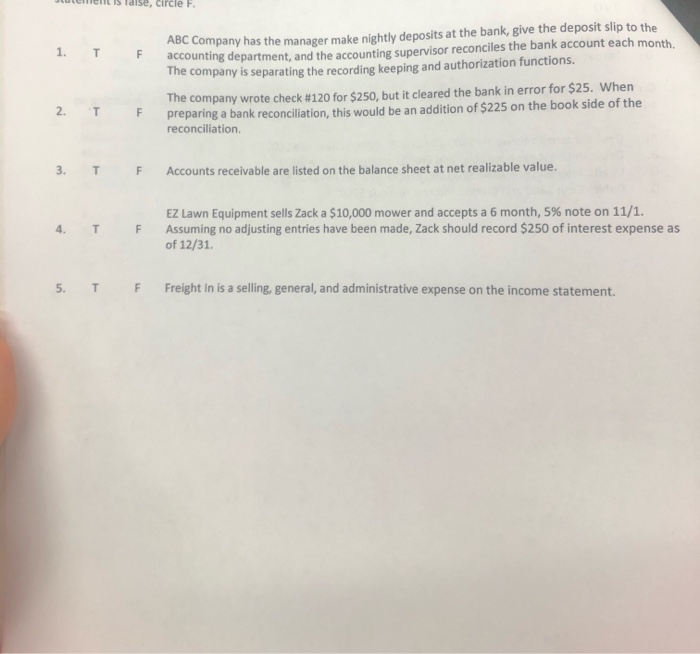

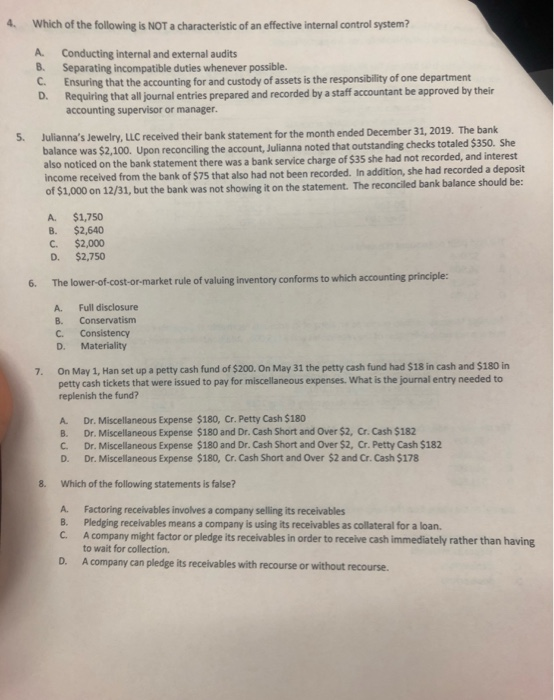

Juteen is ldise, Circle F. 1. TF company has the manager make nightly deposits at the bank, give the deposit slip to the accounting department, and the accounting supervisor reconciles the bank account each month. The company is separating the recording keeping and authorization functions. 2. TF The company wrote check #120 for $250, but it cleared the bank in error for $25. When preparing a bank reconciliation, this would be an addition of $225 on the book side of the reconciliation 3. T F Accounts receivable are listed on the balance sheet at net realizable value. 4. T F EZ Lawn Equipment sells Zack a $10,000 mower and accepts a 6 month, 5% note on 11/1. Assuming no adjusting entries have been made, Zack should record $250 of interest expense as of 12/31. 5. T F Freight in is a selling, general, and administrative expense on the income statement. 4. Which of the following is NOT a characteristic of an effective internal control system? A C. Conducting internal and external audits Separating incompatible duties whenever possible. Ensuring that the accounting for and custody of assets is the responsibility of one department Requiring that all journal entries prepared and recorded by a staff accountant be approved by their accounting supervisor or manager. Julianna's Jewelry, LLC received their bank statement for the month ended December 31, 2019. The bank balance was $2,100. Upon reconciling the account, Julianna noted that outstanding checks totaled $350. She also noticed on the bank statement there was a bank service charge of $35 she had not recorded, and interest income received from the bank of $75 that also had not been recorded. In addition, she had recorded a deposit of $1,000 on 12/31, but the bank was not showing it on the statement. The reconciled bank balance should be: A B. C. D. $1,750 $2,640 $2,000 $2,750 6. The lower-of-cost-or-market rule of valuing inventory conforms to which accounting principle: A Full disclosure Conservatism Consistency Materiality C. D. On May 1, Han set up a petty cash fund of $200. On May 31 the petty cash fund had $18 in cash and $180 in petty cash tickets that were issued to pay for miscellaneous expenses. What is the journal entry needed to replenish the fund? A B. c. D. Dr. Miscellaneous Expense $180, Cr. Petty Cash $180 Dr. Miscellaneous Expense $180 and Dr. Cash Short and Over $2. Cr. Cash $182 Dr. Miscellaneous Expense $180 and Dr. Cash Short and Over $2. Or. Petty Cash $182 Dr. Miscellaneous Expense $180, Cr. Cash Short and Over $2 and Cr. Cash $178 8. Which of the following statements is false? A B. C A Factoring receivables involves a company selling its receivables Pledging receivables means a company is using its receivables as collateral for a loan. company might factor or pledge its receivables in order to receive cash immediately rather than having to wait for collection A company can pledge its receivables with recourse or without recourse. D