Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need from the selling & administrative part, another person from the site told me that the have the other part. can i also have

just need from the selling & administrative part, another person from the site told me that the have the other part. can i also have the formulas?

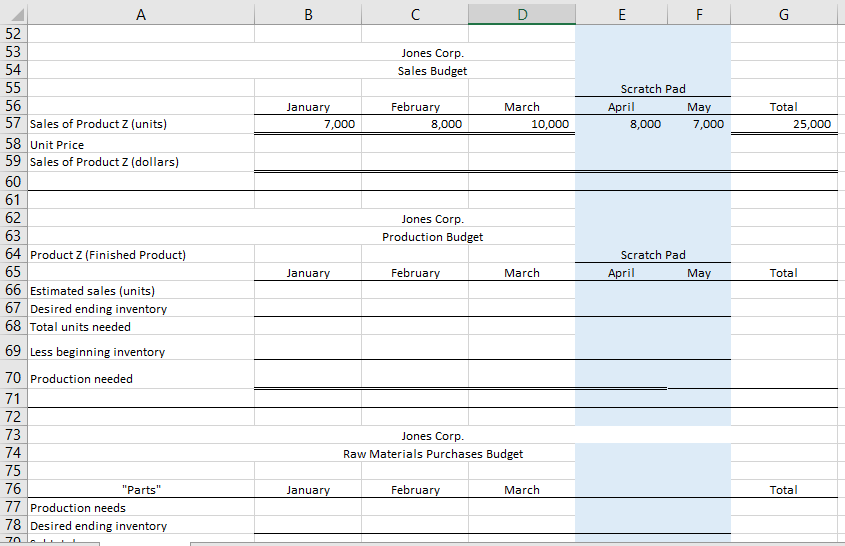

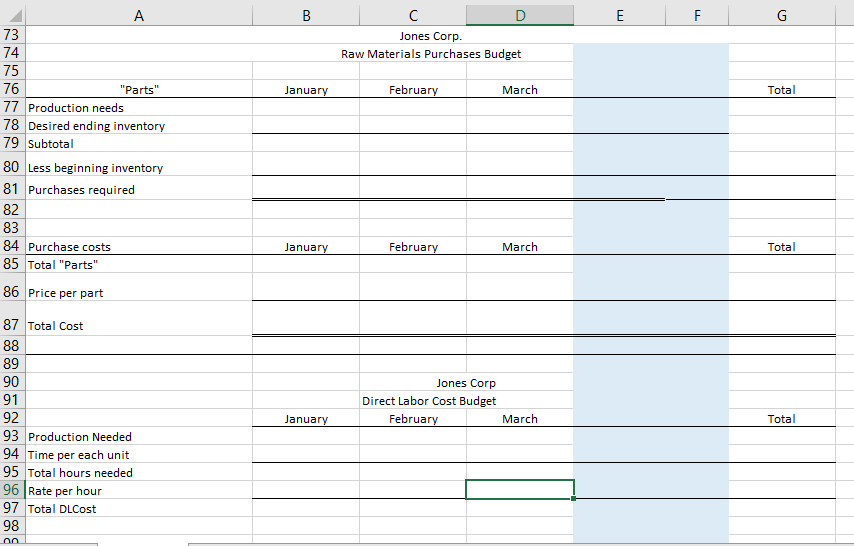

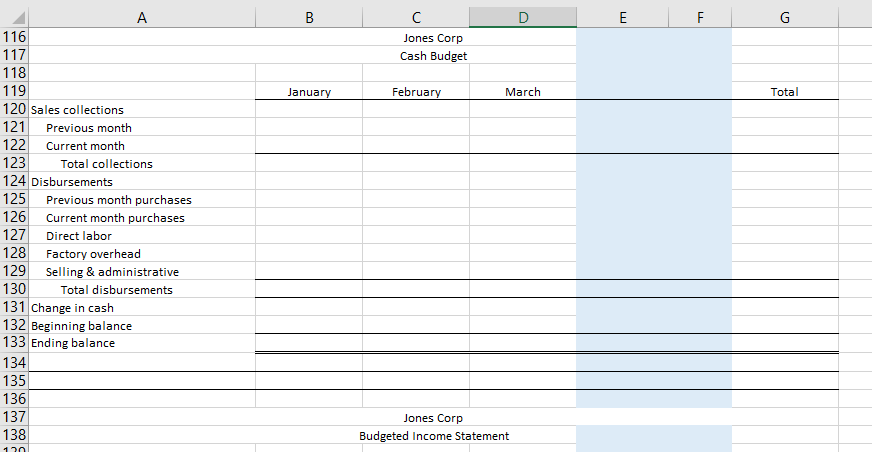

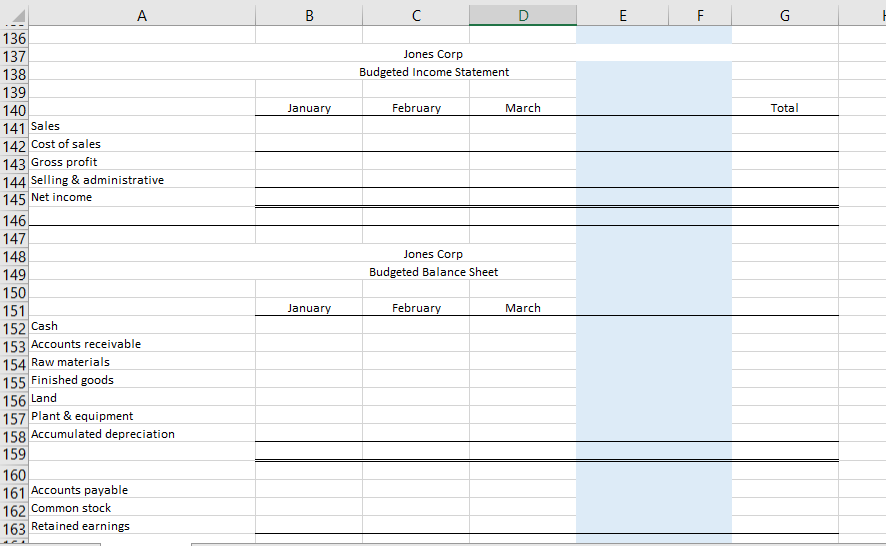

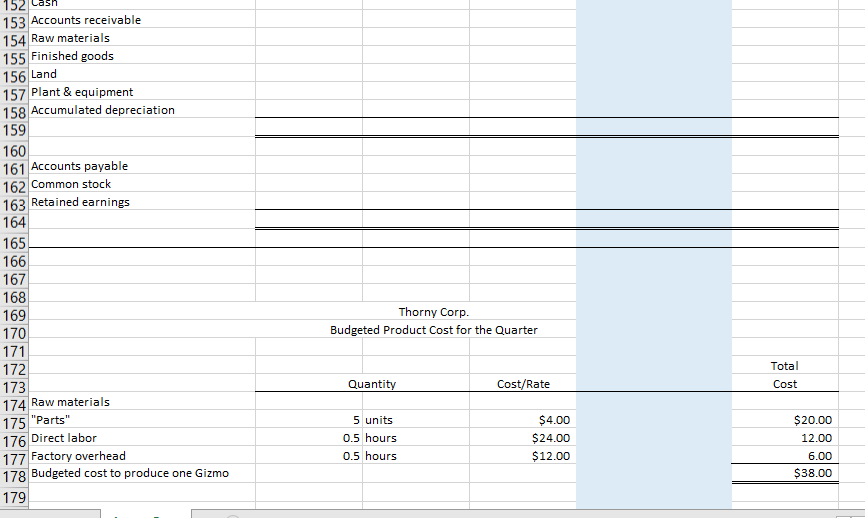

00 E F G D Jones Corp. Balance Sheet, December 31 $41,700 192,000 102,240 64,400 50,000 $500,000 112,000 388,000 $838,340 $40,000 A 1 2 3 4 Cash 5 Accounts receivable 6 Raw materials 7 Finished goods 8 Land 9 Plant and equipment 10 Less: accumulated depreciation 11 Total assets 12 13 Accounts payable to suppliers 14 Common Stock 15 Retained Earnings 16 Total liabilities and equity 17 18 19 Estimated sales of product z 20 January 21 February 22 March 23 April 24 May 25 Selling price 26 Collections from customers 27 Collected in month of sale 28 Collected the following month $100,000 698,340 798,340 $838,340 7,000 8,000 10,000 8,000 7,000 $50 40% 60% D E F 7,000 $50 40% 60% 20% 25% 5 A B 24 May 25 Selling price 26 Collections from customers 27 Collected in month of sale 28 Collected the following month 29 Desired finished goods inventory 30 (% of next month's unit sales) 31 Desired raw material inventory 32 (% of next month's production needs) 33 Raw material units needed to produce one Product Z 34 "Parts" 35 36 B. Inventory units & cost 37 Product Z 38 "Parts" 39 40 Purchases 41 Paid in the month of purchase 42 Paid in the subsequent month 43 44 Direct labor time to produce one Product Z 45 Cost of direct labor 46 Factory overhead 47 48 Selling and administrative expenses 49 50 Plant and equipment depreciation 51 1,400 18,000 $46.00 $4.00 70% 30% 0.5 hours $24 per hour $12 per direct labor hr. $10,000 fixed 10% variable (Sales) $12,000 per year B E G Jones Corp. Sales Budget January 7,000 February 8,000 March 10,000 Scratch Pad April May 8,000 7,000 Total 25,000 Jones Corp. Production Budget 52 53 54 55 56 57 Sales of Product Z (units) 58 Unit Price 59 Sales of Product Z (dollars) 60 61 62 63 64 Product Z (Finished Product) 65 66 Estimated sales (units) 67 Desired ending inventory 68 Total units needed 69 Less beginning inventory 70 Production needed 71 72 73 74 75 76 "Parts" 77 Production needs 78 Desired ending inventory Scratch Pad April May January February March Total Jones Corp Raw Materials Purchases Budget January February March Total B E F G D Jones Corp. Raw Materials Purchases Budget January February March Total 73 74 75 76 "Parts" 77 Production needs 78 Desired ending inventory 79 Subtotal 80 Less beginning inventory 81 Purchases required 82 83 84 Purchase costs 85 Total "Parts" January February March Total 86 Price per part 87 Total Cost 88 89 90 91 Jones Corp Direct Labor Cost Budget February March 92 January Total 93 Production Needed 94 Time per each unit 95 Total hours needed 96 Rate per hour 97 Total DLCost 98 B C E F G 97 Total DLCost 98 99 100 101 102 103 104 Direct Labor Hours 105 Rate per hour 106 Total Factory Overhead 107 Jones Corp Factory Overhead Budget February January March Total 108 Jones Corp S & A Expenses February January March Total 109 110 111 Fixed 112 Variable 113 Total Factory Overhead 114 115 116 117 Jones Corp Cash Budget January February March Total 118 119 120 Sales collections 121 Previous month 122 Current month 123 Total collections B E F G C Jones Corp Cash Budget January February March Total 116 117 118 119 120 Sales collections 121 Previous month 122 Current month 123 Total collections 124 Disbursements 125 Previous month purchases 126 Current month purchases 127 Direct labor 128 Factory overhead 129 Selling & administrative 130 Total disbursements 131 Change in cash 132 Beginning balance 133 Ending balance 134 135 136 137 138 Jones Corp Budgeted Income Statement 120 A B D E F 136 137 138 139 140 Jones Corp Budgeted Income Statement January February March Total 141 Sales 142 Cost of sales 143 Gross profit 144 Selling & administrative 145 Net income 146 147 148 149 150 151 Jones Corp Budgeted Balance Sheet January February March 152 Cash 153 Accounts receivable 154 Raw materials 155 Finished goods 156 Land 157 Plant & equipment 158 Accumulated depreciation 159 160 161 Accounts payable 162 Common stock 163 Retained earnings 153 Accounts receivable 154 Raw materials 155 Finished goods 156 Land 157 Plant & equipment 158 Accumulated depreciation 159 160 161 Accounts payable 162 Common stock 163 Retained earnings 164 165 166 167 168 169 170 171 172 173 174 Raw materials 175 "Parts" 176 Direct labor 177 Factory overhead 178 Budgeted cost to produce one Gizmo 179 Thorny Corp. Budgeted Product Cost for the Quarter Total Cost Quantity Cost/Rate 5 units 0.5 hours 0.5 hours $4.00 $24.00 $12.00 $20.00 12.00 6.00 $38.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started