Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JUST NEED LETTERS F AND G ANSWERED. ALRADY DONE QUESTION A. THANK YOU! f. Suppose that your client prefers to invest in your fund a

JUST NEED LETTERS F AND G ANSWERED. ALRADY DONE QUESTION A.

JUST NEED LETTERS F AND G ANSWERED. ALRADY DONE QUESTION A.

THANK YOU!

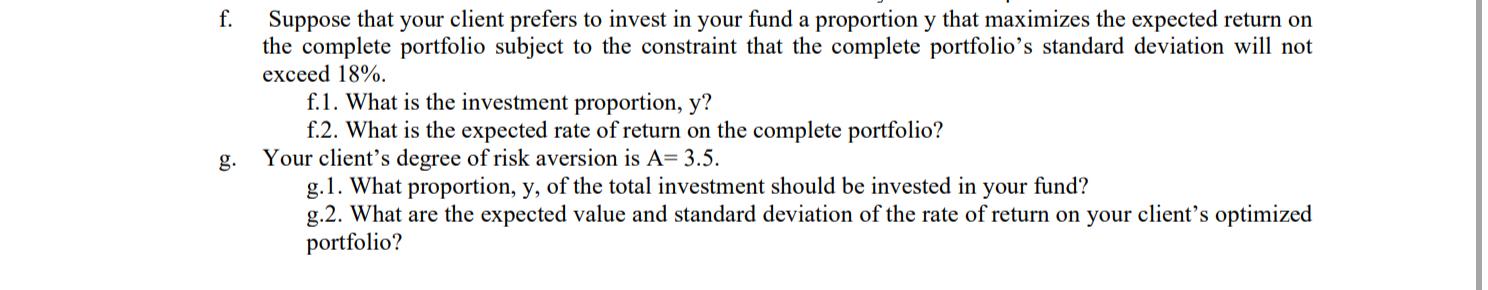

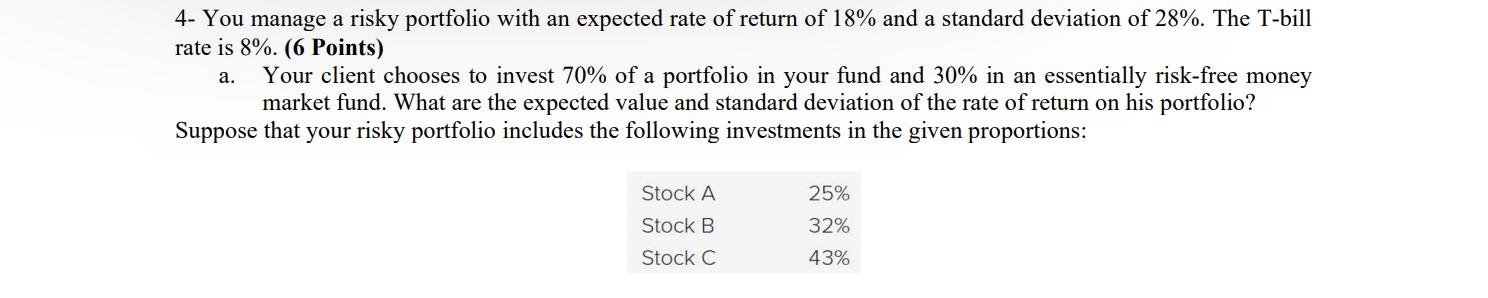

f. Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio's standard deviation will not exceed 18%. f.1. What is the investment proportion, y? f.2. What is the expected rate of return on the complete portfolio? g. Your client's degree of risk aversion is A=3.5. g.1. What proportion, y, of the total investment should be invested in your fund? g.2. What are the expected value and standard deviation of the rate of return on your client's optimized portfolio? 4- You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate is 8%. (6 Points) a. Your client chooses to invest 70% of a portfolio in your fund and 30% in an essentially risk-free money market fund. What are the expected value and standard deviation of the rate of return on his portfolio? Suppose that your risky portfolio includes the following investments in the given proportions: f. Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio's standard deviation will not exceed 18%. f.1. What is the investment proportion, y? f.2. What is the expected rate of return on the complete portfolio? g. Your client's degree of risk aversion is A=3.5. g.1. What proportion, y, of the total investment should be invested in your fund? g.2. What are the expected value and standard deviation of the rate of return on your client's optimized portfolio? 4- You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate is 8%. (6 Points) a. Your client chooses to invest 70% of a portfolio in your fund and 30% in an essentially risk-free money market fund. What are the expected value and standard deviation of the rate of return on his portfolio? Suppose that your risky portfolio includes the following investments in the given proportionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started