Answered step by step

Verified Expert Solution

Question

1 Approved Answer

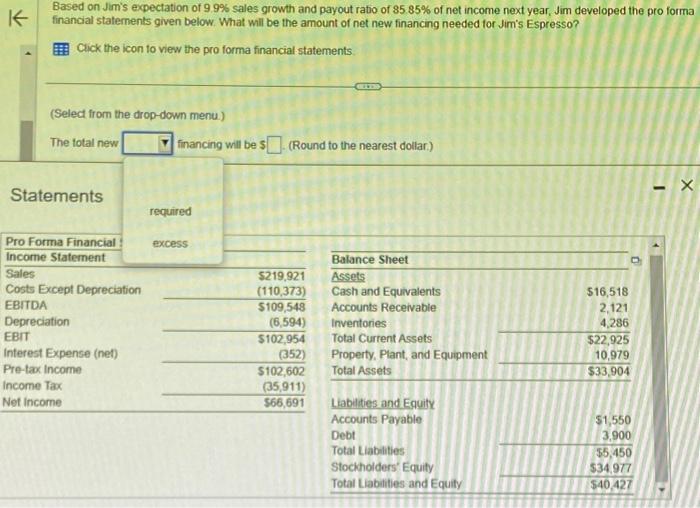

K Based on Jim's expectation of 9.9% sales growth and payout ratio of 85.85% of net income next year, Jim developed the pro forma financial

K Based on Jim's expectation of 9.9% sales growth and payout ratio of 85.85% of net income next year, Jim developed the pro forma financial statements given below. What will be the amount of net new financing needed for Jim's Espresso? Click the icon to view the pro forma financial statements. (Select from the drop-down menu.) The total new Statements Pro Forma Financial Income Statement Sales Costs Except Depreciation EBITDA Depreciation EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income financing will be $ (Round to the nearest dollar.) required excess Balance Sheet $219,921 Assets (110,373) Cash and Equivalents $109,548 Accounts Receivable (6,594) Inventories $102,954 (352) $102,602 (35,911) $66,691 Total Current Assets Property, Plant, and Equipment Total Assets Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity $16,518 2,121 4,286 $22,925 10,979 $33,904 $1,550 3,900 $5,450 $34,977 $40,427 L E X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started