Answered step by step

Verified Expert Solution

Question

1 Approved Answer

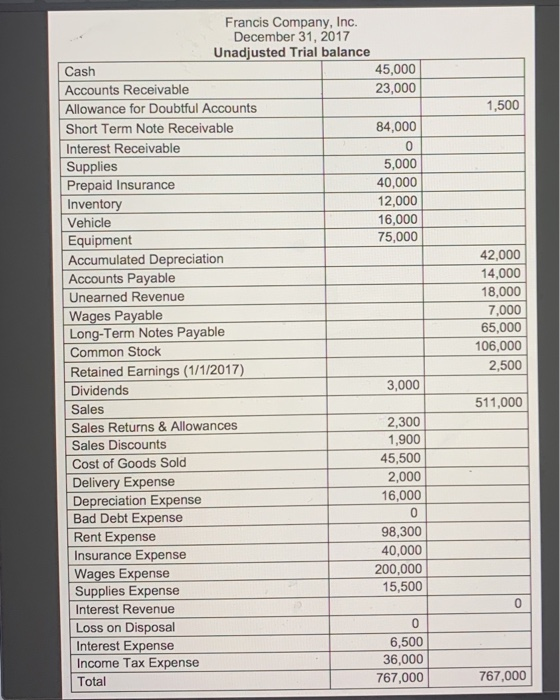

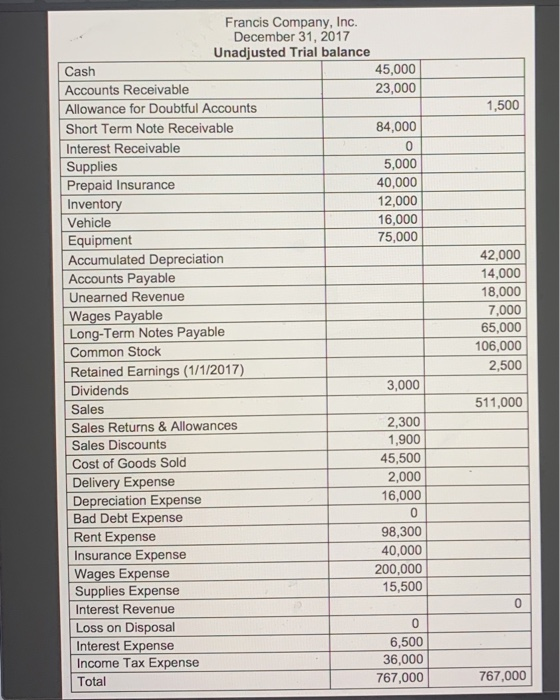

JUST NEED THE T ACCOUNT SECTION, i like to double check my work 1,500 Francis Company, Inc. December 31, 2017 Unadjusted Trial balance Cash 45,000

JUST NEED THE T ACCOUNT SECTION, i like to double check my work

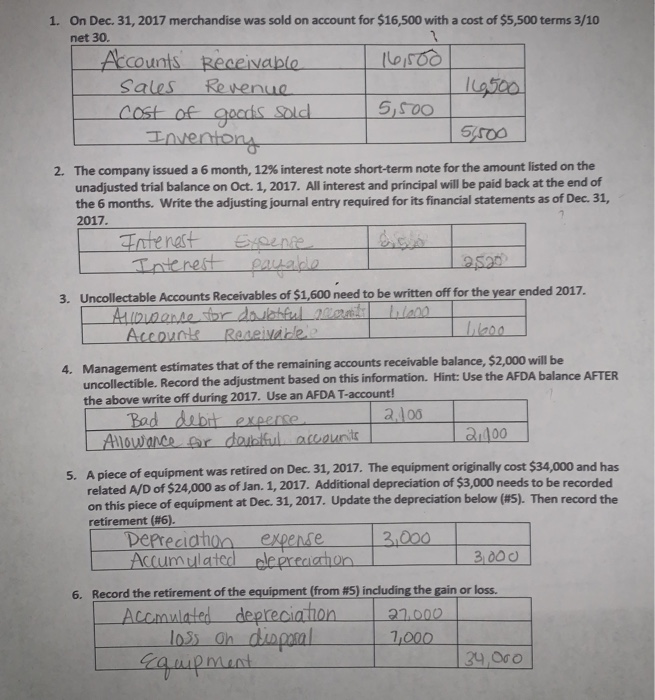

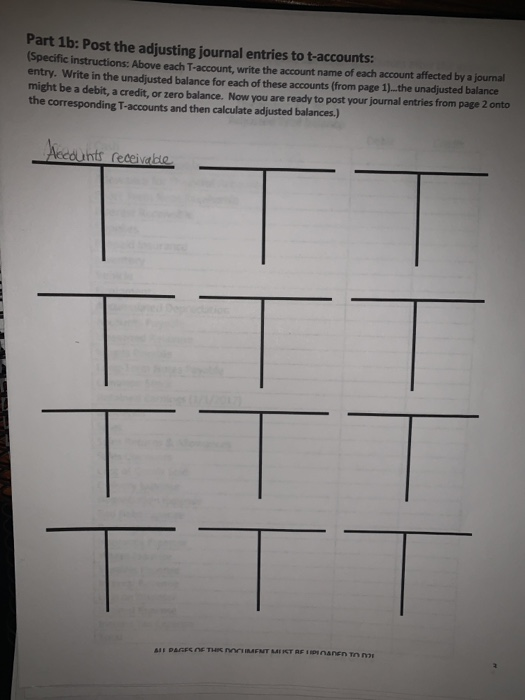

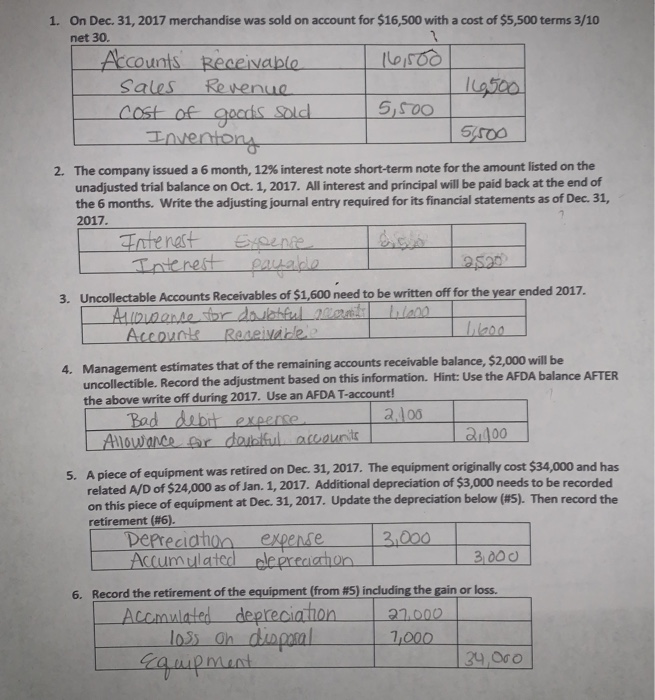

1,500 Francis Company, Inc. December 31, 2017 Unadjusted Trial balance Cash 45,000 Accounts Receivable 23,000 Allowance for Doubtful Accounts Short Term Note Receivable 84,000 Interest Receivable 0 Supplies 5,000 Prepaid Insurance 40,000 Inventory 12,000 Vehicle 16,000 Equipment 75,000 Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2017) Dividends 3,000 Sales Sales Returns & Allowances 2,300 Sales Discounts 1,900 Cost of Goods Sold 45,500 Delivery Expense 2,000 Depreciation Expense 16,000 Bad Debt Expense 0 Rent Expense 98,300 Insurance Expense 40,000 Wages Expense 200,000 Supplies Expense 15,500 Interest Revenue Loss on Disposal 0 Interest Expense 6,500 Income Tax Expense 36,000 Total 767,000 42,000 14,000 18,000 7,000 65,000 106,000 2,500 511,000 0 767,000 1. On Dec 31, 2017 merchandise was sold on account for $16,500 with a cost of $5,500 terms 3/10 net 30. Accounts Receivable sales Revenue 169500 cost of goods sold 5,500 Inventory 5,500 2. The company issued a 6 month, 12% interest note short-term note for the amount listed on the unadjusted trial balance on Oct. 1, 2017. All interest and principal will be paid back at the end of the 6 months. Write the adjusting journal entry required for its financial statements as of Dec. 31, 2017. Interest Expense Interest pauable 2,520 3. Uncollectable Accounts Receivables of $1,600 need to be written off for the year ended 2017. Albuense for doubtful as belono Accounts Receivede 1,600 4. Management estimates that of the remaining accounts receivable balance, $2,000 will be uncollectible. Record the adjustment based on this information. Hint: Use the AFDA balance AFTER the above write off during 2017. Use an AFDA T-account! Bad debit expense a 100 Allowance for doubtful accounts 2.400 5. A piece of equipment was retired on Dec 31, 2017. The equipment originally cost $34,000 and has related A/D of $24,000 as of Jan. 1, 2017. Additional depreciation of $3,000 needs to be recorded on this piece of equipment at Dec 31, 2017. Update the depreciation below (#5). Then record the retirement (#6). Depreciation expense 3.000 Accumulated depreciahon 3000 6. Record the retirement of the equipment (from #5) including the gain or loss. Acamulated depreciation 27.000 1,000 34,000 loss on disparal Equipment Part 1b: Post the adjusting journal entries to t-accounts: (Specific instructions: Above each T-account, write the account name of each account affected by a journal entry. Write in the unadjusted balance for each of these accounts (from page 1)...the unadjusted balance might be a debit, a credit, or zero balance. Now you are ready to post your journal entries from page 2 onto the corresponding T-accounts and then calculate adjusted balances.) Accounts receivable -H T A1 PAGES OF THE PHIRENT MERT RFID AND TO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started