Just the income statement part. Thank you!

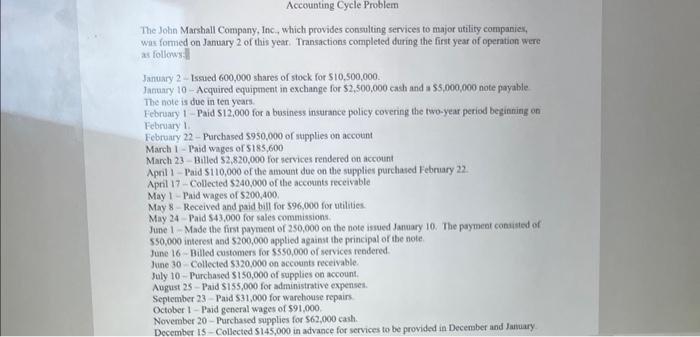

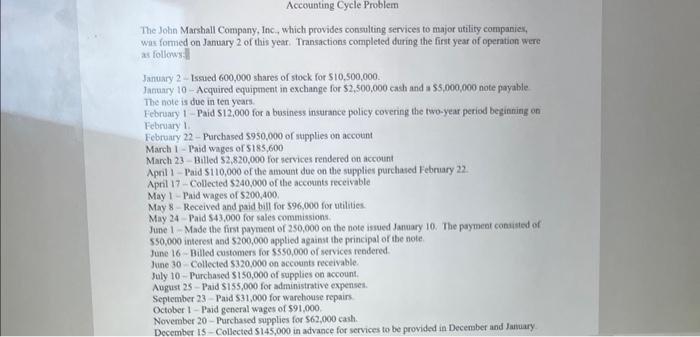

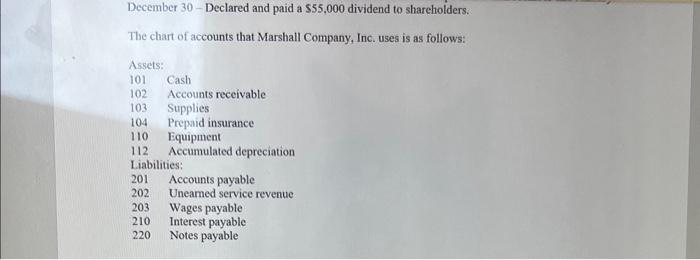

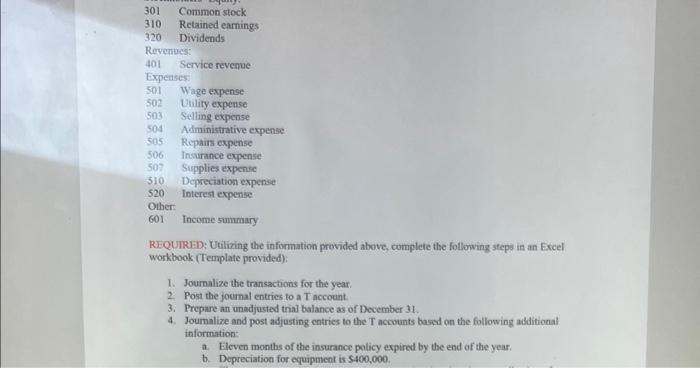

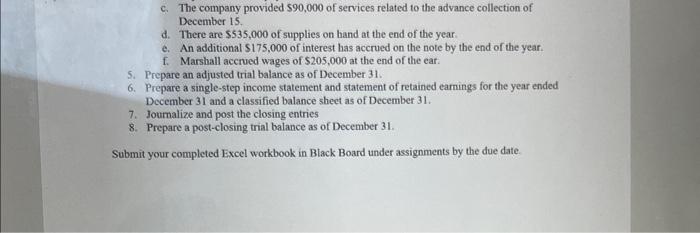

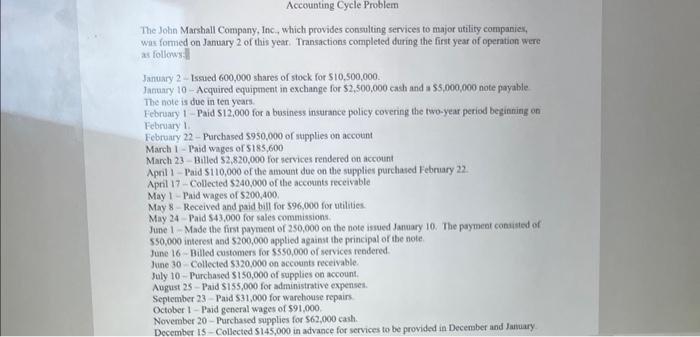

The John Marshall Company, Inc, which provides consulting services to major utility companics, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: January 2 - Isaued 600,000 shares of stock for $10,500,000. lanuary 10 - Acquired equipment in exchange for 52,500,000 cash and a 55,000,000 note payable The note is doe in ten years. Febriary 1-Paid $12,000 for a business insurance policy covering the two-year period beginning on February 1 February 22 - Purchased 5950.000 of stupplies on account March 1 - Raid wages of 5185,600 March 23 - Bitled 52,820,000 for services rendered on account April 1 - Paid $110,000 of the amount due on the supplies purchased February 22. Apnil 17 - Collected $240,000 of the accounts receivable May 1 - Paid wages of 5200,400 . May 8 - Received and paid bill for 596,000 for utitilies. May 24 - Paid 543,000 for rales commissions: June 1 - Made the first payment of 250,000 on the note issued Jamary 10. The payment conusied of 550,000 interest and 5200,000 apptied against the principal of the note. June 16 - Billed customers for $550,000 of services rendered. June 30 - Collected $320,000 on accounts receivable. fuly 10 - Purchased $150,000 of supplies on account. Avgust 25 - Paid $155,000 for administrative expenses. September 23 - Paid $31,000 for warehouse repairs. October 1 - Paid general wages of $91,000. November 20 - Purchased supplies for 562,000 cash. December IS - Collected 5145,000 in advance for services to be provided in December and Jamary. December 30 - Declared and paid a $55,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows: Assets: 1011021031041101121iabilities:201202203210220CashAccountsreceivableSuppliesPrepaidinsuranceEquipmentAccumulateddepreciationAccountspayableUneamedservicerevenueWagespayableInterestpayableNotespayable REQUTRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the joumal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31 . 4. Joumalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance poticy expired by the end of the year. b. Depreciation for equipment is $400,000. c. The company provided $90,000 of services related to the advance collection of December 15. d. There are $535,000 of supplies on hand at the end of the year. e. An additional $175,000 of interest has accrued on the note by the end of the year. f. Marshall accrued wages of $205,000 at the end of the ear. 5. Prepare an adjusted trial balance as of December 31 . 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . 7. Joumalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31 . Submit your completed Excel workbook in Black Board under assignments by the due date