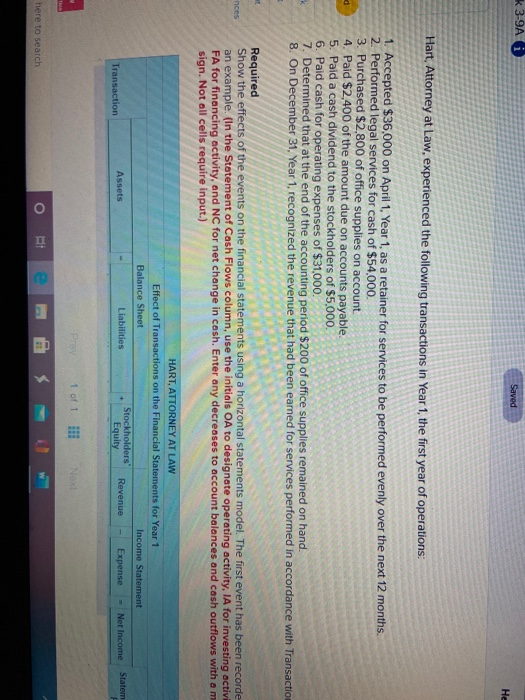

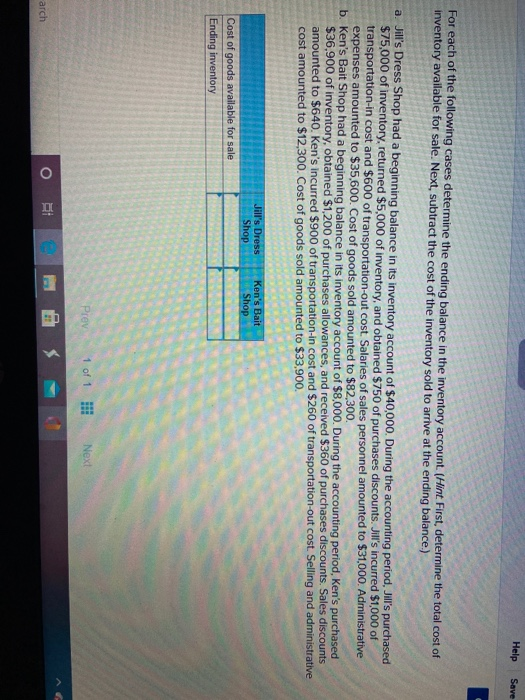

k 3-9A Saved He Hart, Attorney at Law, experienced the following transactions in Year 1, the first year of operations: 1. Accepted $36,000 on April 1, Year 1, as a retainer for services to be performed evenly over the next 12 months. 2. Performed legal services for cash of $54,000. 3. Purchased $2,800 of office supplies on account 4. Paid $2,400 of the amount due on accounts payable. 5. Paid a cash dividend to the stockholders of $5,000. 6. Paid cash for operating expenses of $31.000. 7. Determined that at the end of the accounting period $200 of office supplies remained on hand. 8. On December 31, Year 1, recognized the revenue that had been earned for services performed in accordance with Transaction noes Required Show the effects of the events on the financial statements using a horizontal statements model. The first event has been recorde an example. (In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activi FA for financing activity, and NC for net change in cash. Enter any decreases to account balances and cash outflows with am sign. Not all cells require input.) HART, ATTORNEY AT LAW Effect of Transactions on the Financial Statements for Year 1 Balance Sheet Income Statement Liabilities Stockholders Revenue Expense Net Income Equity Assets Transaction Statem rov 1 of 1 Hi! Next here to search Help Save For each of the following cases determine the ending balance in the inventory account. (Hint First, determine the total cost of inventory available for sale. Next, subtract the cost of the inventory sold to arrive at the ending balance.) a. Jill's Dress Shop had a beginning balance in its inventory account of $40,000. During the accounting period, Jill's purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. Jill's incurred $1,000 of transportation in cost and $600 of transportation-out cost. Salaries of sales personnel amounted to $31,000. Administrative expenses amounted to $35,600. Cost of goods sold amounted to $82.300. b. Ken's Bait Shop had a beginning balance in its inventory account of $8,000. During the accounting period, Ken's purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. Sales discounts amounted to $640. Ken's incurred $900 of transportation in cost and $260 of transportation-out cost. Selling and administrative cost amounted to $12,300. Cost of goods sold amounted to $33,900. Jill's Dress Shop Ken's Bait Shop goods available for sale Ending inventory Prev 1 of 1 !!! Next arch o BI k 3-9A Saved He Hart, Attorney at Law, experienced the following transactions in Year 1, the first year of operations: 1. Accepted $36,000 on April 1, Year 1, as a retainer for services to be performed evenly over the next 12 months. 2. Performed legal services for cash of $54,000. 3. Purchased $2,800 of office supplies on account 4. Paid $2,400 of the amount due on accounts payable. 5. Paid a cash dividend to the stockholders of $5,000. 6. Paid cash for operating expenses of $31.000. 7. Determined that at the end of the accounting period $200 of office supplies remained on hand. 8. On December 31, Year 1, recognized the revenue that had been earned for services performed in accordance with Transaction noes Required Show the effects of the events on the financial statements using a horizontal statements model. The first event has been recorde an example. (In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activi FA for financing activity, and NC for net change in cash. Enter any decreases to account balances and cash outflows with am sign. Not all cells require input.) HART, ATTORNEY AT LAW Effect of Transactions on the Financial Statements for Year 1 Balance Sheet Income Statement Liabilities Stockholders Revenue Expense Net Income Equity Assets Transaction Statem rov 1 of 1 Hi! Next here to search Help Save For each of the following cases determine the ending balance in the inventory account. (Hint First, determine the total cost of inventory available for sale. Next, subtract the cost of the inventory sold to arrive at the ending balance.) a. Jill's Dress Shop had a beginning balance in its inventory account of $40,000. During the accounting period, Jill's purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. Jill's incurred $1,000 of transportation in cost and $600 of transportation-out cost. Salaries of sales personnel amounted to $31,000. Administrative expenses amounted to $35,600. Cost of goods sold amounted to $82.300. b. Ken's Bait Shop had a beginning balance in its inventory account of $8,000. During the accounting period, Ken's purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. Sales discounts amounted to $640. Ken's incurred $900 of transportation in cost and $260 of transportation-out cost. Selling and administrative cost amounted to $12,300. Cost of goods sold amounted to $33,900. Jill's Dress Shop Ken's Bait Shop goods available for sale Ending inventory Prev 1 of 1 !!! Next arch o BI