Answered step by step

Verified Expert Solution

Question

1 Approved Answer

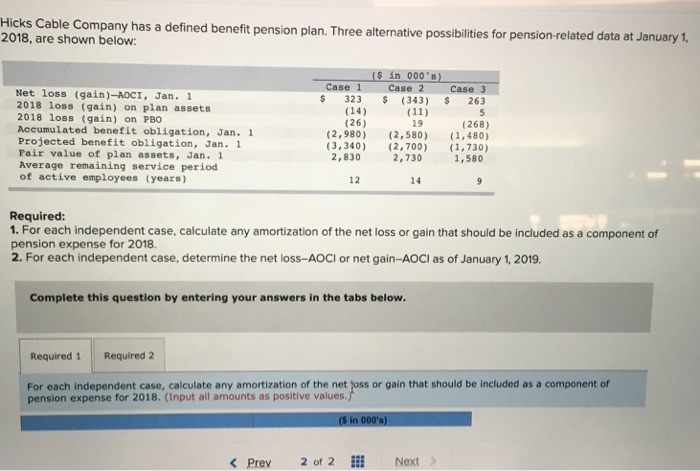

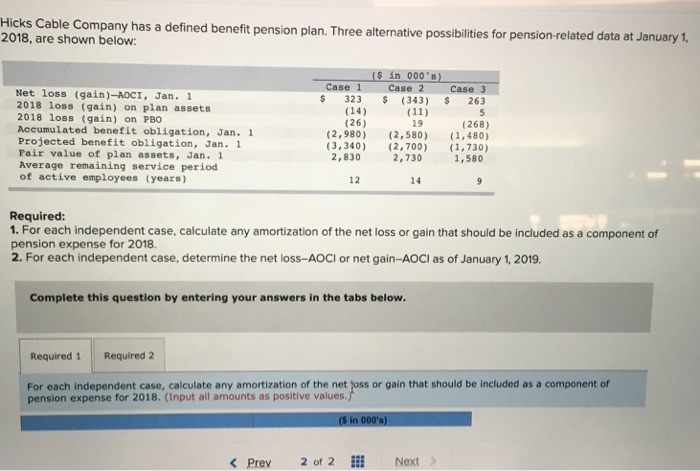

just the answer pls Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for 2018, are shown below: pension-related data at January

just the answer pls

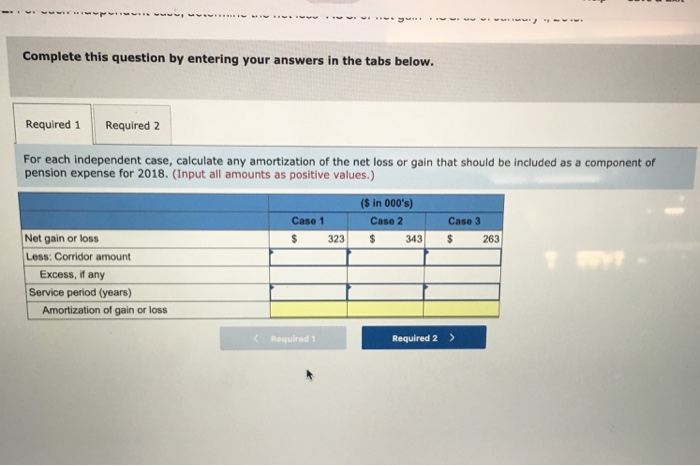

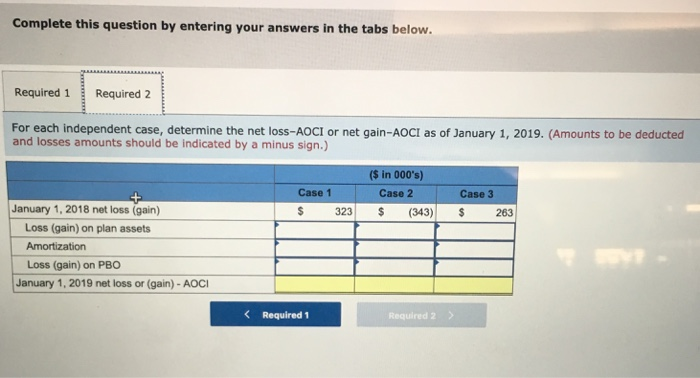

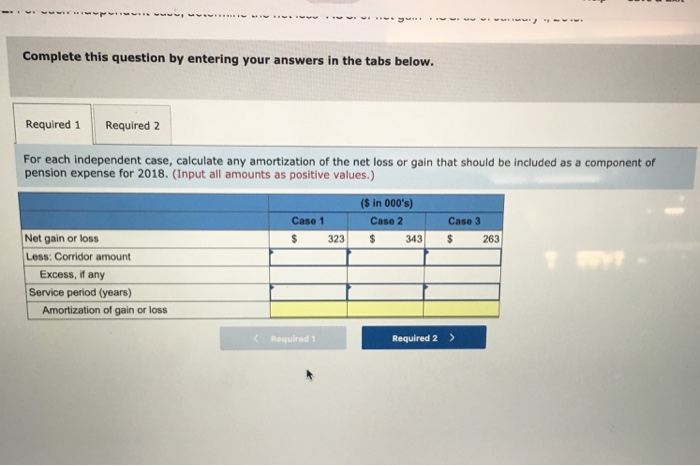

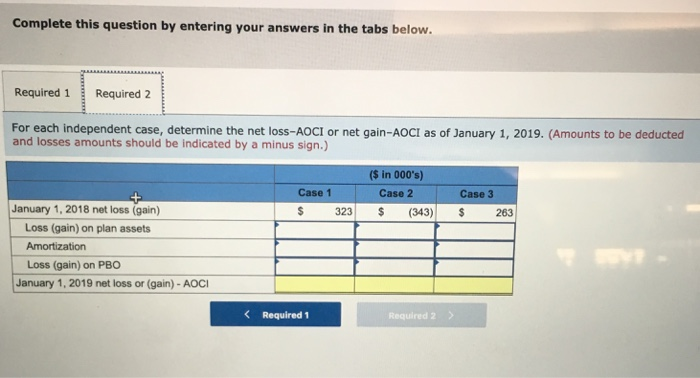

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for 2018, are shown below: pension-related data at January 1, Case 1 Case 2 Case 3 $ 323 (343) 263 Net loss (gain)-AOCI, Jan. 1 2018 loss (gain) on plan assets 2018 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) (14) (26) (268) 19 (2,980) (2,580) (1,480) (3,340)(2,700) (1,730) 2,730 1,580 2,830 12 14 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2018 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2019 Complete this question by entering your answers in the tabs below Required 1 Required 2 For each independent case, calculate any amortization of the net joss or gain that should be included as a component of pension expense for 2018. (Input all amounts as positive values. Prev 2 of 2 Next Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2018. (Input all amounts as positive values.) ($ in 000's) Case 2 Case 1 Case 3 Net gain or loss 323$ 343263 Less: Corridor amount Excess, if any Service period (years) Amortization of gain or loss Required 1 Required 2> Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2019. (Amounts to be deducted and losses amounts should be indicated by a minus sign.) ($ in 000's) Case 2 Case 1 Case 3 January 1, 2018 net loss (gain) S323(343) $ 263 Loss (gain) on plan assets Amortization Loss (gain) on PBO January 1, 2019 net loss or (gain)-AOCI Required 1 Required 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started