Question

Other information: Intercompany sales: On January 1, Year 10: Salt had on hand $30,000 of inventory purchased from Pillar. Pillar had on hand $90,000 of

Other information:

- Intercompany sales: On January 1, Year 10:

Salt had on hand $30,000 of inventory purchased from Pillar. Pillar had on hand $90,000 of inventory purchased from Salt.

Both companies use a gross profit of 40% of sales.

During Year 10, Pillar sold $90,000 of goods to Salt.

On December 31, Year 10, 40% of the goods were unsold.

During 2010 Salt sold $720,000 of goods to Pillar. On Dec. 31, Year 10, 20% were unsold. Both companies have a gross profit on sales of 40%. There were no other intercompany sales.

2. During Year 6, Pillar sold land to Salt at a profit of $60,000. Salt still owns the land.

Required:

A. Prepare all the calculations required to prepare consolidated financial statements.

- Calculate the acquisition differential, goodwill, and NCI, and prepare the ADA table

- Calculate unrealized inventory profits before and after tax

- Calculate consolidated net income and the NCI share.

- Calculate consolidated retained earnings and NCI Balance Sheet.

Calculations above are required .

B. Prepare a consolidated income statement for Year 10 that includes a section below net income attributing income to shareholders of Pillar and NCI shareholders. Prepare a consolidated balance sheet for Year 10. Prepare statements in good form.

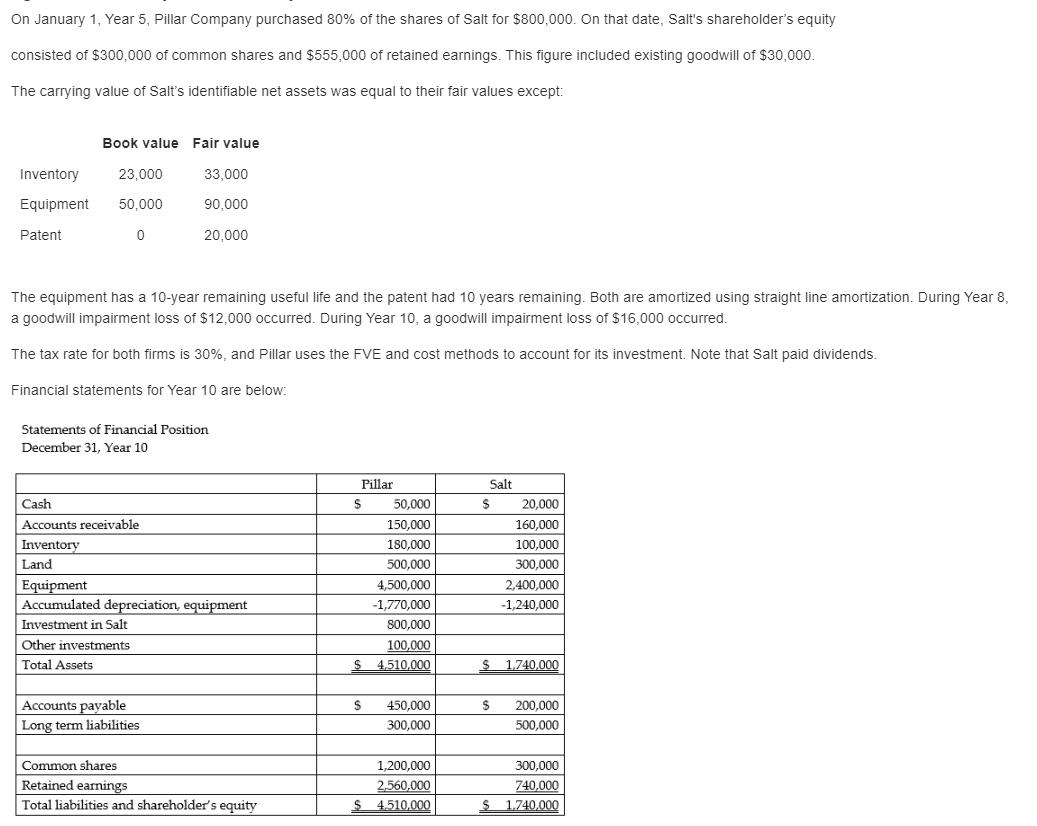

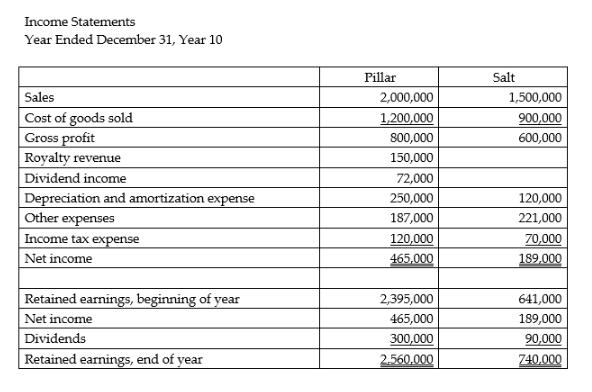

On January 1, Year 5, Pillar Company purchased 80% of the shares of Salt for $800,000. On that date, Salt's shareholder's equity consisted of $300,000 of common shares and $555,000 of retained earnings. This figure included existing goodwill of $30,000. The carrying value of Salt's identifiable net assets was equal to their fair values except: Book value Fair value 33,000 90,000 Inventory 23,000 Equipment 50,000 0 Patent The equipment has a 10-year remaining useful life and the patent had 10 years remaining. Both are amortized using straight line amortization. During Year 8, a goodwill impairment loss of $12,000 occurred. During Year 10, a goodwill impairment loss of $16,000 occurred. The tax rate for both firms is 30%, and Pillar uses the FVE and cost methods to account for its investment. Note that Salt paid dividends. Financial statements for Year 10 are below: Statements of Financial Position December 31, Year 10 Cash Accounts receivable Inventory Land 20,000 Equipment Accumulated depreciation, equipment Investment in Salt Other investments Total Assets Accounts payable Long term liabilities Common shares Retained earnings Total liabilities and shareholder's equity Pillar $ 50,000 150,000 180,000 500,000 4,500,000 -1,770,000 800,000 100,000 $ 4,510,000 $ 450,000 300,000 1,200,000 2,560.000 $ 4.510,000 Salt $ 20,000 160,000 100,000 300,000 2,400,000 -1,240,000 $ 1,740,000 $ 200,000 500,000 300,000 740,000 $ 1.740.000

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A Calculations for Consolidated Financial Statements 1 Calculate the Acquisition Differential Goodwill and NonControlling Interest NCI Purchase Price 800000 Fair Value of Identifiable Net Assets Sum o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started