just need the numbers PLEASE

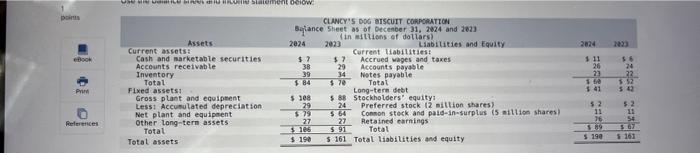

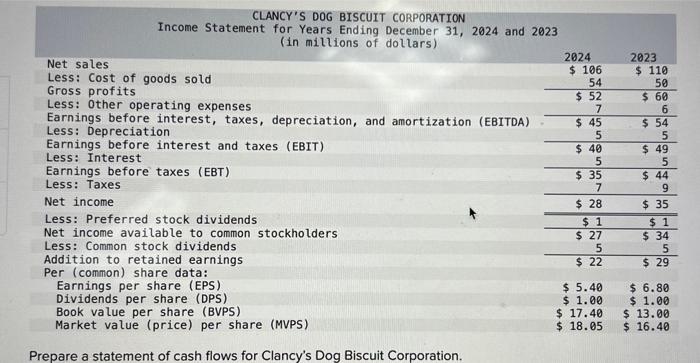

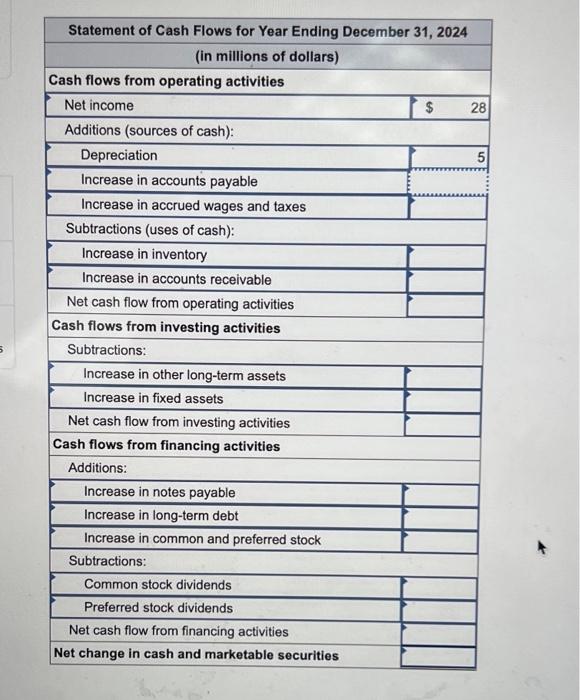

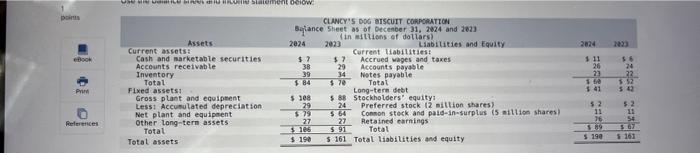

brimpt CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31,2024 and 2023 (in millions of dollars) Net sales Less: Cost of goods sold Gross profits Less: other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) \begin{tabular}{rr} 2024 & 2023 \\ $106 & $110 \\ 54 & 50 \\ \hline$52 & $60 \\ 7 & 6 \\ \hline$45 & $54 \\ 5 & 5 \\ \hline$40 & $49 \\ 5 & 5 \\ \hline$35 & $44 \\ 7 & 9 \\ \hline$28 & $35 \\ \hline$1 & $1 \\ \hline$27 & $34 \\ 5 & 5 \\ \hline$22 & $29 \\ $.40 & $6.80 \\ 1.00 & $1.00 \\ $17.40 & $13.00 \\ $18.05 & $16.40 \\ \hline \end{tabular} Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. \begin{tabular}{|l|l|} \hline Statement of Cash Flows for Year Ending December 31,2024 \\ \hline \multicolumn{1}{|c|}{ (in millions of dollars) } \\ \hline Cash flows from operating activities \\ \hline Net income & \\ \hline Additions (sources of cash): \\ \hline Depreciation & \\ \hline Increase in accounts payable \\ \hline Increase in accrued wages and taxes \\ \hline Subtractions (uses of cash): \\ \hline Increase in inventory & \\ \hline Increase in accounts receivable \\ \hline Net cash flow from operating activities \\ \hline Cash flows from investing activities \\ \hline Subtractions: & \\ \hline Increase in other long-term assets \\ \hline Increase in fixed assets & \\ \hline Net cash flow from investing activities \\ \hline Cash flows from financing activities \\ \hline Additions: \\ \hline Increase in notes payable \\ \hline Increase in long-term debt \\ \hline Increase in common and preferred stock \\ \hline Subtractions: \\ \hline Common stock dividends \\ \hline Preferred stock dividends \\ \hline Net cash flow from financing activities \\ \hline Net change in cash and marketable securities \\ \hline \end{tabular}