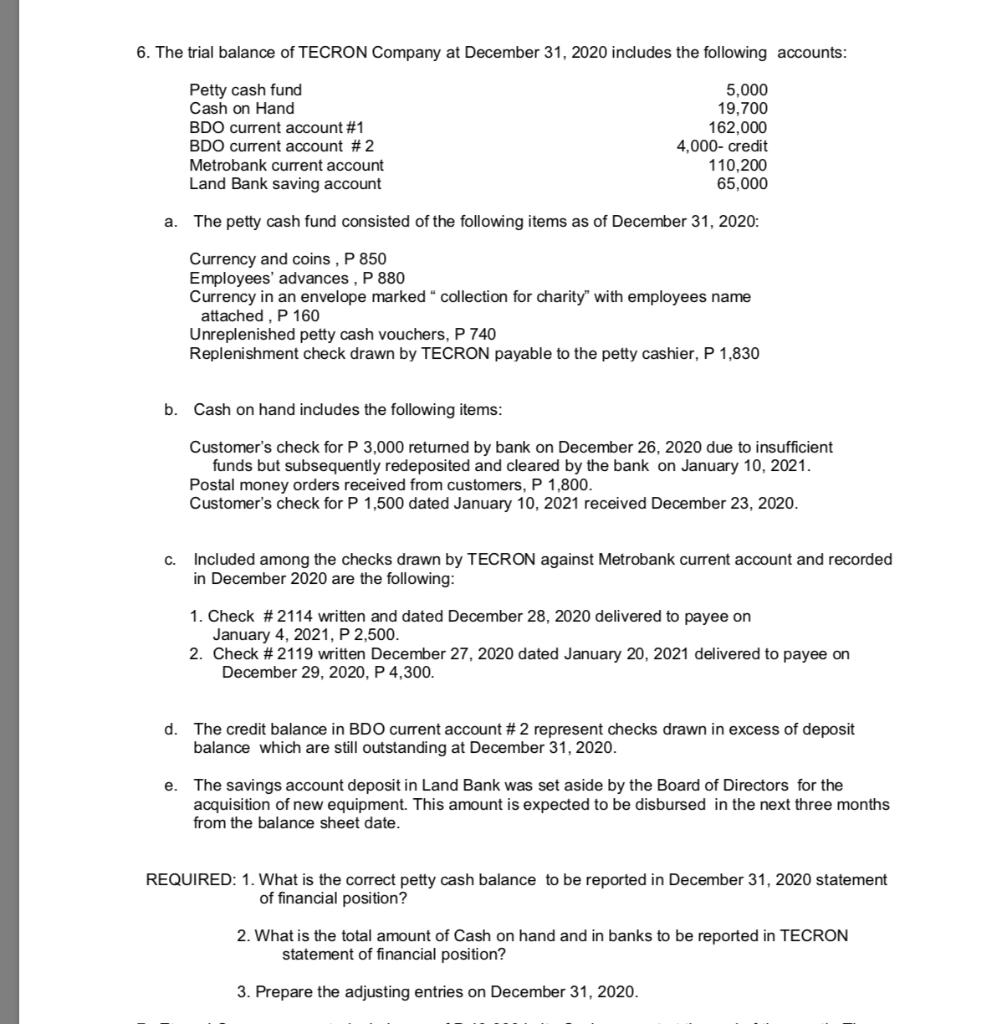

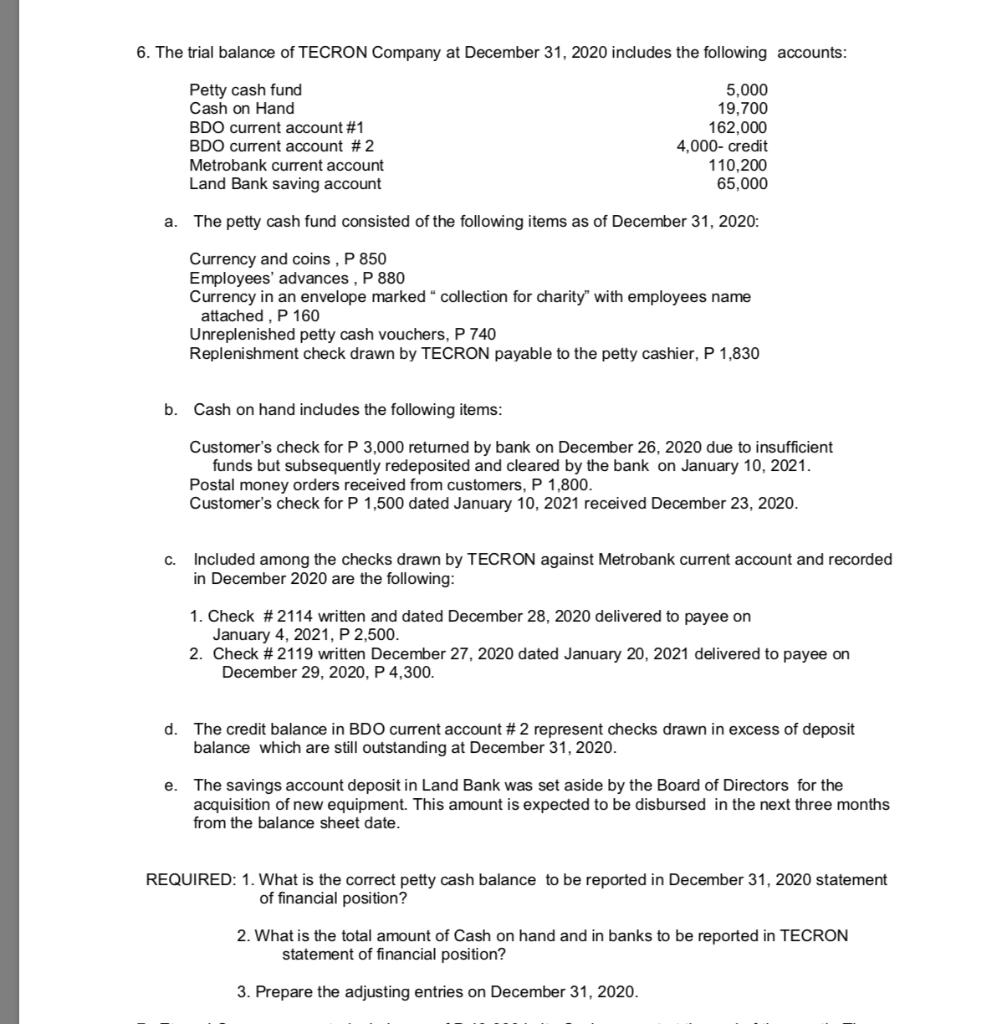

6. The trial balance of TECRON Company at December 31, 2020 includes the following accounts: Petty cash fund Cash on Hand BDO current account #1 BDO current account #2 Metrobank current account Land Bank saving account 5,000 19,700 162.000 4,000-credit 110,200 65,000 a. The petty cash fund consisted of the following items as of December 31, 2020: Currency and coins , P 850 Employees' advances , P 880 Currency in an envelope marked " collection for charity with employees name attached , P 160 Unreplenished petty cash vouchers, P 740 Replenishment check drawn by TECRON payable to the petty cashier, P 1,830 b. Cash on hand includes the following items: Customer's check for P 3,000 returned by bank on December 26, 2020 due to insufficient funds but subsequently redeposited and cleared by the bank on January 10, 2021. Postal money orders received from customers, P 1,800. Customer's check for P 1,500 dated January 10, 2021 received December 23, 2020. C. Included among the checks drawn by TECRON against Metrobank current account and recorded in December 2020 are the following: 1. Check #2114 written and dated December 28, 2020 delivered to payee on January 4, 2021, P2,500. 2. Check # 2119 written December 27, 2020 dated January 20, 2021 delivered to payee on December 29, 2020, P 4,300. d. The credit balance in BDO current account # 2 represent checks drawn in excess of deposit balance which are still outstanding at December 31, 2020. e. The savings account deposit in Land Bank was set aside by the Board of Directors for the acquisition of new equipment. This amount is expected to be disbursed in the next three months from the balance sheet date. REQUIRED: 1. What is the correct petty cash balance to be reported in December 31, 2020 statement of financial position? 2. What is the total amount of Cash on hand and in banks to be reported in TECRON statement of financial position? 3. Prepare the adjusting entries on December 31, 2020. 6. The trial balance of TECRON Company at December 31, 2020 includes the following accounts: Petty cash fund Cash on Hand BDO current account #1 BDO current account #2 Metrobank current account Land Bank saving account 5,000 19,700 162.000 4,000-credit 110,200 65,000 a. The petty cash fund consisted of the following items as of December 31, 2020: Currency and coins , P 850 Employees' advances , P 880 Currency in an envelope marked " collection for charity with employees name attached , P 160 Unreplenished petty cash vouchers, P 740 Replenishment check drawn by TECRON payable to the petty cashier, P 1,830 b. Cash on hand includes the following items: Customer's check for P 3,000 returned by bank on December 26, 2020 due to insufficient funds but subsequently redeposited and cleared by the bank on January 10, 2021. Postal money orders received from customers, P 1,800. Customer's check for P 1,500 dated January 10, 2021 received December 23, 2020. C. Included among the checks drawn by TECRON against Metrobank current account and recorded in December 2020 are the following: 1. Check #2114 written and dated December 28, 2020 delivered to payee on January 4, 2021, P2,500. 2. Check # 2119 written December 27, 2020 dated January 20, 2021 delivered to payee on December 29, 2020, P 4,300. d. The credit balance in BDO current account # 2 represent checks drawn in excess of deposit balance which are still outstanding at December 31, 2020. e. The savings account deposit in Land Bank was set aside by the Board of Directors for the acquisition of new equipment. This amount is expected to be disbursed in the next three months from the balance sheet date. REQUIRED: 1. What is the correct petty cash balance to be reported in December 31, 2020 statement of financial position? 2. What is the total amount of Cash on hand and in banks to be reported in TECRON statement of financial position? 3. Prepare the adjusting entries on December 31, 2020