Just need be part. What I have on it is right so far. Just may need to add more to b part. How do I get the numbers for it? Thanks

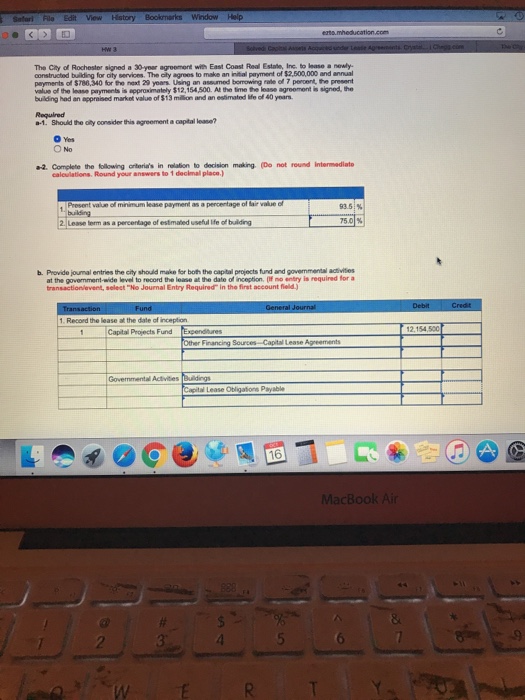

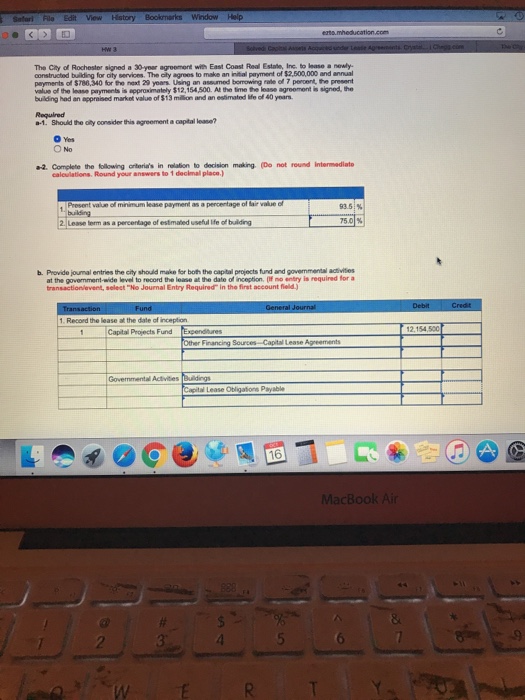

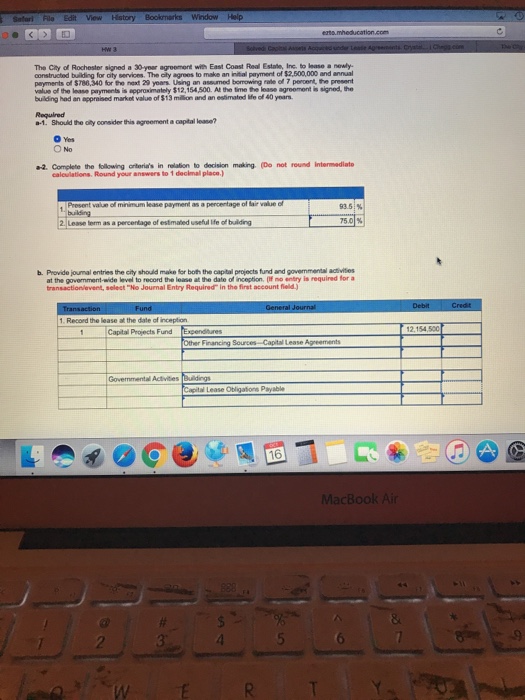

Window Help The Cty of Rochester signed a 30-year agroomont with East Coast Real Estate, Inc. to lease a newly constructed building for oity services. The aily agrees to make an initial pryment of $2,500,000 and annual peyments of $786,340 for the next 29 years. Using an assumed borrowing rate of 7 percent, the present value of the lease payments is approximately $12,154 ,500. A the time the lease agrooment is signed, the building had an appraised market value of $13 million and an estimated ife of 40 yoars Required -1 Should the oity consider this agreement a capital lease? Yes O No a2. Complete the following orteria's in relation to decision making (Do not round Intermediato caloulations. Round your answers to 1 decimal place.) of lair value of 93.51% building 2. Lease term as a percentage of estmated useful Ife of b. Provide jounal entries the city should make for both the capital projects fund and govemmental activities at the govermment-wide level to record the lease at the date of inception, (If no entry is required for a transactionlevent, select "No Jourmal Entry Required in the first account field. 1 Record the lease at the date of inception Capital Projects Fund Expendhures 12,154,500 Sources-Capital Lease Governmental Activities apital Lease Obligations Payable 16 acBook Air 4 WE Window Help The Cty of Rochester signed a 30-year agroomont with East Coast Real Estate, Inc. to lease a newly constructed building for oity services. The aily agrees to make an initial pryment of $2,500,000 and annual peyments of $786,340 for the next 29 years. Using an assumed borrowing rate of 7 percent, the present value of the lease payments is approximately $12,154 ,500. A the time the lease agrooment is signed, the building had an appraised market value of $13 million and an estimated ife of 40 yoars Required -1 Should the oity consider this agreement a capital lease? Yes O No a2. Complete the following orteria's in relation to decision making (Do not round Intermediato caloulations. Round your answers to 1 decimal place.) of lair value of 93.51% building 2. Lease term as a percentage of estmated useful Ife of b. Provide jounal entries the city should make for both the capital projects fund and govemmental activities at the govermment-wide level to record the lease at the date of inception, (If no entry is required for a transactionlevent, select "No Jourmal Entry Required in the first account field. 1 Record the lease at the date of inception Capital Projects Fund Expendhures 12,154,500 Sources-Capital Lease Governmental Activities apital Lease Obligations Payable 16 acBook Air 4 WE