Question

Justine Company budgeted total variable overhead costs at P180,000 for the current period. In addition, they budgeted costs for factory rent at P215,000, costs

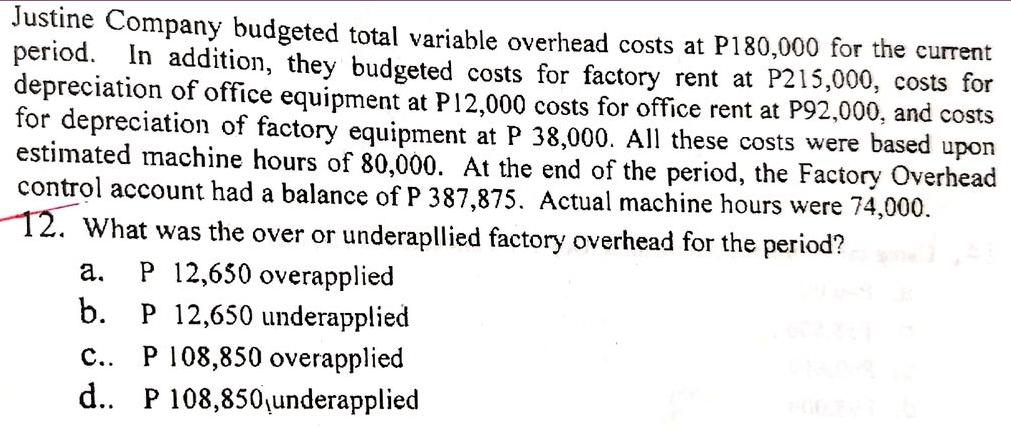

Justine Company budgeted total variable overhead costs at P180,000 for the current period. In addition, they budgeted costs for factory rent at P215,000, costs for depreciation of office equipment at P12,000 costs for office rent at P92,000, and costs for depreciation of factory equipment at P 38,000. All these costs were based upon estimated machine hours of 80,000. At the end of the period, the Factory Overhead control account had a balance of P 387,875. Actual machine hours were 74,000. 12. What was the over or underapllied factory overhead for the period? b. a. P 12,650 overapplied P 12,650 underapplied C.. P 108,850 overapplied d.. P 108,850 underapplied

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

c P 108850 overapplied Explanation The amount of over or und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan Wolcott, Liang Hsuan Chen, Gail Cook

2nd Canadian Edition

1118168879, 9781118168875

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App