Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***JUST QUESTION 3*** Question 1 ( 25 points): A 10 -year energy project requires an initial capital cost of $2,500,000.00 to purchase machinery and equipment

***JUST QUESTION 3***

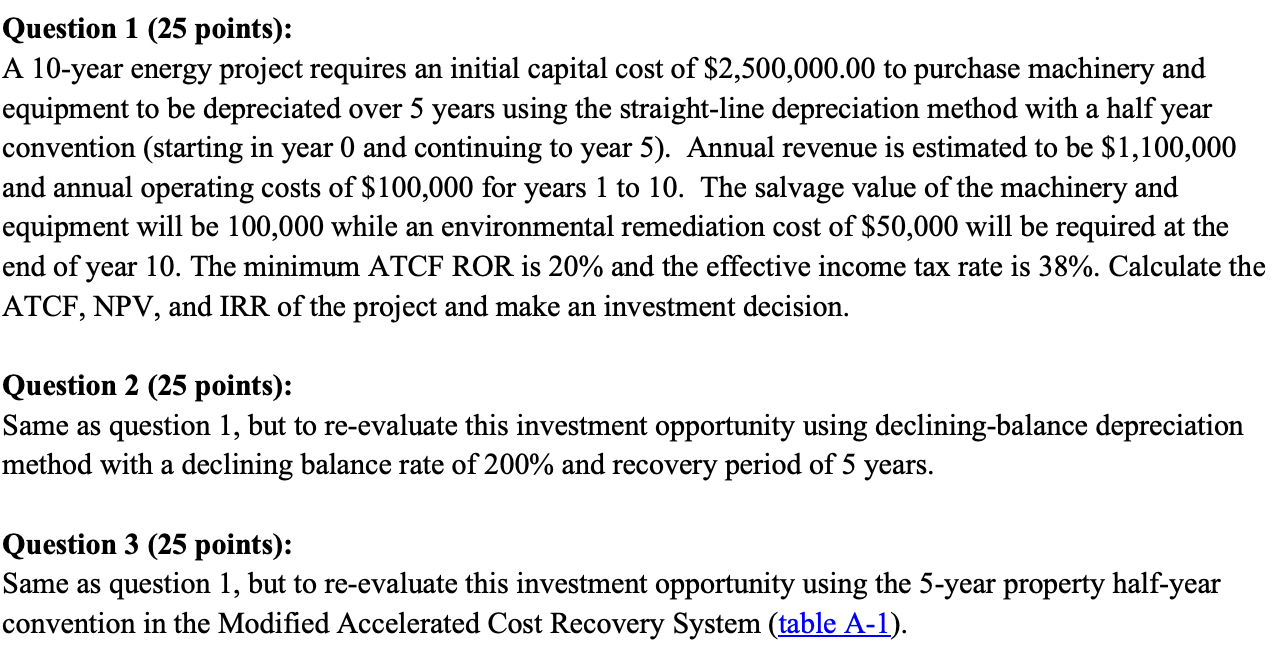

Question 1 ( 25 points): A 10 -year energy project requires an initial capital cost of $2,500,000.00 to purchase machinery and equipment to be depreciated over 5 years using the straight-line depreciation method with a half year convention (starting in year 0 and continuing to year 5). Annual revenue is estimated to be $1,100,000 and annual operating costs of $100,000 for years 1 to 10 . The salvage value of the machinery and equipment will be 100,000 while an environmental remediation cost of $50,000 will be required at the end of year 10 . The minimum ATCF ROR is 20% and the effective income tax rate is 38%. Calculate the ATCF, NPV, and IRR of the project and make an investment decision. Question 2 (25 points): Same as question 1, but to re-evaluate this investment opportunity using declining-balance depreciation method with a declining balance rate of 200% and recovery period of 5 years. Question 3 (25 points): Same as question 1, but to re-evaluate this investment opportunity using the 5-year property half-year convention in the Modified Accelerated Cost Recovery System (table A-1). Question 1 ( 25 points): A 10 -year energy project requires an initial capital cost of $2,500,000.00 to purchase machinery and equipment to be depreciated over 5 years using the straight-line depreciation method with a half year convention (starting in year 0 and continuing to year 5). Annual revenue is estimated to be $1,100,000 and annual operating costs of $100,000 for years 1 to 10 . The salvage value of the machinery and equipment will be 100,000 while an environmental remediation cost of $50,000 will be required at the end of year 10 . The minimum ATCF ROR is 20% and the effective income tax rate is 38%. Calculate the ATCF, NPV, and IRR of the project and make an investment decision. Question 2 (25 points): Same as question 1, but to re-evaluate this investment opportunity using declining-balance depreciation method with a declining balance rate of 200% and recovery period of 5 years. Question 3 (25 points): Same as question 1, but to re-evaluate this investment opportunity using the 5-year property half-year convention in the Modified Accelerated Cost Recovery System (table A-1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started