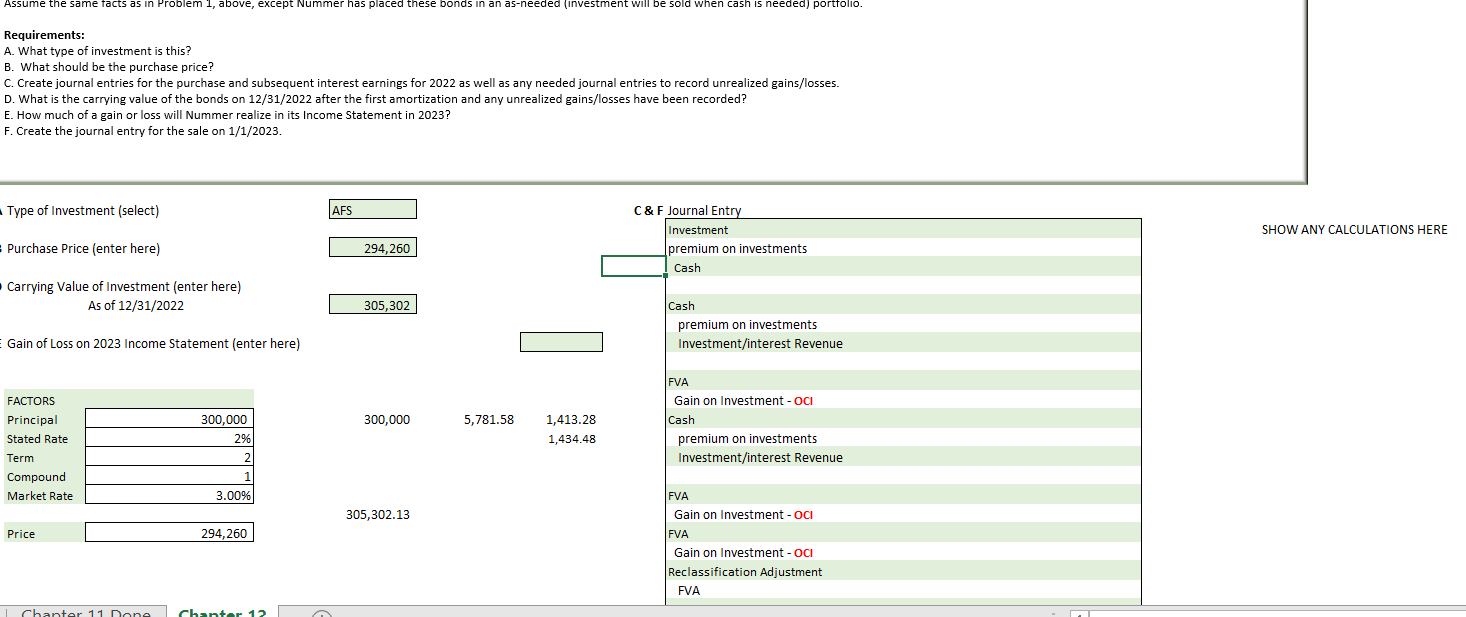

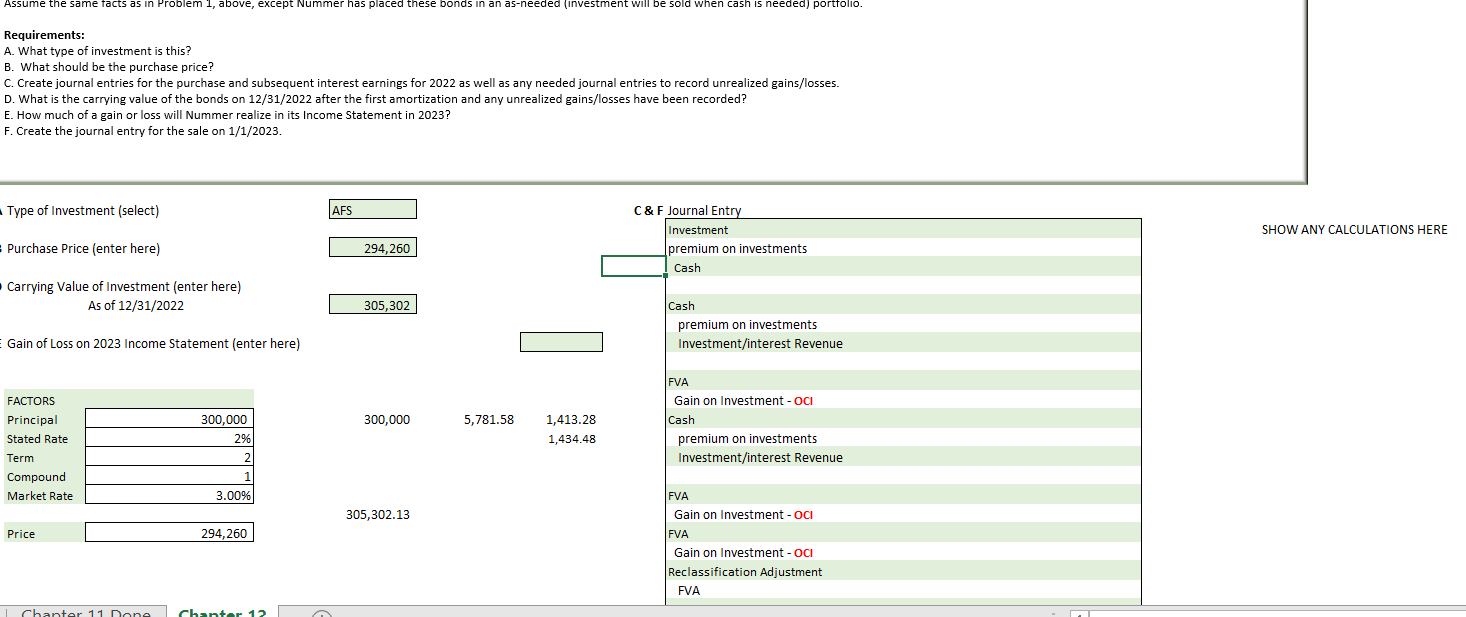

On 1/2/2022 Nummer Corp. purchased 2-year, 2% bonds with a face value of $300,000. On that date, the market rate for similar securities was 3%. Nummer has placed these bonds in an actively-traded portfolio. Subsequent information related to bonds is as follows: On 12/31/2022 the fair value was $298,000 On 1/1/2023 Nummer sold the bonds for $299,000 Assume the same facts as in Problem 1, above, except Nummer has placed these bonds in an as-needed (investment will be sold when cash is needed) portfolio. Requirements: A. What type of investment is this? B. What should be the purchase price? C. Create journal entries for the purchase and subsequent interest earnings for 2022 as well as any needed journal entries to record unrealized gains/losses. D. What is the carrying value of the bonds on 12/31/2022 after the first amortization and any unrealized gains/losses have been recorded? E. How much of a gain or loss will Nummer realize in its Income Statement in 2023? F. Create the journal entry for the sale on 1/1/2023. Type of Investment (select) AFS SHOW ANY CALCULATIONS HERE C&F Journal Entry Investment premium on investments Cash Purchase Price (enter here) 294,260 Carrying Value of Investment (enter here) As of 12/31/2022 305,302 Cash premium on investments Investment/interest Revenue Gain of Loss on 2023 Income Statement (enter here) 300,000 5,781.58 1,413.28 1,434.48 FACTORS Principal Stated Rate Term Compound Market Rate 300,000 2% 2 1 3.00% FVA Gain on Investment - OCI Cash premium on investments Investment/interest Revenue 305,302.13 Price 294,260 FVA Gain on Investment - oci FVA Gain on Investment - OCI Reclassification Adjustment FVA Chanter 11 Done Chanter 12 On 1/2/2022 Nummer Corp. purchased 2-year, 2% bonds with a face value of $300,000. On that date, the market rate for similar securities was 3%. Nummer has placed these bonds in an actively-traded portfolio. Subsequent information related to bonds is as follows: On 12/31/2022 the fair value was $298,000 On 1/1/2023 Nummer sold the bonds for $299,000 Assume the same facts as in Problem 1, above, except Nummer has placed these bonds in an as-needed (investment will be sold when cash is needed) portfolio. Requirements: A. What type of investment is this? B. What should be the purchase price? C. Create journal entries for the purchase and subsequent interest earnings for 2022 as well as any needed journal entries to record unrealized gains/losses. D. What is the carrying value of the bonds on 12/31/2022 after the first amortization and any unrealized gains/losses have been recorded? E. How much of a gain or loss will Nummer realize in its Income Statement in 2023? F. Create the journal entry for the sale on 1/1/2023. Type of Investment (select) AFS SHOW ANY CALCULATIONS HERE C&F Journal Entry Investment premium on investments Cash Purchase Price (enter here) 294,260 Carrying Value of Investment (enter here) As of 12/31/2022 305,302 Cash premium on investments Investment/interest Revenue Gain of Loss on 2023 Income Statement (enter here) 300,000 5,781.58 1,413.28 1,434.48 FACTORS Principal Stated Rate Term Compound Market Rate 300,000 2% 2 1 3.00% FVA Gain on Investment - OCI Cash premium on investments Investment/interest Revenue 305,302.13 Price 294,260 FVA Gain on Investment - oci FVA Gain on Investment - OCI Reclassification Adjustment FVA Chanter 11 Done Chanter 12